Financial News

Buy, Sell or Hold: GoPro (GPRO)

Action camera company GoPro, Inc. (GPRO) has been struggling with consumers cutting back on spending amid high inflation and recession concerns. The company’s revenue declined 19% year-over-year in the first quarter. Moreover, GPRO flipped to a loss.

The company is focusing on its ‘updated go-to-market strategy’ to restore its product pricing to pre-pandemic levels. GPRO believes this move will accelerate growth in units, subscribers, revenue, and earnings. Additionally, GPRO is diversifying its revenue streams across both hardware and software. While its subscription-centric model is gaining traction, attaining a significant share of GPRO’s total revenue might take some time.

“We did a great job adjusting our go-to-market strategy for the pandemic,” Chief Executive Nicholas Woodman said. “But ironically, that same go-to-market strategy that worked so well when consumers weren’t going to stores and stores were closed, and people were shopping online more — that strategy that allowed us to thrive during that period — has been holding us back in this postpandemic world, where people are spending a lot more time and a lot more money in retail, they’re shopping in stores as a form of entertainment.”

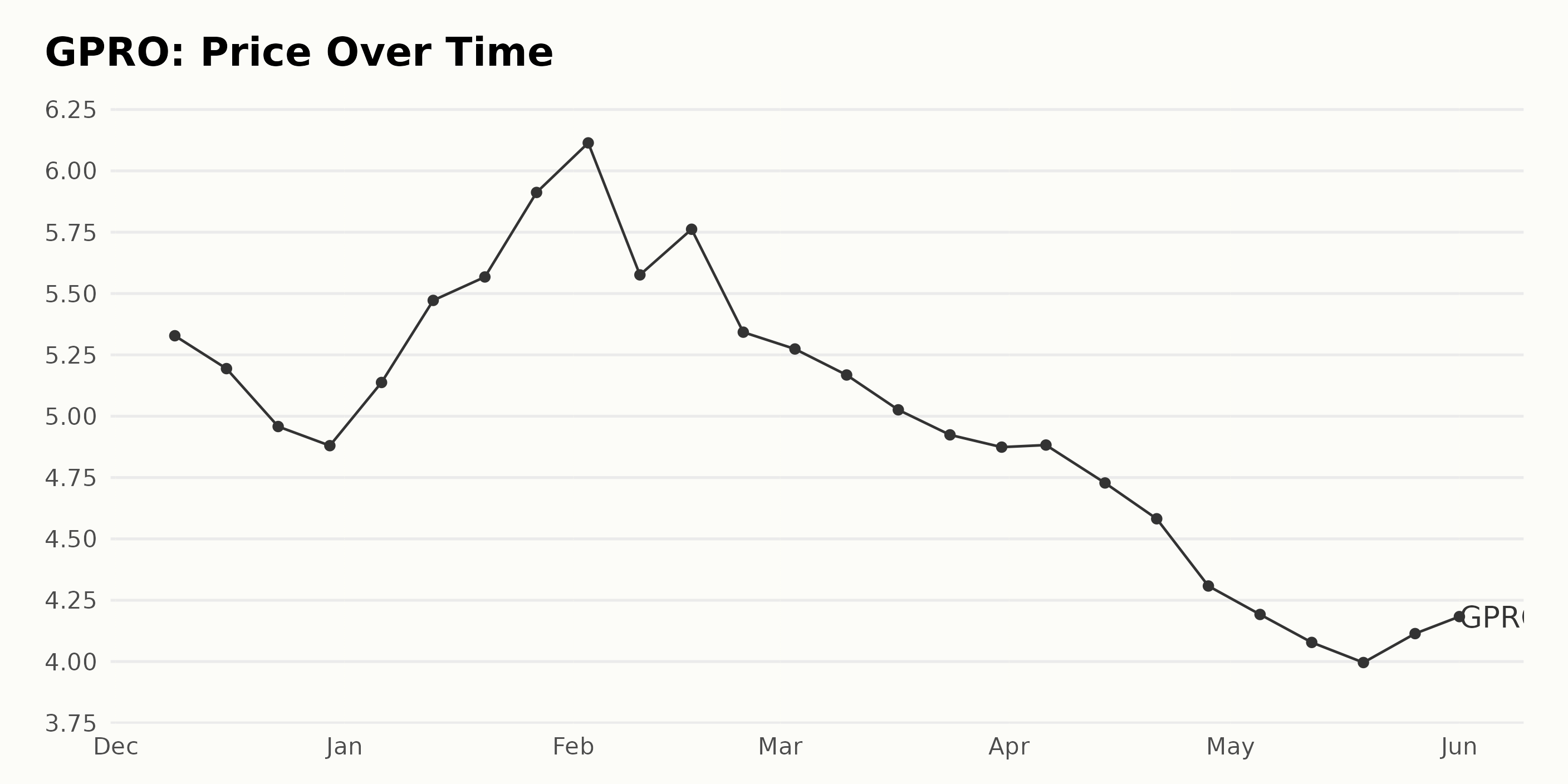

With the stock sinking in price, it might be best to wait for a better entry point. The stock is trading below its 50-day and 200-day moving averages of $4.44 and $5.21.

Let’s look at some of GPRO’s key financial metrics to understand the situation.

Analyzing GPRO’s Financial Trends

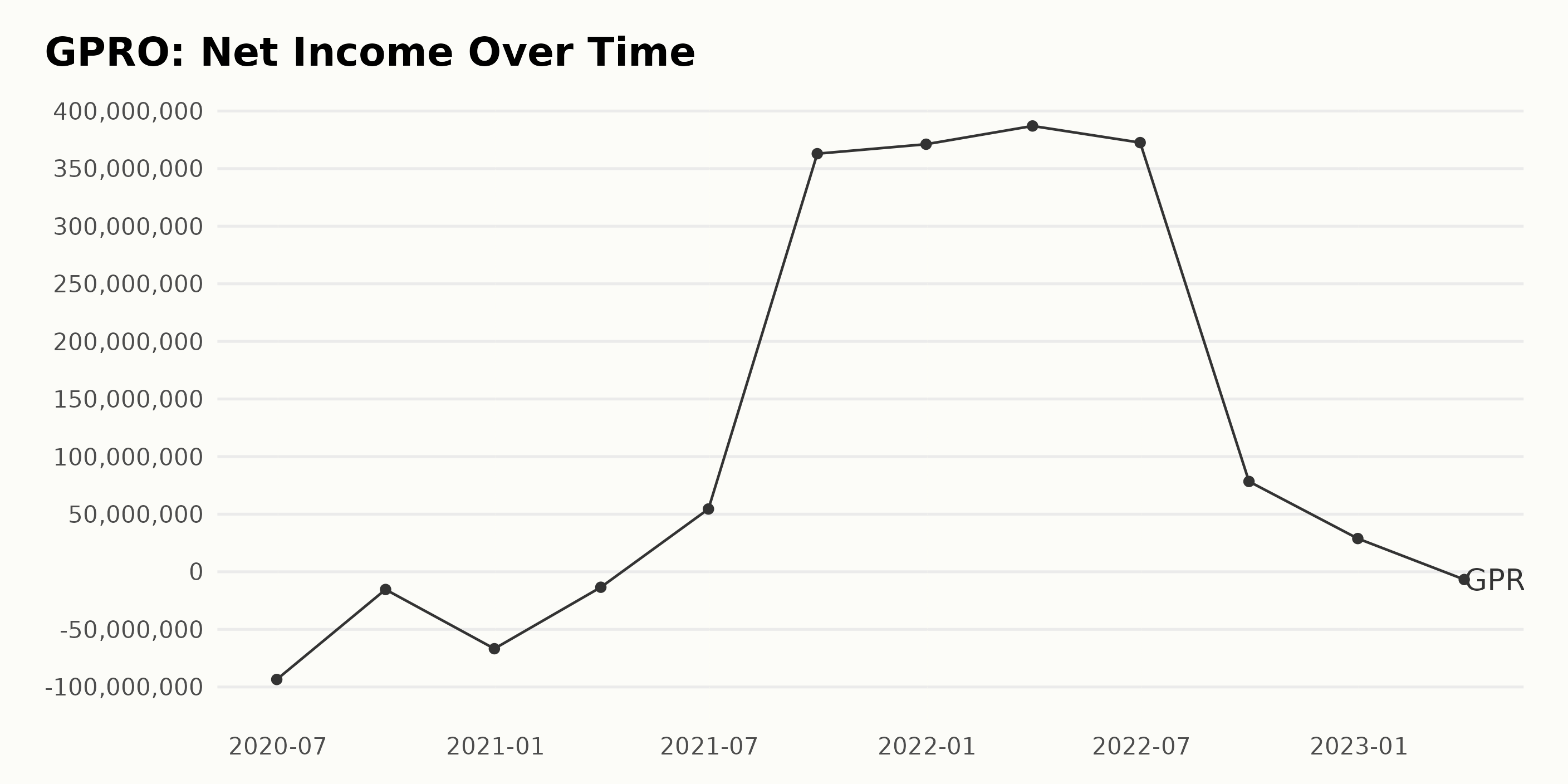

GPRO’s net income fluctuates from negative to positive. Starting at a negative $93.49 million on June 30, 2020, and ending at a negative $6.71 million on March 31, 2023, the net income growth rate has been 485.16%. The most significant fluctuation was between March 31, 2021, and June 30, 2021, shifting from negative $13.42 million to $54.50 million.

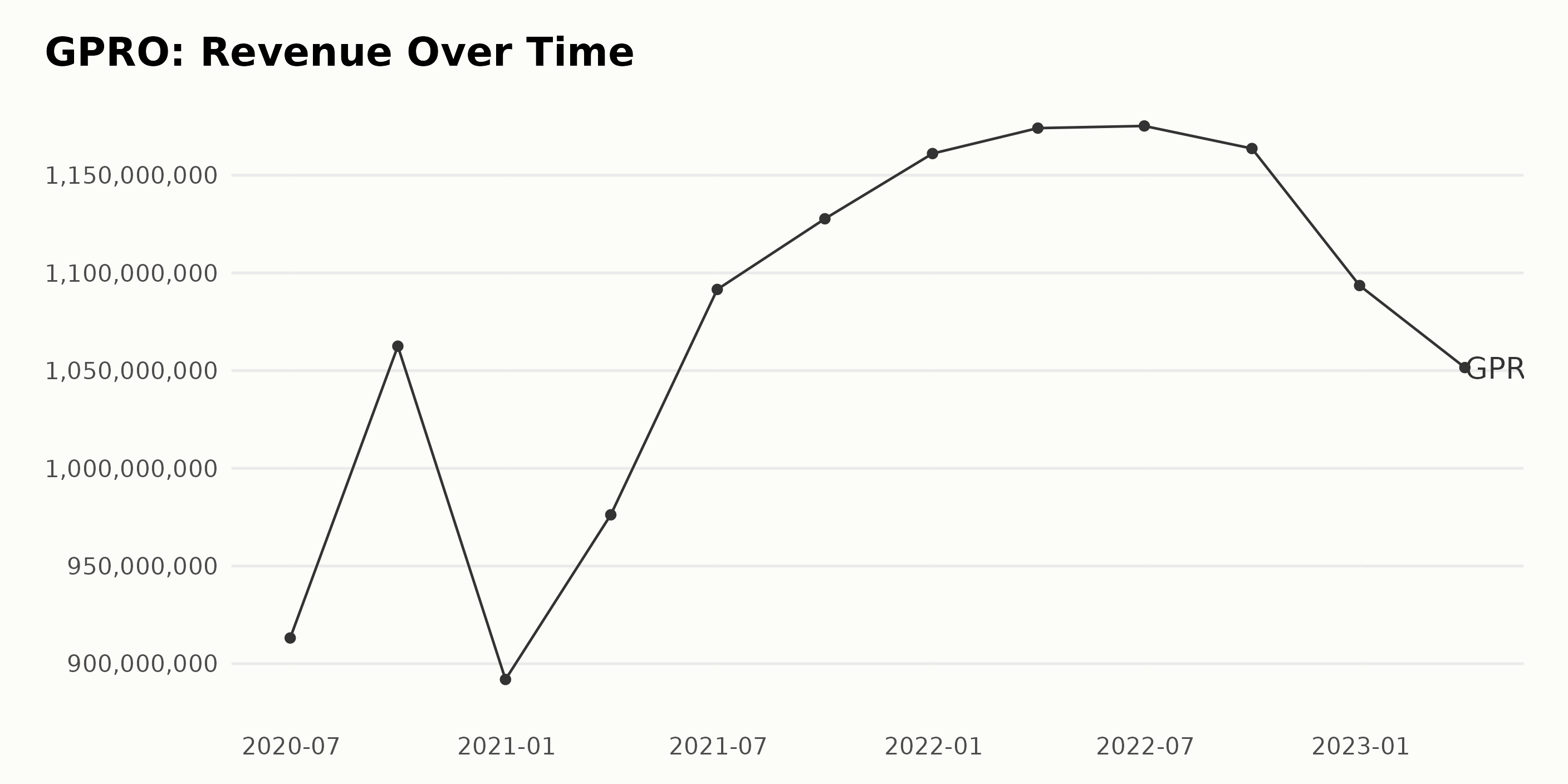

GPRO’s revenue showed a general increase from June 2020 to September 2021, ranging from $91.3 million in June 2020 to $112.8 million in September 2021, representing a 23.7% growth rate. After September 2021, revenue experienced minor fluctuations, with the last reported data in March 2023 being $105.2 million, greater than 11.3% of the first reported value.

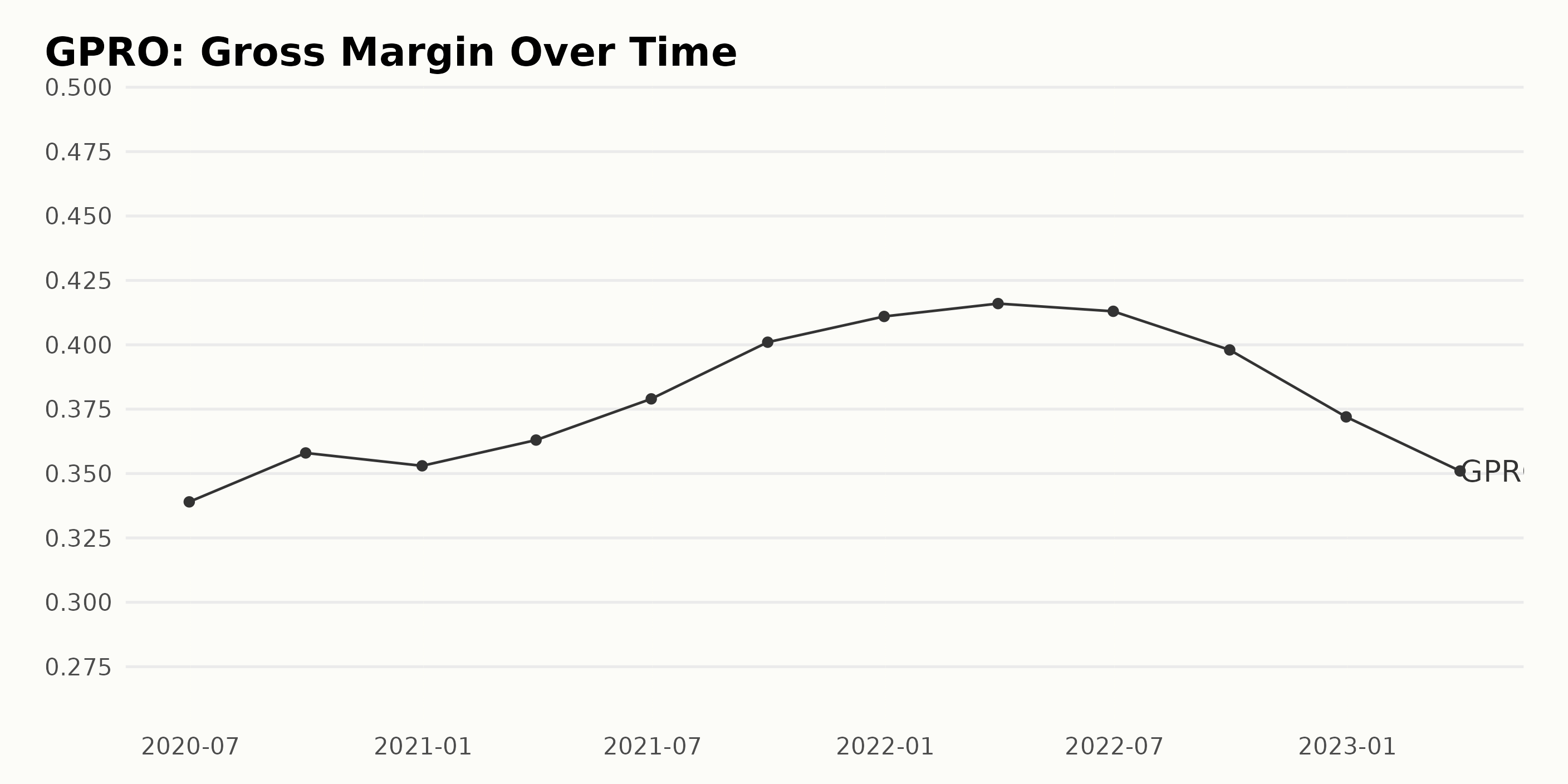

GPRO’s gross margin has seen a generally increasing trend, rising from 33.9% in June 2020 to 41.3% in December 2021, an increase of 23.4%. However, the most recent data point for March 2023 shows that the gross margin had decreased to 35.1%, indicating a fluctuating trend.

The latest Analyst Price Target for GPRO is $5.00, which is a decrease of 46.7% from the first value of $12.00 in November 2021. The price target had remained fairly stable since early 2021, oscillating between $12.00 and $13.25 until May 2022, when it decreased to $11.50. This downward trend continued over the next five months, dropping to $8.00 in November 2022 and eventually reaching the most recent value of $5.00.

GPRO’s Price is Down by 21.63%

GPRO appears to have a decreasing price trend, from $5.328 on December 9, 2022, to $4.185 on May 31, 2023. This is a drop of 21.63% over the course of this period. Here is a chart of GPRO’s price over the past 180 days.

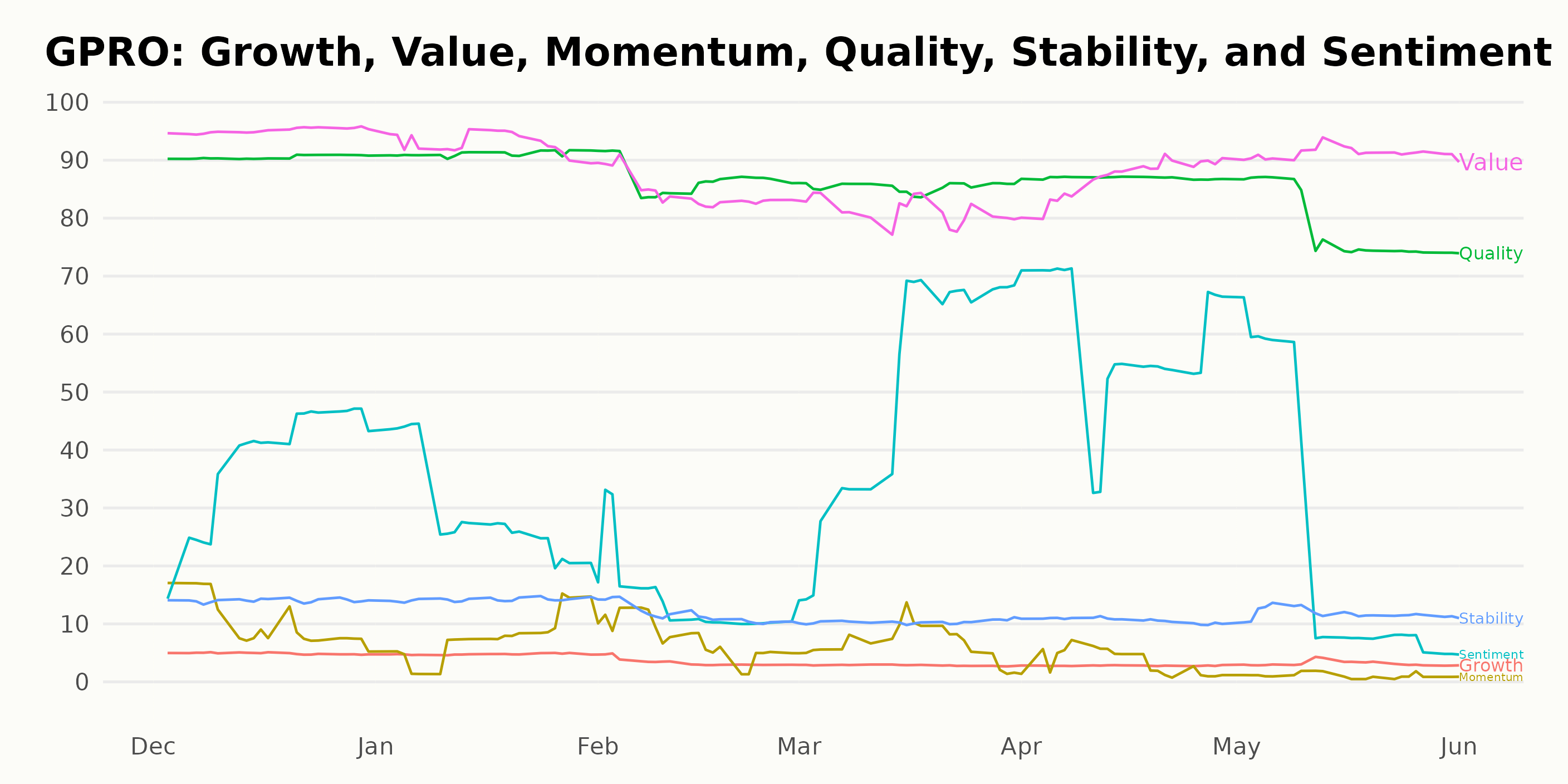

GPRO POWR Ratings: Quality, Value, and Momentum

GPRO has an overall C rating, translating to a Neutral in our POWR Ratings system. It is ranked #30 out of 44 stocks in the Technology - Hardware industry.

The POWR Ratings for GPRO show that the notable ratings are for quality, value, and momentum. Quality is consistently in the range of 85-91 over the months; value is also highly rated, ranging from 81-95, while momentum has the most notable changes, starting at 10 in December 2022, dropping to 7 by February 2023, and finally at its lowest rating of 1 by May 2023.

How does GoPro Inc. (GPRO) Stack Up Against its Peers?

Other stocks in the Technology - Hardware sector that may be worth considering are AstroNova Inc. (ALOT), Panasonic Holdings Corp. (PCRFY), and Canon Inc. (CAJPY) -- they have better POWR Ratings.

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

GPRO shares were trading at $4.18 per share on Thursday afternoon, down $0.02 (-0.48%). Year-to-date, GPRO has declined -16.06%, versus a 10.77% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Buy, Sell or Hold: GoPro (GPRO) appeared first on StockNews.com

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.