Financial News

DON’T Buy Value Stocks!

Some believe that value investing is dead.

Yes, that sounds extreme. However, we live in an age where alternative investments like SPACs, NFTs, Electric Vehicles and Crypto that are constantly in the news and seemingly making new highs day after day.

This appears to negate the virtue of classic value principles pioneered by Benjamin Graham (and his most famous pupil Warren Buffett) as these “in favor” investments have gravity defying multiples.

Those who walked away from value investing point to 3 fatal flaws:

- Value Traps (where stocks head lower and lower)

- Classic Value Metrics Don’t Work Anymore

- Lack of Timeliness Deadens ROI

So, what’s the solution?

Please give me just a few minutes of your time so I can spell it out for you.

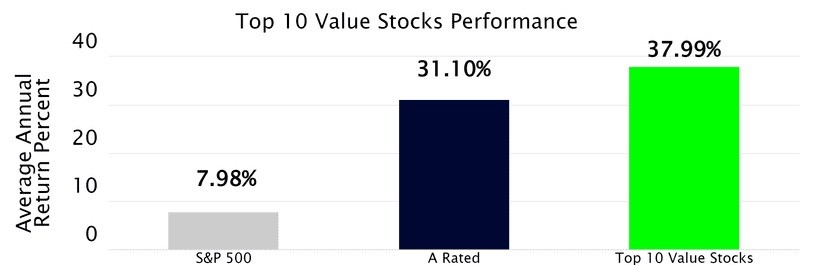

This includes unveiling our coveted Top 10 Value Stocks strategy that has scored an average +37.99% gain since 1999. That is a full 376% better than the S&P 500 over that stretch.

Let me first tell you more about this computer generated model. Then we will discuss how it solves all 3 of the fatal flaws of value investing.

That journey starts with a brief discussion of our quant ranking system; the POWR Ratings.

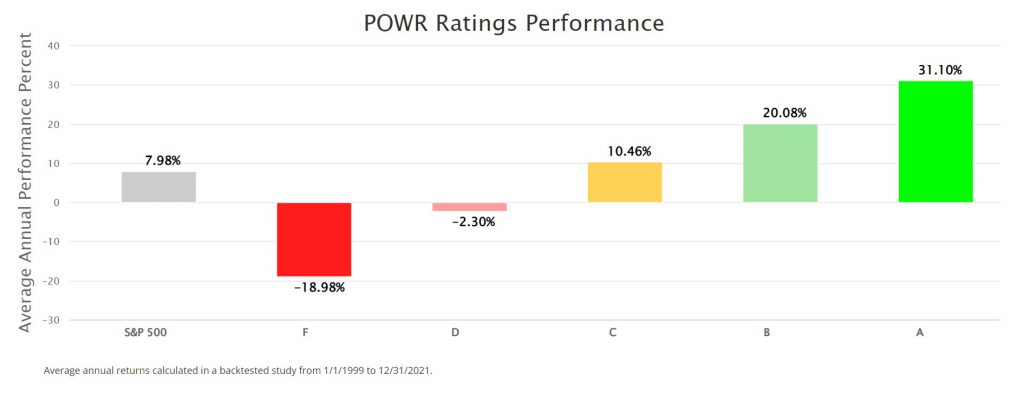

If you have spent any time on StockNews.com you have certainly seen information on our exclusive POWR Ratings system. Indeed, these ratings really do help investors gain a decided advantage over the market, as can clearly be seen in the performance chart below.

Where Does the Outperformance Come From?

The POWR Ratings model is the most complete review of a stock available to individual investors today. All in all, we look at 118 different factors of a stock before assigning an A to F rating.

Which 118 factors?

The simple answer is ONLY the ones that lead to more profitable stock selection. Truly this is like a DNA check of each stock getting down to the molecular level to appreciate the stocks built to outperform.

Once that analysis of the overall POWR Rating is done, we then break down those 118 factors into 6 additional grades to appreciate the virtue of a stock on the following dimensions:

- Value

- Growth

- Momentum

- Stability

- Quality

- Sentiment

For those quick on the draw, you probably just figured out that if you combine a strong overall POWR Rating with a healthy Value score, that you are well on our way to picking the best value stocks.

Gladly that process will get you going in the right direction.

Sadly you will still end up with a list of over 700 stocks to research.

That is not so bad if picking stocks is your full-time job. However, for most of you that is far too time consuming.

This led to an “Aha!” moment.

What if we could develop a strategy to unearth the 10 top value stocks at any time producing consistent outperformance?

So, we went back to the same Data Scientist who created the POWR Ratings and asked the seemingly impossible—could he turn up the volume on the value metrics and somehow exceed their already market beating returns?

After months of research and rigorous testing the Top 10 Value Stocks strategy was born.

Not only did we narrow to just 10 value stocks. But we also greatly increased performance to +37.99% per year since 1999.

The hallmark of this screen is a zealous focus on the 31 individual value factors that help to consistently discover the market’s best value stocks (and just as importantly, ignoring the 100’s of factors that actually don’t work at all!).

Combining those 31 unique value factors together in optimal fashion leads to uncovering this incredibly consistent winning strategy.

The Key Word is “Consistency”

That’s because the POWR Ratings also focuses on the consistency of growth. Not just earnings growth, but also improvements in revenue, profit margins and cash flow.

Then our rating model goes further into the Quality of a stock by drilling down on the main metrics that show the health of operations over time.

The steps noted above solve the #1 fatal flaw of value investing. That being how to avoid the value traps that are really just poorly run companies that go from bad to worse. The focus on Growth and Quality aspects are the best possible health checks to alleviate these problems.

Meaning that we look beyond the overly simplistic value measurements used in the past, allowing us to deliver to you the healthiest growing companies, that just so happen to be trading at attractive discount prices.

Next up we need to tackle the 2nd fatal flaw. Which is that most classic value metrics don’t work like they used to.

Consider this.

Computer driven trading now dominates the investment landscape. No longer is it seasoned investment managers making the decisions. Instead the vast majority of trades are run by these quant models.

This has been true for more than 10 years. And truly billions of dollars have been thrown at these quant models to squeeze out every last drop of profit hidden in shares.

So long ago these models tapped into the benefit of the typical value approaches like PE, Book Value, PEG, Price to Sales etc.

Now after years of high volume trading of these models it could be said that the value well has run dry.

More precisely, the best value metrics have very little benefit on their own. So the key to success is to stack as many of these metrics in your favor as possible. Like the 31 value metrics inside the POWR Ratings model.

That’s 31 advantages working in your favor to generate outperformance. Each one increasing the odds of success. And that’s how the Top 10 Value Stocks strategy is able to produce a +37.99% annual return.

Finally we address the 3rd fatal flaw which is that value stocks are generally not timely which damages your ROI.

Value is considered a contrarian investing style. That’s because you are betting on companies that are currently out of favor hoping that the share price turns around.

Unfortunately the longer it takes...the more it harms your Return On Investment.

Gladly the POWR Ratings focuses on 25 different factors that greatly increase the timeliness and ROI of the stocks.

13 Sentiment Factors

12 Momentum Factors

Sentiment factors track what the smart money is doing with the stock such as institutional ownership, Wall Street analyst estimates and insider buying. These are time-tested ways of finding timely, in-favor stocks.

Next up is narrowing in on 12 different Momentum factors that targets stocks ready to rise. Indeed Momentum is just like physics where “a body in motion... stays in motion”.

All in all the POWR Ratings applies 118 factors to find the best stocks. The combination of which truly helps overcome the 3 fatal flaws of value investing.

Then we dial up value attributes to create the Top 10 Value Stocks strategy that increases performance to a stellar +37.99% a year.

This is how you solve the 3 fatal flaws of value investing.

And this is the consistent path to finding the best value stocks in the future…

One last improvement

For as great as the Top 10 Value Stocks strategy truly is, there is still one glaring flaw that exists in all quantitative systems. And that is understanding the all-important WHY behind which stocks to buy, and when to sell to maximize gains.

That is why I go one step further, using my 40 years of investing experience to dive deeper into each stock, pulling the curtain back on the all-important qualitative metrics that no computer ratings system can uncover.

The final result is the very best value stocks for today’s market, that I hand select for subscribers to our popular POWR Value Newsletter

This is truly a best of both world’s solution:

+37.99% annual return from Top 10 Value strategy

+

Steve Reitmeister with 40+ years of investing experience with a keen eye for uncovering hidden value stocks

=

POWR Value newsletter to help you discover the best value stocks for today’s market.

Now you can experience the market beating returns of the POWR Value newsletter, for just $1 for a full 30 days.

During your trial you’ll get full access to the current portfolio of 14 stocks, weekly market commentary and every trade alert by text & email.

There’s no obligation beyond the 30 day trial, so there is absolutely no risk in getting started today.

About POWR Value & 30 day Trial > >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com

Editor of Reitmeister Total Return & POWR Value

SPY shares . Year-to-date, SPY has declined -8.58%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post DON’T Buy Value Stocks! appeared first on StockNews.comStock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.