Financial News

[Video Enhanced] Real Costing, Final Engineering, Detailed Mine Plan: West Red Lake Gold Outlines Mine Restart Activities

| |||||||||

|  |  |  | ||||||

Vancouver, BC, November 5, 2024 – TheNewswire – Global Stocks News – Sponsored content disseminated on behalf of West Red Lake Gold. On October 31, 2024 West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) reported on its restart readiness activities at the Madsen Mine project in Red Lake, Ontario.

On November 1, 2024 West Red Lake Gold VP Investor Relations Gwen Preston, published a video address giving context to the mine restart activities.

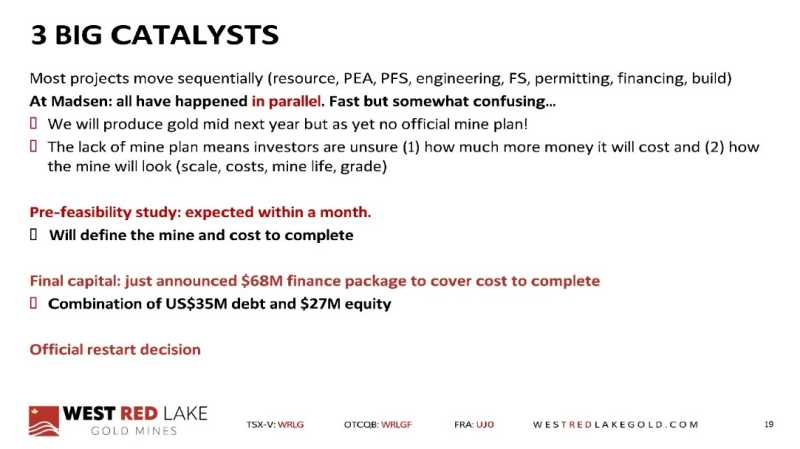

“Let me run you through the things that we discussed in the October 31 news release, and why they matter,” stated Preston. “We started by pointing to our pre-feasibility study (PFS). We expect to issue that study in the next month, and it's going to be a really important document.”

“It may be called a pre-feasibility study, but this is the plan upon which we will operate the Madsen Mine” continued Preston. “There are several reasons why we believe the Madsen PFS will be an accurate, comprehensive, and sufficient plan for the mine restart.”

WRLG is working with SRK Consulting to complete the PFS. West Red Lake Gold listed three examples of how its pre-feasibility study will be notably more accurate and complete than most such studies.

1. Real Costing: Operating underground at the Madsen Mine for the last year means West Red Lake Gold understands real costs for blasting, mucking, and haulage of mined material

2. Final Engineering: The Madsen Mine is essentially built. With the mine having operated as recently as 2022 and with West Red Lake Gold having studied and remedied many of the issues from that period over the last 18 months, there are very few unresolved engineering questions at Madsen.

3. Detailed Mine Plan: West Red Lake Gold has built a detailed mine design for the first 18 months of operation and intends to have 24 months of definition drilled in-situ mineral inventory defined prior to restart, which is targeted for mid-2025. This level of operational readiness far exceeds what is typical at the PFS stage in most development scenarios.

“Typically, pre-feasibility studies pre-date a detailed mine-plan. Starting with a mine already built meant we immediately started in on definition drilling, detailed mine planning, and detailed budgeting,” commented Preston. “We're excited to get this document out, so that everyone can see what this mine is going to look like.”

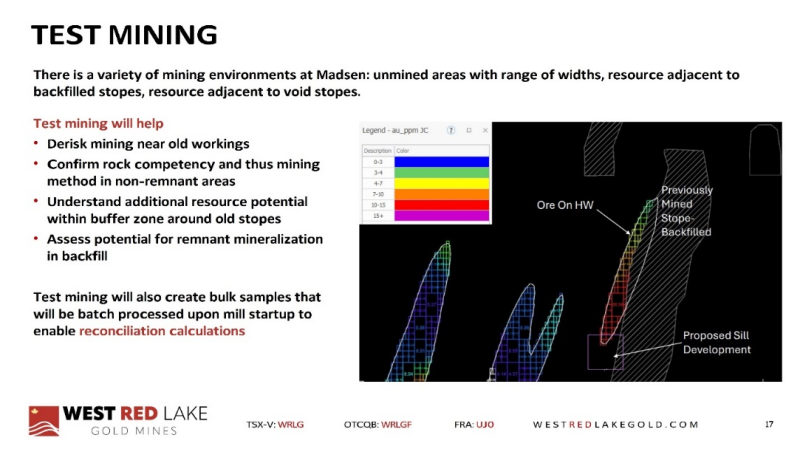

“We've been operating at this site for the last year, doing underground development,” continued Preston. “We're doing test mining now and the mill ran just two years ago. There are very few outstanding questions on how the mine will be built because it's already built. This greatly reduces the initial capex requirements in the PFS, which is expected to have a positive effect on the overall economics.”

Some aspects of the mine and surface infrastructure needed attention before restart, including a tailings dam lift. The project to increase the height of the tailings dam by four feet was completed on October 8th, 2024.

This lift creates enough additional capacity in the tailings facility to accommodate more than 5 years of mining at a rate of 800 tonnes per day, which is the nameplate throughput of the Madsen mill.

“We completed the only major earthworks project needed before the mine restart: a tailings dam lift,” confirmed Preston. “It came in ahead of schedule and about 18% under budget. That speaks to what can be accomplished when there is good communication and collaboration between contractors and operators.”

FIGURE 1. Aerial view of the tailings dam lift project at completion.

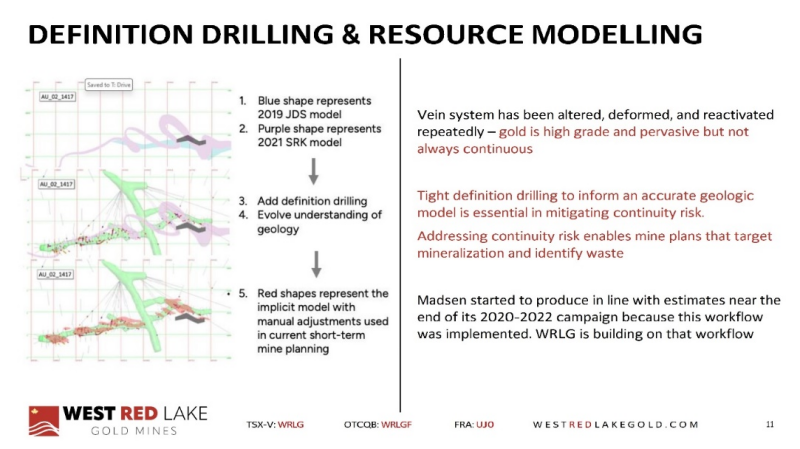

“Definition drilling is fundamental to our mine restart plan,” stated Preston. “We've done 43,000 meters of definition drilling. We aren't willing to define stopes unless we've tightened drill spacing from about 20 meters to six or eight meters between drill holes. That's what we believe is necessary for a confident, accurate model.”

“In the October 31 press release, we also talked about underground development,” stated Preston. “In 2024 we've done over two kilometers of underground development at the Madsen mine. That adds to over 19 kilometers of underground development that was completed between 2019 and 2022.”

“For context, it costs us about $7,500 to do one meter of underground development right now, so 21 kilometers of workings is very valuable,” continued Preston. “And all of these modern underground workings give us so much access to this deposit.”

The company is also getting the process plant ready for restart.

“Our restart plan has that mill ready to go in Q1, 2025. We are pushing to ensure that we get all the work done as quickly as possible, to support a sustainable restart.”

“Over 40 million ounces of gold have been pulled out of the Red Lake region, all high-grade,” Williams recently told BTV, “Madsen produced over 2 million ounces at an average grade of nine grams gold per tonne. From an infrastructure perspective: it has a mill in place, it has a tailings facility and it has permits.”

“Madsen is set up to go straight back into production,” continued Williams. “We're looking at this as a base for a large gold mining company. We've assembled the technical team, and we have great backers, like Frank Giustra and his network.”

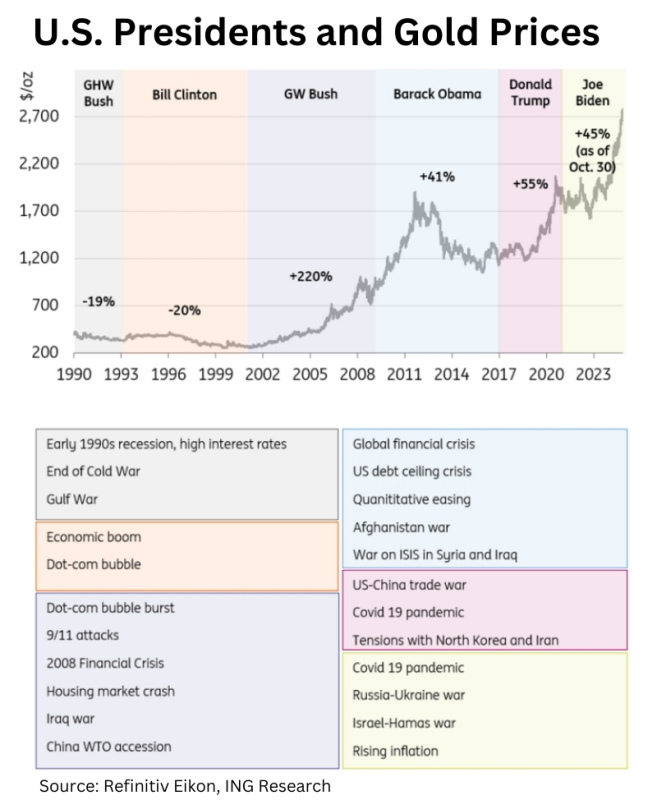

As U.S. voters go to the polls to choose a new President, there has been speculation about the effect of the federal election outcome on gold prices.

“Under Kamala Harris, relatively less inflationary pressure due to lower growth, the absence of an escalation in trade tensions and relatively looser immigration policy means the Fed may feel more comfortable with looser monetary policy, which would eventually provide support to gold prices,” stated ING commodity strategist Ewa Manthey.

“However, less uncertainty over trade could decrease demand for the precious metal as a safe-haven asset.”

“In 2023, central banks added 1,037 tonnes of gold – the second highest annual purchase in history – following a record high of 1,082 tonnes in 2022. A World Gold Council survey conducted in April 2024 found that 29% of central bank respondents intend to increase their gold reserves in the next 12 months.”

“These drivers are likely to continue regardless of who wins the presidential election,” added Manthey.

The Madsen Mine deposit presently hosts an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold. [1.] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,500 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we can not ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

-

SRK Consulting. (2021). Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada (West Red Lake Gold Mines, Ed.) [Review of Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada.

-

Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

-

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the purpose of the updated report. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Copyright (c) 2024 TheNewswire - All rights reserved.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.