Financial News

Applied Industrial (NYSE:AIT) Reports Sales Below Analyst Estimates In Q4 CY2025 Earnings

Industrial products distributor Applied Industrial (NYSE: AIT) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 8.4% year on year to $1.16 billion. Its GAAP profit of $2.51 per share was 0.7% above analysts’ consensus estimates.

Is now the time to buy Applied Industrial? Find out by accessing our full research report, it’s free.

Applied Industrial (AIT) Q4 CY2025 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.17 billion (8.4% year-on-year growth, 0.7% miss)

- EPS (GAAP): $2.51 vs analyst estimates of $2.49 (0.7% beat)

- Adjusted EBITDA: $140.4 million vs analyst estimates of $143.2 million (12.1% margin, 1.9% miss)

- EPS (GAAP) guidance for the full year is $10.60 at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 10.6%, in line with the same quarter last year

- Free Cash Flow Margin: 8%, similar to the same quarter last year

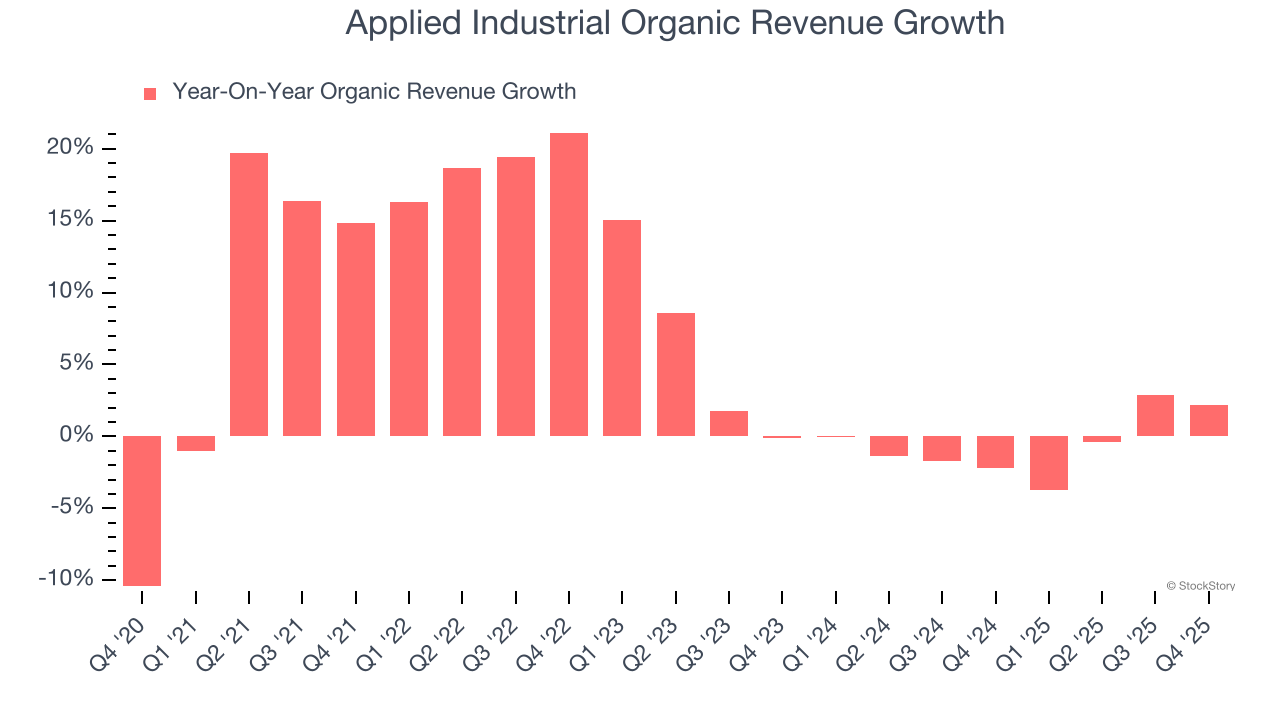

- Organic Revenue rose 2.2% year on year (miss)

- Market Capitalization: $10.62 billion

Neil A. Schrimsher, Applied’s President & Chief Executive Officer, commented, “During the second quarter we continued to effectively manage through an evolving but still mixed end-market backdrop while positioning the Company for stronger growth that we see ahead. Sales and EBITDA margins were in line with our guidance, and earnings grew modestly over the prior year. This is inclusive of greater than expected LIFO expense and muted December sales activity. Our teams responded with an ongoing focus on internal initiatives and channel execution. These efforts drove solid underlying gross margin and EBITDA margin performance when excluding the LIFO impact, particularly considering difficult prior-year comparisons as previously highlighted. In addition, we continued to see encouraging signs on the sales front with order growth continuing to build across both segments. We believe this positive momentum could translate more meaningfully to sales in the second half of our fiscal year, as reflected by organic sales trending up by a mid single-digit percent year over year month to date in January. Lastly, we remain active with capital deployment including ongoing share repurchases, as well as today’s announced 11% increase in our quarterly dividend and the bolt-on Service Center acquisition of Thompson Industrial Supply Inc.”

Company Overview

Formerly called The Ohio Ball Bearing Company, Applied Industrial (NYSE: AIT) distributes industrial products–everything from power tools to industrial valves–and services to a wide variety of industries.

Revenue Growth

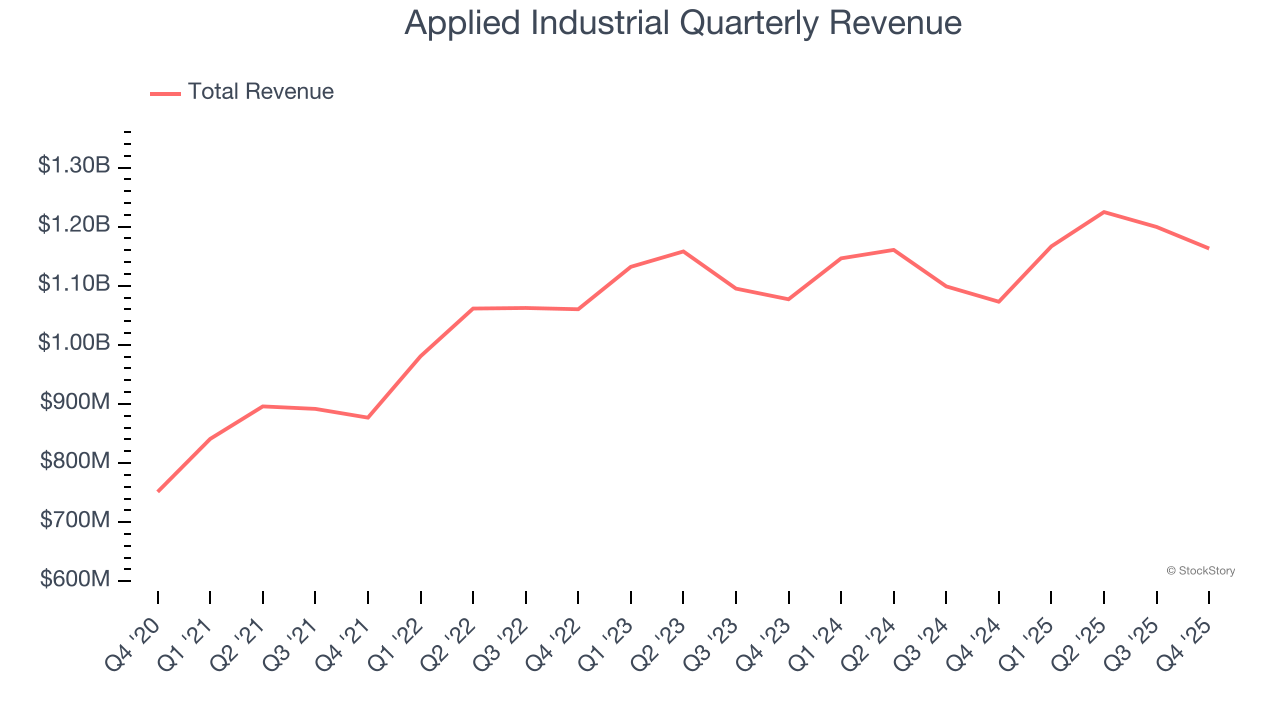

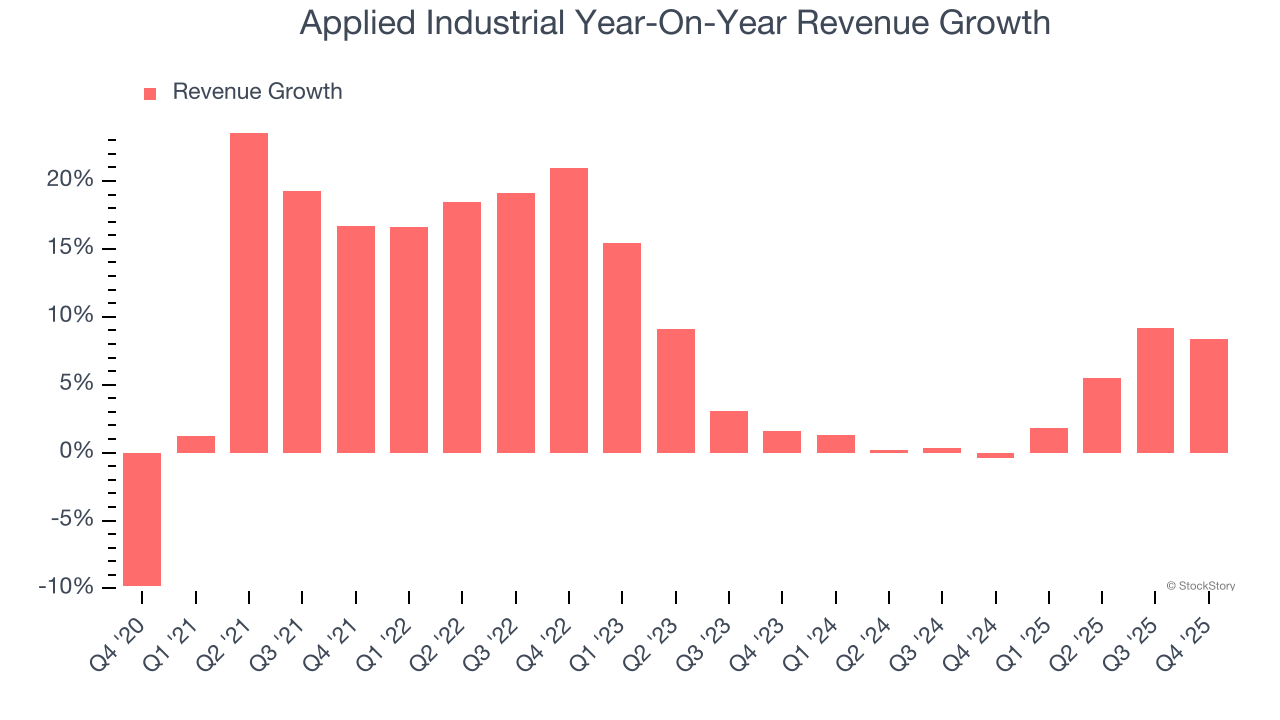

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Applied Industrial grew its sales at a solid 9.2% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Applied Industrial’s recent performance shows its demand has slowed as its annualized revenue growth of 3.2% over the last two years was below its five-year trend.

Applied Industrial also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Applied Industrial’s organic revenue was flat. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Applied Industrial’s revenue grew by 8.4% year on year to $1.16 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

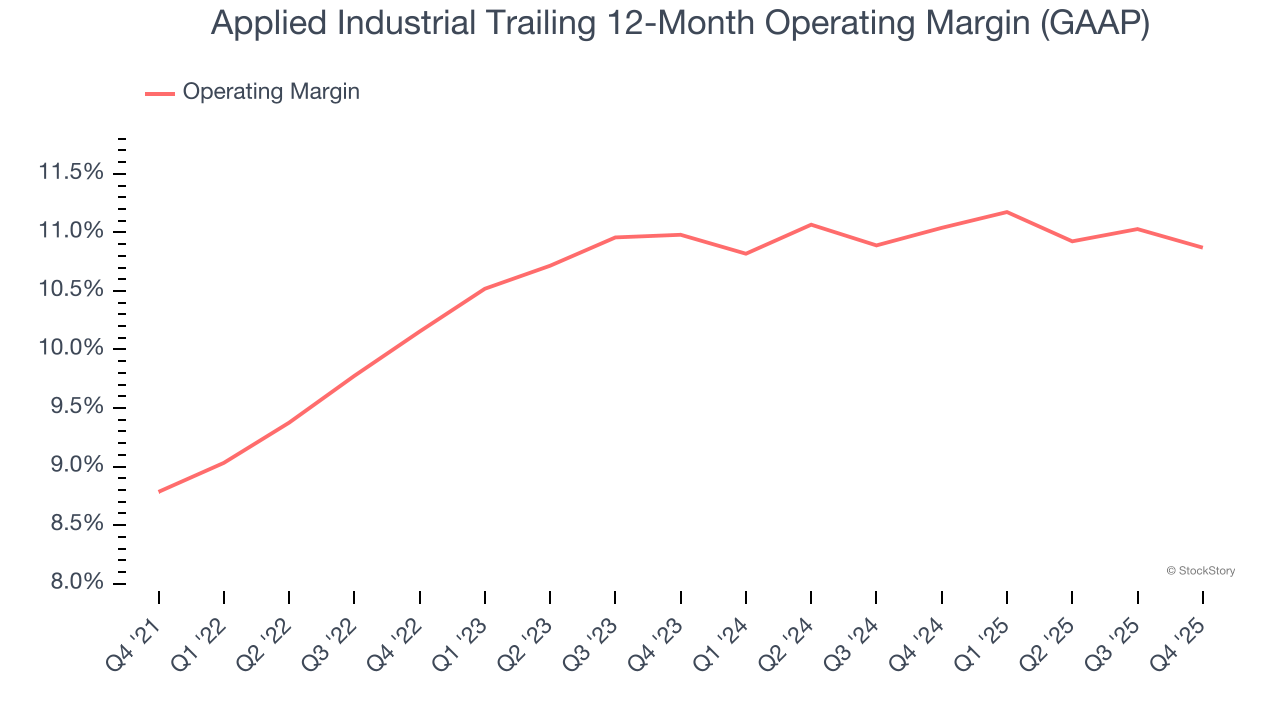

Applied Industrial has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Applied Industrial’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Applied Industrial generated an operating margin profit margin of 10.6%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

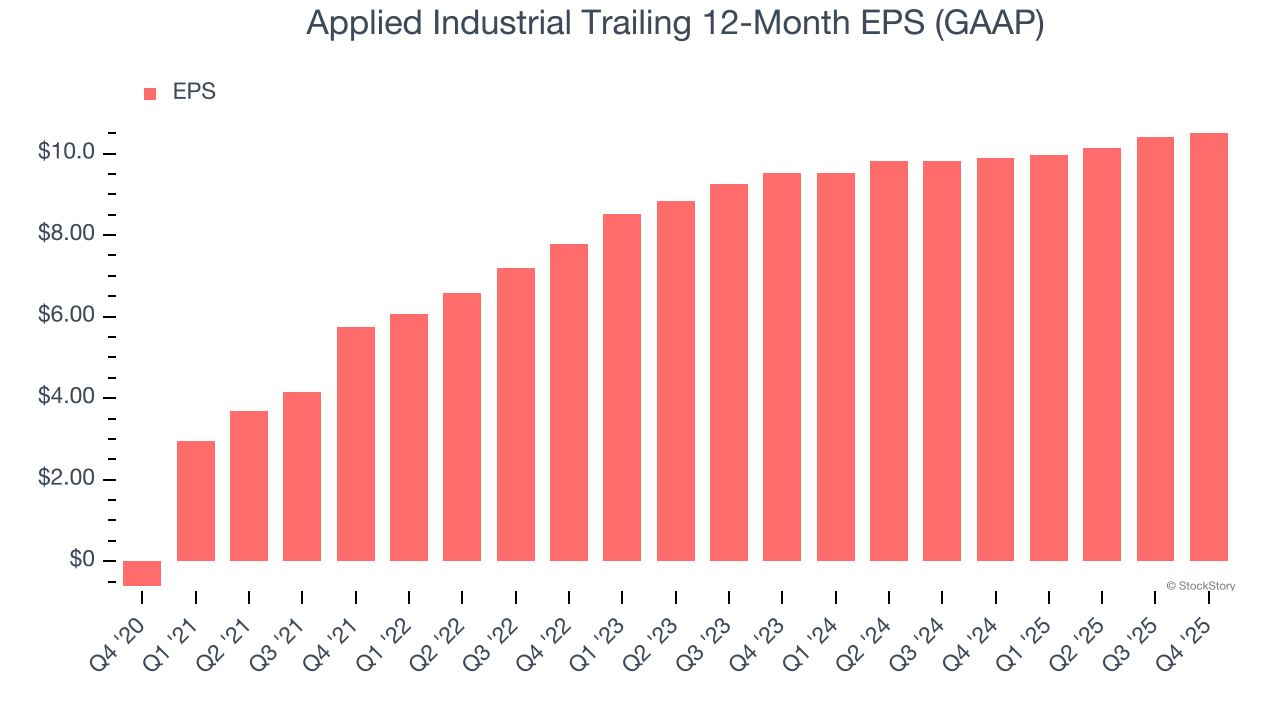

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Applied Industrial’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Applied Industrial’s unimpressive 5% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

In Q4, Applied Industrial reported EPS of $2.51, up from $2.39 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Applied Industrial’s full-year EPS of $10.51 to grow 5.6%.

Key Takeaways from Applied Industrial’s Q4 Results

Revenue missed slightly, EPS beat slightly, and EPS guidance was roughly in line with expectations. Overall, this quarter was without many large surprises. The stock remained flat at $280 immediately after reporting.

Applied Industrial underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.