Financial News

Finance and HR Software Stocks Q2 Recap: Benchmarking American Express Global Business Travel (NYSE:GBTG)

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at American Express Global Business Travel (NYSE: GBTG) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 13 finance and hr software stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 1% below.

Thankfully, share prices of the companies have been resilient as they are up 6.6% on average since the latest earnings results.

American Express Global Business Travel (NYSE: GBTG)

Originally spun off from American Express in 2014 but maintaining the Amex GBT brand, Global Business Travel Group (NYSE: GBTG) provides end-to-end business travel and expense management solutions, connecting corporate clients with travel suppliers and offering specialized software services.

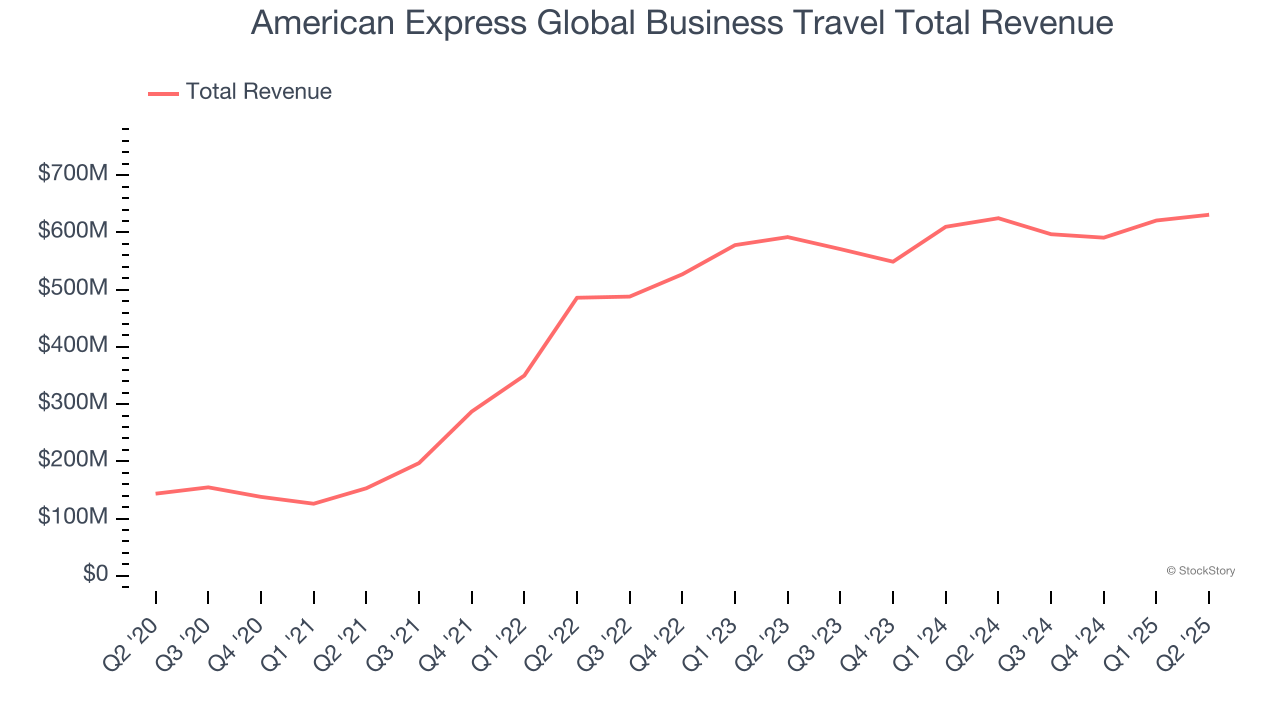

American Express Global Business Travel reported revenues of $631 million, flat year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with full-year EBITDA and revenue guidance topping analysts’ expectations.

Paul Abbott, Amex GBT’s Chief Executive Officer, stated: "In the second quarter, we again delivered on our commitments. We delivered quarterly results ahead of expectations, raised our full-year guidance, reached a significant milestone on CWT and can now accelerate share repurchases to underscore our confidence in the business. We look forward to welcoming CWT customers and employees to Amex GBT in the third quarter and are incredibly excited about the growth prospects for the combined company."

American Express Global Business Travel delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 31.4% since reporting and currently trades at $8.19.

Is now the time to buy American Express Global Business Travel? Access our full analysis of the earnings results here, it’s free.

Best Q2: Marqeta (NASDAQ: MQ)

Powering the cards behind innovative fintech services like Block's Cash App, Marqeta (NASDAQ: MQ) provides a cloud-based platform that allows businesses to create customized payment card programs and process card transactions.

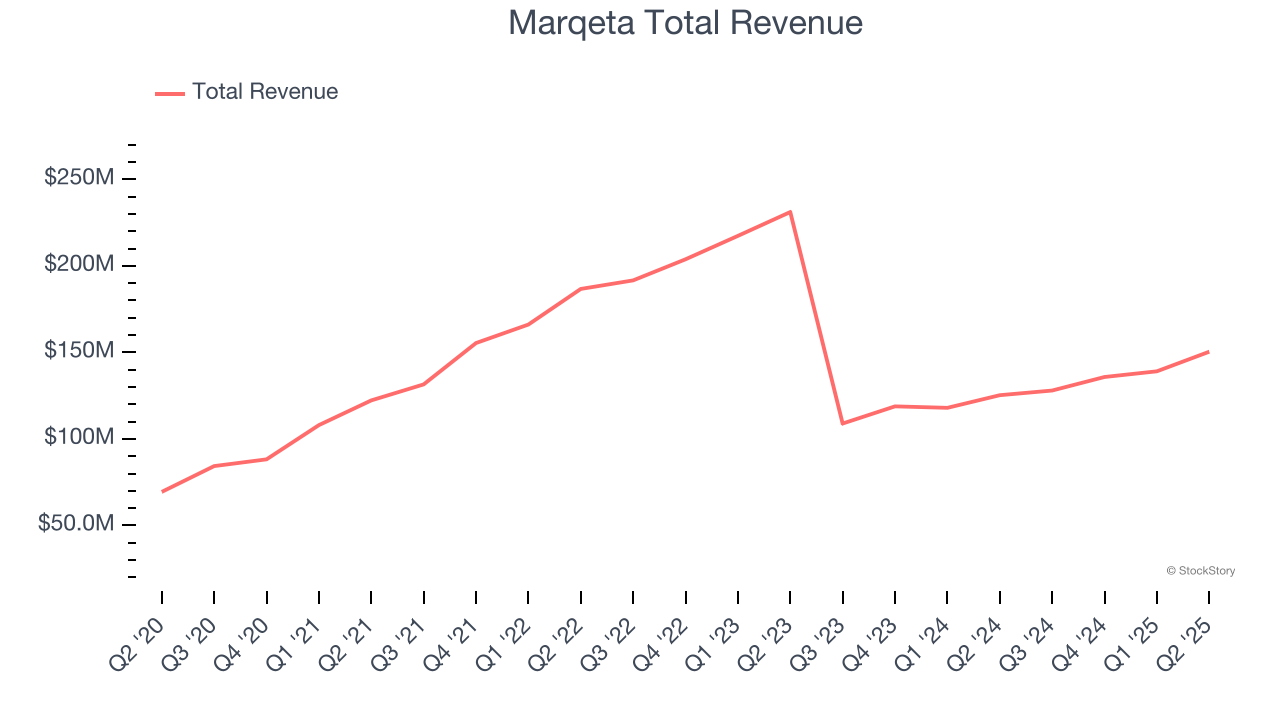

Marqeta reported revenues of $150.4 million, up 20.1% year on year, outperforming analysts’ expectations by 6.9%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA and total payment volume estimates.

Marqeta pulled off the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 1.8% since reporting. It currently trades at $5.80.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Paychex (NASDAQ: PAYX)

Once known as the go-to service for small business payroll needs, Paychex (NASDAQ: PAYX) provides payroll processing, HR services, employee benefits administration, and insurance solutions to small and medium-sized businesses.

Paychex reported revenues of $1.43 billion, up 10.2% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a miss of analysts’ EBITDA estimates.

As expected, the stock is down 13.5% since the results and currently trades at $131.74.

Read our full analysis of Paychex’s results here.

BILL (NYSE: BILL)

Transforming the messy back-office financial operations that plague small business owners, BILL (NYSE: BILL) provides a cloud-based platform that automates accounts payable, accounts receivable, and expense management for small and midsize businesses.

BILL reported revenues of $383.3 million, up 11.5% year on year. This result surpassed analysts’ expectations by 2%. Taking a step back, it was a slower quarter as it logged full-year EPS guidance missing analysts’ expectations.

The company added 5,200 customers to reach a total of 493,800. The stock is up 24.3% since reporting and currently trades at $51.85.

Read our full, actionable report on BILL here, it’s free.

BlackLine (NASDAQ: BL)

Born from the vision to eliminate tedious manual spreadsheet work for accountants, BlackLine (NASDAQ: BL) provides cloud-based software that automates and streamlines financial close, intercompany accounting, and invoice-to-cash processes for accounting departments.

BlackLine reported revenues of $172 million, up 7.2% year on year. This number beat analysts’ expectations by 0.7%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ billings estimates but EPS guidance for next quarter missing analysts’ expectations.

The company lost 4 customers and ended up with a total of 4,451. The stock is flat since reporting and currently trades at $54.36.

Read our full, actionable report on BlackLine here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.