Financial News

Sonos (NASDAQ:SONO) Delivers Impressive Q2

Audio technology Sonos company (NASDAQ: SONO) beat Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 13.2% year on year to $344.8 million. Its non-GAAP profit of $0.19 per share was 26.7% above analysts’ consensus estimates.

Is now the time to buy Sonos? Find out by accessing our full research report, it’s free.

Sonos (SONO) Q2 CY2025 Highlights:

- Revenue: $344.8 million vs analyst estimates of $324.7 million (13.2% year-on-year decline, 6.2% beat)

- Adjusted EPS: $0.19 vs analyst estimates of $0.15 (26.7% beat)

- Adjusted EBITDA: $35.59 million vs analyst estimates of $24.42 million (10.3% margin, 45.7% beat)

- Operating Margin: -0.8%, down from 3.2% in the same quarter last year

- Free Cash Flow Margin: 9.5%, similar to the same quarter last year

- Market Capitalization: $1.30 billion

Company Overview

A pioneer in connected home audio systems, Sonos (NASDAQ: SONO) offers a range of premium wireless speakers and sound systems.

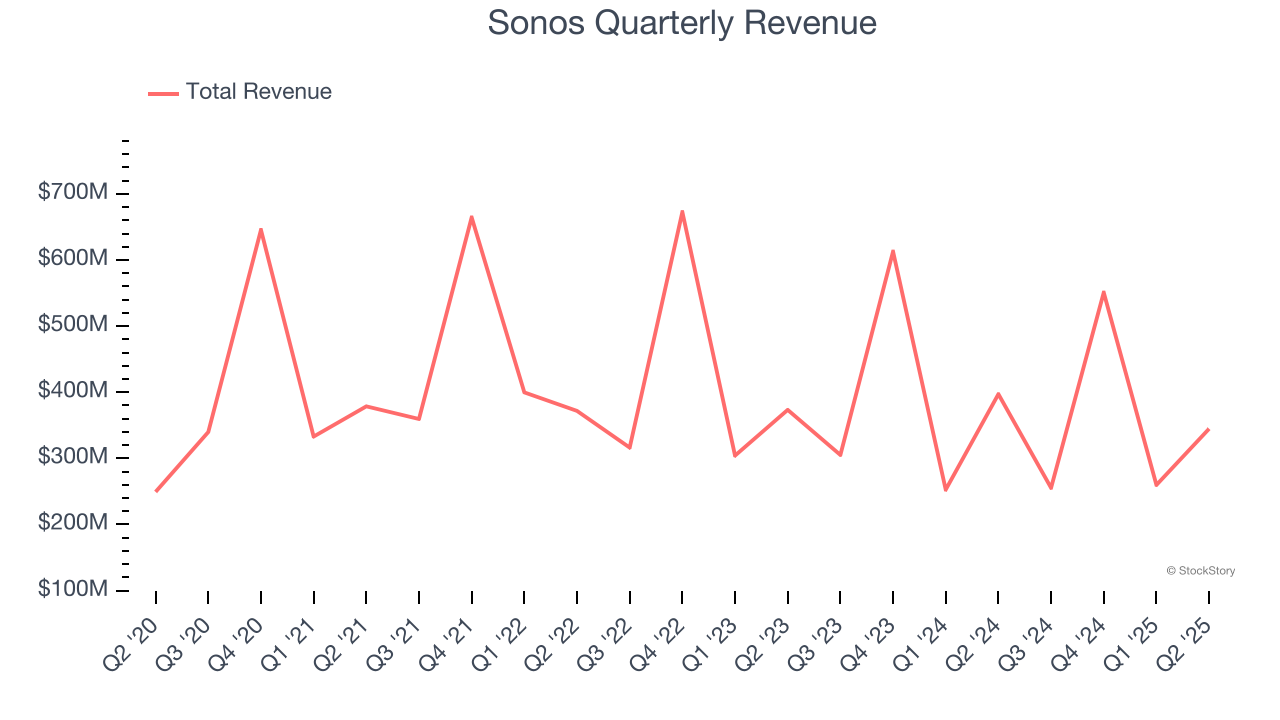

Revenue Growth

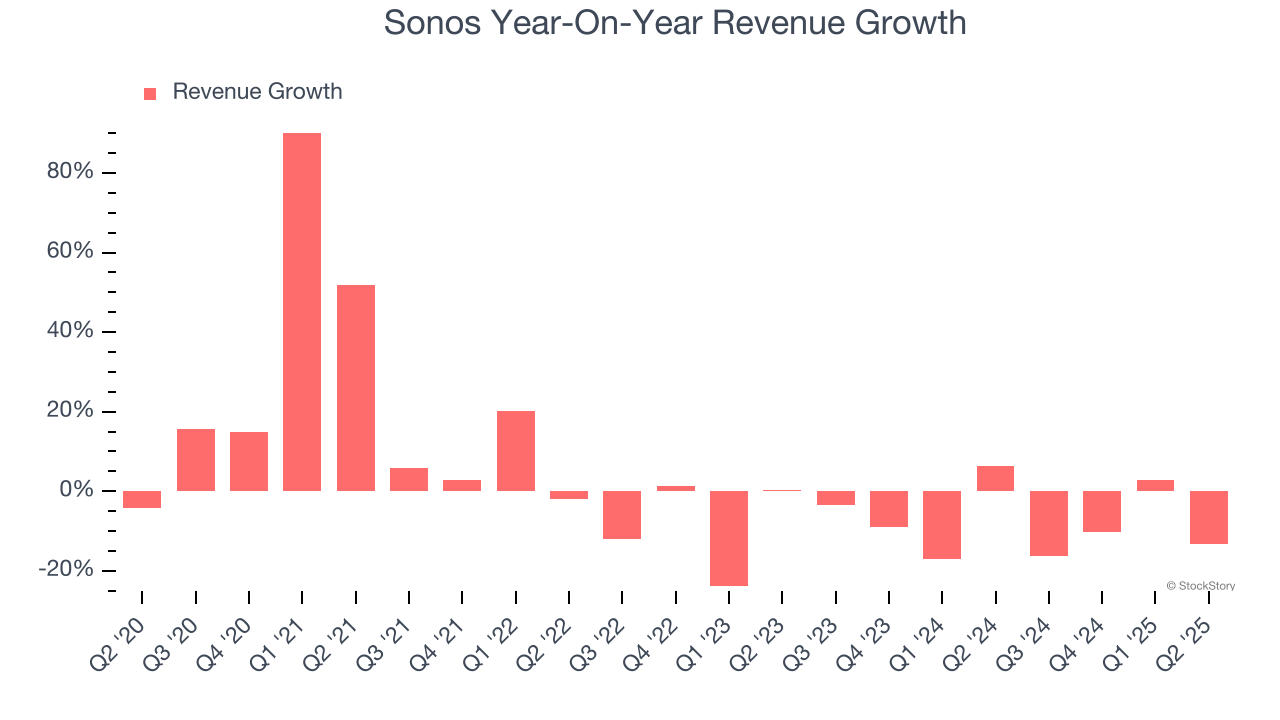

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Sonos grew its sales at a weak 2% compounded annual growth rate. This fell short of our benchmarks and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Sonos’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 8% annually.

This quarter, Sonos’s revenue fell by 13.2% year on year to $344.8 million but beat Wall Street’s estimates by 5.1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

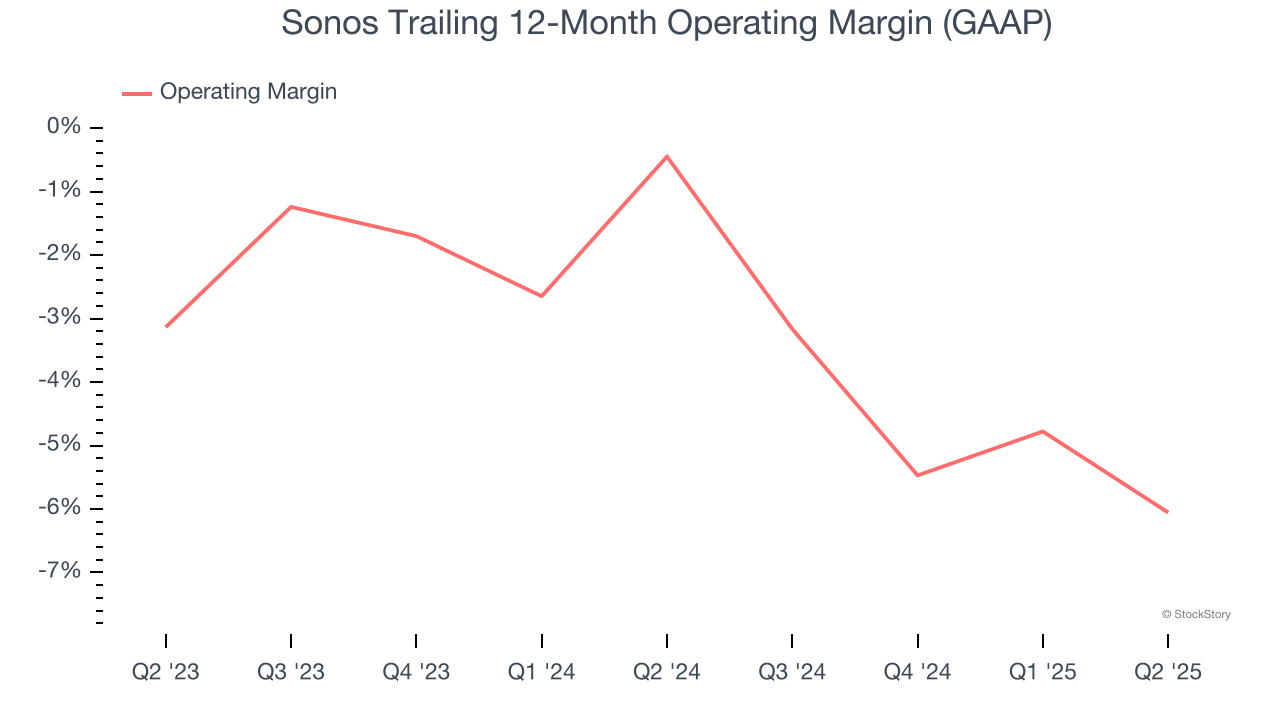

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Sonos’s operating margin has shrunk over the last 12 months and averaged negative 3.1% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q2, Sonos generated a negative 0.8% operating margin. The company's consistent lack of profits raise a flag.

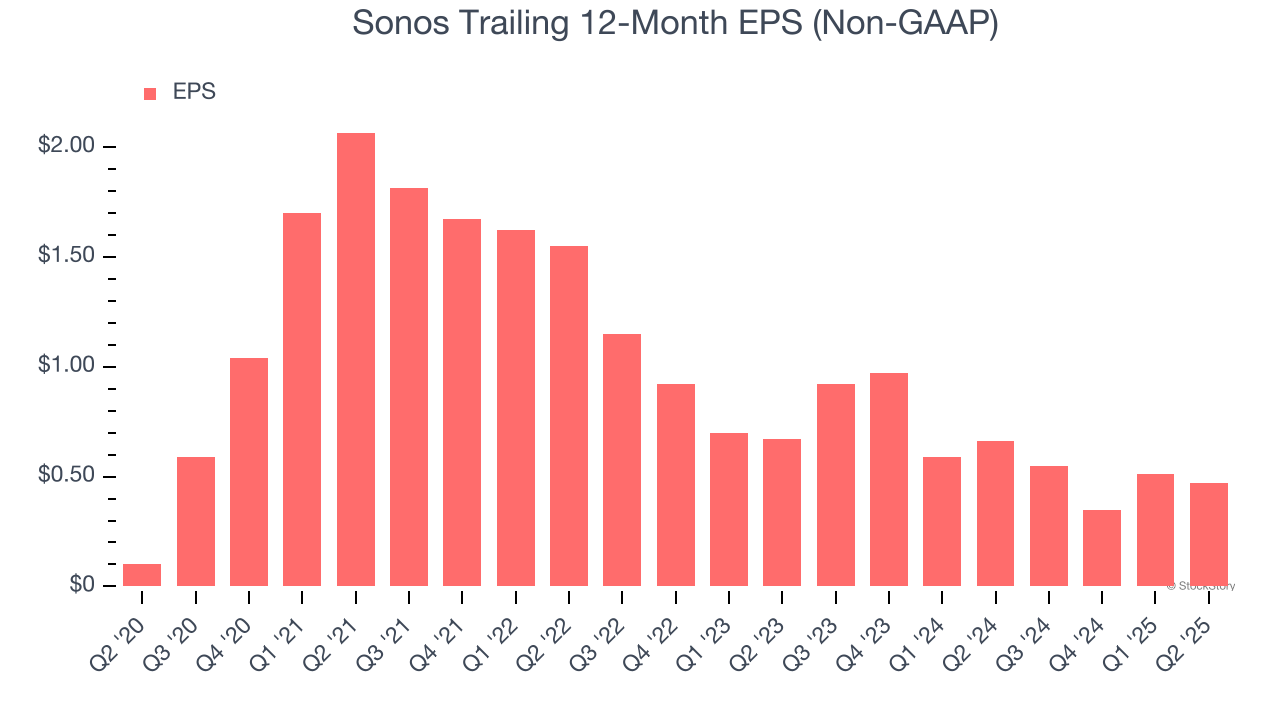

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sonos’s EPS grew at an astounding 35.2% compounded annual growth rate over the last five years, higher than its 2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q2, Sonos reported adjusted EPS at $0.19, down from $0.23 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Sonos’s full-year EPS of $0.47 to grow 29.8%.

Key Takeaways from Sonos’s Q2 Results

We were impressed by how significantly Sonos blew past analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.3% to $11.52 immediately after reporting.

Sonos had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.