Financial News

McKesson’s (NYSE:MCK) Q2 Sales Top Estimates

Healthcare distributor and services company McKesson (NYSE: MCK) announced better-than-expected revenue in Q2 CY2025, with sales up 23.4% year on year to $97.83 billion. Its non-GAAP profit of $8.26 per share was 1.4% above analysts’ consensus estimates.

Is now the time to buy McKesson? Find out by accessing our full research report, it’s free.

McKesson (MCK) Q2 CY2025 Highlights:

- Revenue: $97.83 billion vs analyst estimates of $96.48 billion (23.4% year-on-year growth, 1.4% beat)

- Adjusted EPS: $8.26 vs analyst estimates of $8.15 (1.4% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $37.50 at the midpoint

- Operating Margin: 1.1%, in line with the same quarter last year

- Free Cash Flow was -$1.11 billion compared to -$1.55 billion in the same quarter last year

- Market Capitalization: $88.76 billion

Company Overview

With roots dating back to 1833, making it one of America's oldest continuously operating businesses, McKesson (NYSE: MCK) is a healthcare services company that distributes pharmaceuticals, medical supplies, and provides technology solutions to pharmacies, hospitals, and healthcare providers.

Revenue Growth

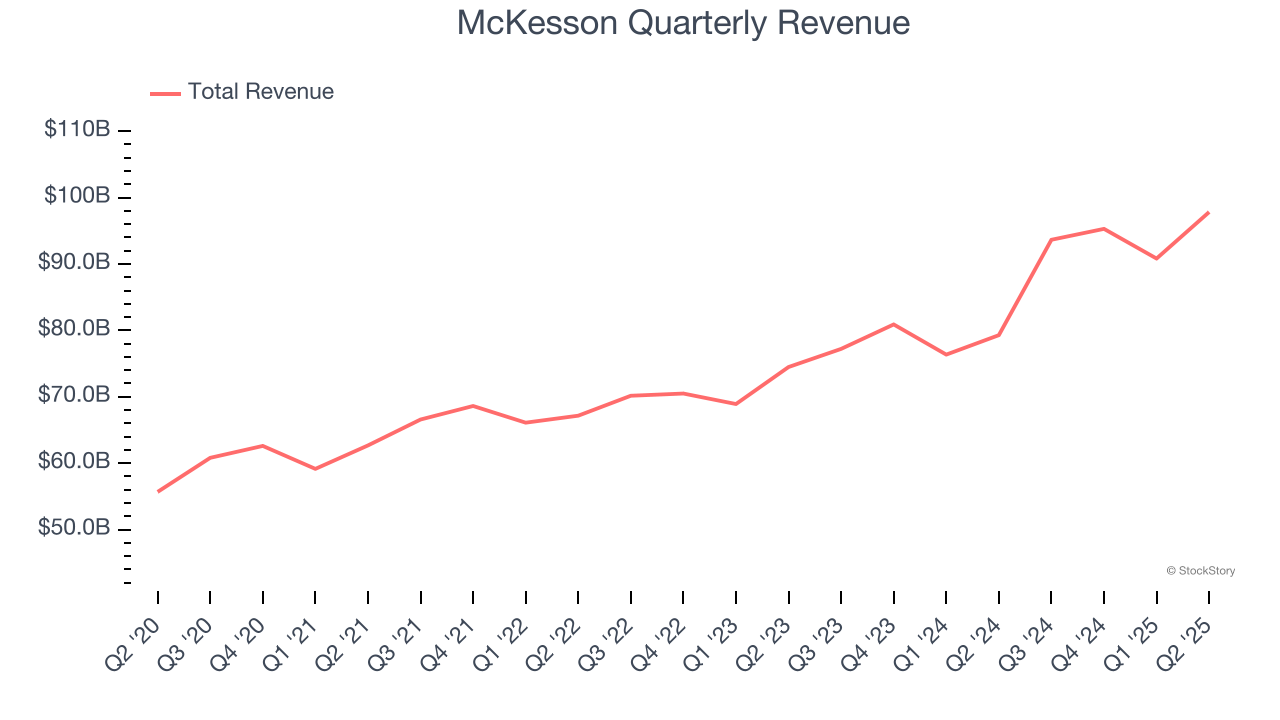

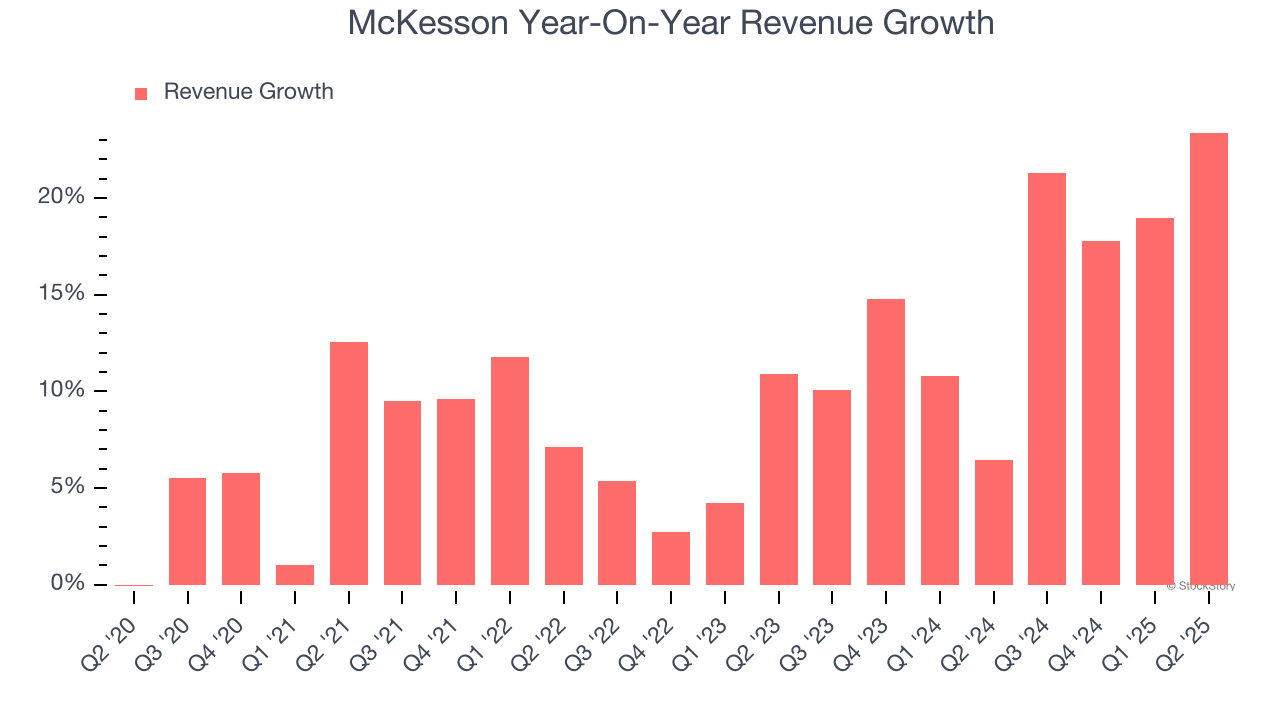

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, McKesson grew its sales at a decent 10.3% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. McKesson’s annualized revenue growth of 15.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

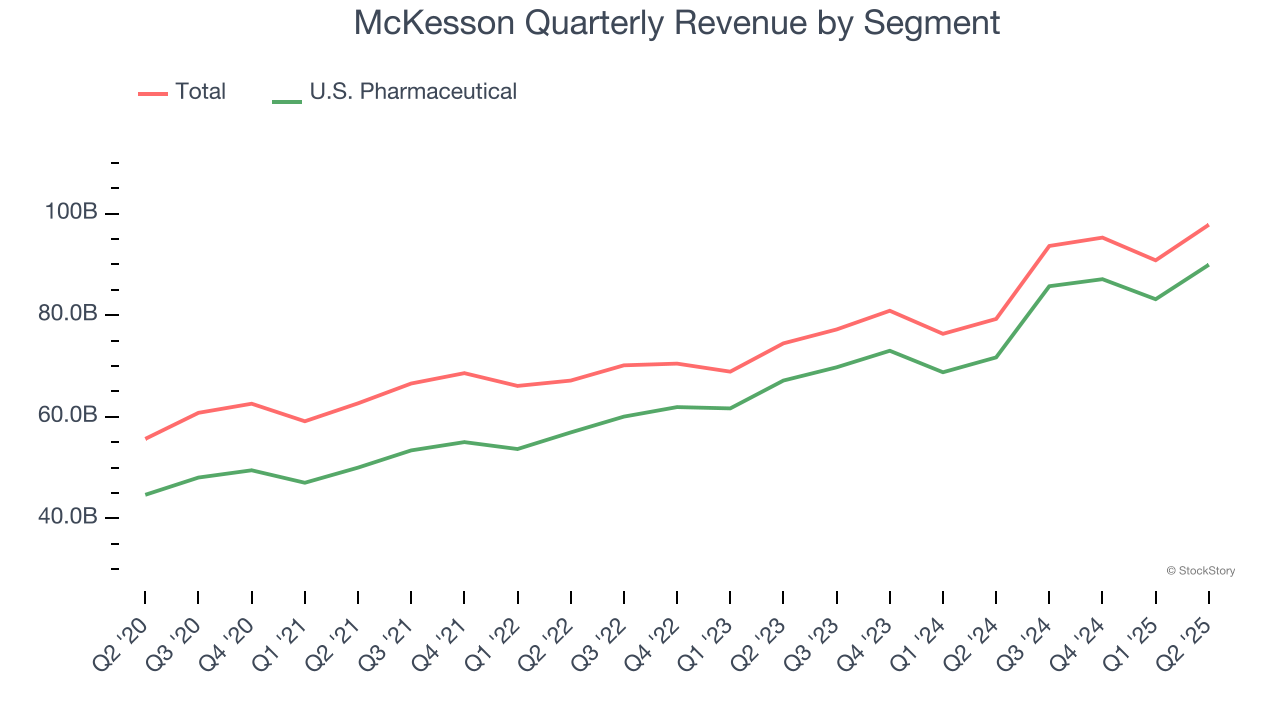

We can better understand the company’s revenue dynamics by analyzing its most important segment, U.S. Pharmaceutical

. Over the last two years, McKesson’s U.S. Pharmaceutical

revenue averaged 17.6% year-on-year growth.

This quarter, McKesson reported robust year-on-year revenue growth of 23.4%, and its $97.83 billion of revenue topped Wall Street estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and implies the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

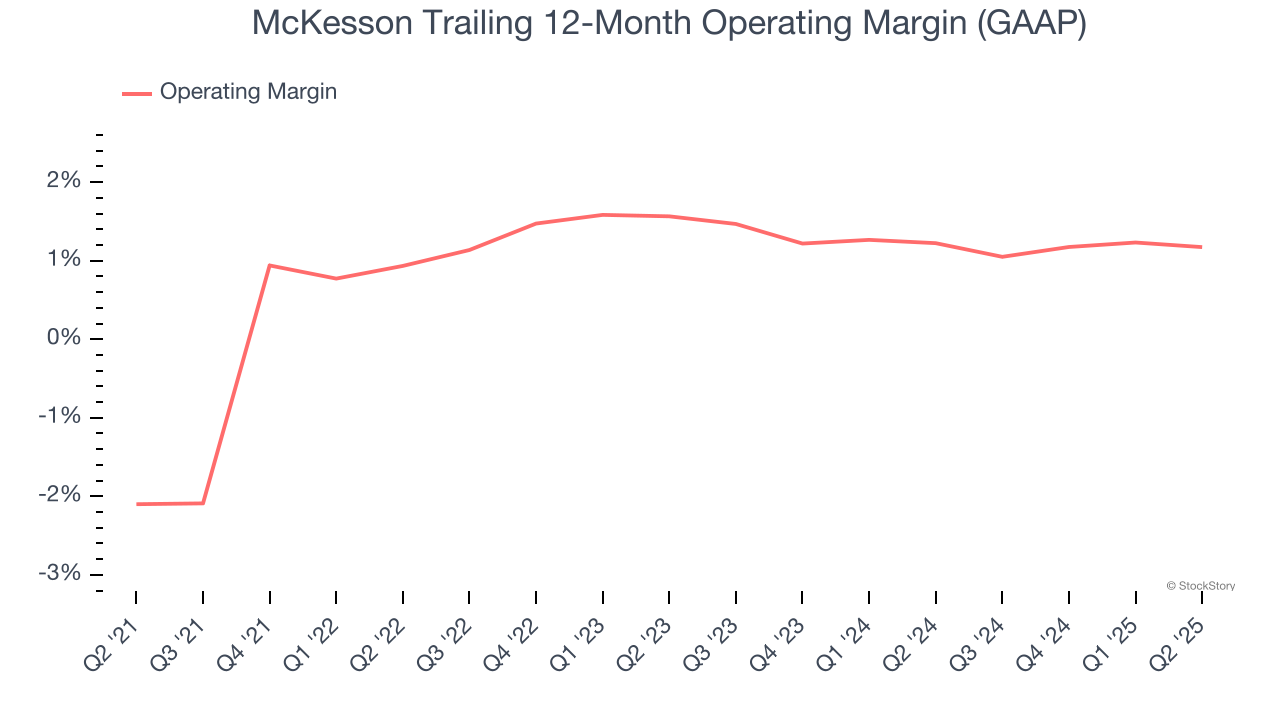

McKesson was roughly breakeven when averaging the last five years of quarterly operating profits, lousy for a healthcare business.

On the plus side, McKesson’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q2, McKesson generated an operating margin profit margin of 1.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

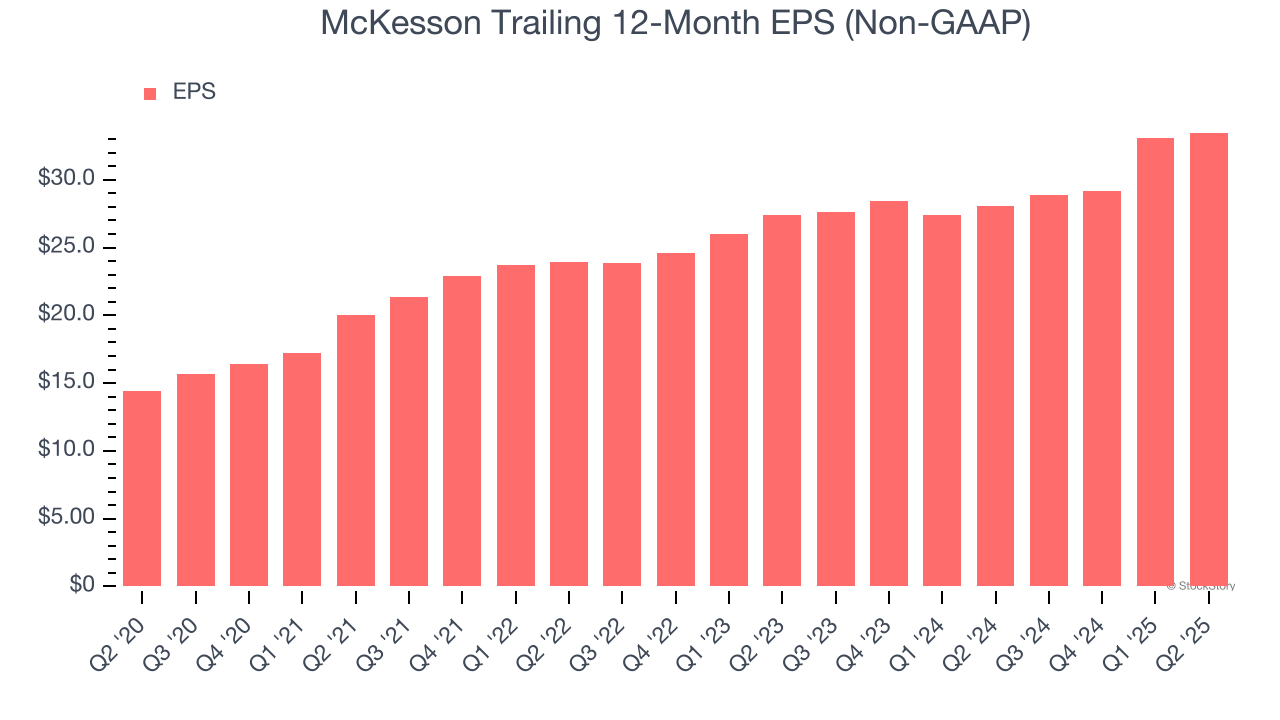

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

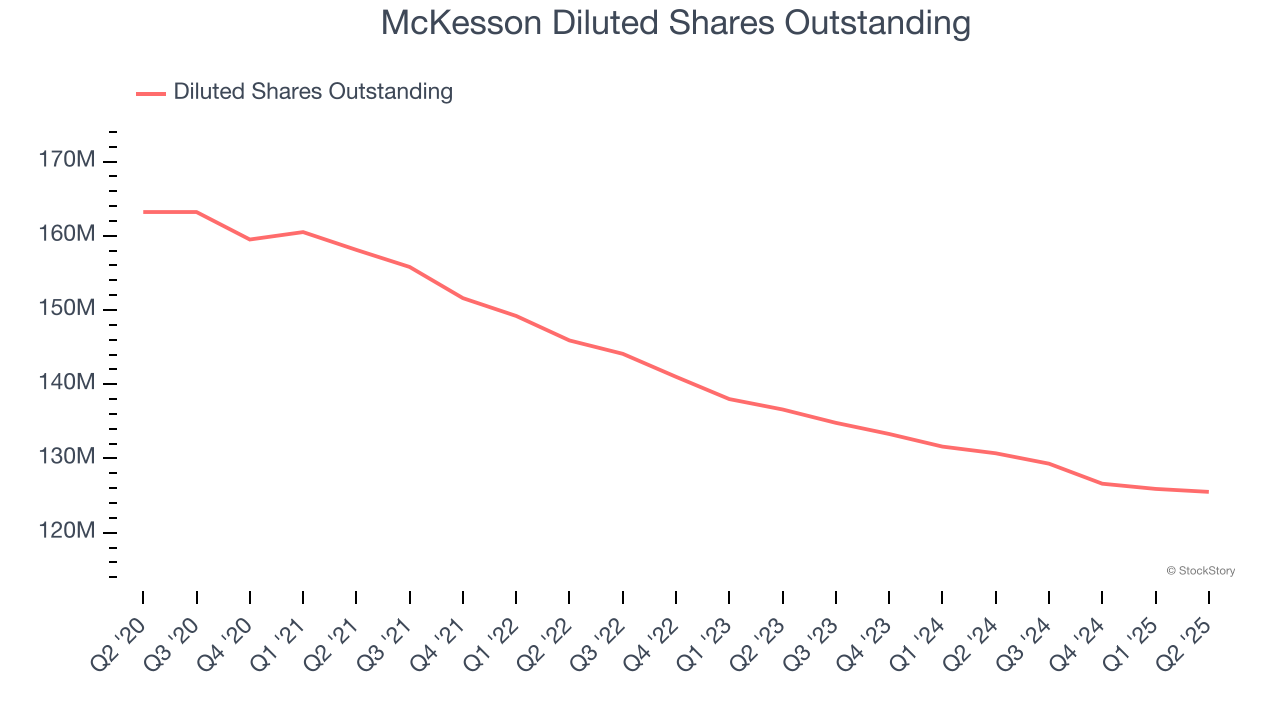

McKesson’s EPS grew at an astounding 18.3% compounded annual growth rate over the last five years, higher than its 10.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of McKesson’s earnings can give us a better understanding of its performance. As we mentioned earlier, McKesson’s operating margin was flat this quarter but expanded by 3.3 percentage points over the last five years. On top of that, its share count shrank by 23.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q2, McKesson reported adjusted EPS at $8.26, up from $7.88 in the same quarter last year. This print beat analysts’ estimates by 1.4%. Over the next 12 months, Wall Street expects McKesson’s full-year EPS of $33.48 to grow 15.5%.

Key Takeaways from McKesson’s Q2 Results

It was good to see McKesson narrowly top analysts’ revenue and EPS expectations this quarter. The market seemed to be hoping for more, and the stock traded down 1.8% to $692 immediately following the results.

Is McKesson an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.