Financial News

Crane NXT (NYSE:CXT) Delivers Impressive Q2

Payment technology company Crane NXT (NYSE: CXT) beat Wall Street’s revenue expectations in Q2 CY2025, with sales up 9.1% year on year to $404.4 million. Its non-GAAP profit of $0.97 per share was 2.5% above analysts’ consensus estimates.

Is now the time to buy Crane NXT? Find out by accessing our full research report, it’s free.

Crane NXT (CXT) Q2 CY2025 Highlights:

- Revenue: $404.4 million vs analyst estimates of $381.7 million (9.1% year-on-year growth, 5.9% beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.95 (2.5% beat)

- Adjusted EBITDA: $97.9 million vs analyst estimates of $93.95 million (24.2% margin, 4.2% beat)

- Management reiterated its full-year Adjusted EPS guidance of $4.15 at the midpoint

- Operating Margin: 11.8%, down from 18.2% in the same quarter last year

- Free Cash Flow Margin: 13.8%, similar to the same quarter last year

- Backlog: $591.6 million at quarter end

- Market Capitalization: $3.29 billion

Aaron W. Saak, Crane NXT's President and Chief Executive Officer, stated: "Our second quarter results were in line with our expectations, with sales growth of approximately 9% and adjusted segment operating profit margin of approximately 24%. We are excited about the continued record high backlog in international currency and the positive momentum in CPI gaming orders."

Company Overview

Born from a corporate transformation completed in 2023, Crane NXT (NYSE: CXT) provides specialized technology solutions for payment processing, banknote security, and authentication systems for financial institutions and businesses.

Revenue Growth

A company’s top-line performance can indicate its business quality. Rapid growth can signal it’s benefiting from an innovative new product or burgeoning market trend.

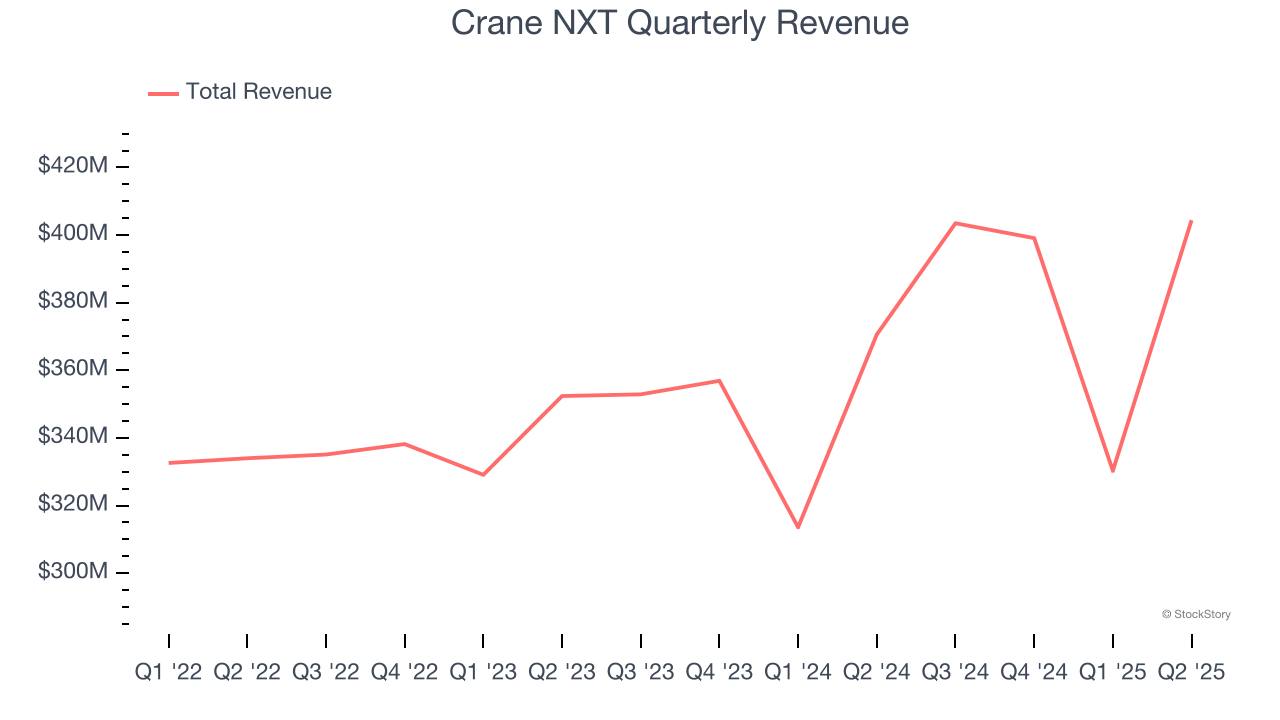

With $1.54 billion in revenue over the past 12 months, Crane NXT is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

This quarter, Crane NXT reported year-on-year revenue growth of 9.1%, and its $404.4 million of revenue exceeded Wall Street’s estimates by 5.9%.

Looking ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

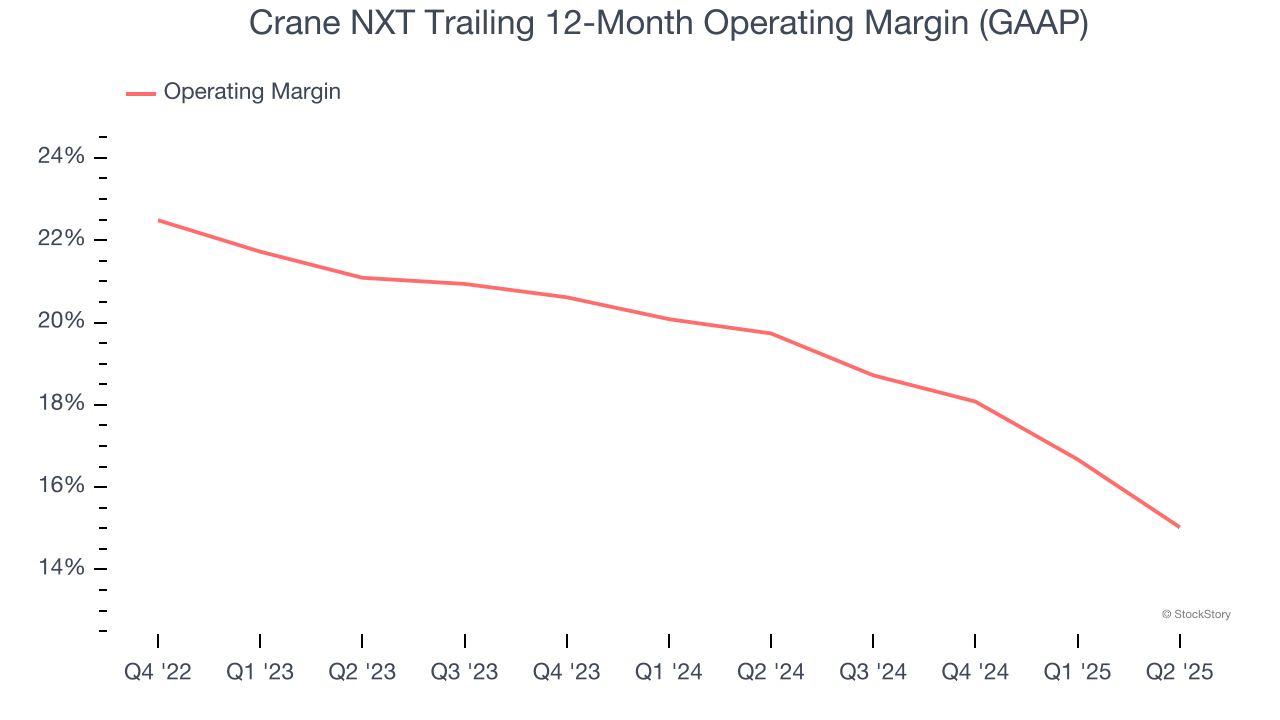

Crane NXT has been a well-oiled machine over the last four years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 19%.

Looking at the trend in its profitability, Crane NXT’s operating margin decreased by 11 percentage points over the last four years. Even though its historical margin was healthy, shareholders will want to see Crane NXT become more profitable in the future.

This quarter, Crane NXT generated an operating margin profit margin of 11.8%, down 6.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

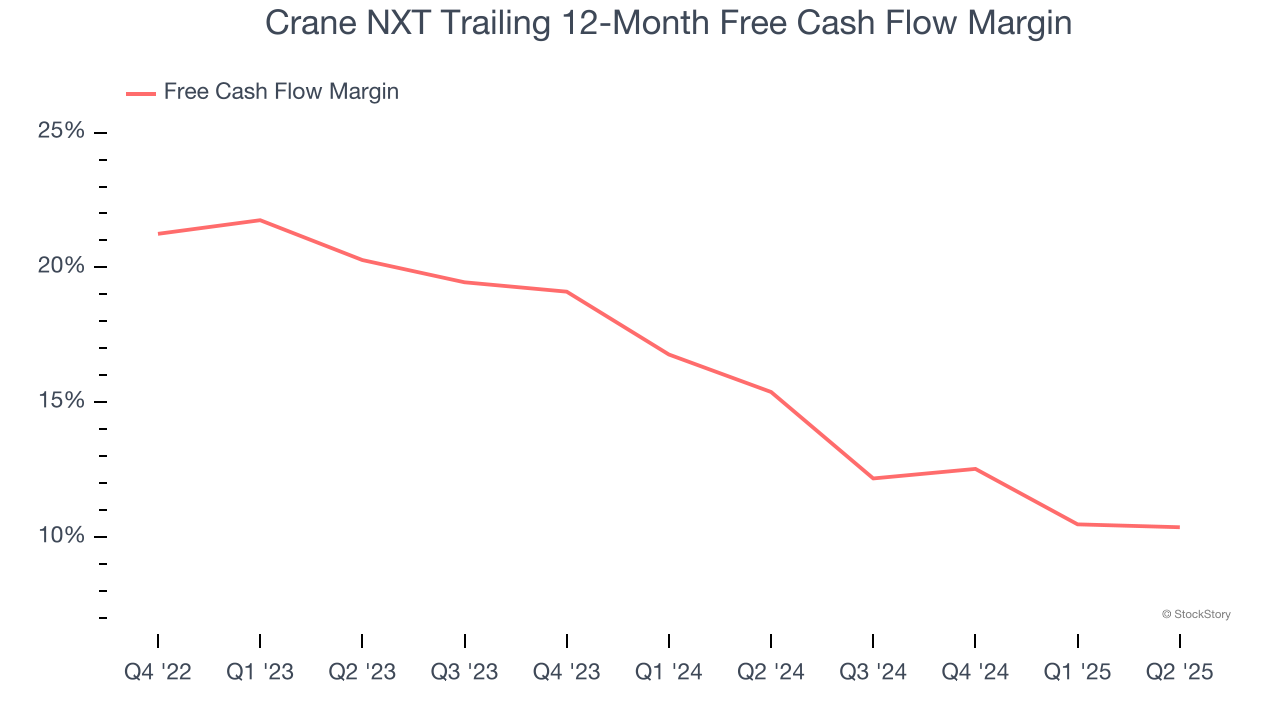

Crane NXT has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 15.4% over the last four years.

Taking a step back, we can see that Crane NXT’s margin dropped by 13.6 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Crane NXT’s free cash flow clocked in at $55.8 million in Q2, equivalent to a 13.8% margin. This cash profitability was in line with the comparable period last year but below its four-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Crane NXT’s Q2 Results

We were impressed by how significantly Crane NXT blew past analysts’ revenue expectations this quarter. We were also happy its full-year EPS guidance narrowly outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $56.81 immediately after reporting.

Crane NXT may have had a good quarter, but does that mean you should invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.