Financial News

Sales And Marketing Software Stocks Q1 Recap: Benchmarking Braze (NASDAQ:BRZE)

As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the sales and marketing software industry, including Braze (NASDAQ: BRZE) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.1% on average since the latest earnings results.

Weakest Q1: Braze (NASDAQ: BRZE)

Founded in 2011 after the co-founders met at NYC Disrupt Hackathon, Braze (NASDAQ: BRZE) is a customer engagement software platform that allows brands to connect with customers through data-driven and contextual marketing campaigns.

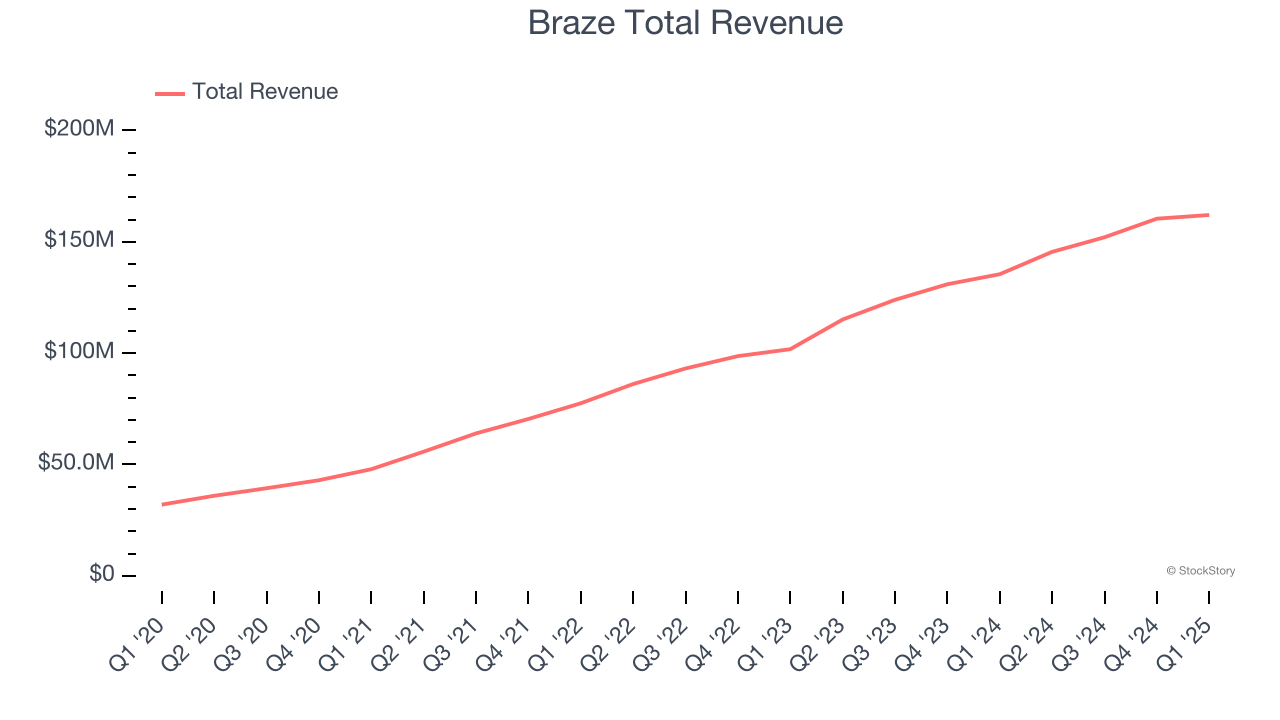

Braze reported revenues of $162.1 million, up 19.6% year on year. This print exceeded analysts’ expectations by 2.2%. Despite the top-line beat, it was still a slower quarter for the company with full-year EPS guidance missing analysts’ expectations.

“We are off to a good start in fiscal year 2026, delivering strong revenue growth, profitability, and free cash flow in an ever-changing environment,” said Bill Magnuson, Cofounder and CEO of Braze.

Braze pulled off the highest full-year guidance raise of the whole group. The company added 46 customers to reach a total of 2,342. Still, the market seems discontent with the results. The stock is down 18.6% since reporting and currently trades at $27.15.

Is now the time to buy Braze? Access our full analysis of the earnings results here, it’s free.

Best Q1: Yext (NYSE: YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE: YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

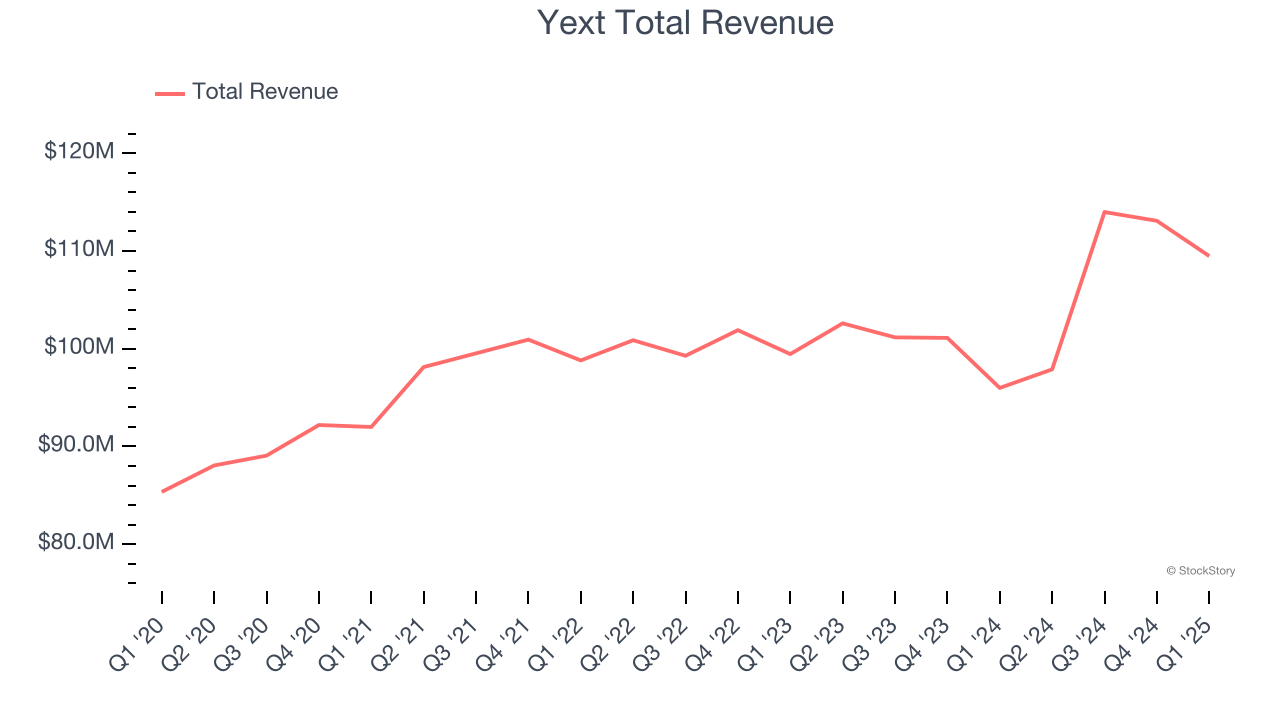

Yext reported revenues of $109.5 million, up 14.1% year on year, outperforming analysts’ expectations by 1.8%. The business had an exceptional quarter with an impressive beat of analysts’ annual recurring revenue estimates and a solid beat of analysts’ billings estimates.

The market seems happy with the results as the stock is up 18.6% since reporting. It currently trades at $8.08.

Is now the time to buy Yext? Access our full analysis of the earnings results here, it’s free.

ON24 (NYSE: ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE: ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $34.73 million, down 7.9% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and EPS guidance for next quarter missing analysts’ expectations significantly.

Interestingly, the stock is up 11% since the results and currently trades at $5.23.

Read our full analysis of ON24’s results here.

The Trade Desk (NASDAQ: TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ: TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $616 million, up 25.4% year on year. This number surpassed analysts’ expectations by 7%. It was a very strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

The stock is up 36.3% since reporting and currently trades at $81.75.

Read our full, actionable report on The Trade Desk here, it’s free.

VeriSign (NASDAQ: VRSN)

While the company is not a domain registrar and does not directly sell domain names to end users, Verisign (NASDAQ: VRSN) operates and maintains the infrastructure to support domain names such as .com and .net.

VeriSign reported revenues of $402.3 million, up 4.7% year on year. This print was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it underperformed in some other aspects of the business.

The stock is up 12.2% since reporting and currently trades at $283.26.

Read our full, actionable report on VeriSign here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.