Financial News

Hilltop Holdings (HTH): Buy, Sell, or Hold Post Q1 Earnings?

Hilltop Holdings trades at $30.71 and has moved in lockstep with the market. Its shares have returned 9.5% over the last six months while the S&P 500 has gained 7.1%.

Is now the time to buy Hilltop Holdings, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Do We Think Hilltop Holdings Will Underperform?

We're swiping left on Hilltop Holdings for now. Here are three reasons why there are better opportunities than HTH and a stock we'd rather own.

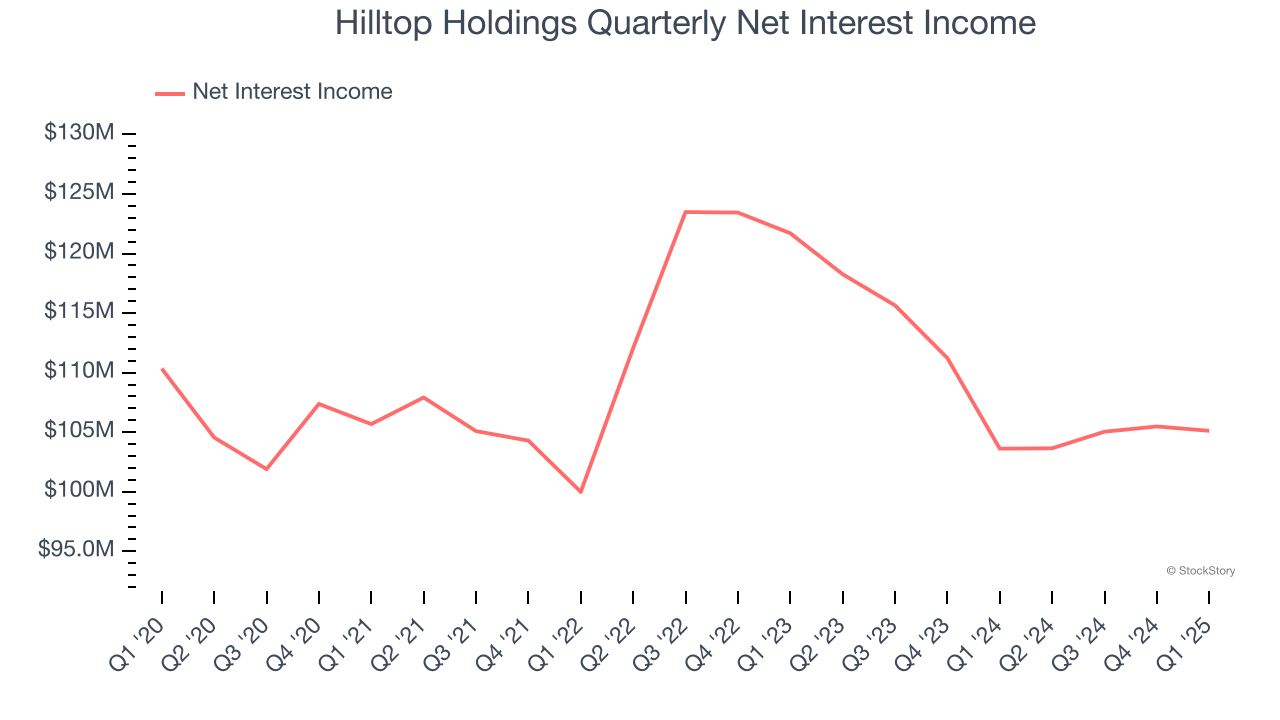

1. Net Interest Income Hits a Plateau

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Hilltop Holdings’s net interest income was flat over the last four years, much worse than the broader bank industry.

2. Efficiency Ratio Expected to Falter

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Hilltop Holdings to become less profitable as it anticipates an efficiency ratio of 86.5% compared to 54.5% over the past year.

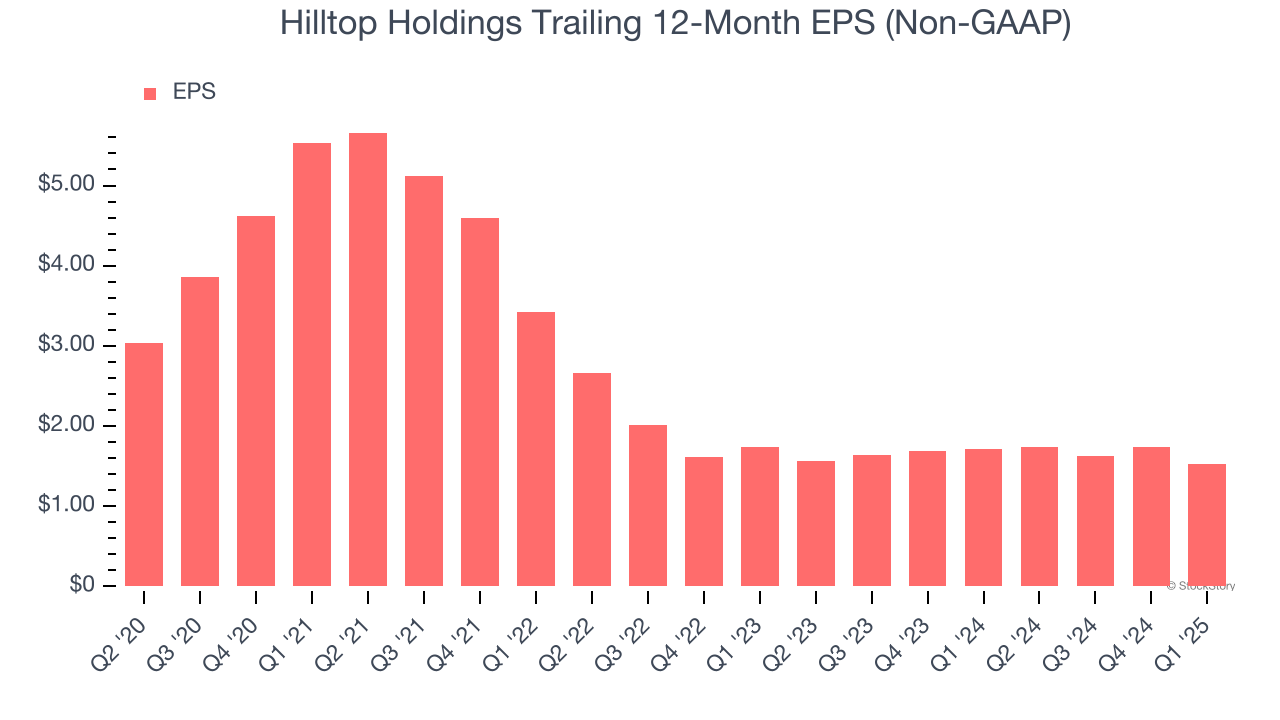

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Hilltop Holdings, its EPS declined by 9% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

We cheer for all companies supporting the economy, but in the case of Hilltop Holdings, we’ll be cheering from the sidelines. That said, the stock currently trades at 0.9× forward P/B (or $30.71 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Hilltop Holdings

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.