Financial News

3 Reasons to Sell STAA and 1 Stock to Buy Instead

Over the last six months, STAAR Surgical’s shares have sunk to $17.38, producing a disappointing 19.7% loss - a stark contrast to the S&P 500’s 7.1% gain. This may have investors wondering how to approach the situation.

Is now the time to buy STAAR Surgical, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think STAAR Surgical Will Underperform?

Even though the stock has become cheaper, we don't have much confidence in STAAR Surgical. Here are three reasons why we avoid STAA and a stock we'd rather own.

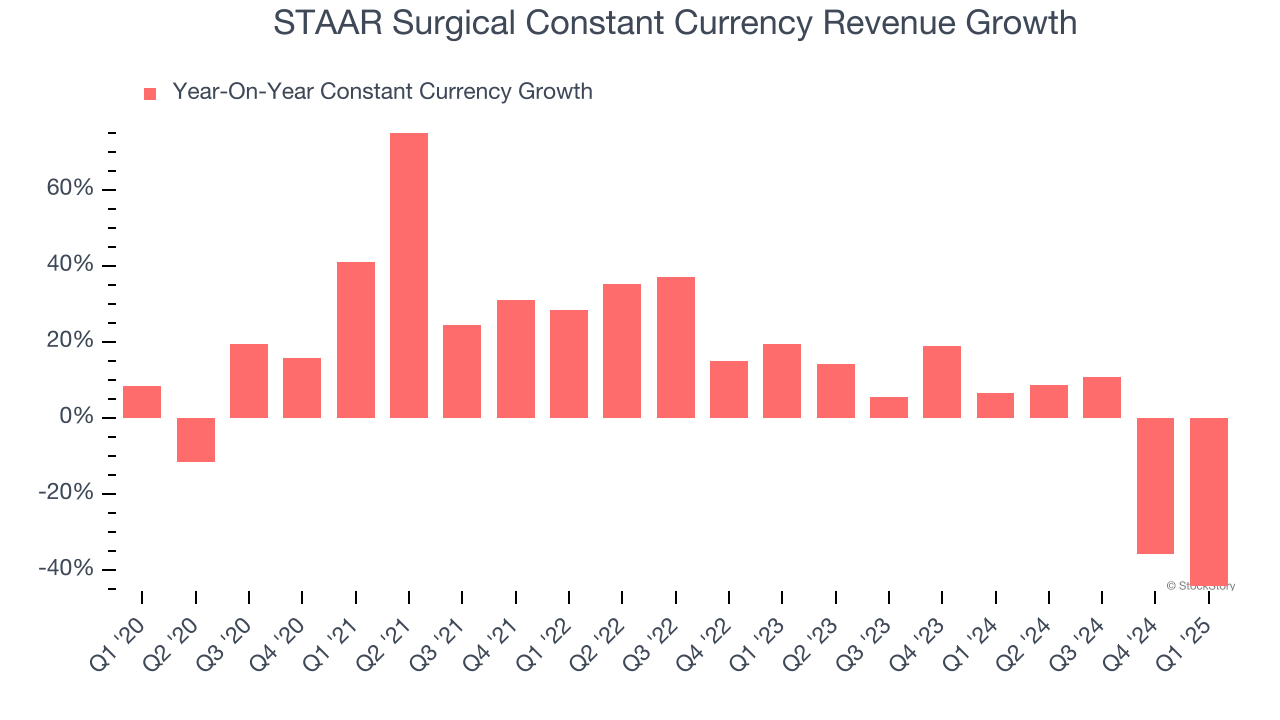

1. Declining Constant Currency Revenue, Demand Takes a Hit

We can better understand Medical Devices & Supplies - Specialty companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of STAAR Surgical’s control and are not indicative of underlying demand.

Over the last two years, STAAR Surgical’s constant currency revenue averaged 1.9% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests STAAR Surgical might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

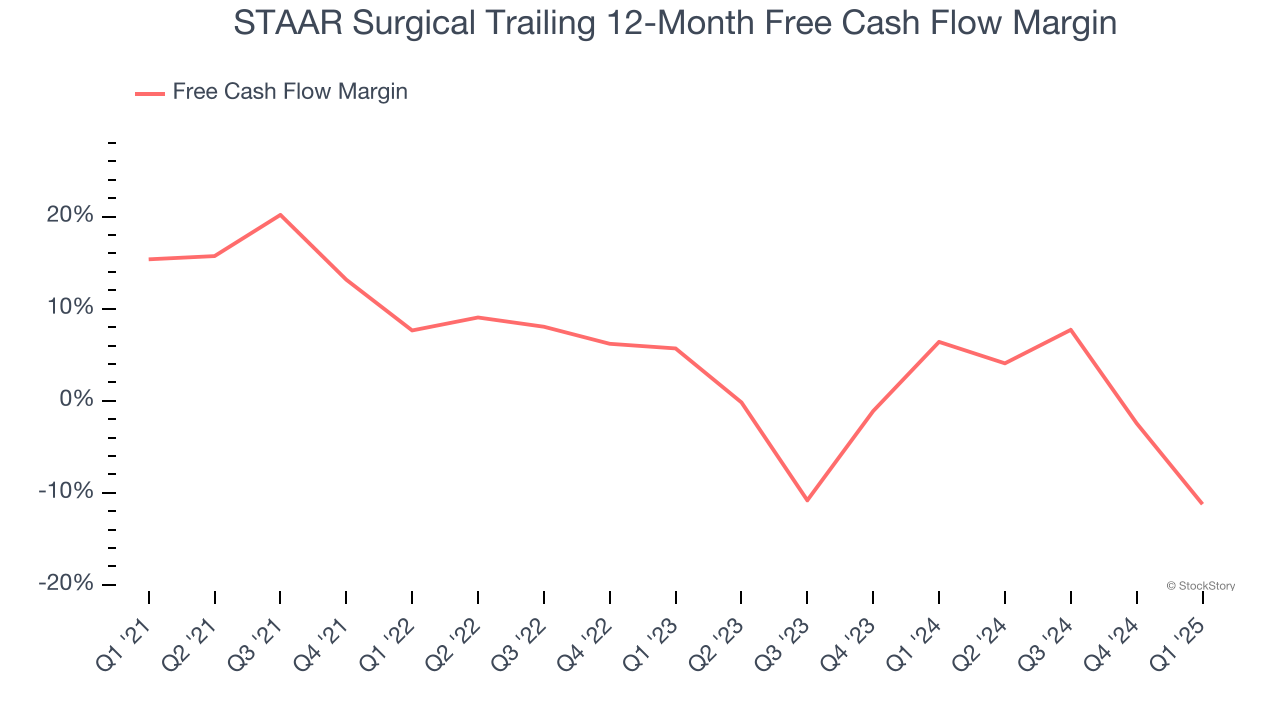

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, STAAR Surgical’s margin dropped by 26.6 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of a big investment cycle. STAAR Surgical’s free cash flow margin for the trailing 12 months was negative 11.2%.

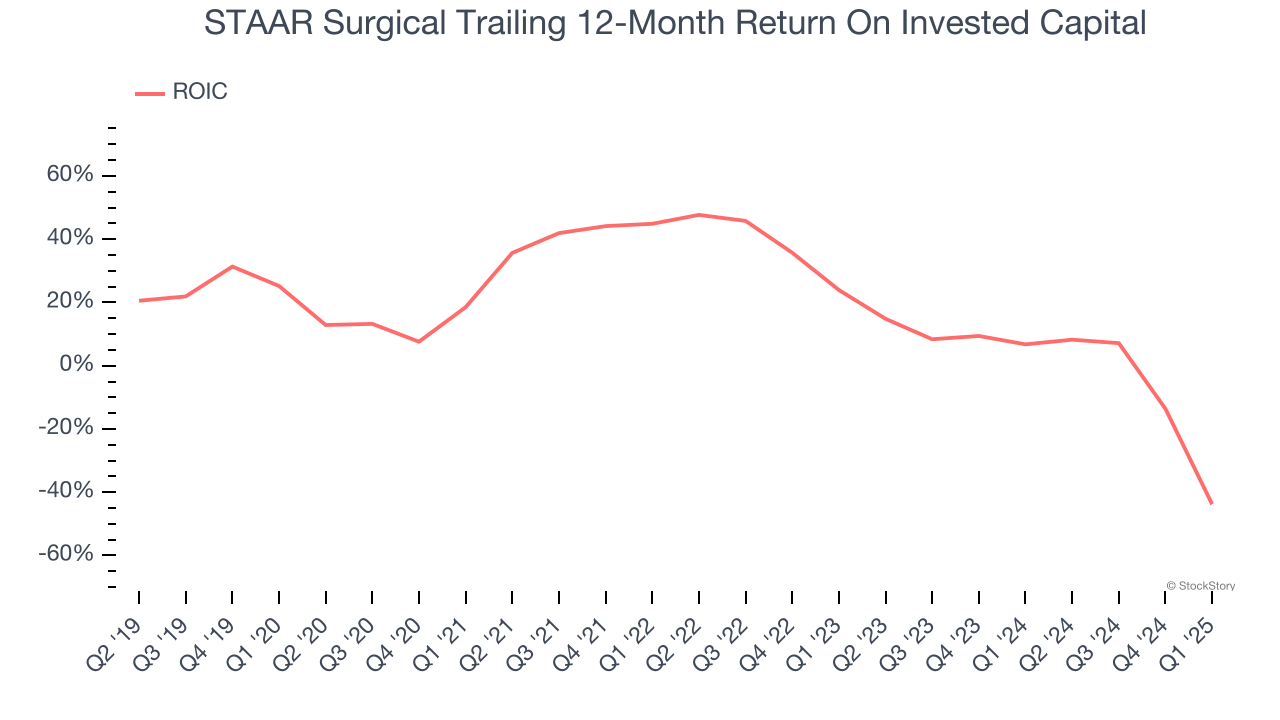

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, STAAR Surgical’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We see the value of companies making people healthier, but in the case of STAAR Surgical, we’re out. Following the recent decline, the stock trades at $17.38 per share (or a forward price-to-sales ratio of 3×). The market typically values companies like STAAR Surgical based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d suggest looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.