Financial News

3 Reasons to Avoid EIG and 1 Stock to Buy Instead

Over the past six months, Employers Holdings’s shares (currently trading at $46.22) have posted a disappointing 6.3% loss, well below the S&P 500’s 7.1% gain. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Employers Holdings, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Employers Holdings Will Underperform?

Even though the stock has become cheaper, we're swiping left on Employers Holdings for now. Here are three reasons why we avoid EIG and a stock we'd rather own.

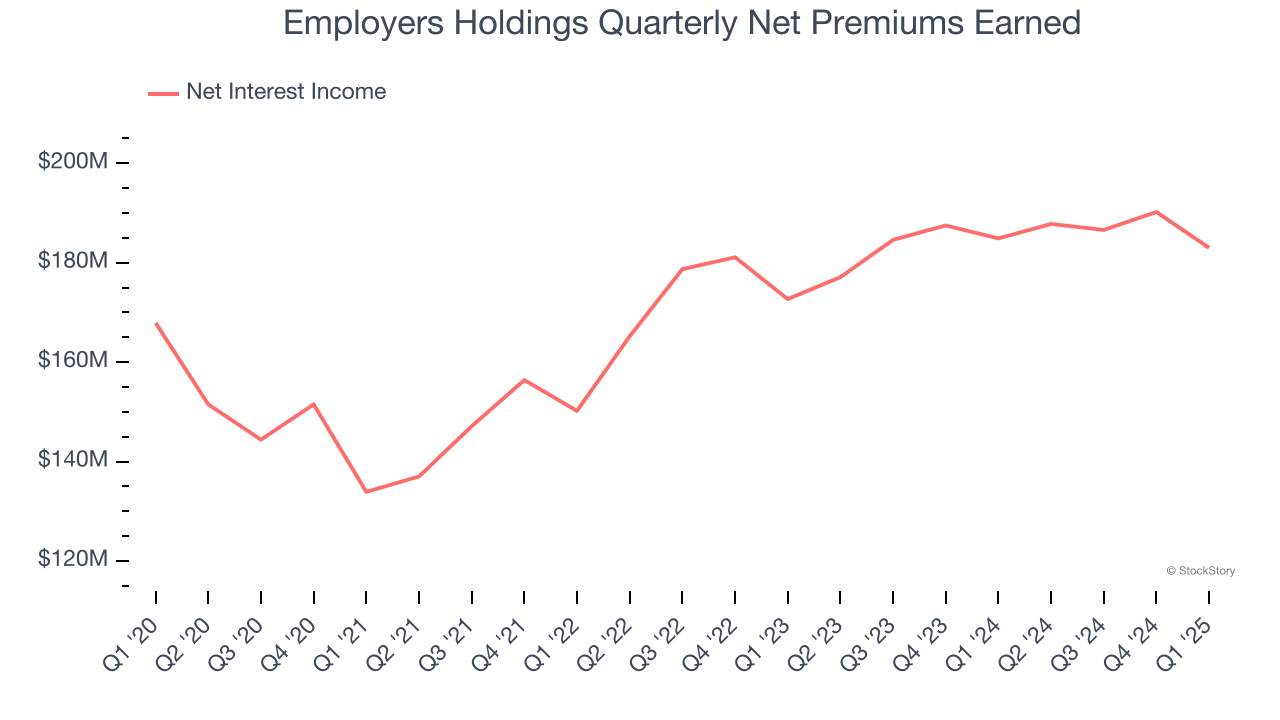

1. Net Premiums Earned Points to Soft Demand

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

Employers Holdings’s net premiums earned has grown at a 3.5% annualized rate over the last two years, worse than the broader insurance industry and slower than its total revenue.

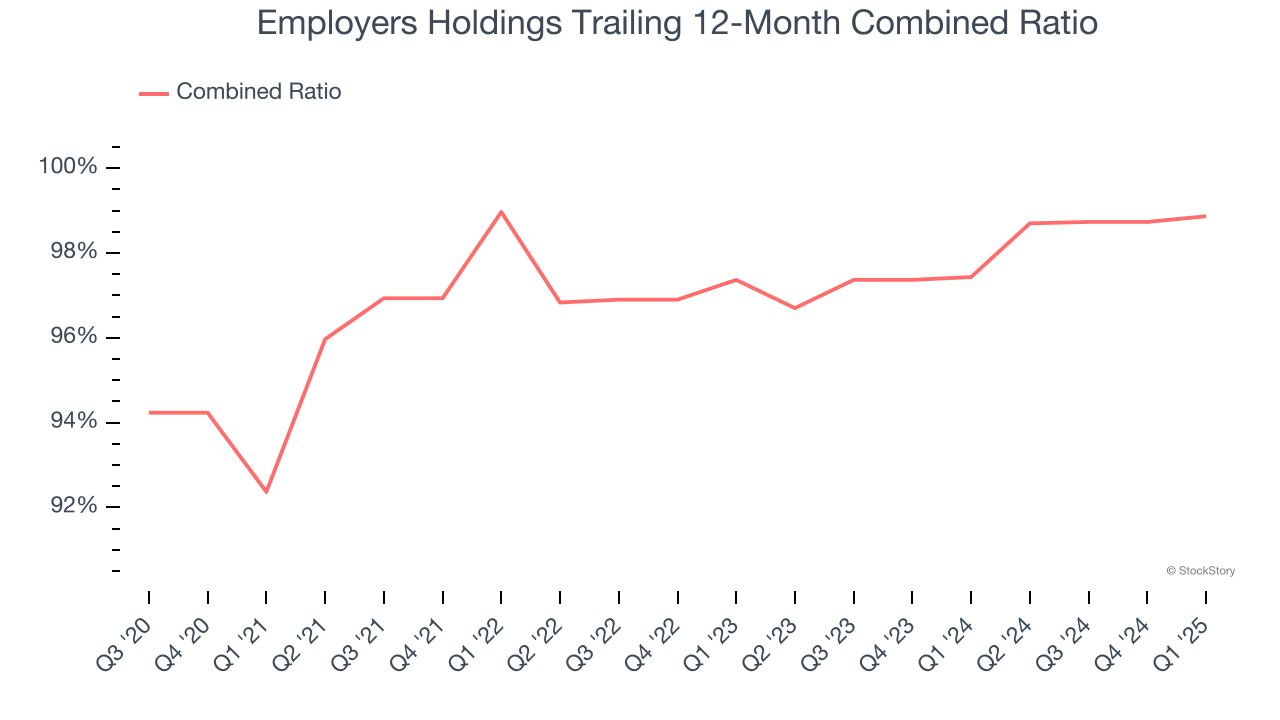

2. Deteriorating Combined Ratio

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio is:

- The costs of underwriting (salaries, commissions, overhead) + what an insurer pays out in claims, all divided by net premiums earned

If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Over the last four years, Employers Holdings’s combined ratio has swelled by 6.5 percentage points, hitting 98.9% for the past 12 months. Said differently, the company’s expenses have increased at a faster rate than revenue, which is usually raises questions in mature industries (the exception is a high-growth company that reinvests its profits in attractive ventures).

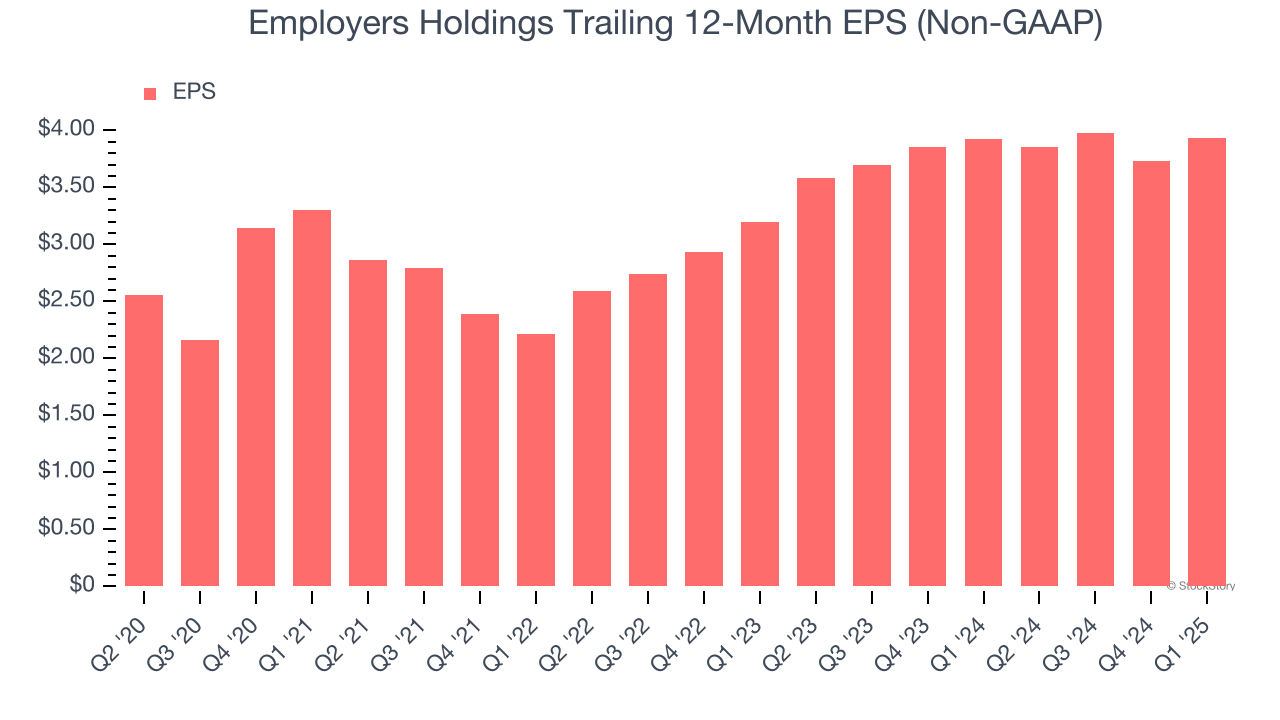

3. Recent EPS Growth Below Our Standards

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Employers Holdings’s EPS grew at a weak 10.8% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 5.8% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

We see the value of companies helping consumers, but in the case of Employers Holdings, we’re out. Following the recent decline, the stock trades at 1× forward P/B (or $46.22 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.