Financial News

GitLab (GTLB): 3 Reasons We Love This Stock

GitLab’s stock price has taken a beating over the past six months, shedding 28.6% of its value and falling to $45.60 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now an opportune time to buy GTLB? Find out in our full research report, it’s free.

Why Is GitLab a Good Business?

Founded as an open-source project in 2011, GitLab (NASDAQ: GTLB) is a leading software development tools platform.

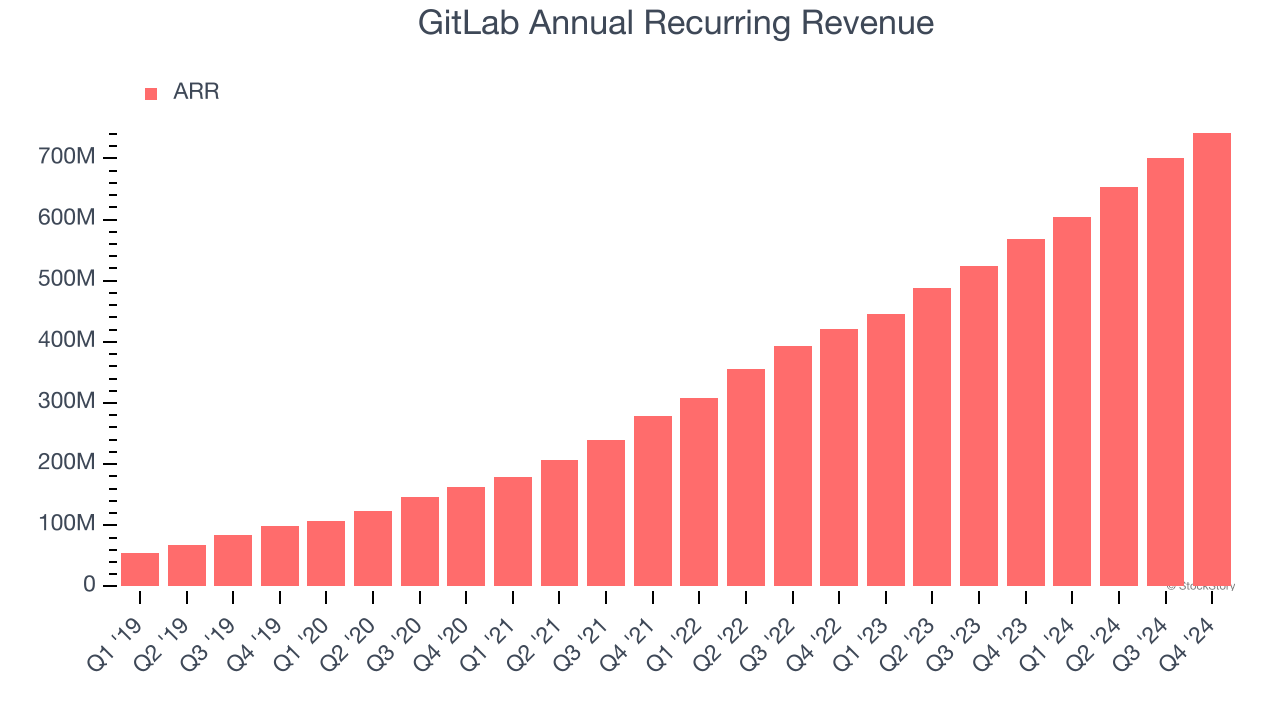

1. ARR Surges as Recurring Revenue Flows In

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

GitLab’s ARR punched in at $742.2 million in Q4, and over the last four quarters, its year-on-year growth averaged 33.5%. This performance was fantastic and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes GitLab a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

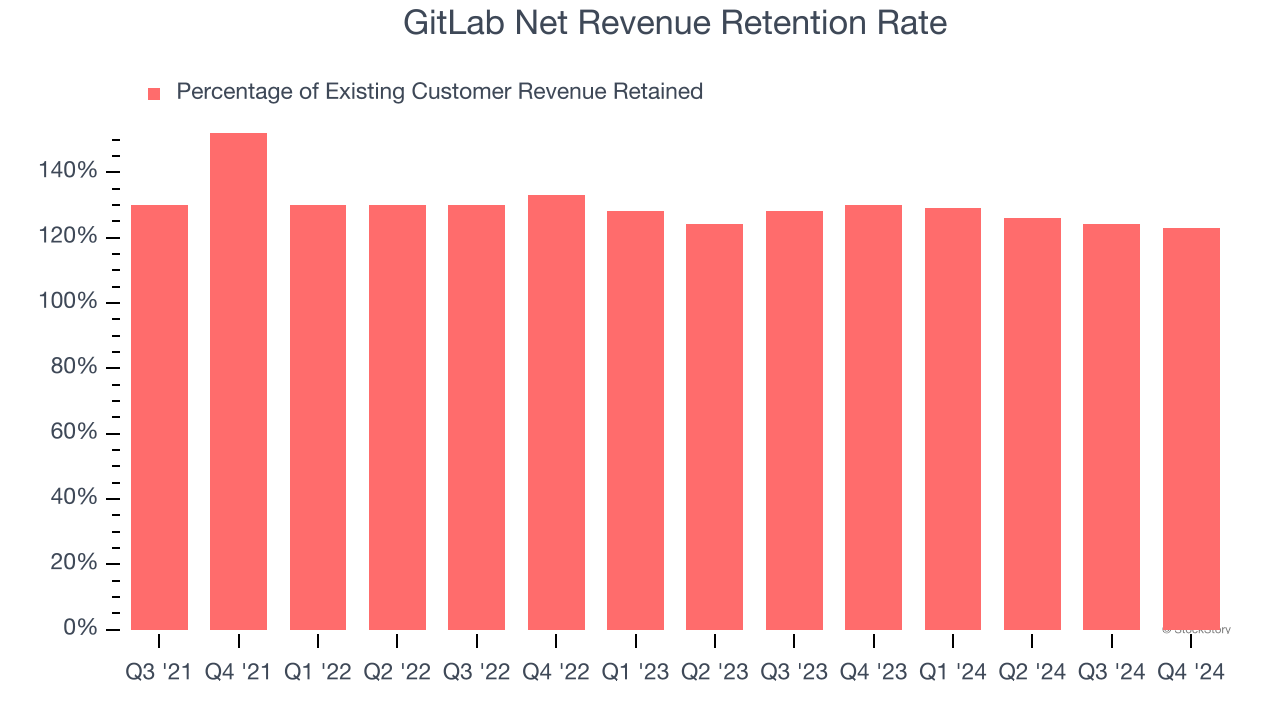

2. Outstanding Retention Sets the Stage for Huge Gains

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

GitLab’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 126% in Q4. This means GitLab would’ve grown its revenue by 25.5% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, GitLab still has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

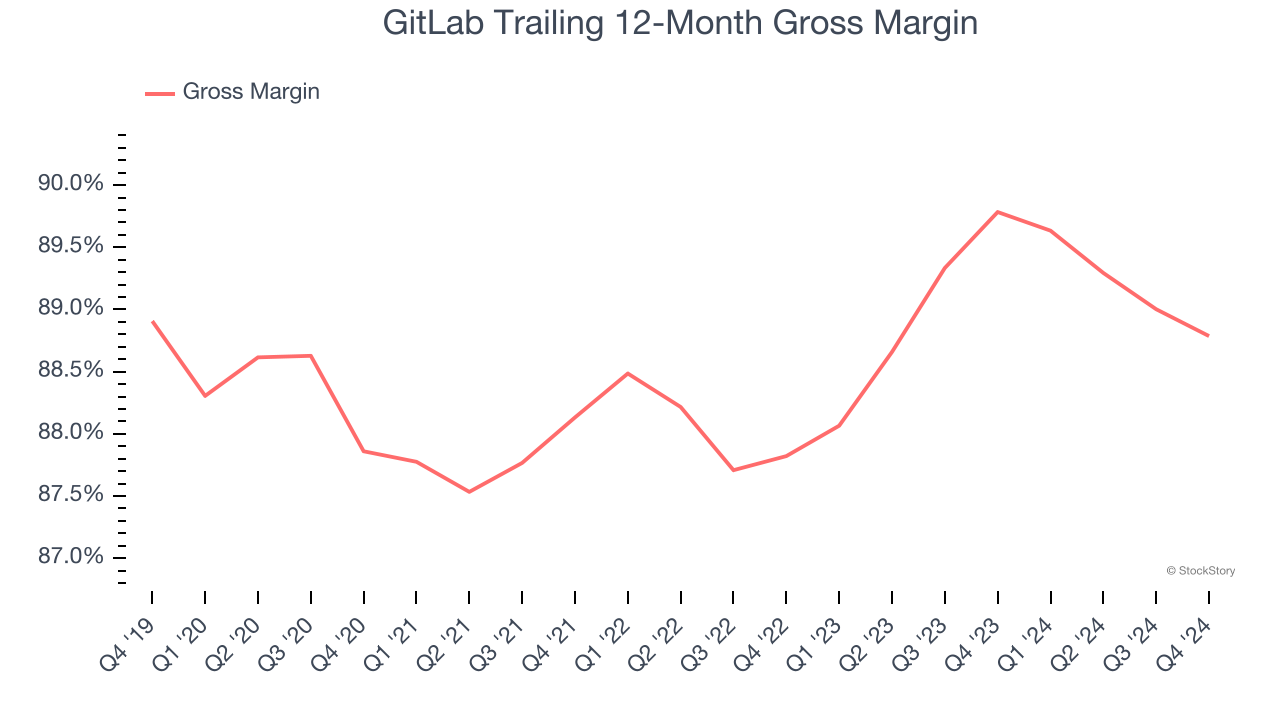

3. Elite Gross Margin Powers Best-In-Class Business Model

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

GitLab’s gross margin is one of the best in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 88.8% gross margin over the last year. That means GitLab only paid its providers $11.21 for every $100 in revenue.

Final Judgment

These are just a few reasons GitLab is a rock-solid business worth owning. With the recent decline, the stock trades at 8.3× forward price-to-sales (or $45.60 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.