Financial News

2 Reasons to Like CAH and 1 to Stay Skeptical

Since June 2020, the S&P 500 has delivered a total return of 100%. But one standout stock has nearly doubled the market - over the past five years, Cardinal Health has surged 193% to $154 per share. Its momentum hasn’t stopped as it’s also gained 31.2% in the last six months, beating the S&P by 31.9%.

Is now still a good time to buy CAH? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does CAH Stock Spark Debate?

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE: CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

Two Things to Like:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $222.3 billion in revenue over the past 12 months, Cardinal Health is one of the most scaled enterprises in healthcare. This is particularly important because healthcare distribution & related services companies are volume-driven businesses due to their low margins.

2. EPS Increasing Steadily

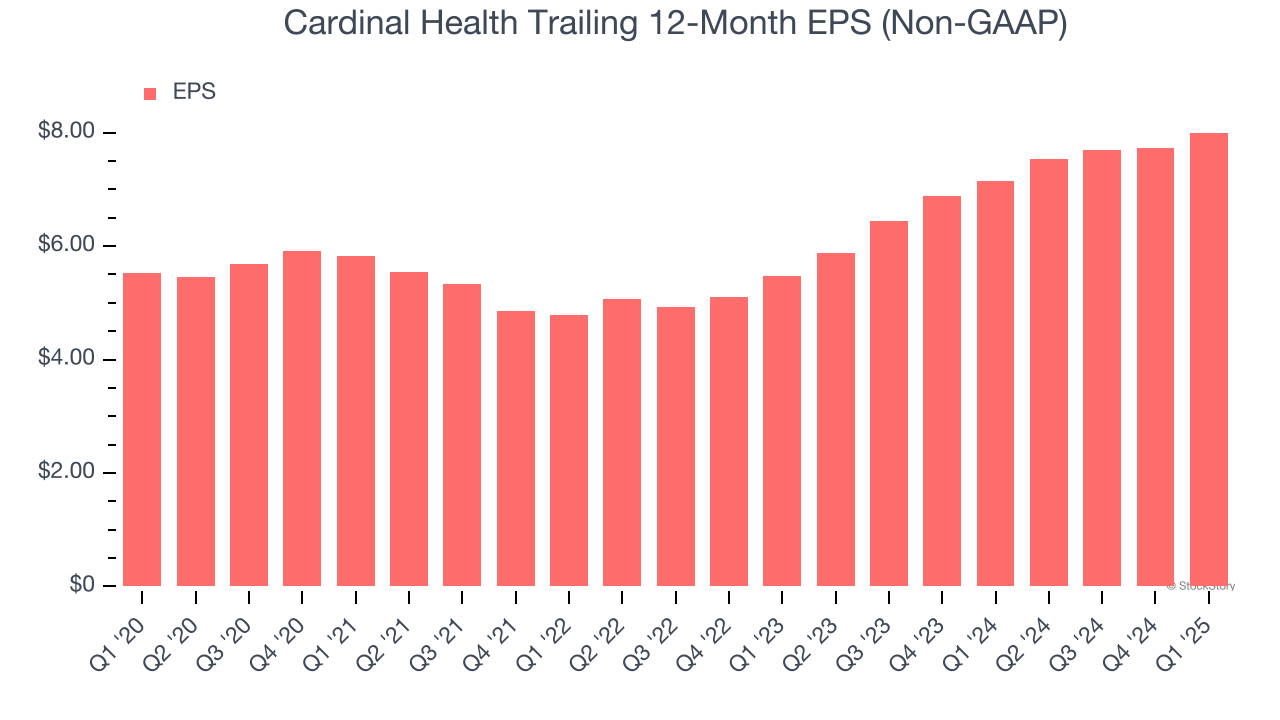

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Cardinal Health’s solid 7.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

One Reason to be Careful:

Lackluster Revenue Growth

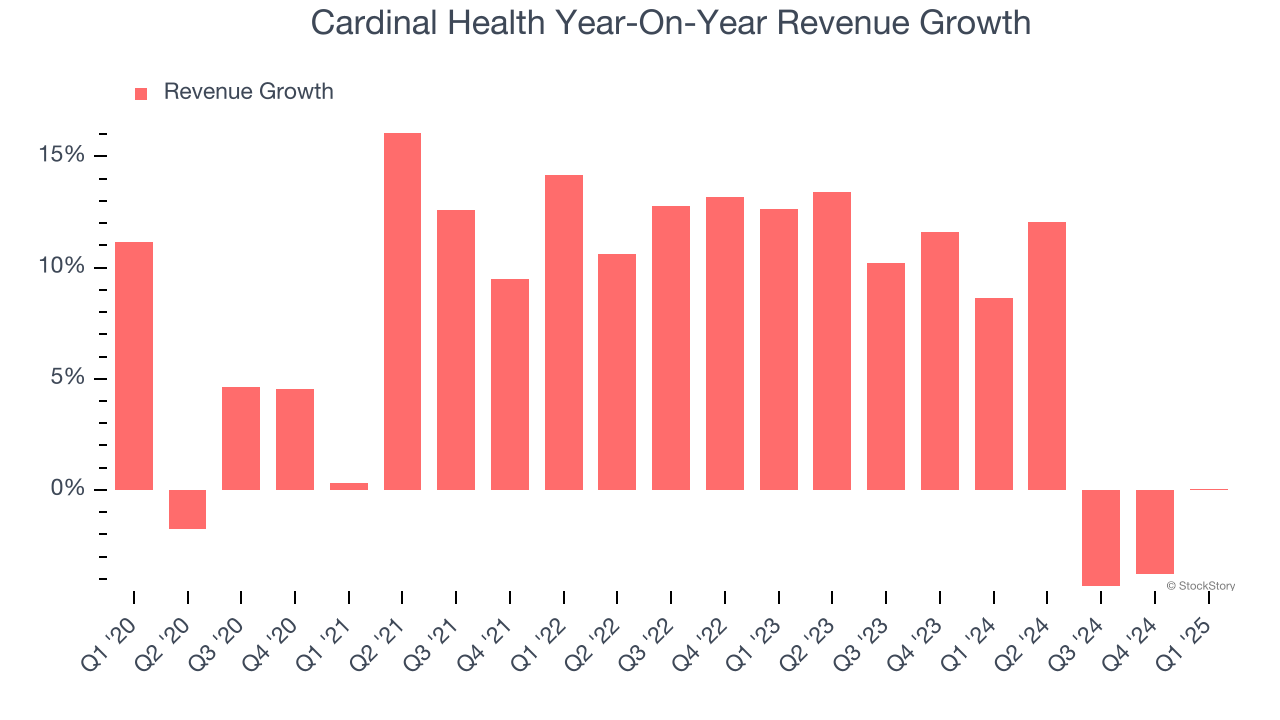

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. Cardinal Health’s recent performance shows its demand has slowed as its annualized revenue growth of 5.8% over the last two years was below its five-year trend.

Final Judgment

Cardinal Health’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 17.5× forward P/E (or $154 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Cardinal Health

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.