Financial News

3 Reasons GIS is Risky and 1 Stock to Buy Instead

Over the last six months, General Mills’s shares have sunk to $54.81, producing a disappointing 17.1% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy General Mills, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is General Mills Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than GIS and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

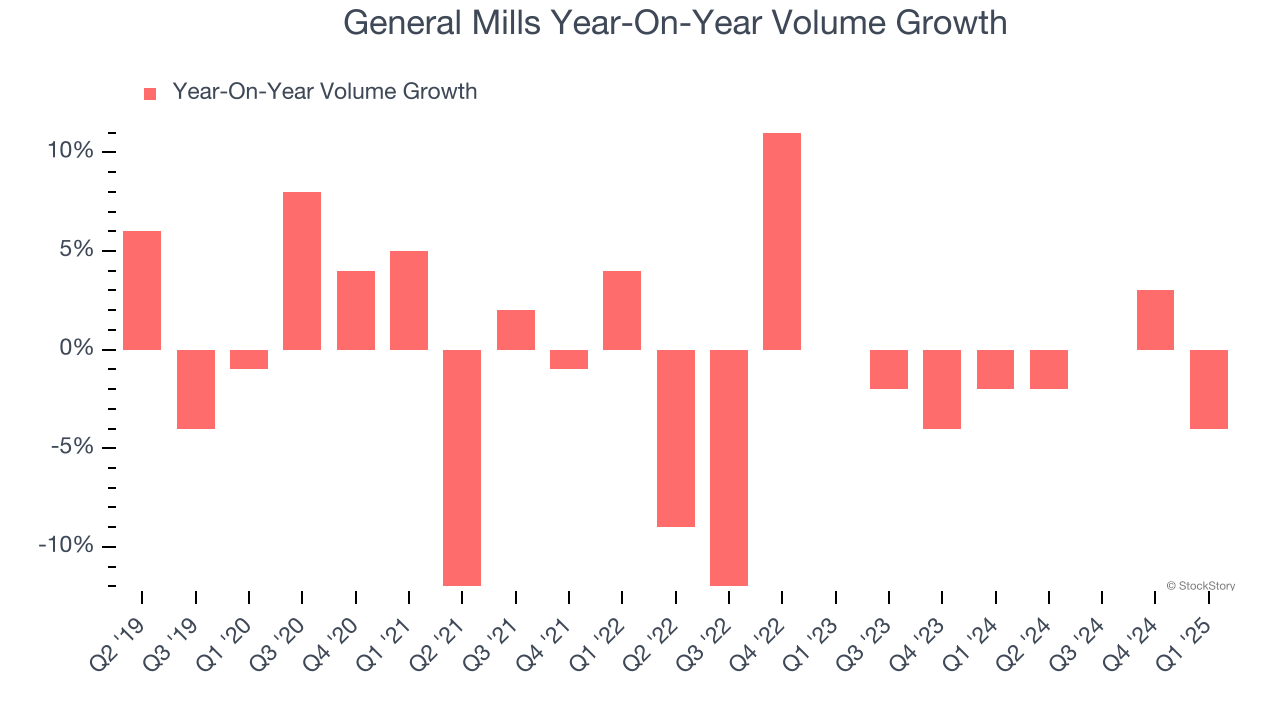

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

General Mills’s average quarterly sales volumes have shrunk by 1.6% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Core Business Falling Behind as Demand Plateaus

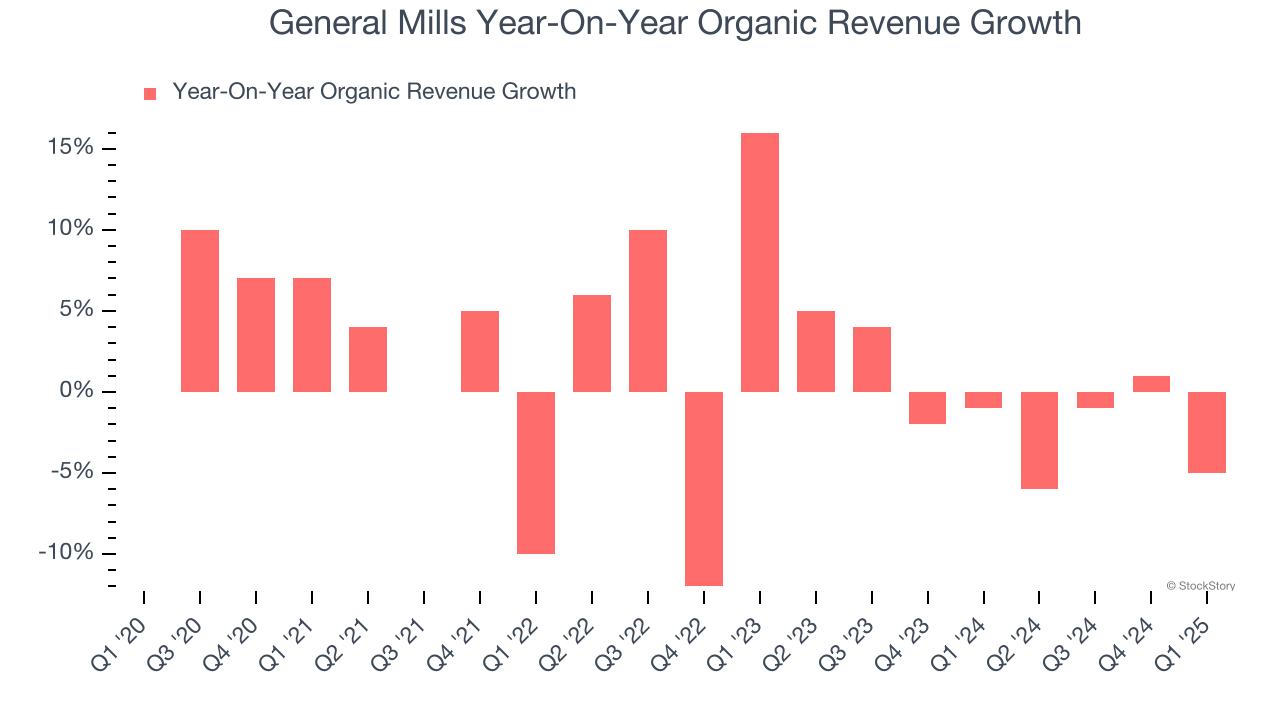

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for General Mills’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

3. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect General Mills’s revenue to drop by 4.3%, a decrease from This projection is underwhelming and indicates its products will face some demand challenges.

Final Judgment

General Mills isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 12.9× forward P/E (or $54.81 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of General Mills

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.