Financial News

Winners And Losers Of Q1: OPENLANE (NYSE:KAR) Vs The Rest Of The Business Services & Supplies Stocks

As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the business services & supplies industry, including OPENLANE (NYSE: KAR) and its peers.

This is a sector that encompasses many types of business, and so it follows that a number of trends will impact the space. For industrial and environmental services companies, for example, trends around environmental compliance and increasing corporate ESG commitments matter while for safety and security services companies, the intersection of physical security, cybersecurity, and workplace safety regulations are the topics du jour. Broadly, AI and automation could be tailwinds for companies in the space that invest wisely. On the other hand, shifting regulatory frameworks could force continual changes in go-to-market and costly investments.

The 19 business services & supplies stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.4% on average since the latest earnings results.

OPENLANE (NYSE: KAR)

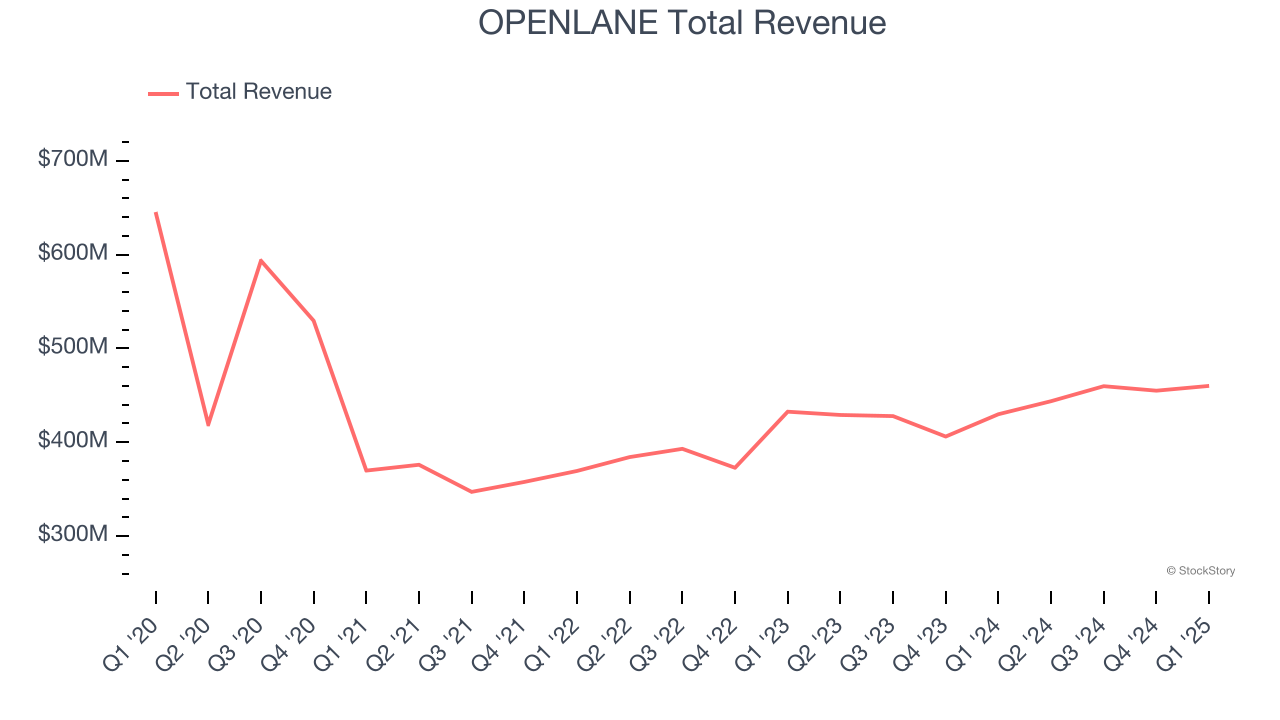

Facilitating the sale of approximately 1.3 million used vehicles in 2023, OPENLANE (NYSE: KAR) operates digital marketplaces that connect sellers and buyers of used vehicles across North America and Europe, facilitating wholesale transactions.

OPENLANE reported revenues of $460.1 million, up 7% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates.

"OPENLANE delivered a strong start to 2025, building on our positive momentum and delivering record performance in many areas, particularly within the marketplace business," said Peter Kelly, CEO of OPENLANE.

The stock is up 18.7% since reporting and currently trades at $22.75.

Is now the time to buy OPENLANE? Access our full analysis of the earnings results here, it’s free.

Best Q1: CECO Environmental (NASDAQ: CECO)

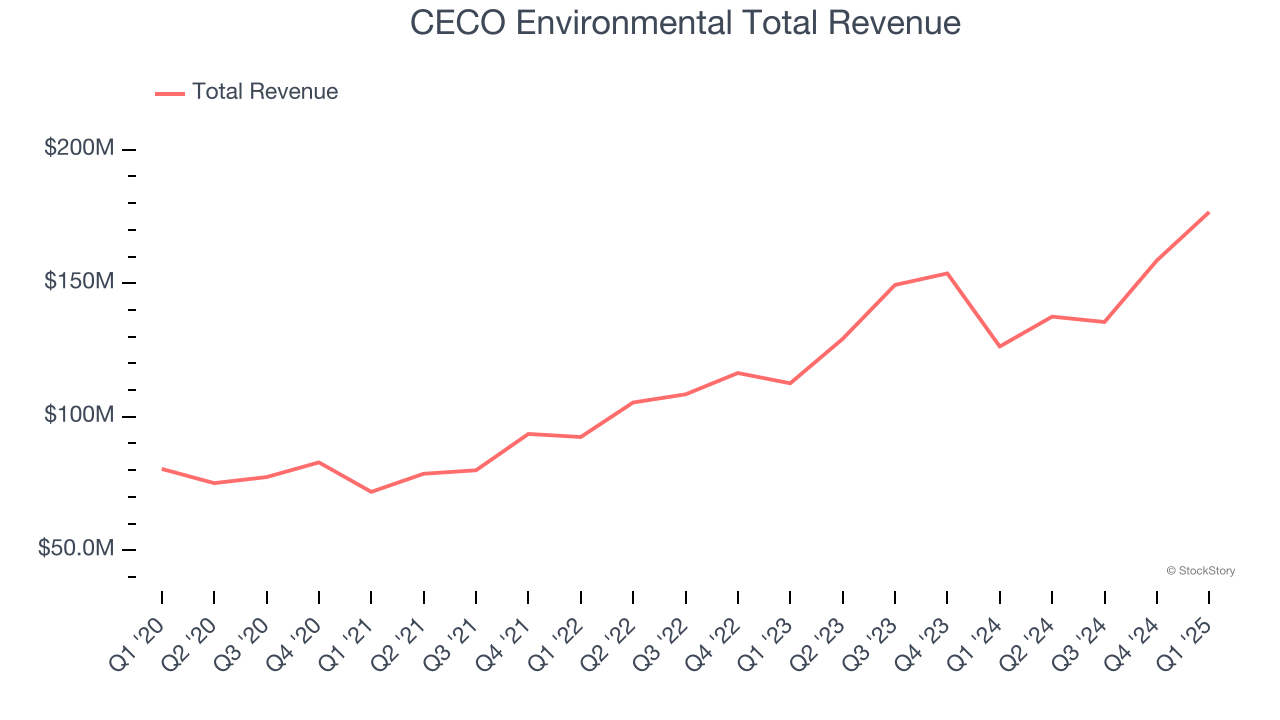

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

CECO Environmental reported revenues of $176.7 million, up 39.9% year on year, outperforming analysts’ expectations by 17%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and full-year revenue guidance beating analysts’ expectations.

CECO Environmental delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 55.7% since reporting. It currently trades at $29.90.

Is now the time to buy CECO Environmental? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: GEO Group (NYSE: GEO)

With a global footprint spanning three continents and approximately 81,000 beds across 100 facilities, GEO Group (NYSE: GEO) operates secure facilities, processing centers, and reentry services for government agencies in the United States, Australia, and South Africa.

GEO Group reported revenues of $604.6 million, flat year on year, falling short of analysts’ expectations by 2%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

GEO Group delivered the weakest full-year guidance update in the group. As expected, the stock is down 8.9% since the results and currently trades at $27.60.

Read our full analysis of GEO Group’s results here.

RB Global (NYSE: RBA)

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE: RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

RB Global reported revenues of $1.11 billion, up 4.1% year on year. This print topped analysts’ expectations by 6.9%. Overall, it was an exceptional quarter as it also logged a solid beat of analysts’ EPS estimates.

The stock is up 2.4% since reporting and currently trades at $104.74.

Read our full, actionable report on RB Global here, it’s free.

UniFirst (NYSE: UNF)

With a fleet of trucks making weekly deliveries to over 300,000 customer locations, UniFirst (NYSE: UNF) provides, rents, cleans, and maintains workplace uniforms and protective clothing for businesses across various industries.

UniFirst reported revenues of $602.2 million, up 1.9% year on year. This number met analysts’ expectations. Overall, it was a strong quarter as it also put up a solid beat of analysts’ full-year EPS guidance estimates and an impressive beat of analysts’ EPS estimates.

The stock is up 8.1% since reporting and currently trades at $188.95.

Read our full, actionable report on UniFirst here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.