Financial News

Construction Partners’s (NASDAQ:ROAD) Q4: Strong Sales, Stock Soars

Civil infrastructure company Construction Partners (NASDAQ: ROAD) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 41.6% year on year to $561.6 million. The company’s full-year revenue guidance of $2.7 billion at the midpoint came in 5.9% above analysts’ estimates. Its non-GAAP profit of $0.25 per share was 68.5% above analysts’ consensus estimates.

Is now the time to buy Construction Partners? Find out by accessing our full research report, it’s free.

Construction Partners (ROAD) Q4 CY2024 Highlights:

- Revenue: $561.6 million vs analyst estimates of $512.1 million (41.6% year-on-year growth, 9.7% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.15 (68.5% beat)

- Adjusted EBITDA: $68.8 million vs analyst estimates of $58.46 million (12.3% margin, 17.7% beat)

- The company lifted its revenue guidance for the full year to $2.7 billion at the midpoint from $2.53 billion, a 6.7% increase

- EBITDA guidance for the full year is $387.5 million at the midpoint, above analyst estimates of $361 million

- Operating Margin: 2.5%, down from 4.2% in the same quarter last year

- Free Cash Flow Margin: 2.5%, down from 9.1% in the same quarter last year

- Backlog: $2.66 billion at quarter end

- Market Capitalization: $4.73 billion

Fred J. (Jule) Smith, III, the Company's President and Chief Executive Officer, said, "Today we are reporting strong first quarter performance, with revenue growth of 42% and Adjusted EBITDA growth of 68% compared to the first quarter last year, which led to an exceptional first quarter Adjusted EBITDA margin of 12.25%. The outstanding operational performance of our family of companies throughout the Sunbelt and favorable weather during the quarter produced these strong results. We also continued to win more project work, growing our project backlog to a record $2.66 billion. We were pleased to have completed the transformational acquisition of Lone Star Paving, our new platform company in Texas, during the first quarter. In addition, we have completed two acquisitions since January 2025. In January, we entered Oklahoma by acquiring our eighth platform company, Overland Corporation, which is well-positioned to participate in the strong economic activity occurring in southern Oklahoma and northern Texas. Earlier this week, we announced our latest strategic acquisition with the purchase of Mobile Asphalt Company in Mobile, Alabama. This represents a significant expansion of our presence in the Mobile metro area and the surrounding southwestern Alabama markets following our initial entry into Mobile last September. Reflecting these strong first quarter results and incorporating the expected contribution of these two newly acquired companies, we are raising our fiscal 2025 outlook ranges."

Company Overview

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Construction and Maintenance Services

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years–. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

Sales Growth

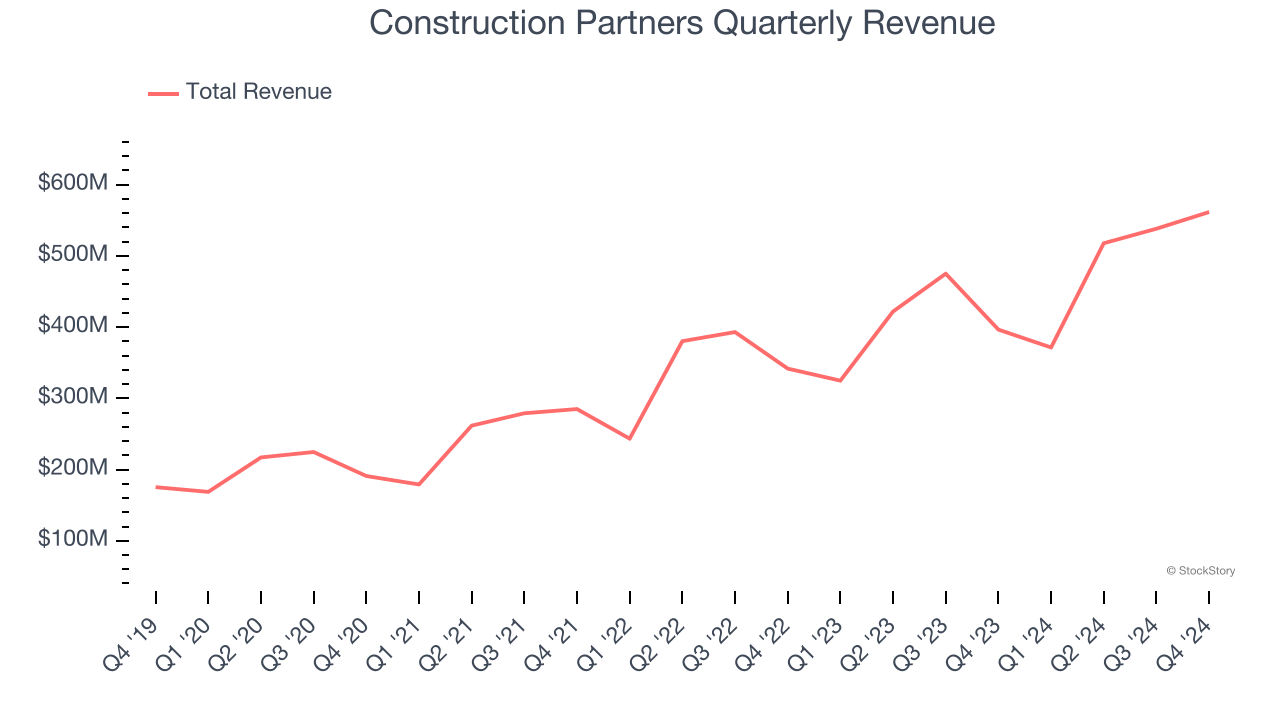

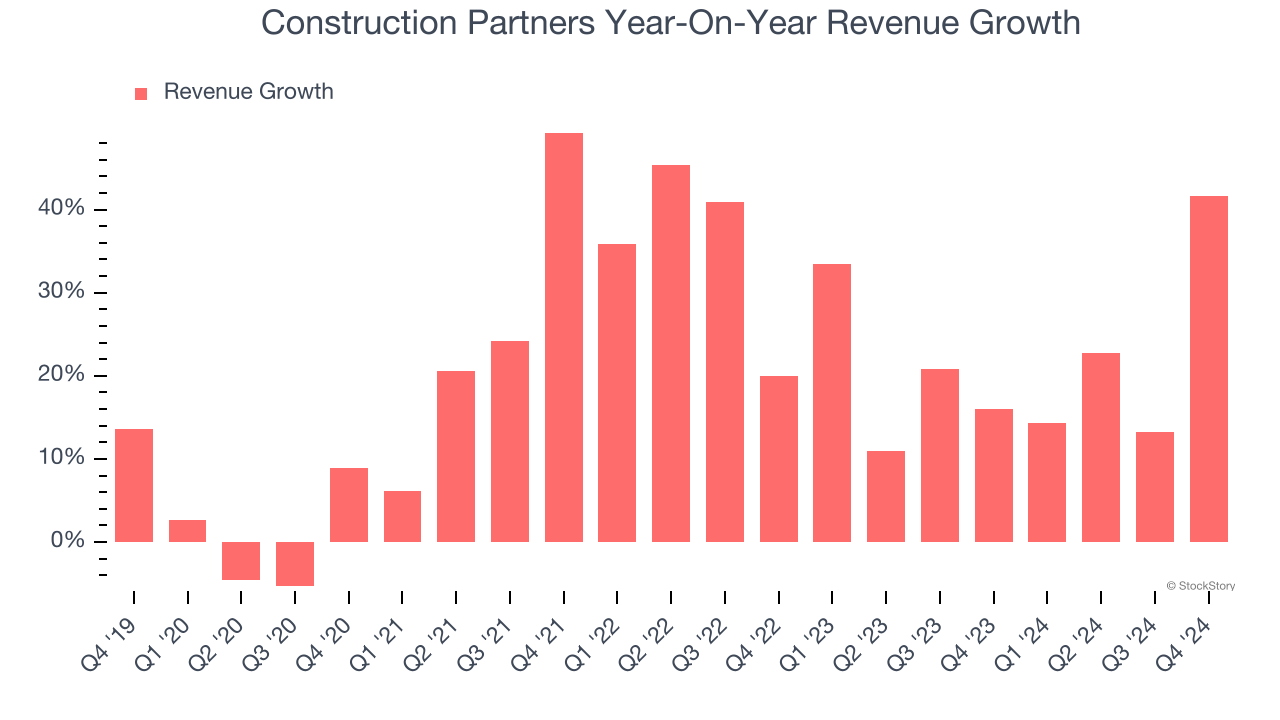

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Construction Partners grew its sales at an incredible 19.9% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Construction Partners’s annualized revenue growth of 21% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Construction Partners reported magnificent year-on-year revenue growth of 41.6%, and its $561.6 million of revenue beat Wall Street’s estimates by 9.7%.

Looking ahead, sell-side analysts expect revenue to grow 33.3% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

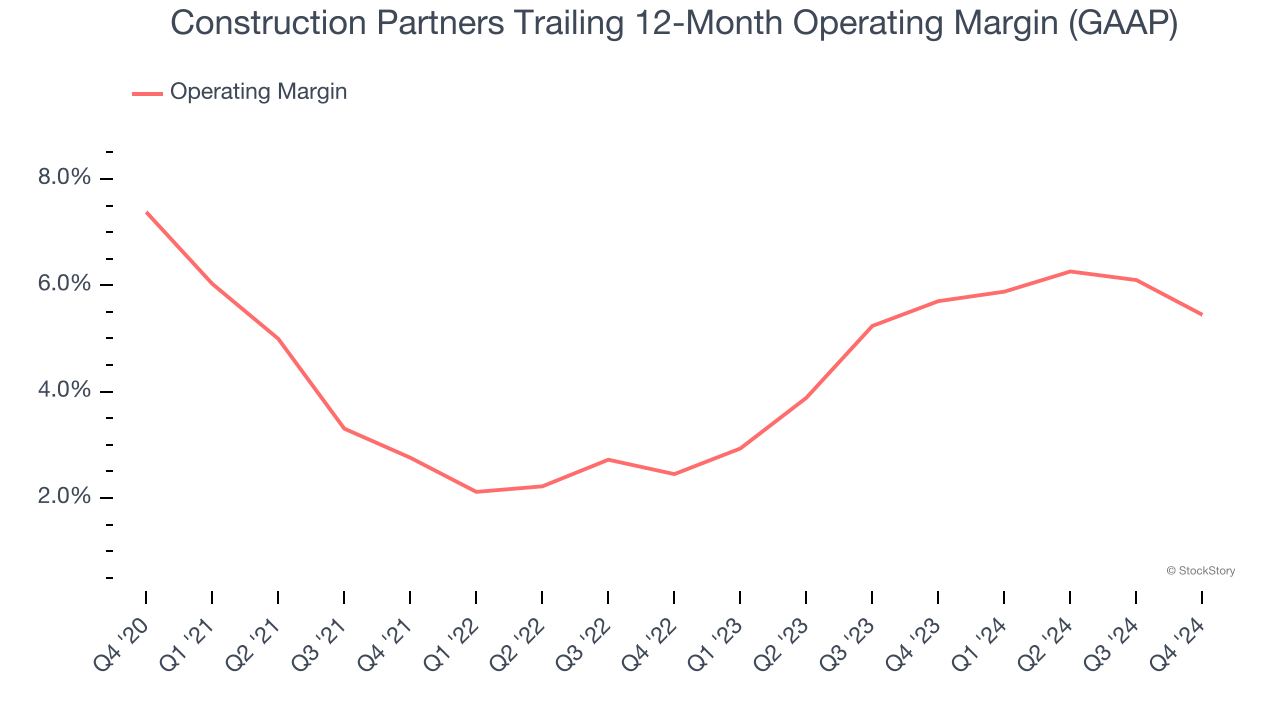

Construction Partners was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Construction Partners’s operating margin decreased by 1.9 percentage points over the last five years. The company’s performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

In Q4, Construction Partners generated an operating profit margin of 2.5%, down 1.8 percentage points year on year. Since Construction Partners’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

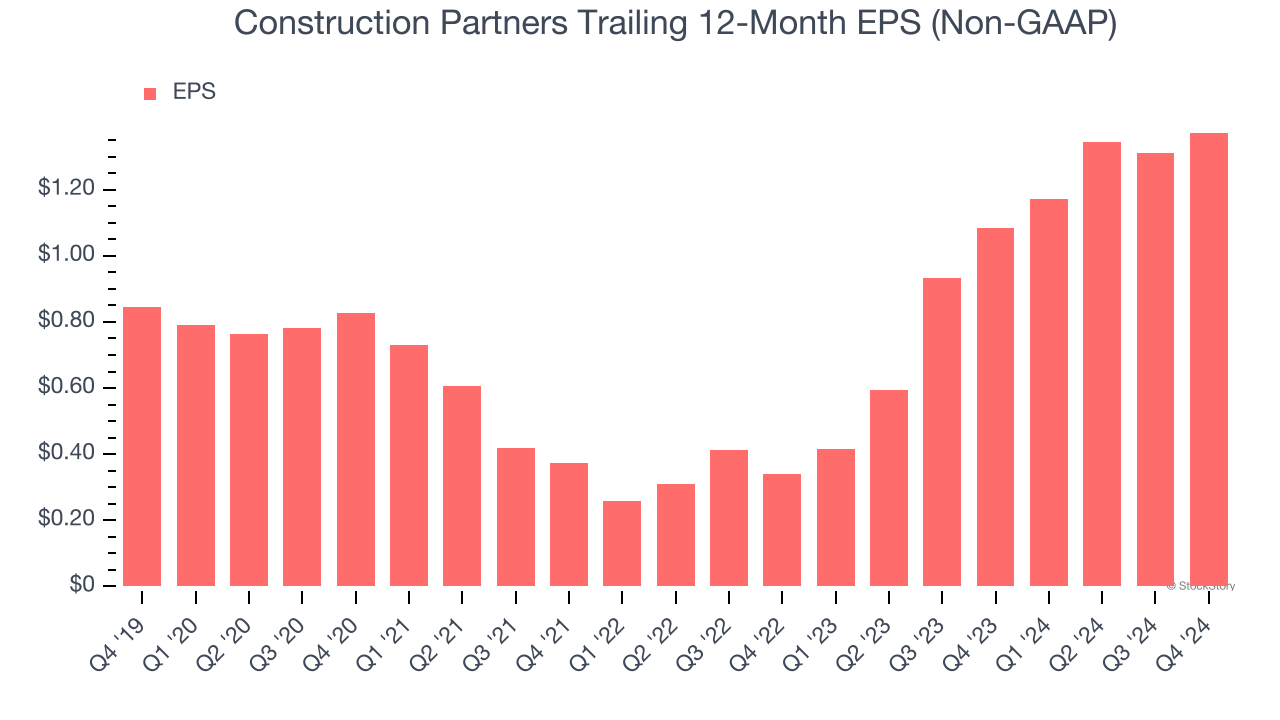

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Construction Partners’s EPS grew at a solid 10.2% compounded annual growth rate over the last five years. However, this performance was lower than its 19.9% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

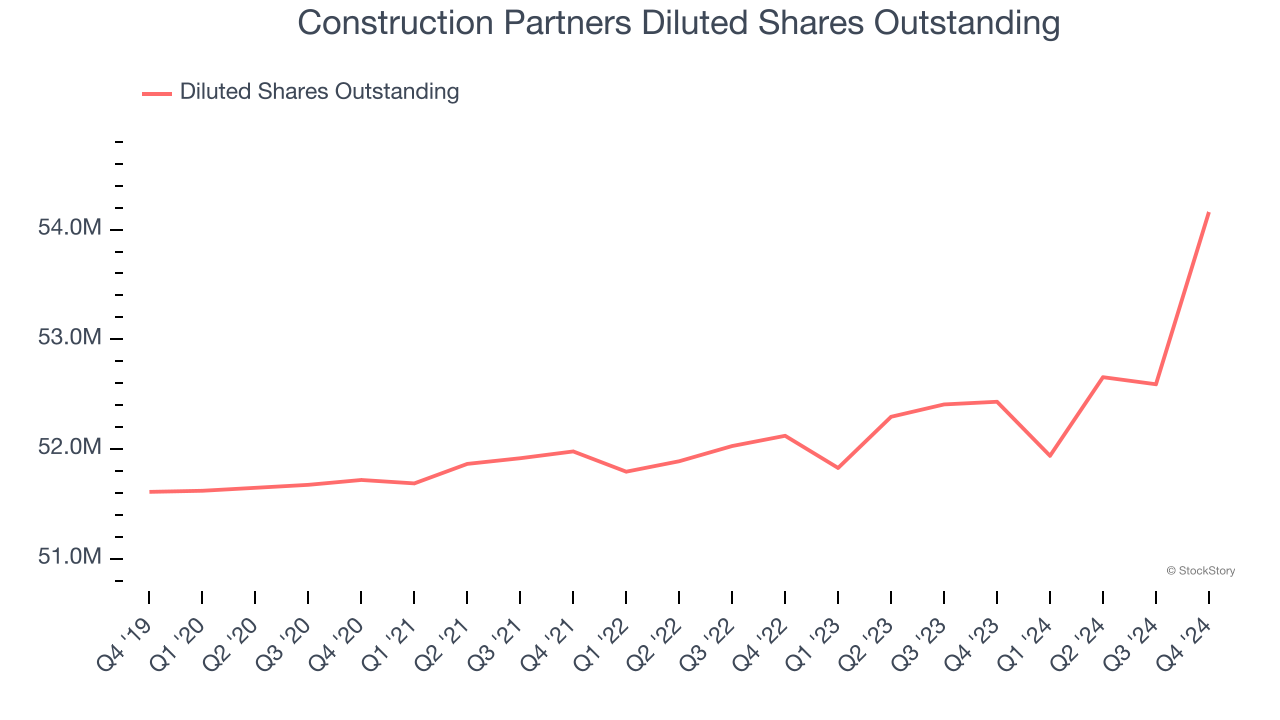

We can take a deeper look into Construction Partners’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Construction Partners’s operating margin declined by 1.9 percentage points over the last five years. Its share count also grew by 4.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Construction Partners, its two-year annual EPS growth of 101% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Construction Partners reported EPS at $0.25, up from $0.19 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Construction Partners’s full-year EPS of $1.37 to grow 48.9%.

Key Takeaways from Construction Partners’s Q4 Results

We were impressed by how significantly Construction Partners blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Guidance was also encouraging, with the company lifting full-yea revenue guidance. Zooming out, we think this quarter featured some important positives. The stock traded up 5.5% to $89.41 immediately after reporting.

Indeed, Construction Partners had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.