Financial News

Globus Medical’s (NYSE:GMED) Q4 Sales Beat Estimates

Medical device company Globus Medical (NYSE: GMED) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 6.6% year on year to $657.3 million. The company expects the full year’s revenue to be around $2.68 billion, close to analysts’ estimates. Its non-GAAP profit of $0.84 per share was 12.2% above analysts’ consensus estimates.

Is now the time to buy Globus Medical? Find out by accessing our full research report, it’s free.

Globus Medical (GMED) Q4 CY2024 Highlights:

- Revenue: $657.3 million vs analyst estimates of $641.7 million (6.6% year-on-year growth, 2.4% beat)

- Adjusted EPS: $0.84 vs analyst estimates of $0.75 (12.2% beat)

- Adjusted EBITDA: $196.9 million vs analyst estimates of $207.4 million (30% margin, 5.1% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $2.68 billion at the midpoint, in line with analyst expectations and implying 6.2% growth (vs 76.2% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $3.45 at the midpoint, beating analyst estimates by 0.7%

- Operating Margin: 9.2%, up from 1.6% in the same quarter last year

- Free Cash Flow Margin: 29.4%, up from 13.3% in the same quarter last year

- Constant Currency Revenue rose 6.9% year on year (124% in the same quarter last year)

- Market Capitalization: $11.45 billion

“I’m proud of our team at Globus Medical, delivering incredible results for 2024. We made significant progress integrating the business and creating a strong foundation for future growth while remaining focused on improving patient outcomes. Our spine sales force is the most dedicated and talented team in the market. Our innovation engine delivered a record amount of new product launches in 2024 and remains unmatched in our industry.” said Dan Scavilla, President and CEO.

Company Overview

Founded in 2003, Globus Medical (NYSE: GMED) develops and manufactures medical devices and solutions for musculoskeletal disorders, with a focus on products for spine surgery, orthopedic trauma, and joint reconstruction.

Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Sales Growth

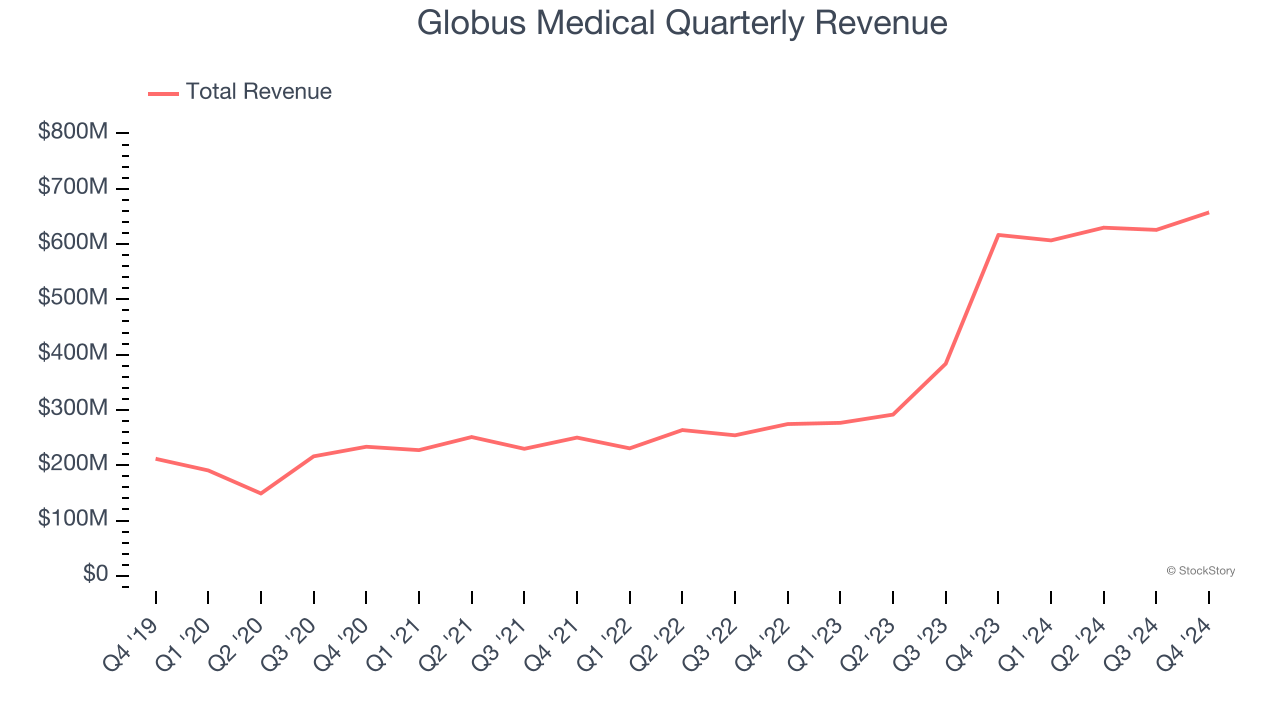

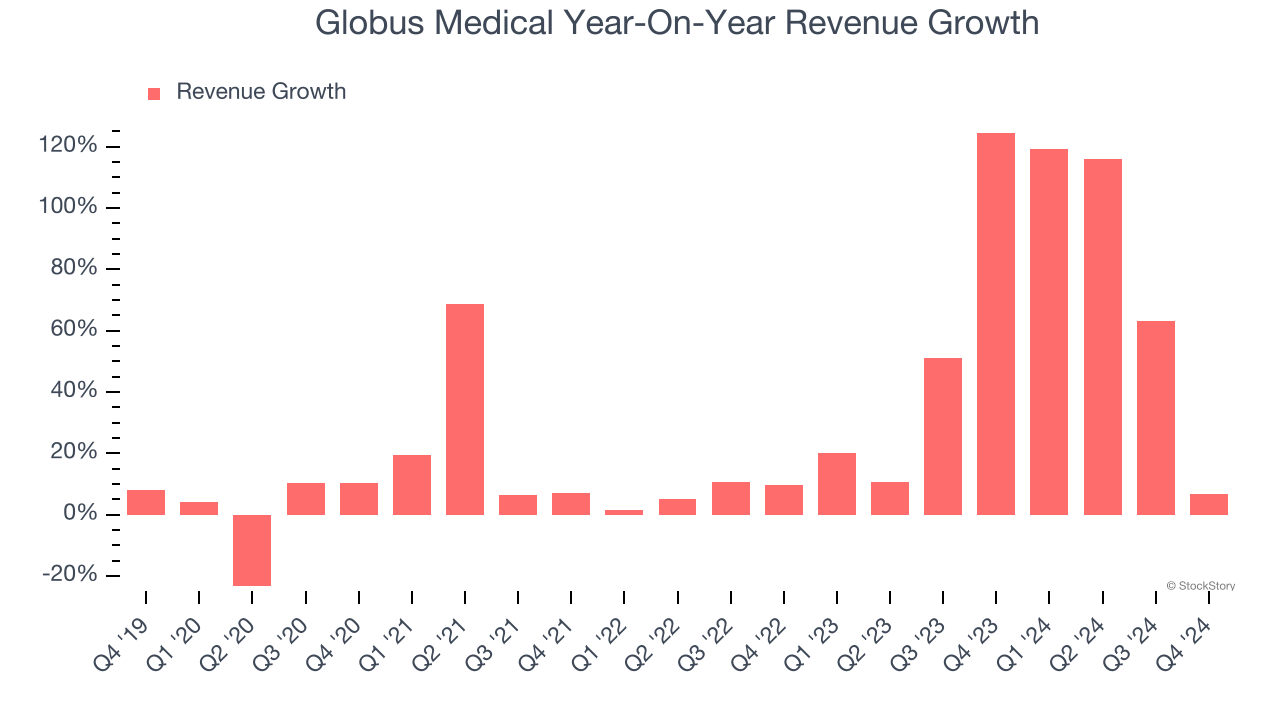

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Globus Medical grew its sales at an exceptional 26.3% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Globus Medical’s annualized revenue growth of 56.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

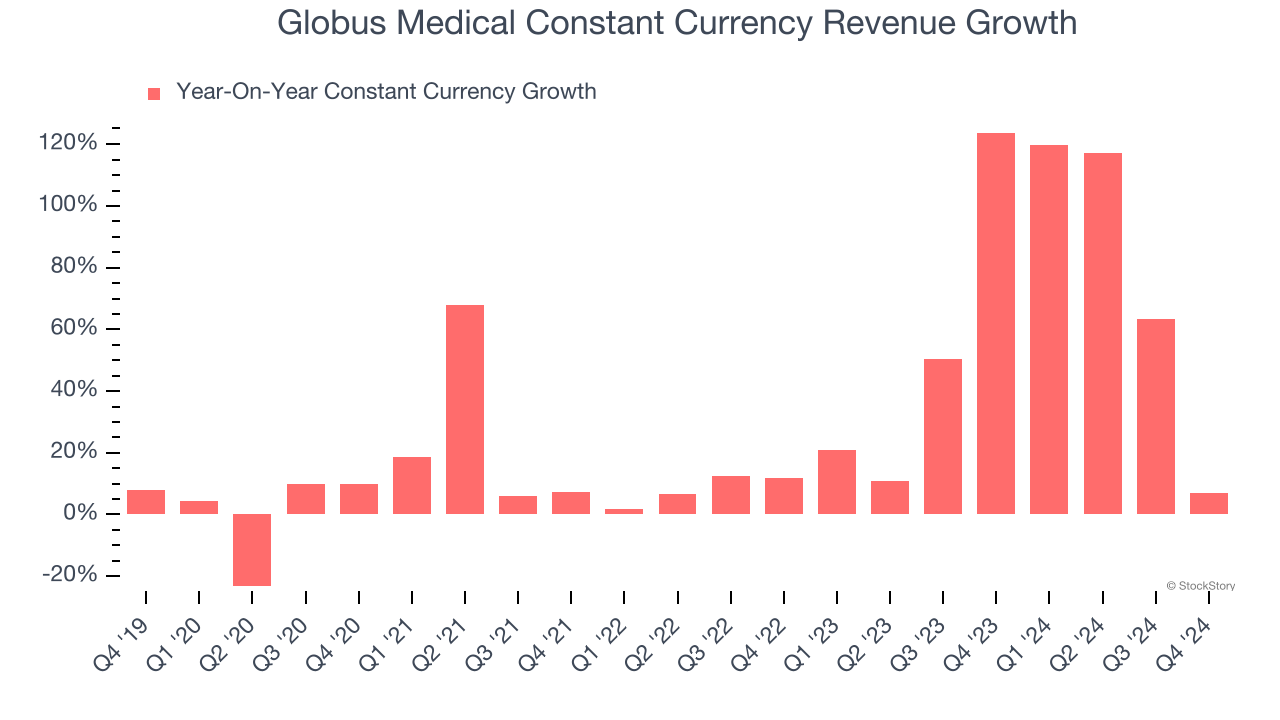

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 64.2% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Globus Medical.

This quarter, Globus Medical reported year-on-year revenue growth of 6.6%, and its $657.3 million of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

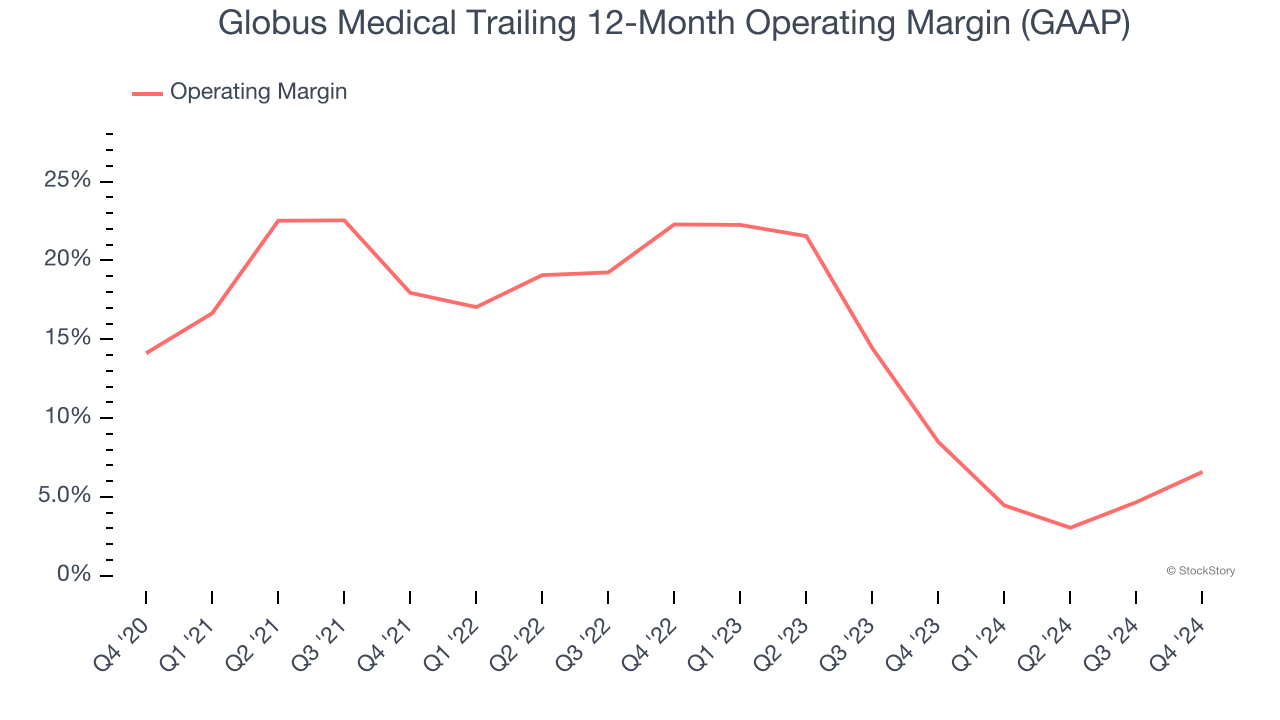

Globus Medical has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.8%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Globus Medical’s operating margin decreased by 7.5 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 15.7 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Globus Medical generated an operating profit margin of 9.2%, up 7.5 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

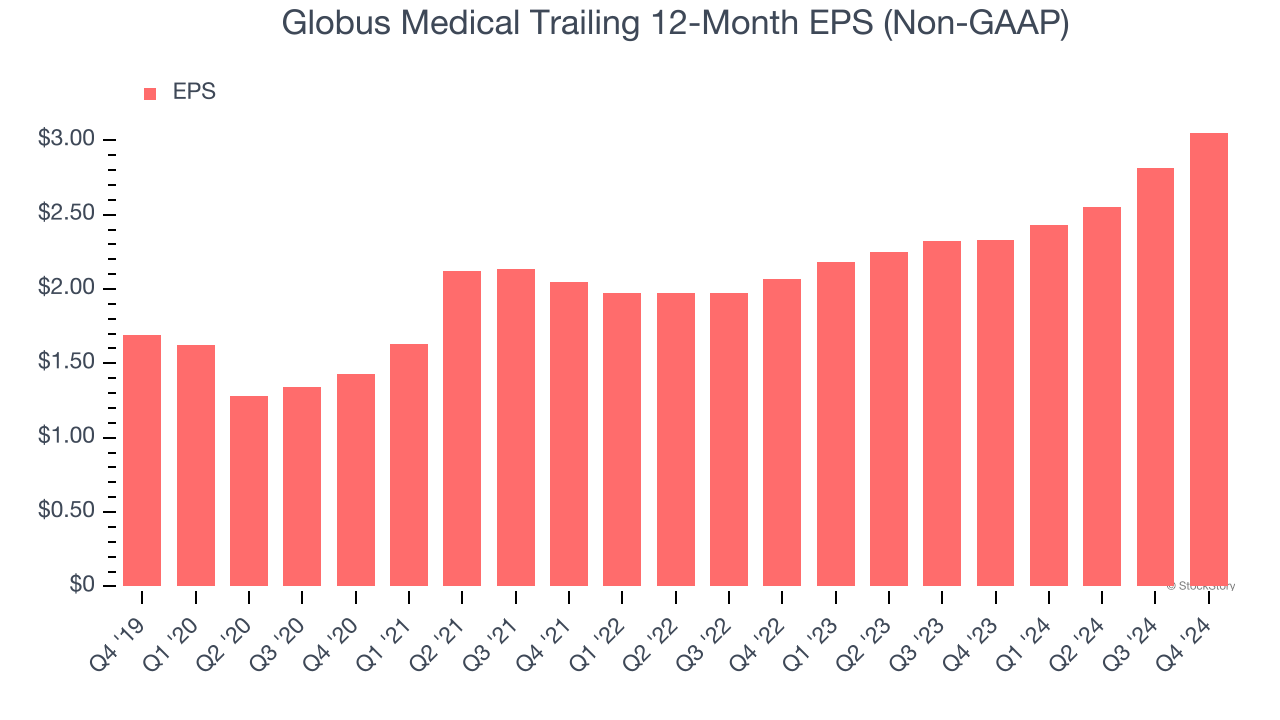

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Globus Medical’s EPS grew at a spectacular 12.5% compounded annual growth rate over the last five years. However, this performance was lower than its 26.3% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

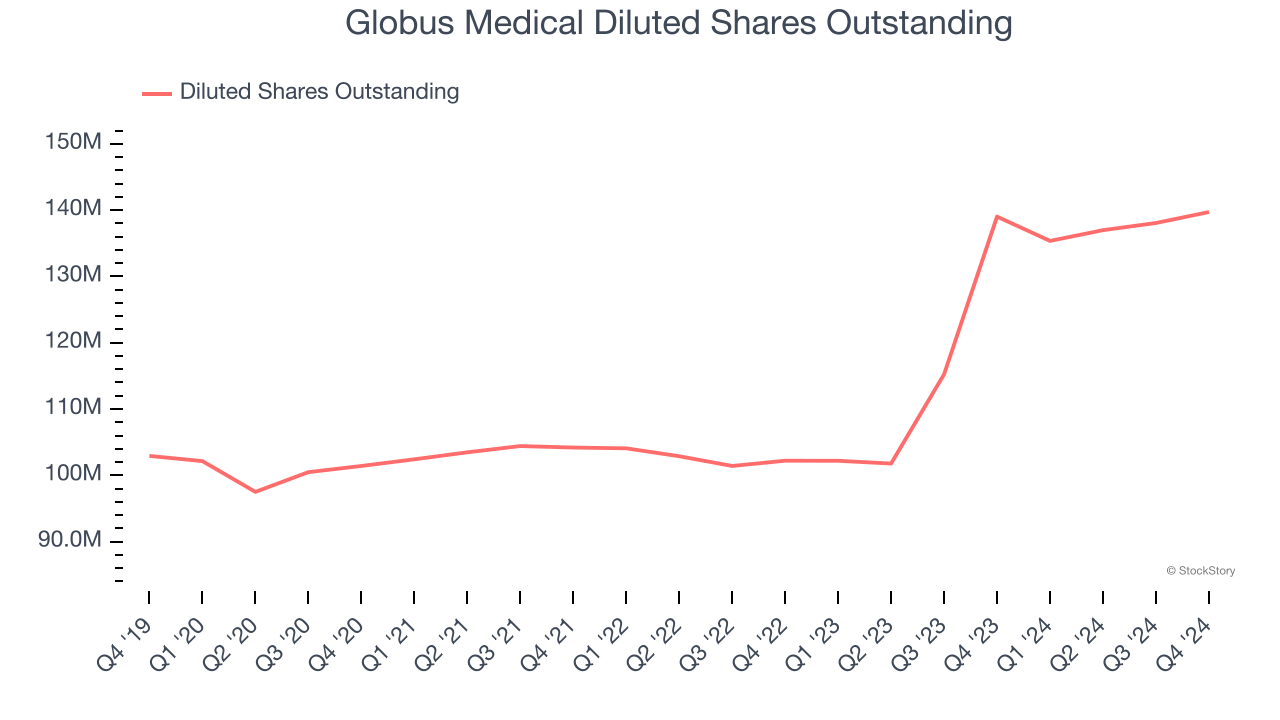

Diving into Globus Medical’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Globus Medical’s operating margin improved this quarter but declined by 7.5 percentage points over the last five years. Its share count also grew by 35.7%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Globus Medical reported EPS at $0.84, up from $0.60 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Globus Medical’s full-year EPS of $3.05 to grow 11.5%.

Key Takeaways from Globus Medical’s Q4 Results

It was encouraging to see Globus Medical beat analysts’ revenue and EPS expectations this quarter. We were also happy its full-year EPS guidance topped Wall Street’s estimates. Overall, this quarter had some key positives. The stock traded up 1.1% to $85 immediately after reporting.

Indeed, Globus Medical had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.