Financial News

DraftKings (NASDAQ:DKNG) Misses Q4 Revenue Estimates, But Stock Soars 7.3%

Fantasy sports and betting company DraftKings (NASDAQ: DKNG) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 13.2% year on year to $1.39 billion. On the other hand, the company’s full-year revenue guidance of $6.45 billion at the midpoint came in 1.1% above analysts’ estimates. Its non-GAAP profit of $0.14 per share was significantly above analysts’ consensus estimates.

Is now the time to buy DraftKings? Find out by accessing our full research report, it’s free.

DraftKings (DKNG) Q4 CY2024 Highlights:

- Revenue: $1.39 billion vs analyst estimates of $1.41 billion (13.2% year-on-year growth, 0.9% miss)

- Adjusted EPS: $0.14 vs analyst estimates of $0.04 (significant beat)

- Adjusted EBITDA: $89.45 million vs analyst estimates of $85.22 million (6.4% margin, 5% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $6.45 billion at the midpoint, beating analyst estimates by 1.1% and implying 35.3% growth (vs 32.7% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $950 million at the midpoint, in line with analyst expectations

- Operating Margin: -10%, down from -3.6% in the same quarter last year

- Free Cash Flow Margin: 16.3%, up from 5.8% in the same quarter last year

- Monthly Unique Payers: 4.8 million, up 1.3 million year on year

- Market Capitalization: $22.16 billion

“We continued to efficiently acquire and engage customers, expand structural sportsbook hold percentage and optimize promotional reinvestment in fiscal year 2024, while we simultaneously experienced customer-friendly sport outcomes,” said Jason Robins, DraftKings’ Chief Executive Officer and Co-Founder.

Company Overview

Getting its start in daily fantasy sports, DraftKings (NASDAQ: DKNG) is a digital sports entertainment and gaming company.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

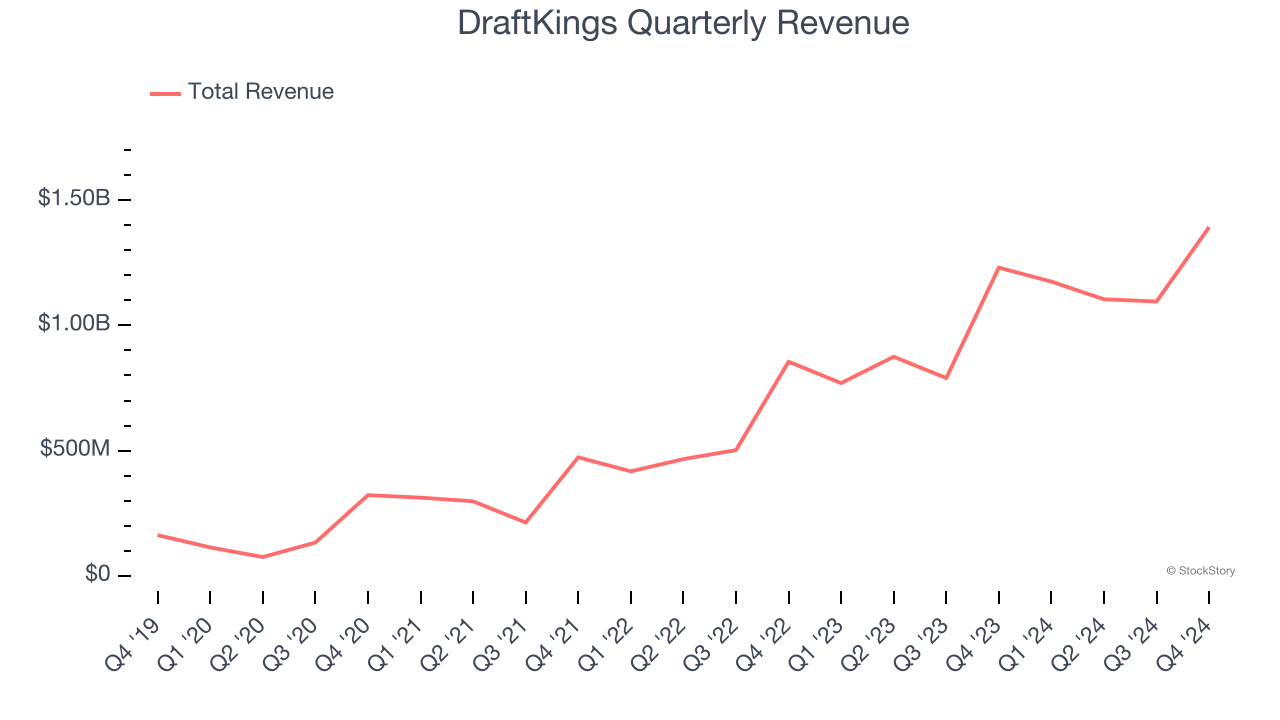

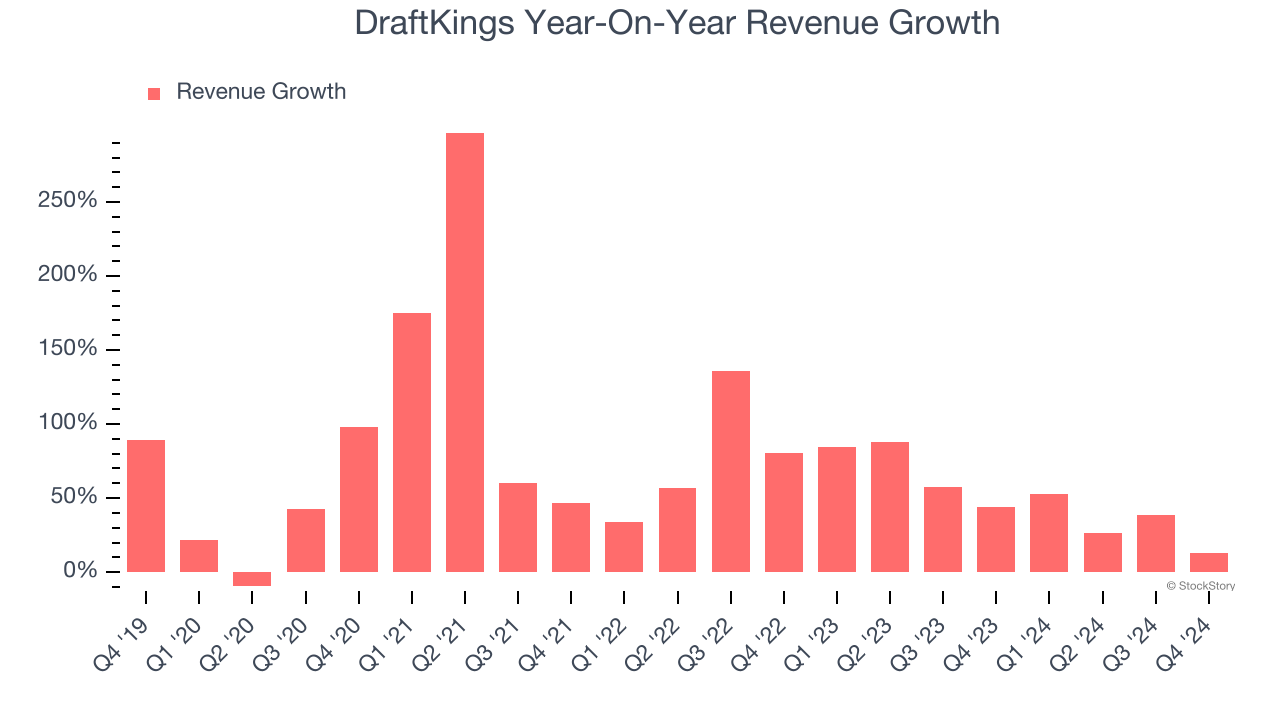

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, DraftKings’s sales grew at an incredible 61.7% compounded annual growth rate over the last five years. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. DraftKings’s annualized revenue growth of 45.9% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong.

This quarter, DraftKings’s revenue grew by 13.2% year on year to $1.39 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 34.2% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

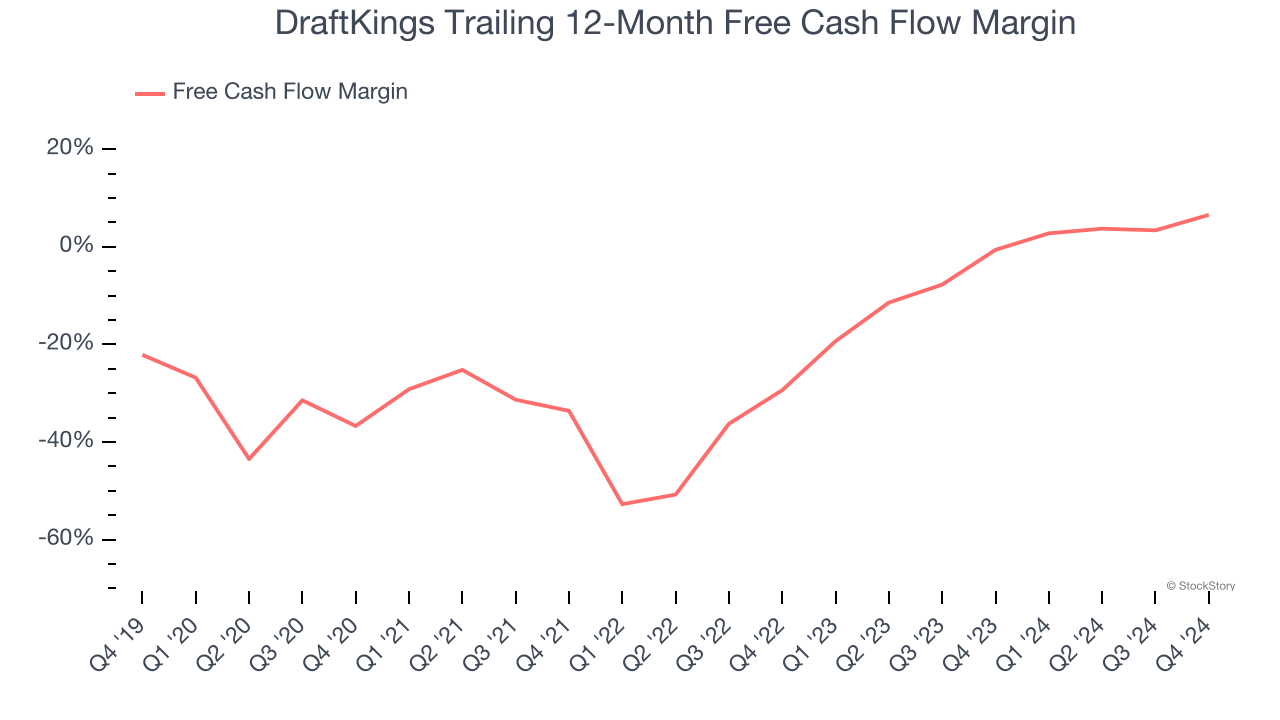

DraftKings has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.4%, lousy for a consumer discretionary business.

DraftKings’s free cash flow clocked in at $227.5 million in Q4, equivalent to a 16.3% margin. This result was good as its margin was 10.6 percentage points higher than in the same quarter last year. Its cash profitability was also above its two-year level, and we hope the company can build on this trend.

Over the next year, analysts predict DraftKings’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 6.5% for the last 12 months will increase to 12.9%, giving it more flexibility for investments, share buybacks, and dividends.

Key Takeaways from DraftKings’s Q4 Results

We were impressed by how significantly DraftKings blew past analysts’ EPS and EBITDA expectations this quarter. We were also glad it slightly lifted its full-year revenue guidance. Overall, this quarter had some key positives. The stock traded up 7.3% to $49.80 immediately after reporting.

DraftKings may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.