Financial News

Generac (NYSE:GNRC) Misses Q4 Revenue Estimates

Power generation products company Generac (NYSE: GNRC) fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 16.1% year on year to $1.23 billion. Its non-GAAP profit of $2.80 per share was 10.8% above analysts’ consensus estimates.

Is now the time to buy Generac? Find out by accessing our full research report, it’s free.

Generac (GNRC) Q4 CY2024 Highlights:

- Revenue: $1.23 billion vs analyst estimates of $1.24 billion (16.1% year-on-year growth, 0.7% miss)

- Adjusted EPS: $2.80 vs analyst estimates of $2.53 (10.8% beat)

- Adjusted EBITDA: $264.7 million vs analyst estimates of $252.5 million (21.4% margin, 4.8% beat)

- Operating Margin: 16%, up from 14.2% in the same quarter last year

- Free Cash Flow Margin: 23.2%, down from 25% in the same quarter last year

- Market Capitalization: $8.43 billion

“Our fourth quarter results highlight our ability to rapidly increase production and execute on the strong demand for home standby and portable generators resulting from elevated outage activity in the second half of the year,” said Aaron Jagdfeld, President and Chief Executive Officer.

Company Overview

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

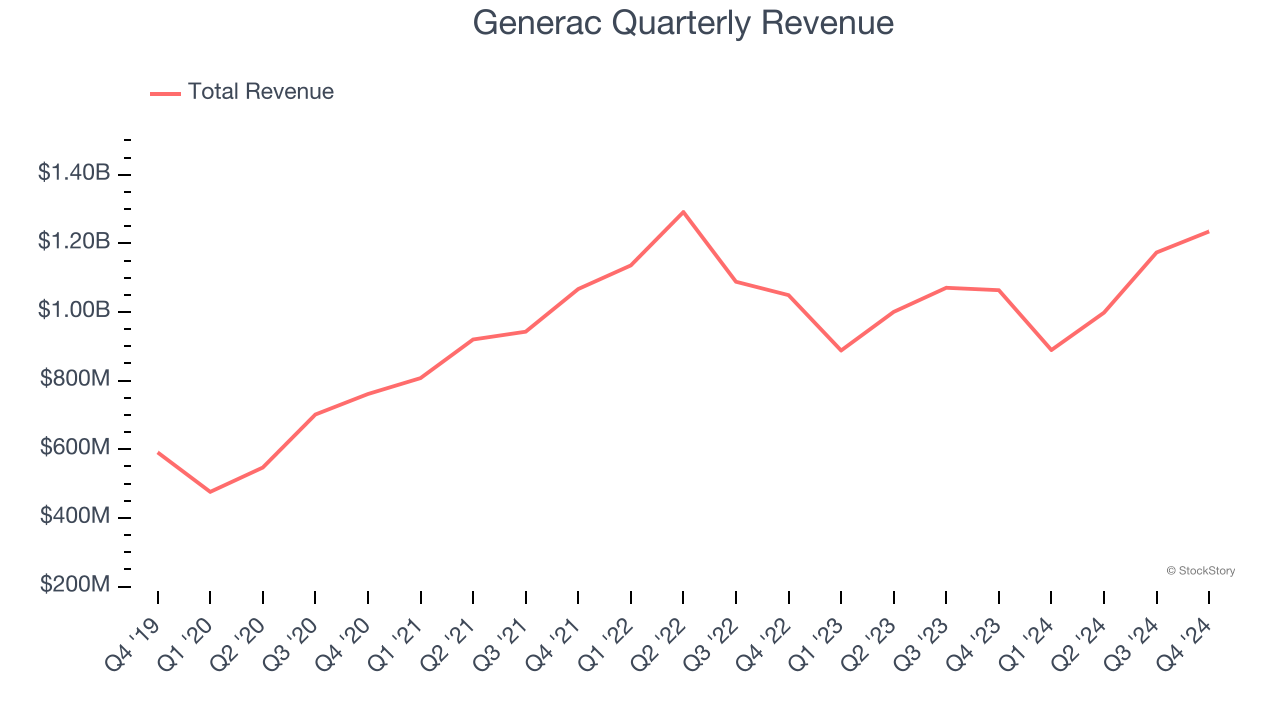

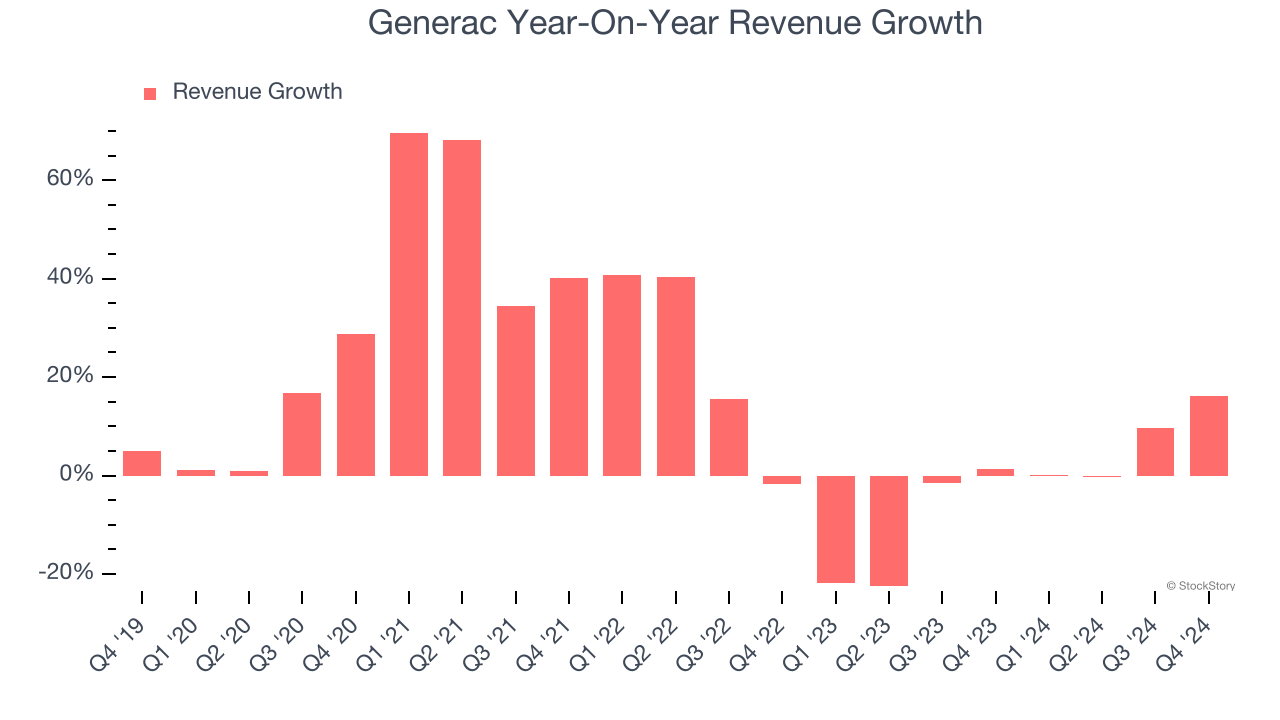

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Generac’s sales grew at an exceptional 14.3% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Generac’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Residential and Commercial and Industrial, which are 60.2% and 29.4% of revenue. Over the last two years, Generac’s Residential revenue (sales to consumers) averaged 4.8% year-on-year declines. On the other hand, its Commercial and Industrial revenue (sales to contractors and pros) averaged 6.4% growth.

This quarter, Generac’s revenue grew by 16.1% year on year to $1.23 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.2% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

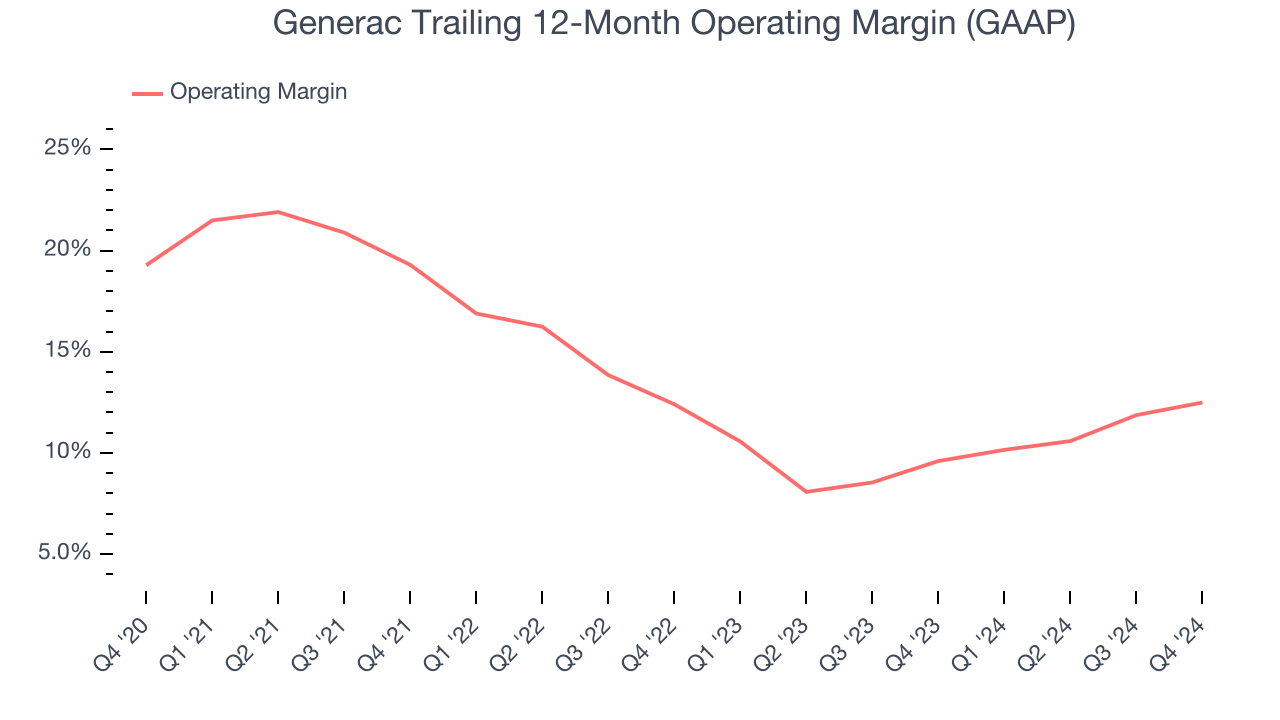

Generac has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Generac’s operating margin decreased by 6.8 percentage points over the last five years. Even though its historical margin is high, shareholders will want to see Generac become more profitable in the future.

This quarter, Generac generated an operating profit margin of 16%, up 1.8 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

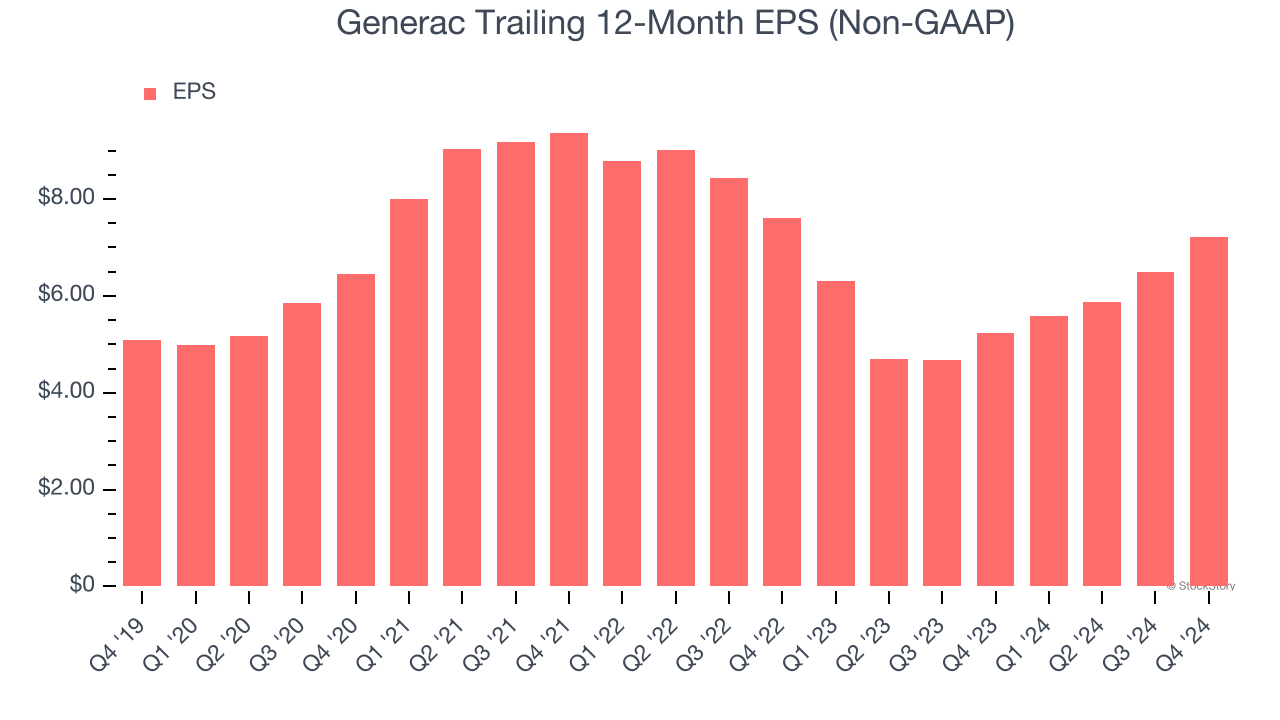

Generac’s EPS grew at an unimpressive 7.3% compounded annual growth rate over the last five years, lower than its 14.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into Generac’s earnings to better understand the drivers of its performance. As we mentioned earlier, Generac’s operating margin improved this quarter but declined by 6.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Generac, its two-year annual EPS declines of 2.5% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Generac reported EPS at $2.80, up from $2.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Generac’s full-year EPS of $7.23 to grow 12.6%.

Key Takeaways from Generac’s Q4 Results

We enjoyed seeing Generac exceed analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue slightly missed. Overall, this quarter was mixed. The stock remained flat at $142.50 immediately after reporting.

Generac may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.