Financial News

Burlington (NYSE:BURL) Reports Q3 CY2025 In Line With Expectations

Off-price retail company Burlington Stores (NYSE: BURL) met Wall Streets revenue expectations in Q3 CY2025, with sales up 7.1% year on year to $2.71 billion. On the other hand, next quarter’s revenue guidance of $3.54 billion was less impressive, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $1.68 per share was 2.7% above analysts’ consensus estimates.

Is now the time to buy Burlington? Find out by accessing our full research report, it’s free for active Edge members.

Burlington (BURL) Q3 CY2025 Highlights:

- Revenue: $2.71 billion vs analyst estimates of $2.72 billion (7.1% year-on-year growth, in line)

- Adjusted EPS: $1.68 vs analyst estimates of $1.64 (2.7% beat)

- Revenue Guidance for Q4 CY2025 is $3.54 billion at the midpoint, below analyst estimates of $3.57 billion

- Management raised its full-year Adjusted EPS guidance to $9.79 at the midpoint, a 4.3% increase

- Operating Margin: 9.3%, up from 5.4% in the same quarter last year

- Free Cash Flow was -$109.6 million compared to -$56.22 million in the same quarter last year

- Locations: 1,211 at quarter end, up from 1,103 in the same quarter last year

- Same-Store Sales rose 1% year on year, in line with the same quarter last year

- Market Capitalization: $17.71 billion

BURLINGTON, N.J., Nov. 25, 2025 (GLOBE NEWSWIRE) -- Burlington Stores, Inc. (NYSE: BURL), a nationally recognized off-price retailer of high-quality, branded apparel, footwear, accessories, and merchandise for the home at everyday low prices, today announced its results for the third quarter ended November 1, 2025. Michael O’Sullivan, CEO, stated, “Total sales increased 7% in the third quarter, while comparable store sales increased 1%. Traffic to our stores fell off significantly after the back-to-school period driven by unseasonably warm temperatures in our major markets. Our comp trend then picked up to mid-single-digits in mid-October once the weather cooled, and that strong trend has continued through the first three weeks of November.”

Company Overview

Founded in 1972 as a discount coat and outerwear retailer, Burlington Stores (NYSE: BURL) is now an off-price retailer that has broadened into general apparel, footwear, and home goods.

Revenue Growth

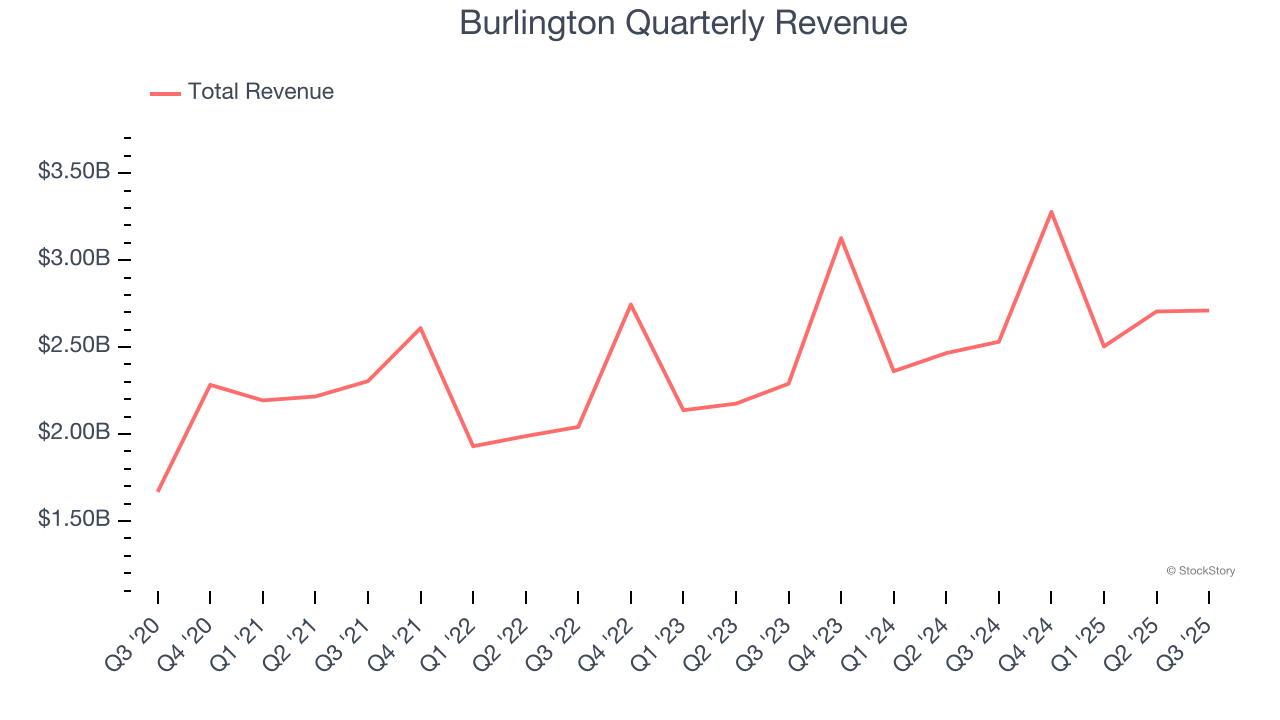

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $11.2 billion in revenue over the past 12 months, Burlington is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, Burlington grew its sales at a mediocre 9.3% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Burlington grew its revenue by 7.1% year on year, and its $2.71 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.4% over the next 12 months, similar to its three-year rate. This projection is eye-popping for a company of its scale and indicates the market is baking in success for its products.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Store Performance

Number of Stores

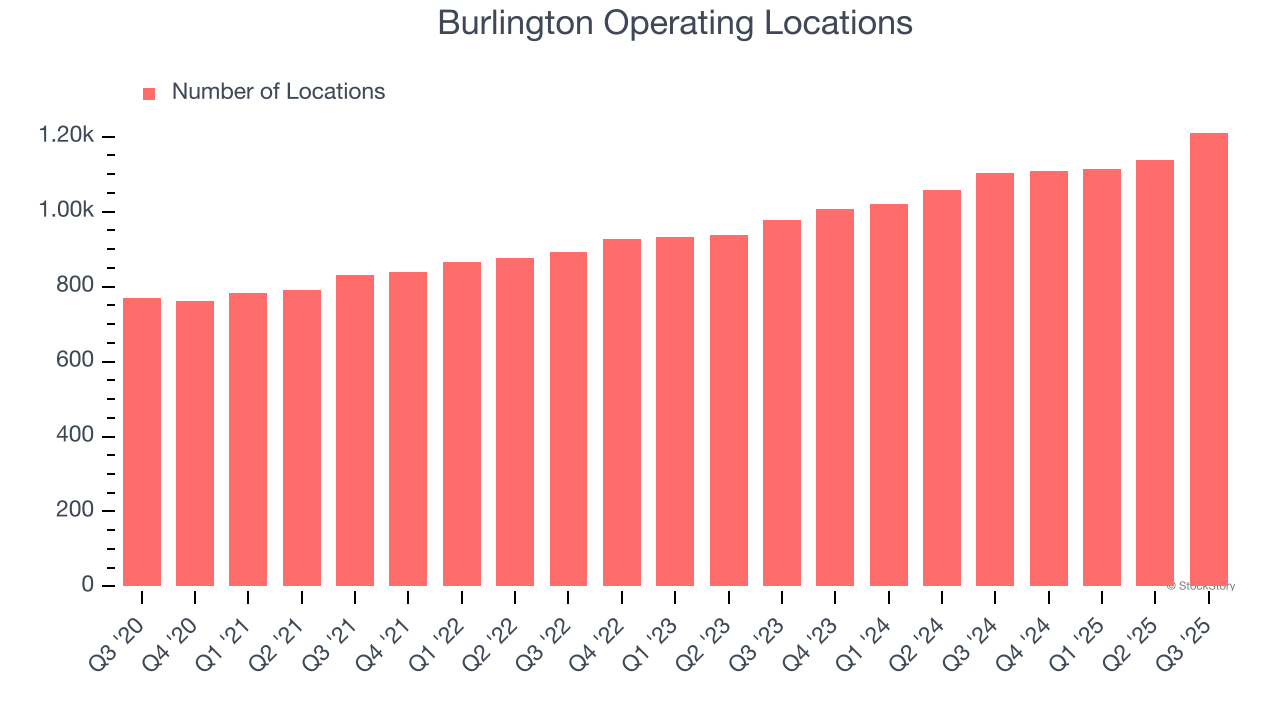

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Burlington sported 1,211 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 10% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

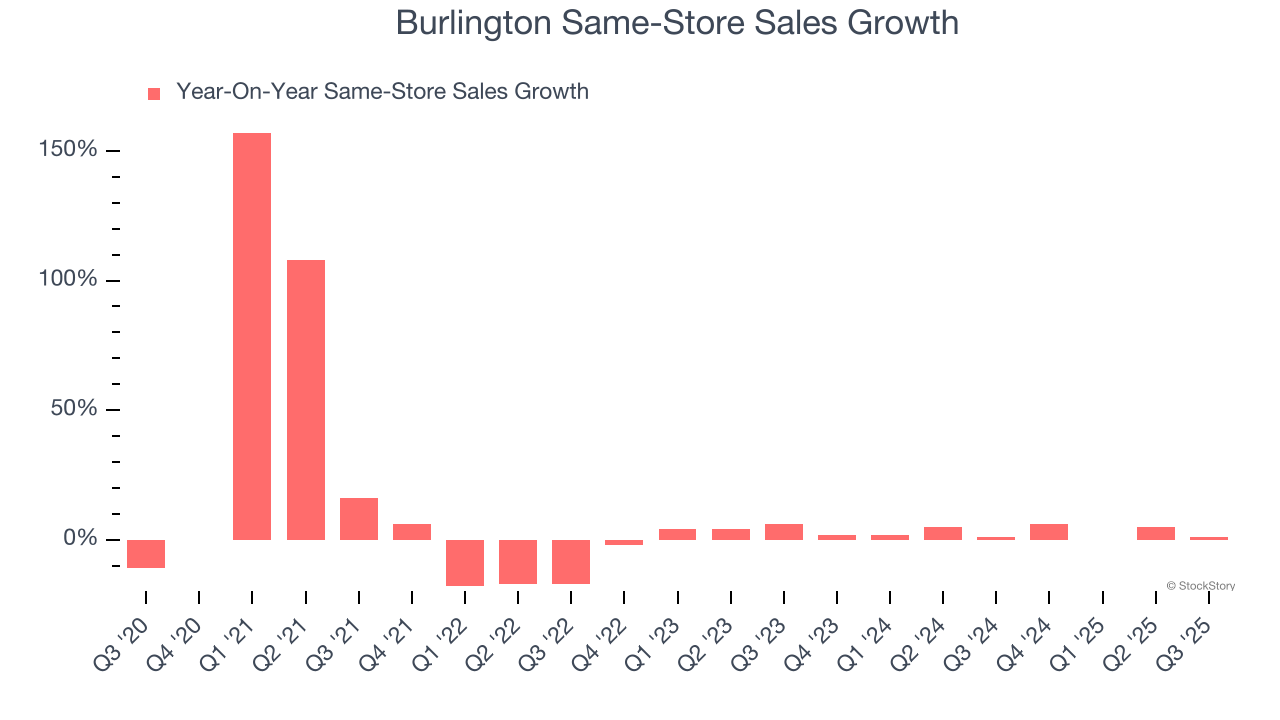

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Burlington’s demand has been healthy for a retailer over the last two years. On average, the company has grown its same-store sales by a robust 2.7% per year. This performance gives it the confidence to meaningfully expand its store base.

In the latest quarter, Burlington’s same-store sales rose 1% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Burlington can reaccelerate growth.

Key Takeaways from Burlington’s Q3 Results

We enjoyed seeing Burlington beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed and its EPS guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. Investors were likely hoping for more, and shares traded down 4.6% to $271.40 immediately following the results.

Big picture, is Burlington a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.