Financial News

Insight Enterprises (NASDAQ:NSIT) Misses Q3 Revenue Estimates

IT solutions integrator Insight Enterprises (NASDAQ: NSIT) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 4% year on year to $2.00 billion. Its non-GAAP profit of $2.43 per share was 2.5% below analysts’ consensus estimates.

Is now the time to buy Insight Enterprises? Find out by accessing our full research report, it’s free for active Edge members.

Insight Enterprises (NSIT) Q3 CY2025 Highlights:

- Revenue: $2.00 billion vs analyst estimates of $2.13 billion (4% year-on-year decline, 5.9% miss)

- Adjusted EPS: $2.43 vs analyst expectations of $2.49 (2.5% miss)

- Adjusted EBITDA: $137 million vs analyst estimates of $133.5 million (6.8% margin, 2.6% beat)

- Management lowered its full-year Adjusted EPS guidance to $9.75 at the midpoint, a 1.5% decrease

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 12.2%, up from 5.3% in the same quarter last year

- Market Capitalization: $3.26 billion

Company Overview

With over 35 years of IT expertise and partnerships with more than 8,000 technology providers, Insight Enterprises (NASDAQ: NSIT) provides end-to-end digital transformation solutions that help businesses modernize their IT infrastructure and maximize the value of technology.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $8.27 billion in revenue over the past 12 months, Insight Enterprises is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To accelerate sales, Insight Enterprises likely needs to optimize its pricing or lean into new offerings and international expansion.

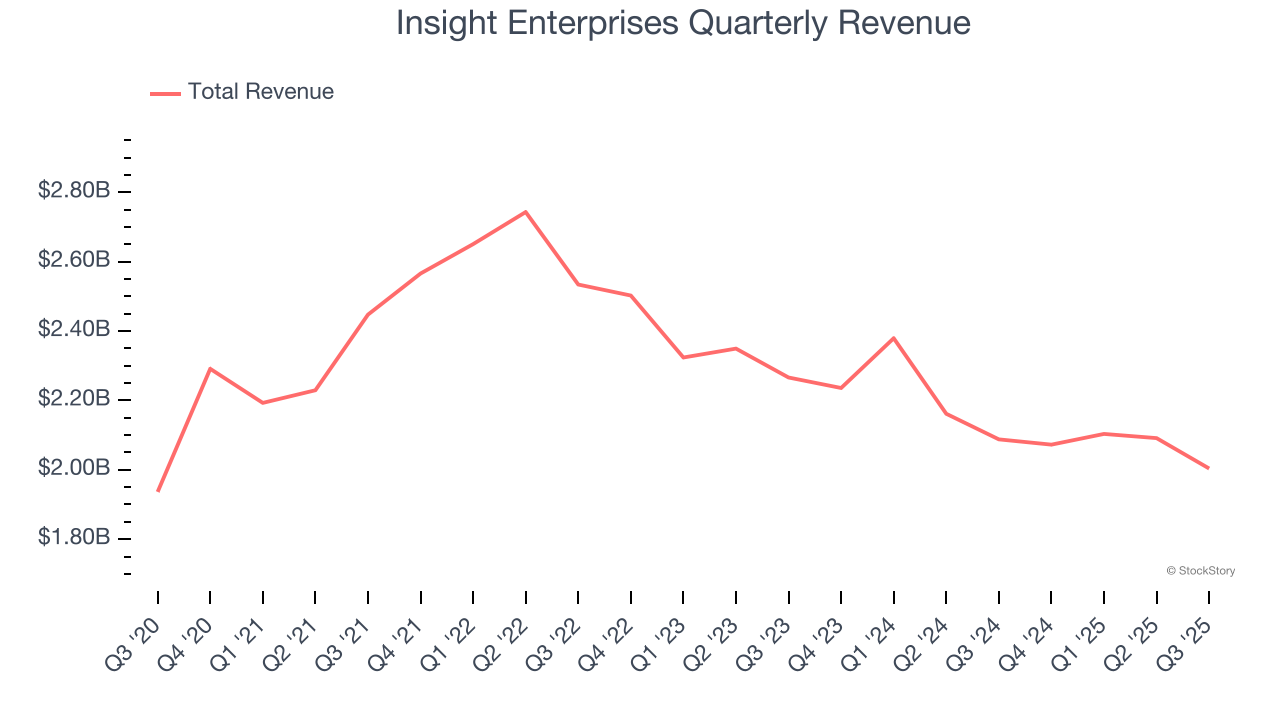

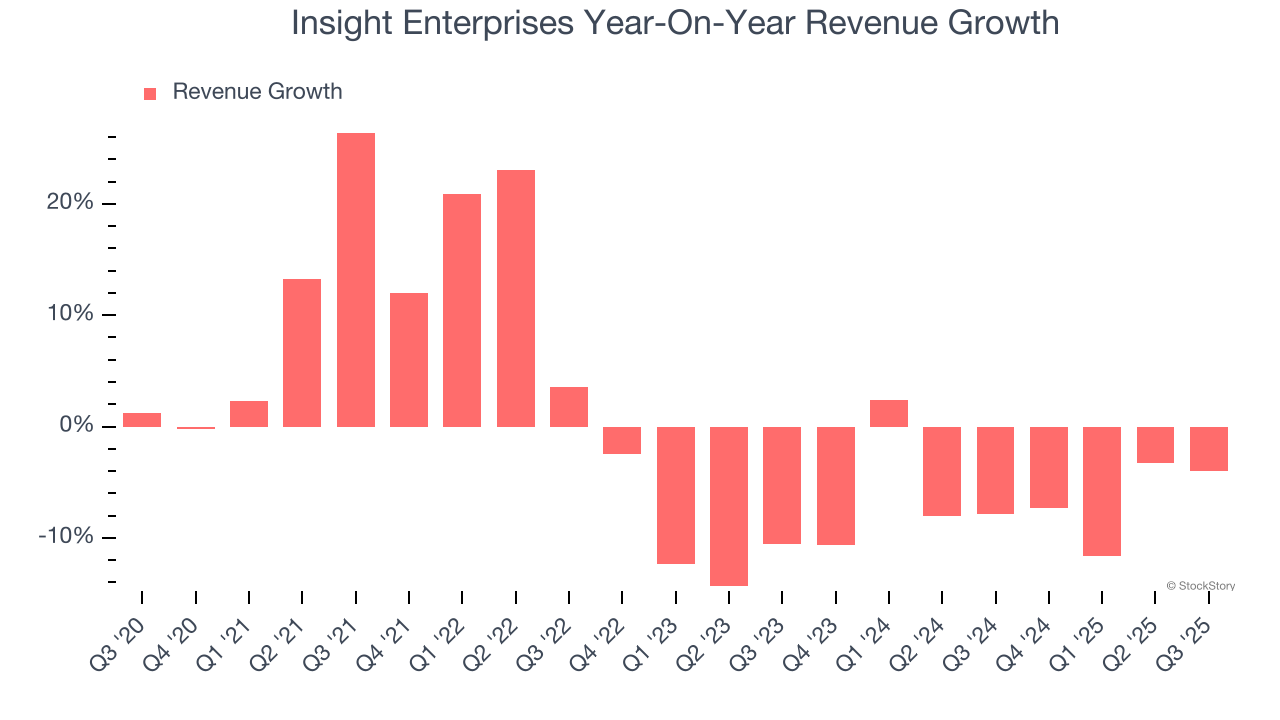

As you can see below, Insight Enterprises struggled to increase demand as its $8.27 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Insight Enterprises’s recent performance shows its demand remained suppressed as its revenue has declined by 6.4% annually over the last two years.

This quarter, Insight Enterprises missed Wall Street’s estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $2.00 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

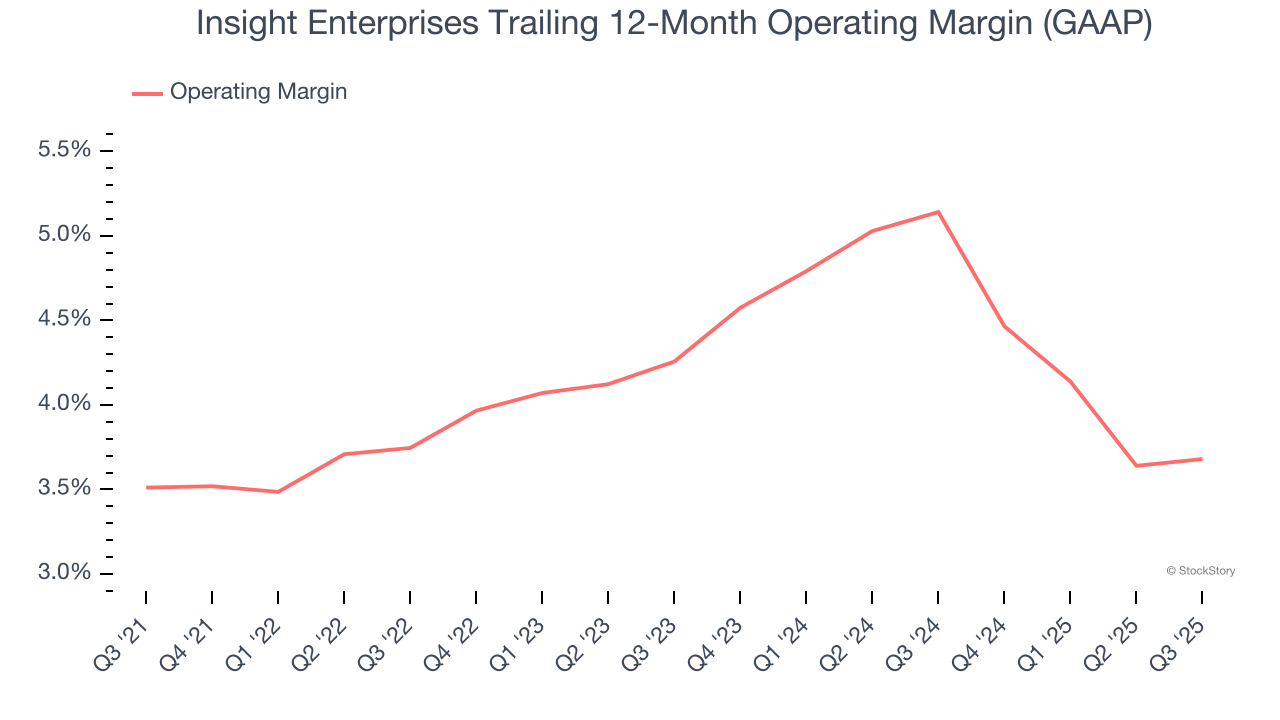

Insight Enterprises’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.1% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Insight Enterprises’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

In Q3, Insight Enterprises generated an operating margin profit margin of 4.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

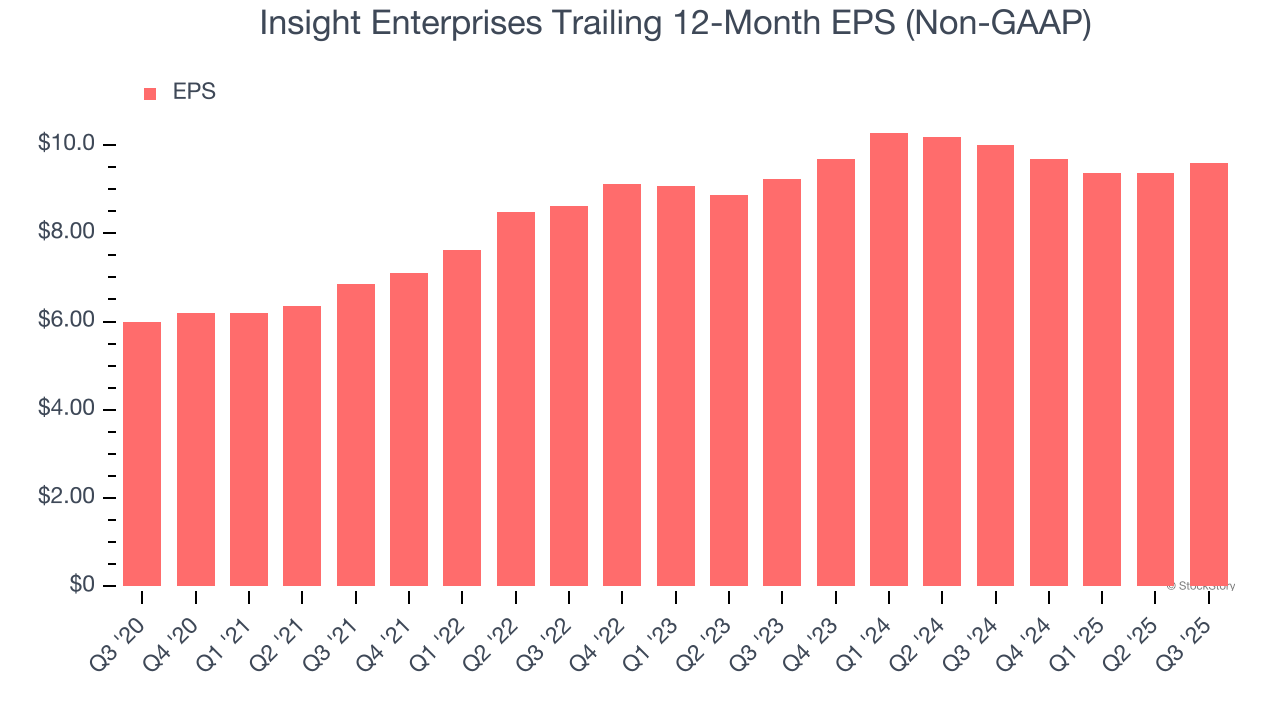

Insight Enterprises’s EPS grew at a solid 9.9% compounded annual growth rate over the last five years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Insight Enterprises, its two-year annual EPS growth of 1.9% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, Insight Enterprises reported adjusted EPS of $2.43, up from $2.19 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Insight Enterprises’s full-year EPS of $9.60 to grow 11.1%.

Key Takeaways from Insight Enterprises’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $103.33 immediately after reporting.

Insight Enterprises didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.