Financial News

Packaging Corporation of America’s (NYSE:PKG) Q4: Beats On Revenue

Packaging Corporation of America (NYSE: PKG) announced better-than-expected revenue in Q4 CY2024, with sales up 10.7% year on year to $2.15 billion. Its GAAP profit of $2.45 per share was 3.3% below analysts’ consensus estimates.

Is now the time to buy Packaging Corporation of America? Find out by accessing our full research report, it’s free.

Packaging Corporation of America (PKG) Q4 CY2024 Highlights:

- Revenue: $2.15 billion vs analyst estimates of $2.13 billion (10.7% year-on-year growth, 0.6% beat)

- EPS (GAAP): $2.45 vs analyst expectations of $2.53 (3.3% miss)

- Adjusted EBITDA: $439.3 million vs analyst estimates of $445.9 million (20.5% margin, 1.5% miss)

- EPS (GAAP) guidance for Q1 CY2025 is $2.21 at the midpoint, missing analyst estimates by 5.2%

- Operating Margin: 14.1%, in line with the same quarter last year

- Sales Volumes rose 8% year on year (26.2% in the same quarter last year)

- Market Capitalization: $21.38 billion

Commenting on reported results, Mark W. Kowlzan, Chairman and CEO, said, “As we have seen throughout the year, demand in our Packaging segment during the quarter remained very strong. Our corrugated products plants delivered record fourth quarter total shipments and an all-time record shipments per day. The plants also set new annual records for total shipments and shipments per day. Excellent operations throughout our mill containerboard system set new quarterly and annual production records as well. This allowed us to meet our customer’s demand needs in a timely manner as well as achieve year-end inventory targets ahead of the mill outages scheduled for the first half of 2025. Although seasonally slower, volume and price/mix in the Paper segment were above last year’s levels. Throughout the Company, our employees together with the benefits of our capital spending program continued to do a great job to lessen the inflationary impact across most of our cost structure.”

Company Overview

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products, also offering displays and protective packaging solutions.

Industrial Packaging

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

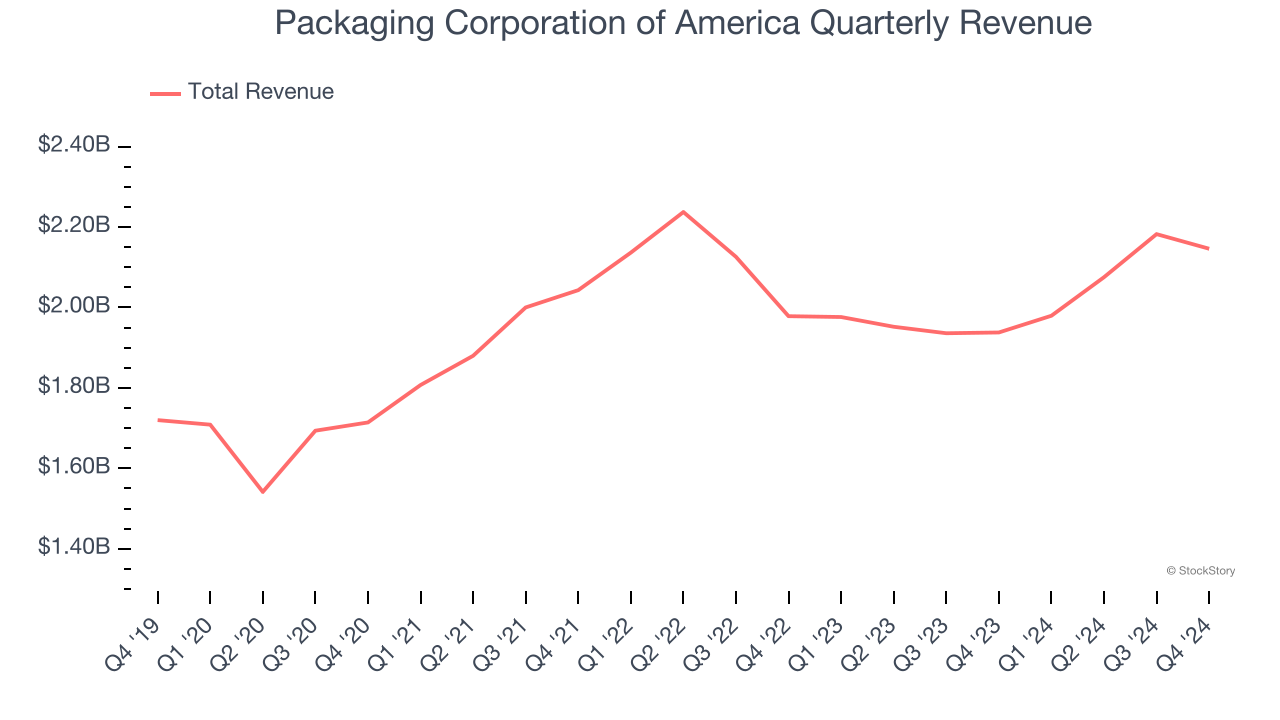

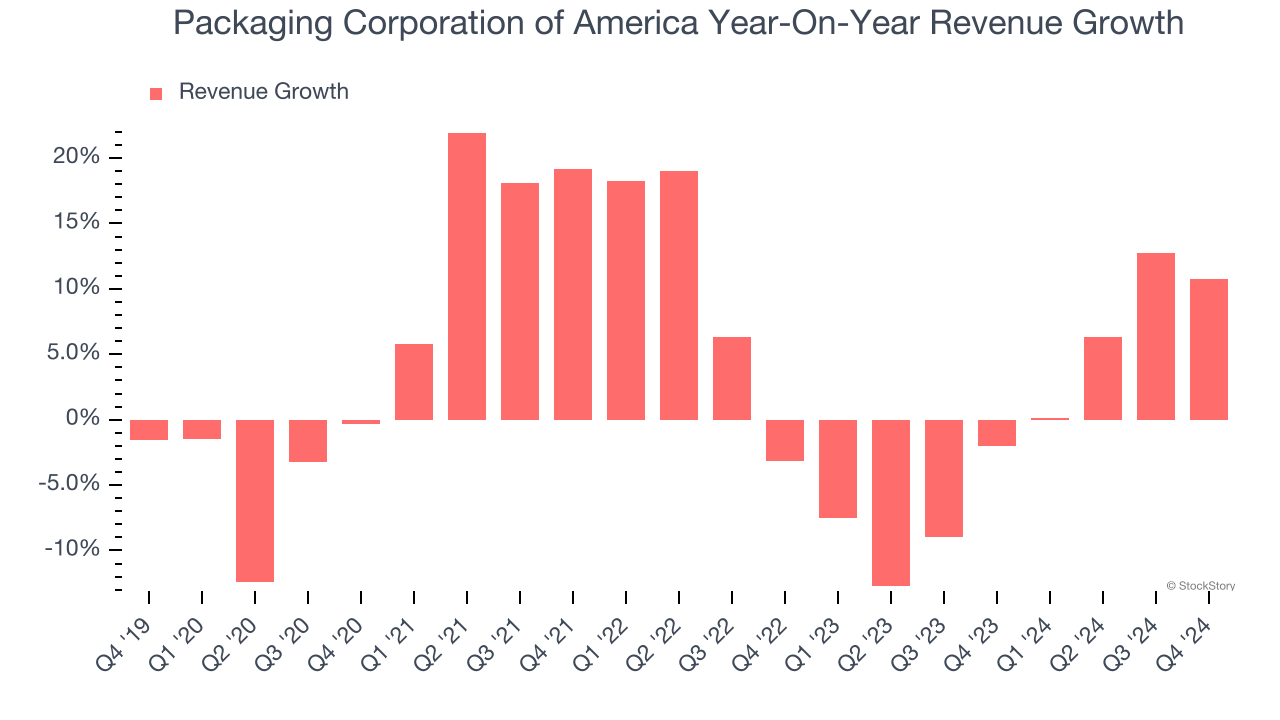

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Packaging Corporation of America grew its sales at a sluggish 3.8% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Packaging Corporation of America’s recent history shows its demand slowed as its revenue was flat over the last two years. We also note many other Industrial Packaging businesses have faced declining sales because of cyclical headwinds. While Packaging Corporation of America’s growth wasn’t the best, it did perform better than its peers.

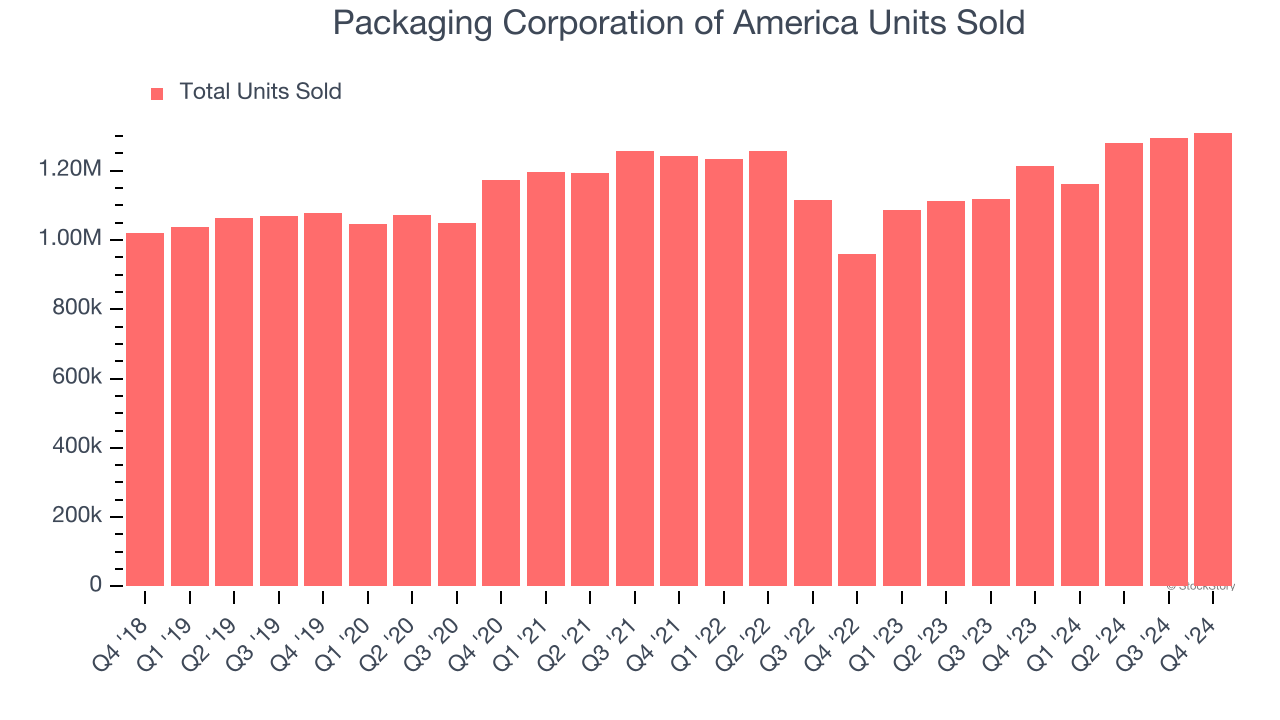

Packaging Corporation of America also reports its units sold, which reached 1.31 million in the latest quarter. Over the last two years, Packaging Corporation of America’s units sold averaged 6.1% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Packaging Corporation of America reported year-on-year revenue growth of 10.7%, and its $2.15 billion of revenue exceeded Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will catalyze better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

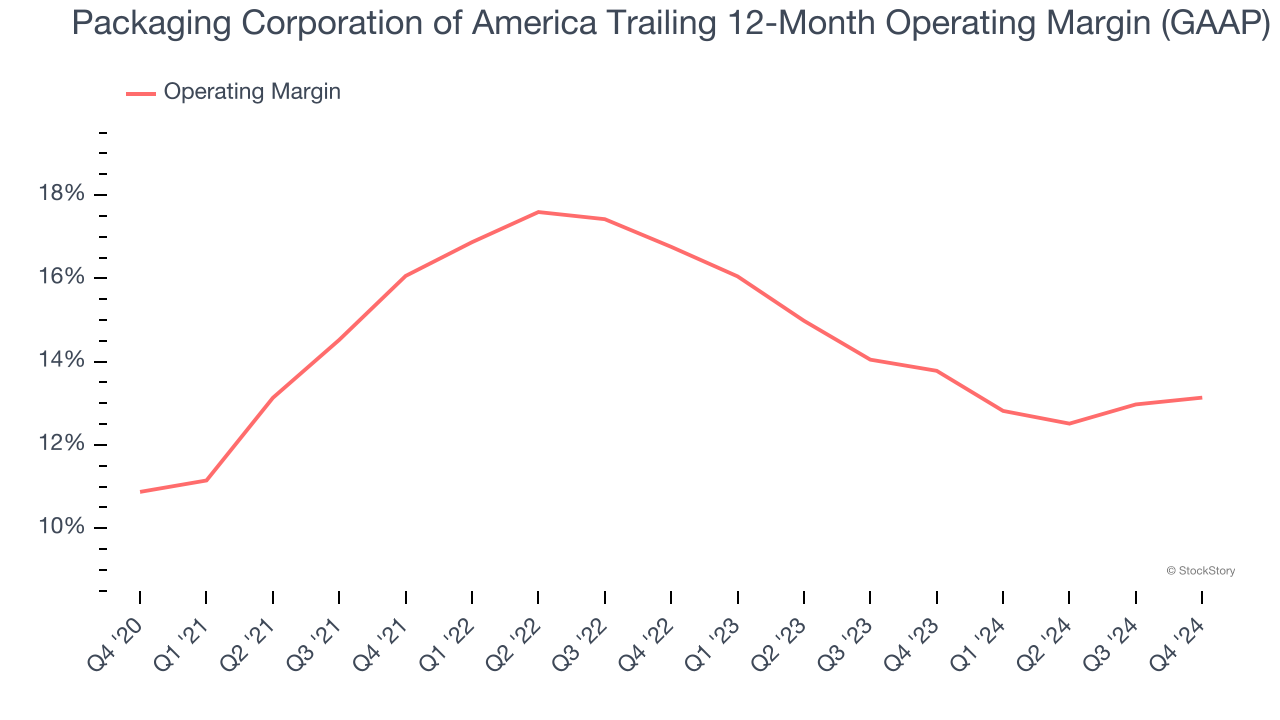

Packaging Corporation of America has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Packaging Corporation of America’s operating margin rose by 2.3 percentage points over the last five years, showing its efficiency has improved.

This quarter, Packaging Corporation of America generated an operating profit margin of 14.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

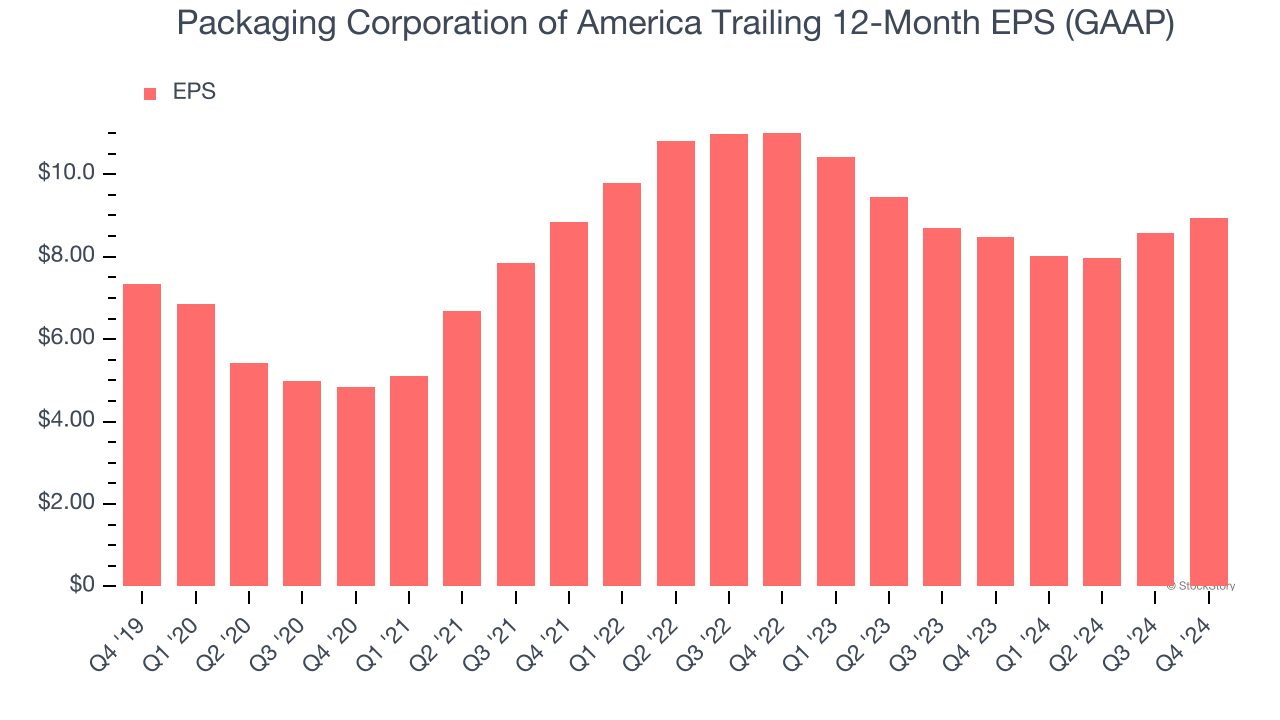

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Packaging Corporation of America’s weak 4% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Packaging Corporation of America, its two-year annual EPS declines of 9.9% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Packaging Corporation of America reported EPS at $2.45, up from $2.10 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Packaging Corporation of America’s full-year EPS of $8.93 to grow 25.6%.

Key Takeaways from Packaging Corporation of America’s Q4 Results

We were impressed by how significantly Packaging Corporation of America blew past analysts’ sales volume expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed significantly and its EPS fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter featuring some areas of strength but also some blemishes. The stock remained flat at $238.41 immediately following the results.

So should you invest in Packaging Corporation of America right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.