Financial News

Bloomin' Brands (NASDAQ:BLMN) Misses Q3 Sales Targets, Stock Drops 11.8%

Restaurant company Bloomin’ Brands (NASDAQ: BLMN) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 3.8% year on year to $1.04 billion. Its non-GAAP profit of $0.21 per share was 2.8% above analysts’ consensus estimates.

Is now the time to buy Bloomin' Brands? Find out by accessing our full research report, it’s free.

Bloomin' Brands (BLMN) Q3 CY2024 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.04 billion (in line)

- Adjusted EPS: $0.21 vs analyst estimates of $0.20 (beat by $0.01)

- Management lowered its full-year Adjusted EPS guidance to $1.77 at the midpoint, a 19.5% decrease

- Gross Margin (GAAP): 13.6%, down from 15% in the same quarter last year

- Operating Margin: 1.7%, down from 5.4% in the same quarter last year

- Locations: 1,463 at quarter end, down from 1,484 in the same quarter last year

- Same-Store Sales fell 1.5% year on year (-0.5% in the same quarter last year)

- Market Capitalization: $1.43 billion

Company Overview

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ: BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years.

Bloomin' Brands is one of the larger restaurant chains in the industry and benefits from a well-known brand that influences consumer purchasing decisions. However, its scale is a double-edged sword because it's harder to find incremental growth when you've already penetrated the market.

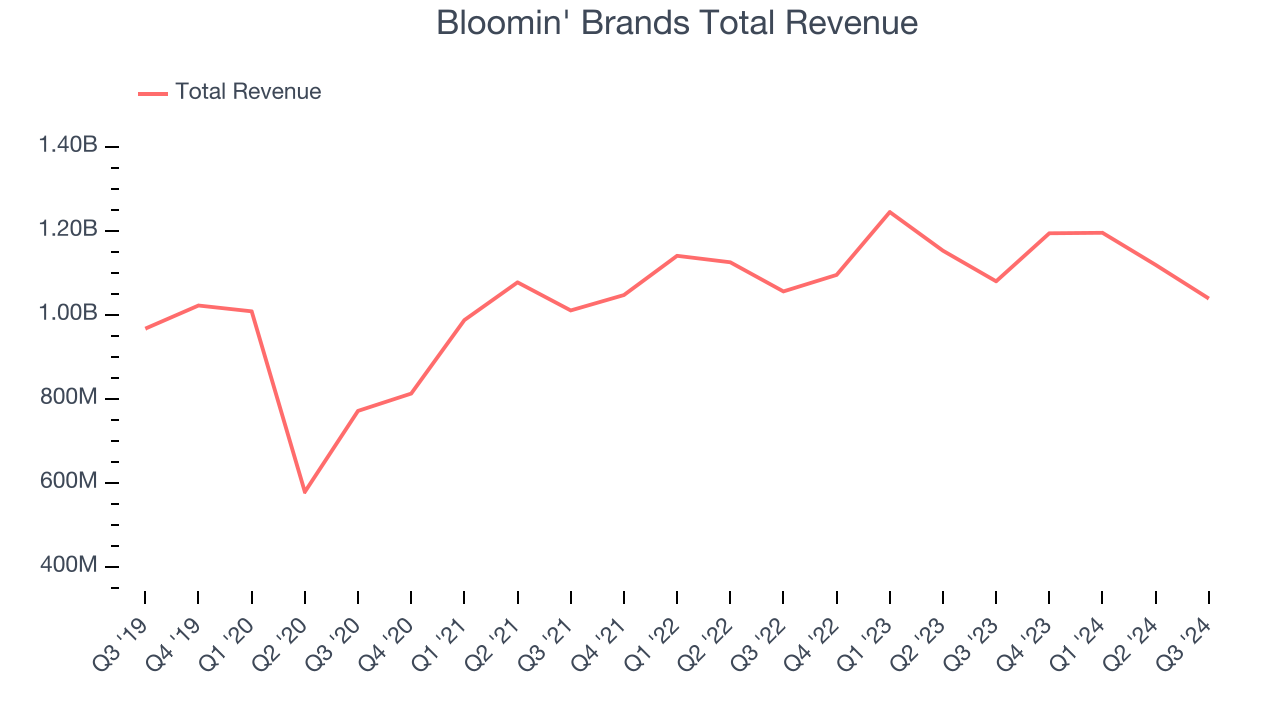

As you can see below, Bloomin' Brands grew its sales at a weak 1.9% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it didn’t open many new restaurants.

This quarter, Bloomin' Brands reported a rather uninspiring 3.8% year-on-year revenue decline to $1.04 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last five years. This projection is underwhelming and shows the market thinks its offerings will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Restaurant Performance

Number of Restaurants

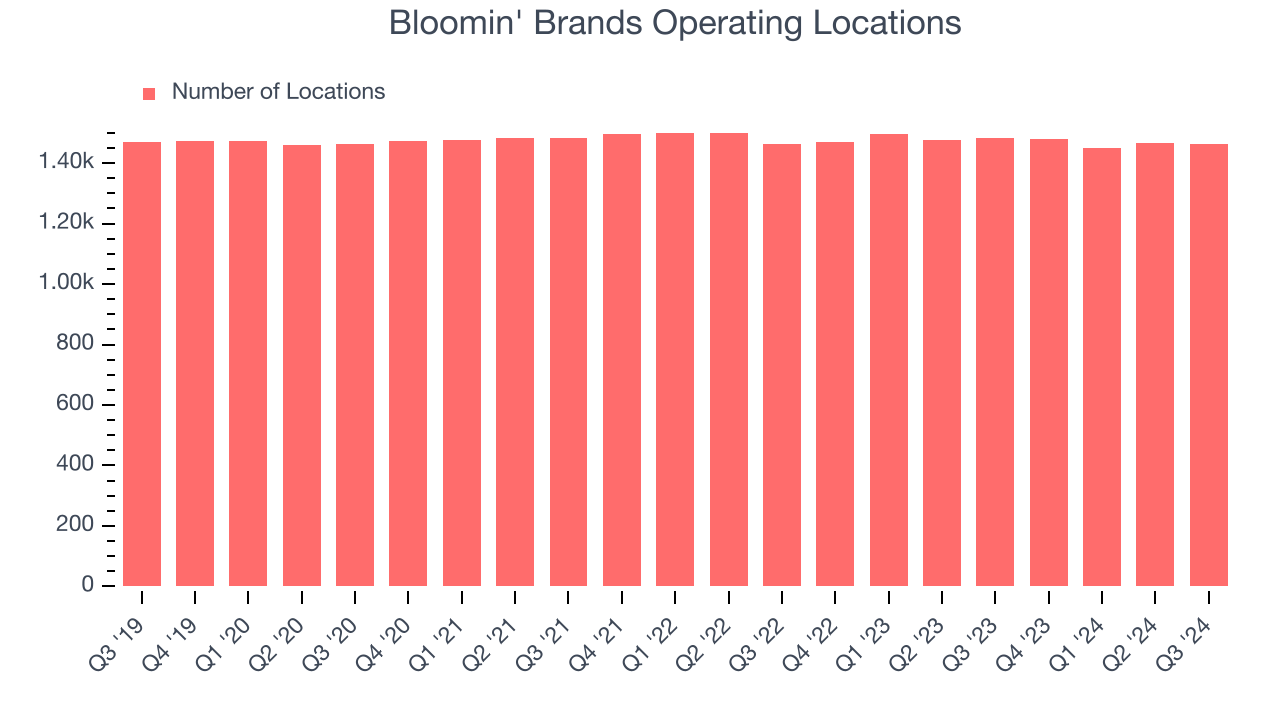

Bloomin' Brands listed 1,463 locations in the latest quarter and has kept its restaurant count flat over the last two years while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

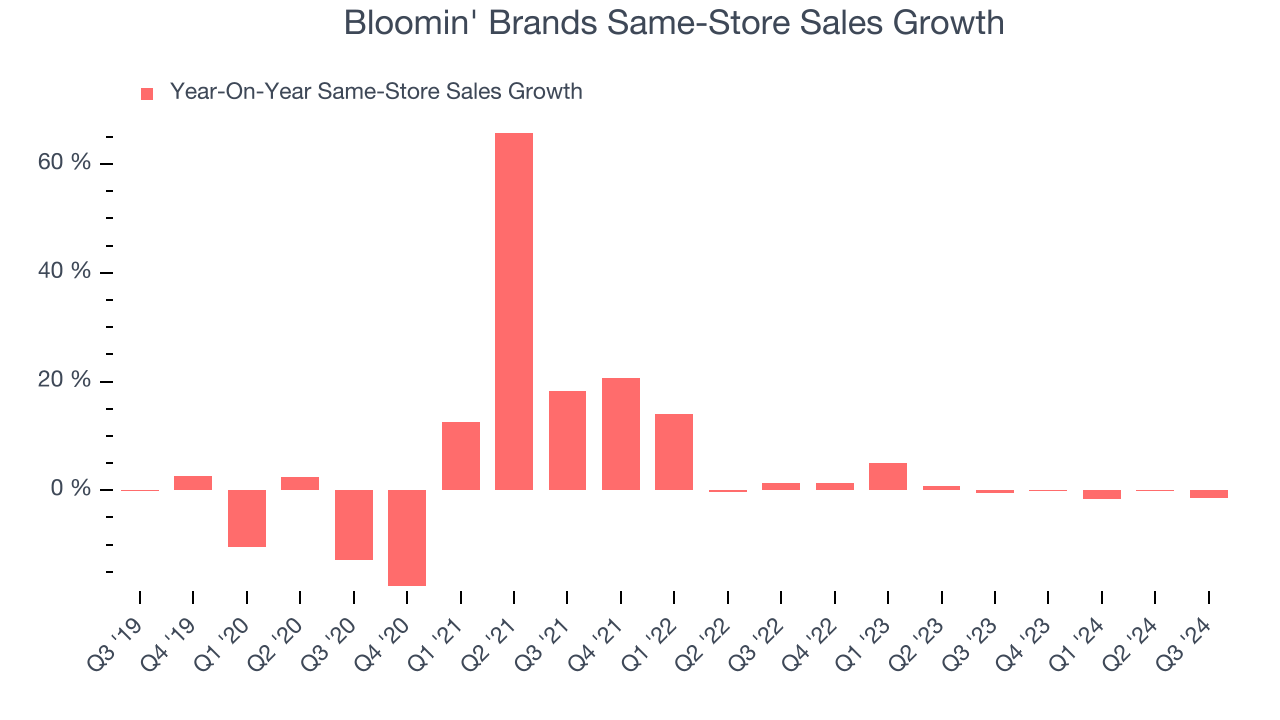

Bloomin' Brands’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and we’d be skeptical if Bloomin' Brands starts opening new restaurants to artifically boost revenue growth.

In the latest quarter, Bloomin' Brands’s same-store sales fell by 1.5% annually. This performance was more or less in line with the same quarter last year.

Key Takeaways from Bloomin' Brands’s Q3 Results

We struggled to find many strong positives in these results as it lowered its full-year EPS guidance, missing Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 11.8% to $14.80 immediately after reporting.

Bloomin' Brands underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.