Financial News

Thermon (NYSE:THR) Reports Sales Below Analyst Estimates In Q3 Earnings

Industrial process heating solutions provider Thermon (NYSE: THR) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 7.3% year on year to $114.6 million. The company’s full-year revenue guidance of $502.5 million at the midpoint came in 6.7% below analysts’ estimates. Its GAAP profit of $0.28 per share was in line with analysts’ consensus estimates.

Is now the time to buy Thermon? Find out by accessing our full research report, it’s free.

Thermon (THR) Q3 CY2024 Highlights:

- Revenue: $114.6 million vs analyst estimates of $116.2 million (1.3% miss)

- EPS (GAAP): $0.28 vs analyst expectations of $0.28 (in line)

- EBITDA: $21.34 million vs analyst estimates of $22.94 million (7% miss)

- The company dropped its revenue guidance for the full year to $502.5 million at the midpoint from $540 million, a 6.9% decrease

- EBITDA guidance for the full year is $107.5 million at the midpoint, below analyst estimates of $115.3 million

- Gross Margin (GAAP): 44.4%, in line with the same quarter last year

- Operating Margin: 13.3%, down from 17.8% in the same quarter last year

- EBITDA Margin: 18.6%, down from 20.5% in the same quarter last year

- Free Cash Flow Margin: 5.8%, up from 0.5% in the same quarter last year

- Market Capitalization: $995.1 million

"Our second quarter results once again demonstrated the benefits of our disciplined execution against our key strategic pillars, highlighted by continued momentum in bookings during the quarter and the ability to strategically deploy capital in support of our growth initiatives, including our recent acquisition of F.A.T.I.," stated Bruce Thames, President and CEO of Thermon.

Company Overview

Creating the first packaged tracing systems, Thermon (NYSE: THR) is a leading provider of engineered industrial process heating solutions for process industries.

Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Sales Growth

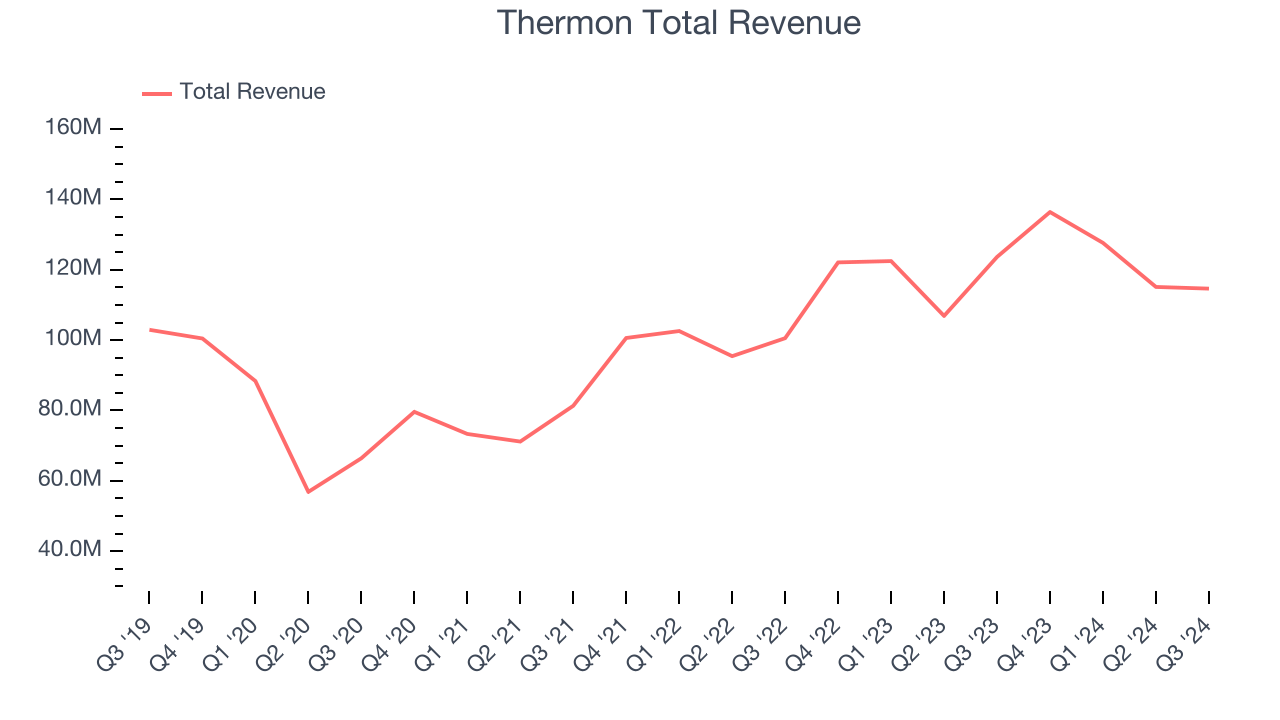

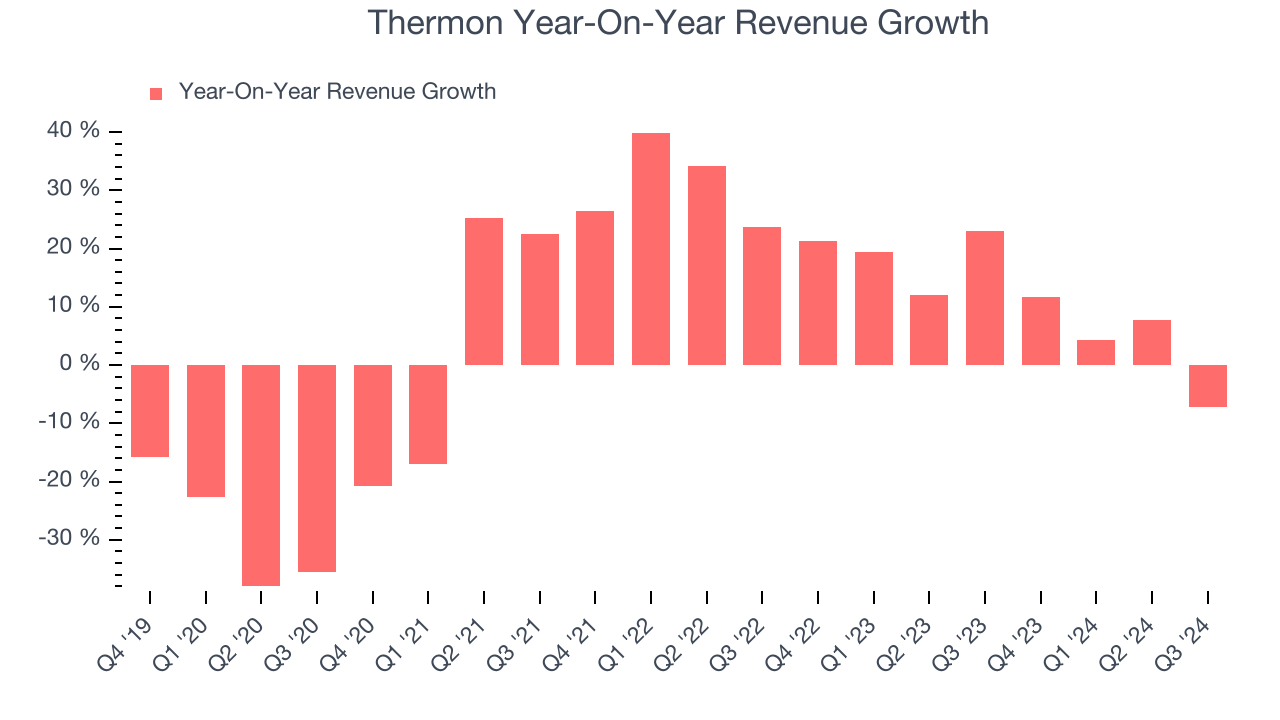

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Thermon’s 2.9% annualized revenue growth over the last five years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Thermon’s annualized revenue growth of 11.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Thermon missed Wall Street’s estimates and reported a rather uninspiring 7.3% year-on-year revenue decline, generating $114.6 million of revenue.

We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates. This signals Thermon could be a hidden gem because it doesn’t get attention from professional brokers.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

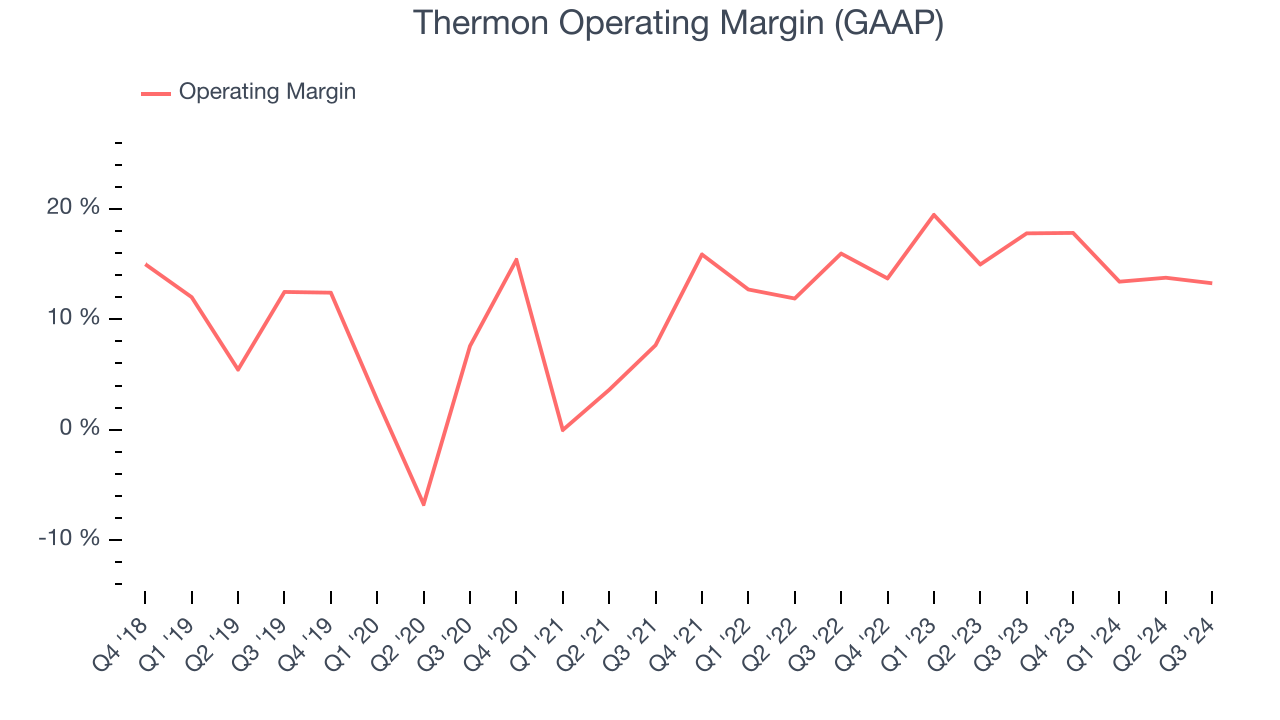

Thermon has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.3%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Thermon’s annual operating margin rose by 9.5 percentage points over the last five years, showing its efficiency has meaningfully improved.

This quarter, Thermon generated an operating profit margin of 13.3%, down 4.5 percentage points year on year. Since Thermon’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

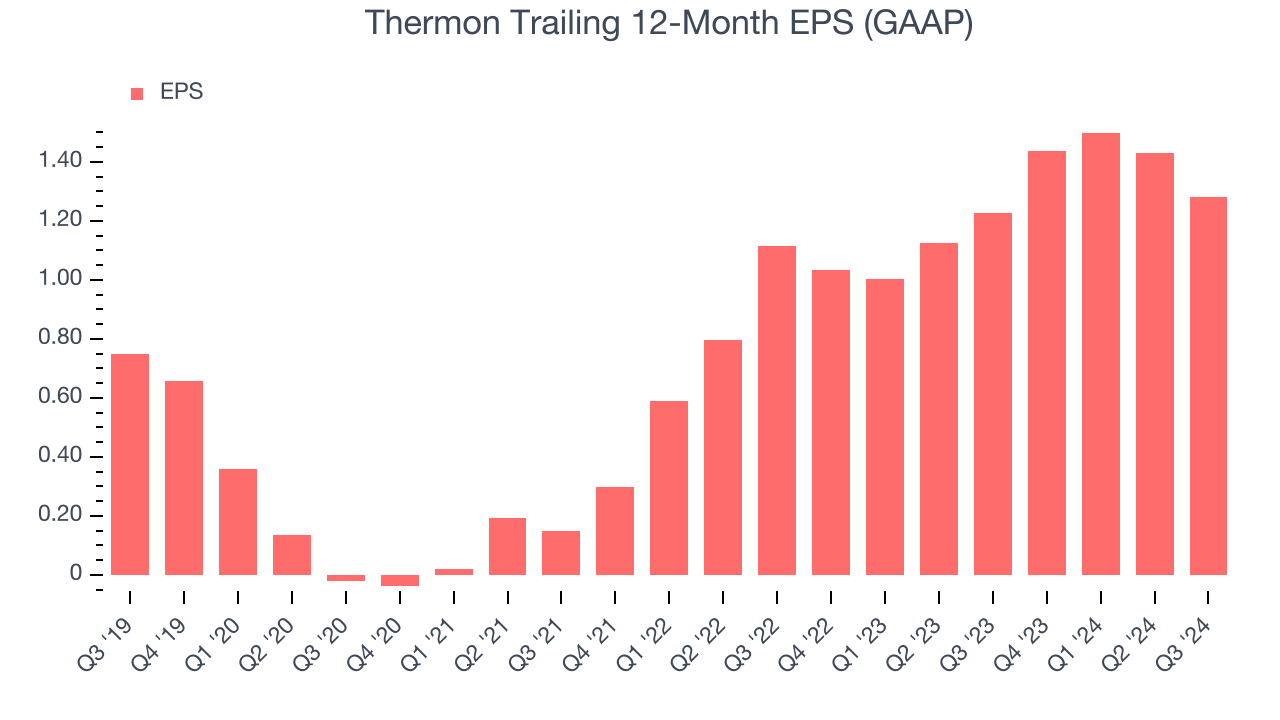

Thermon’s EPS grew at a solid 11.3% compounded annual growth rate over the last five years, higher than its 2.9% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into Thermon’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Thermon’s operating margin declined this quarter but expanded by 9.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Thermon, its two-year annual EPS growth of 7.2% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.In Q3, Thermon reported EPS at $0.28, down from $0.43 in the same quarter last year. This print was close to analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data. This signals Thermon could be a hidden gem because it doesn’t have much coverage among professional brokers.

Key Takeaways from Thermon’s Q3 Results

We struggled to find many strong positives in these results. Its full-year revenue guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5% to $27.98 immediately after reporting.

Thermon underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.