Financial News

Resideo (NYSE:REZI) Reports Q3 In Line With Expectations,

Home automation and security solutions provider Resideo Technologies (NYSE: REZI) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 17.6% year on year to $1.83 billion. The company expects next quarter’s revenue to be around $1.84 billion, coming in 1.2% above analysts’ estimates. Its non-GAAP profit of $0.58 per share was 6.5% below analysts’ consensus estimates.

Is now the time to buy Resideo? Find out by accessing our full research report, it’s free.

Resideo (REZI) Q3 CY2024 Highlights:

- Revenue: $1.83 billion vs analyst estimates of $1.82 billion (in line)

- Adjusted EPS: $0.58 vs analyst expectations of $0.62 (6.5% miss)

- EBITDA: $190 million vs analyst estimates of $174 million (9.2% beat)

- Revenue Guidance for Q4 CY2024 is $1.84 billion at the midpoint, above analyst estimates of $1.81 billion

- Management lowered its full-year Adjusted EPS guidance to $2.23 at the midpoint, a 0.9% decrease

- EBITDA guidance for the full year is $679.5 million at the midpoint, above analyst estimates of $669.9 million

- Gross Margin (GAAP): 28.7%, up from 26.8% in the same quarter last year

- Operating Margin: 6.9%, in line with the same quarter last year

- EBITDA Margin: 10.4%, up from 1.4% in the same quarter last year

- Free Cash Flow Margin: 6.8%, up from 2.3% in the same quarter last year

- Market Capitalization: $3.21 billion

"We delivered strong results in the third quarter with organic sales growth at both Products and Solutions and ADI in addition to consolidated Adjusted EBITDA again coming in ahead of our outlook," commented Jay Geldmacher, Resideo's President and CEO.

Company Overview

Resideo Technologies, Inc. (NYSE: REZI) is a manufacturer and distributor of technology-driven products and solutions for home comfort, energy management, water management, and safety and security.

Building Materials

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

Sales Growth

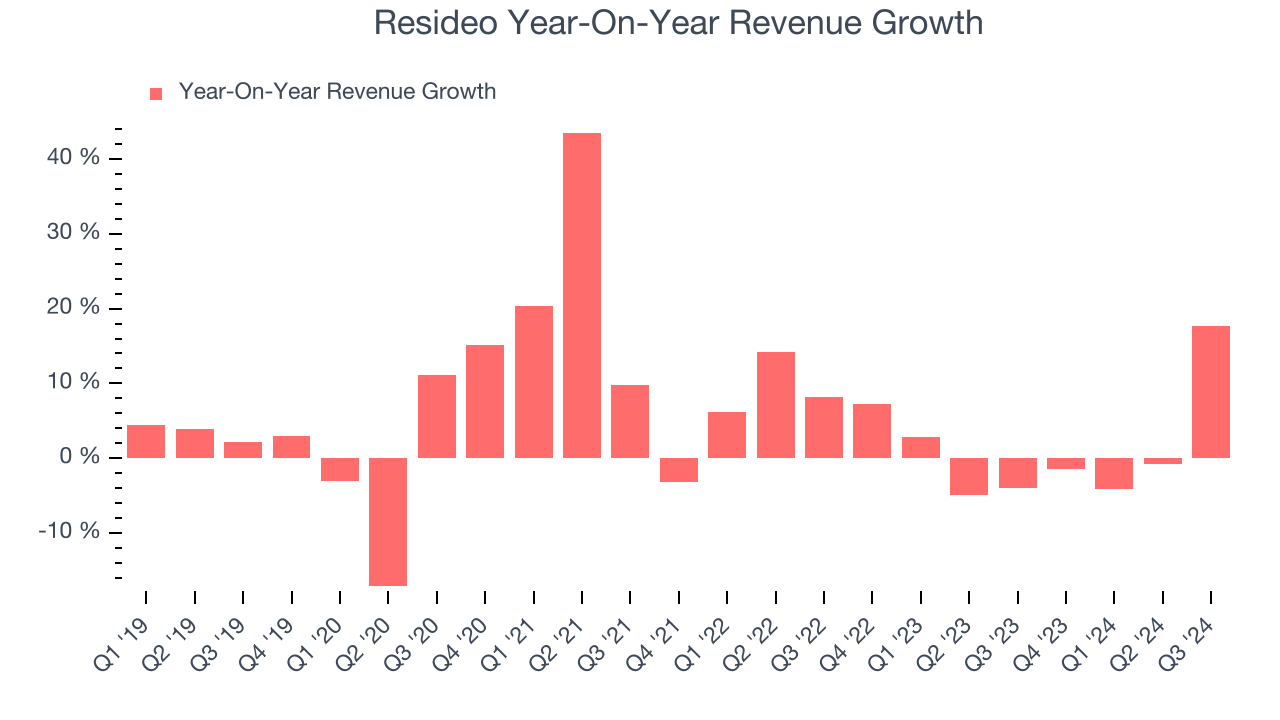

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Regrettably, Resideo’s sales grew at a tepid 5.4% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Resideo’s recent history shows its demand slowed as its annualized revenue growth of 1.4% over the last two years is below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its most important segments, ADI Global Distribution and Products & Solutions, which are 64.7% and 35.3% of revenue. Over the last two years, Resideo’s ADI Global Distribution revenue (wholesale distribution of 450k+ products) averaged 4.5% year-on-year growth. On the other hand, its Products & Solutions revenue (branded offerings) averaged 2.3% declines.

This quarter, Resideo’s year-on-year revenue growth was 17.6%, and its $1.83 billion of revenue was in line with Wall Street’s estimates. Management is currently guiding for a 19.4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.5% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates the market thinks its newer products and services will spur faster growth.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

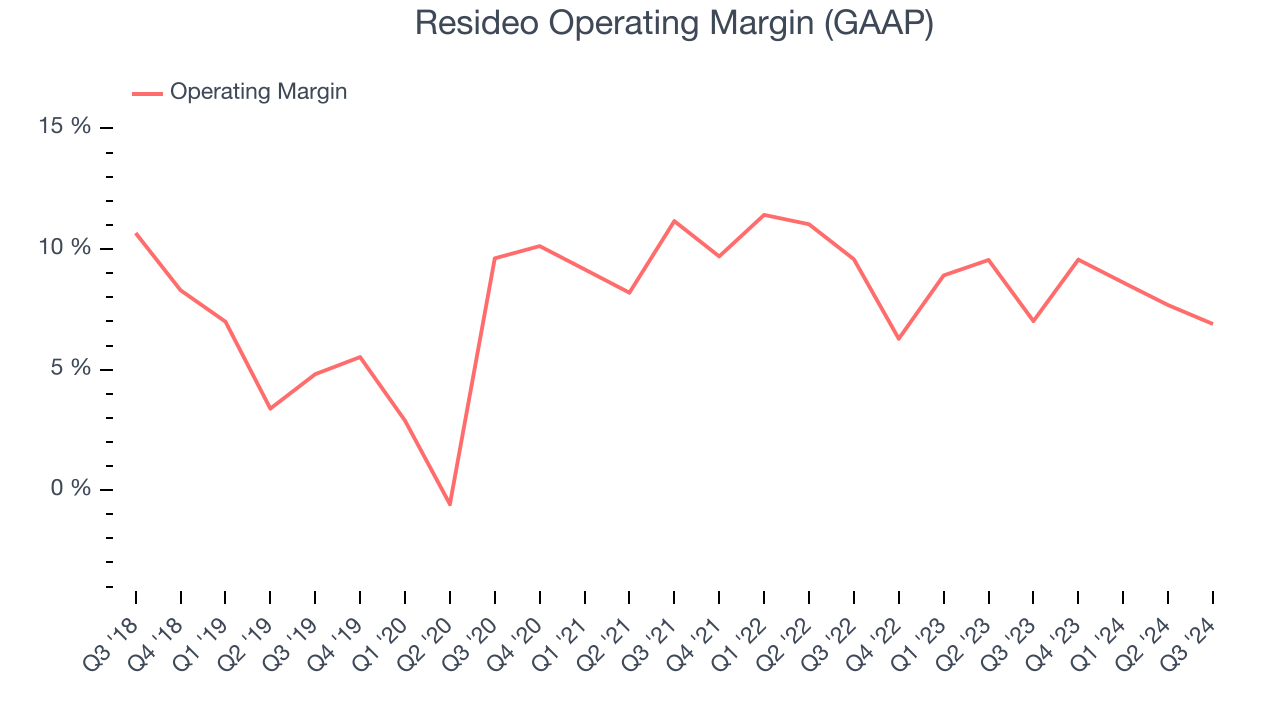

Resideo has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.3%, higher than the broader industrials sector.

Looking at the trend in its profitability, Resideo’s annual operating margin rose by 3.4 percentage points over the last five years, showing its efficiency has improved.

In Q3, Resideo generated an operating profit margin of 6.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

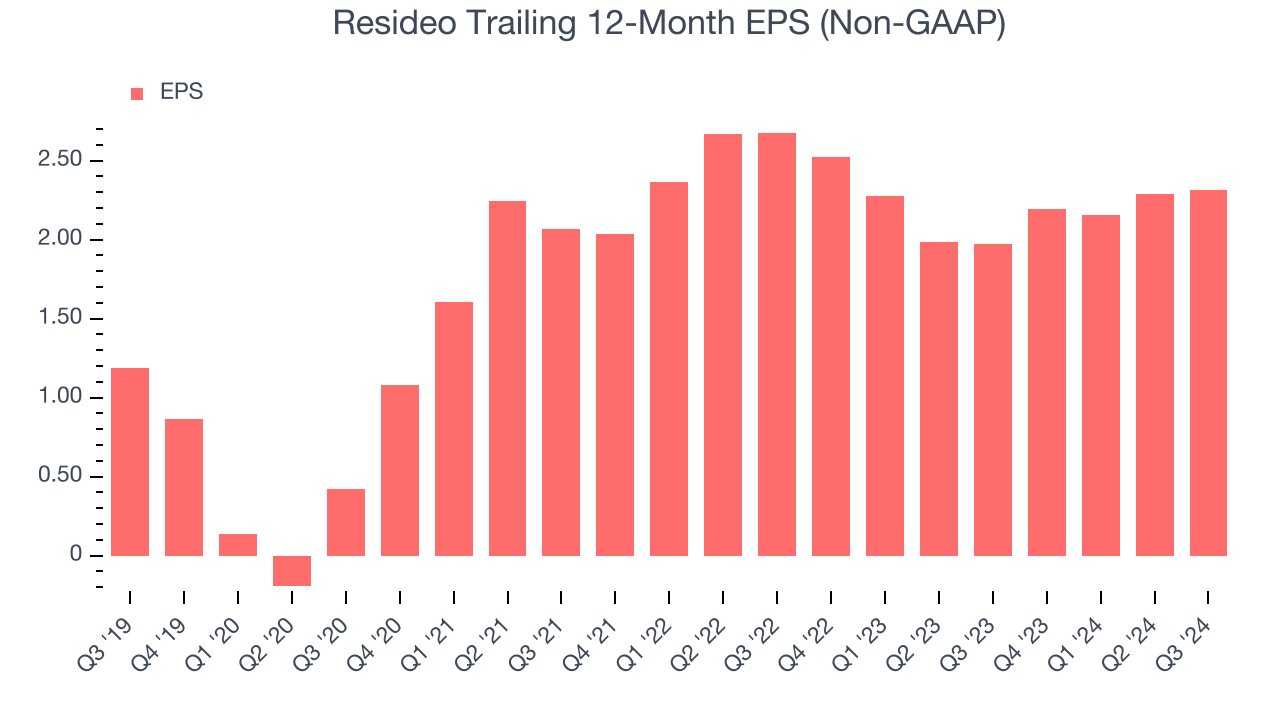

Resideo’s EPS grew at a remarkable 14.4% compounded annual growth rate over the last five years, higher than its 5.4% annualized revenue growth. This tells us the company became more profitable as it expanded.

We can take a deeper look into Resideo’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Resideo’s operating margin was flat this quarter but expanded by 3.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Resideo, its two-year annual EPS declines of 7% mark a reversal from its (seemingly) healthy five-year trend. We hope Resideo can return to earnings growth in the future.In Q3, Resideo reported EPS at $0.58, up from $0.55 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Resideo’s full-year EPS of $2.32 to grow by 6.2%.

Key Takeaways from Resideo’s Q3 Results

We were impressed by how significantly Resideo blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance exceeded Wall Street’s estimates. On the other hand, its EPS missed. Overall, this quarter was mixed but still had some key positives. The stock remained flat at $21.75 immediately following the results.

So do we think Resideo is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.