Financial News

MercadoLibre (NASDAQ:MELI) Posts Q3 Sales In Line With Estimates But Stock Drops

Latin American e-commerce and fintech company MercadoLibre (NASDAQ:MELI) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 35.3% year on year to $5.31 billion. Its GAAP profit of $7.83 per share was 20.5% below analysts’ consensus estimates.

Is now the time to buy MercadoLibre? Find out by accessing our full research report, it’s free.

MercadoLibre (MELI) Q3 CY2024 Highlights:

- Revenue: $5.31 billion vs analyst estimates of $5.28 billion (in line)

- EPS: $7.83 vs analyst expectations of $9.85 (20.5% miss)

- EBITDA: $714 million vs analyst estimates of $919.4 million (22.3% miss)

- Gross Margin (GAAP): 45.9%, down from 54.6% in the same quarter last year

- Operating Margin: 10.5%, down from 20% in the same quarter last year

- EBITDA Margin: 13.4%, down from 23.4% in the same quarter last year

- Free Cash Flow Margin: 25.9%, down from 33.6% in the previous quarter

- Market Capitalization: $106 billion

Company Overview

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

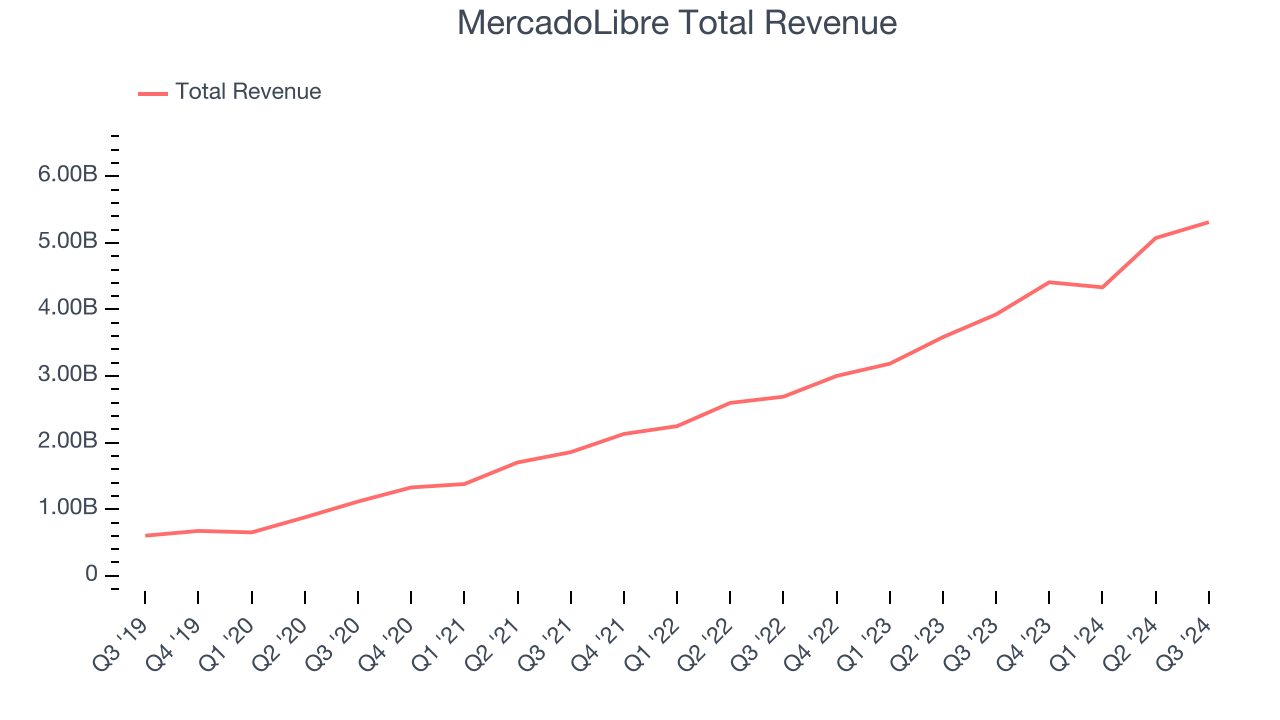

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, MercadoLibre’s 45.1% annualized revenue growth over the last three years was incredible. This is a great starting point for our analysis because it shows MercadoLibre’s offerings resonate with customers.

This quarter, MercadoLibre’s year-on-year revenue growth of 35.3% was wonderful, and its $5.31 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 25.6% over the next 12 months, a deceleration versus the last three years. Some tapering is natural given the magnitude of its revenue base, and we still think its growth trajectory is attractive.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

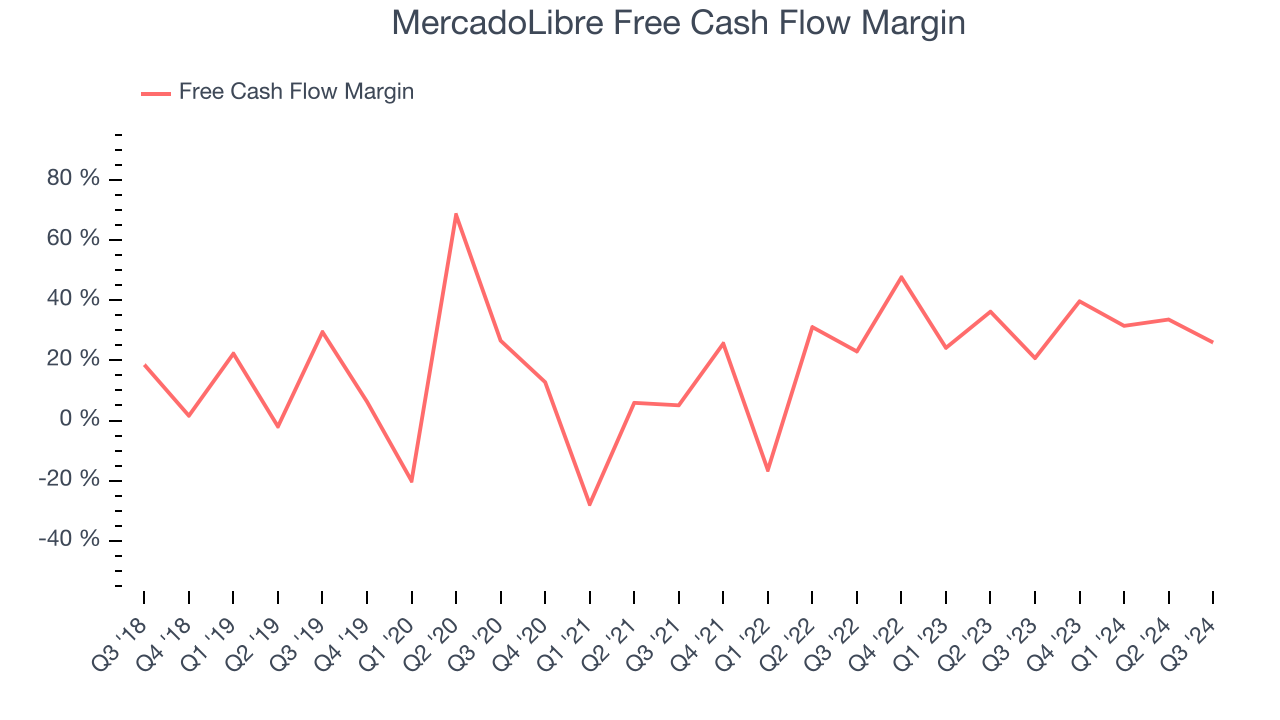

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

MercadoLibre has shown terrific cash profitability, driven by its cost-effective customer acquisition strategy that enables it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 32% over the last two years.

Taking a step back, we can see that MercadoLibre’s margin expanded by 32.7 percentage points over the last three years. This is encouraging because its free cash flow profitability rose more than its operating profitability, suggesting it’s becoming a less capital-intensive business.

MercadoLibre’s free cash flow clocked in at $1.38 billion in Q3, equivalent to a 25.9% margin. This result was good as its margin was 5.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from MercadoLibre’s Q3 Results

We enjoyed seeing MercadoLibre’s impressive revenue growth this quarter. On the other hand, its EBITDA and EPS missed because it ramped up investments in its credit and logistics businesses. Overall, this quarter could have been better, but we trust management and are excited it's investing for the future. The stock traded down 9.2% to $1,925 immediately after reporting.

MercadoLibre may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.