Financial News

Expeditors (NYSE:EXPD) Delivers Impressive Q3

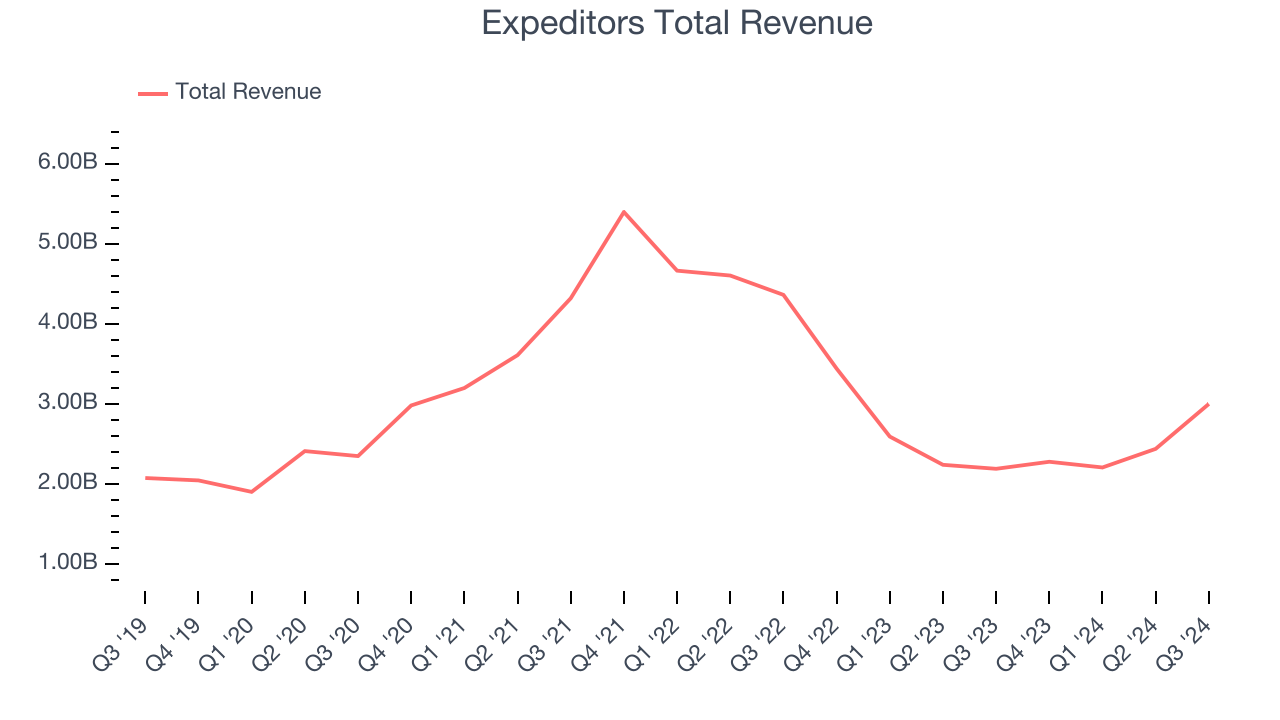

Logistics and freight forwarding company Expeditors (NYSE: EXPD) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 37% year on year to $3 billion. Its GAAP profit of $1.63 per share was also 22.1% above analysts’ consensus estimates.

Is now the time to buy Expeditors? Find out by accessing our full research report, it’s free.

Expeditors (EXPD) Q3 CY2024 Highlights:

- Revenue: $3 billion vs analyst estimates of $2.47 billion (21.3% beat)

- EPS: $1.63 vs analyst estimates of $1.34 (22.1% beat)

- EBITDA: $327.1 million vs analyst estimates of $249 million (31.4% beat)

- Gross Margin (GAAP): 15.2%, in line with the same quarter last year

- Operating Margin: 10.1%, in line with the same quarter last year

- EBITDA Margin: 10.9%, in line with the same quarter last year

- Free Cash Flow Margin: 2.6%, down from 8.3% in the same quarter last year

- Market Capitalization: $16.99 billion

“We have worked hard over this past year to gain additional volumes and grow our business by winning new customers and gaining additional business with current customers,” said Jeffrey S. Musser, President and Chief Executive Officer.

Company Overview

Expeditors (NYSE: EXPD) offers air and ocean freight as well as brokerage services.

Air Freight and Logistics

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Sales Growth

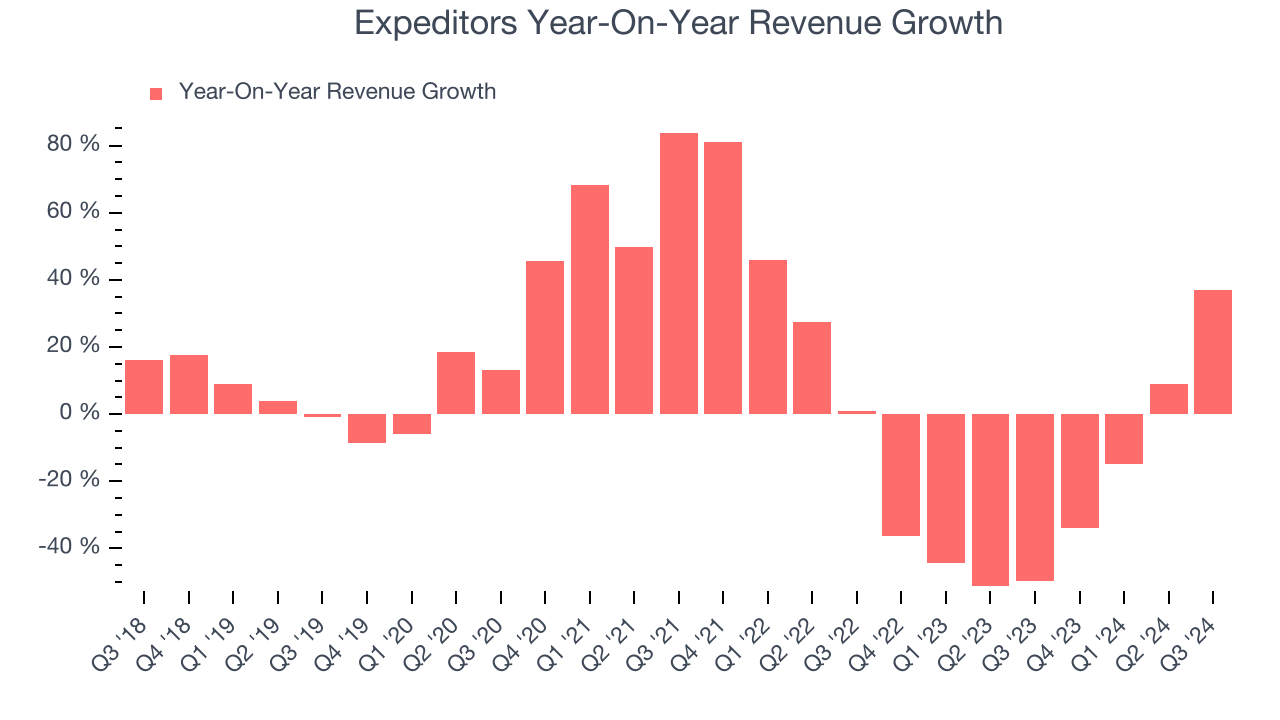

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Expeditors grew its sales at a sluggish 3.5% compounded annual growth rate. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Expeditors’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 27.8% annually. Expeditors isn’t alone in its struggles as the Air Freight and Logistics industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Airfreight and Ocean freight, which are 32.9% and 33.9% of revenue. Over the last two years, Expeditors’s Airfreight revenue (transport by plane) averaged 23.6% year-on-year declines while its Ocean freight revenue (transport by sea) averaged 27.5% declines.

This quarter, Expeditors reported wonderful year-on-year revenue growth of 37%, and its $3 billion of revenue exceeded Wall Street’s estimates by 21.3%.

Looking ahead, sell-side analysts expect revenue to decline 1.4% over the next 12 months. While this projection is better than its two-year trend it's hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

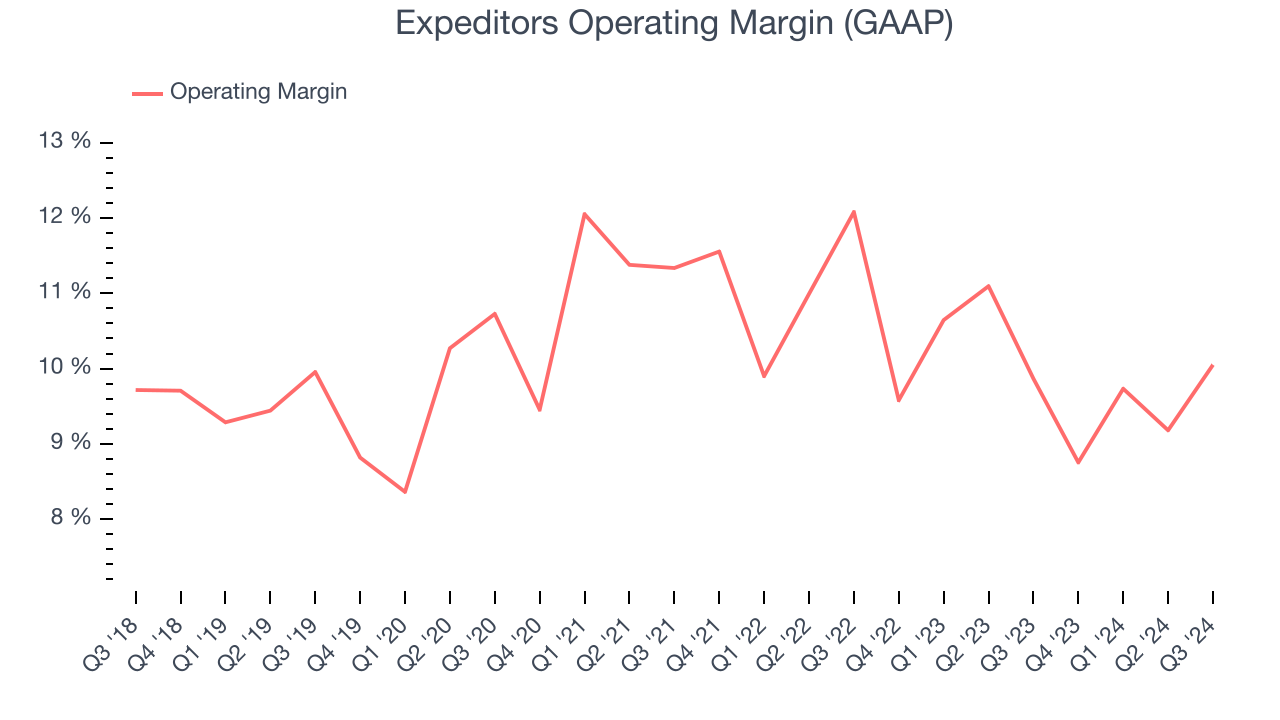

Operating Margin

Expeditors has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.5%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Expeditors’s annual operating margin might have seen some fluctuations but has generally stayed the same over the last five years, highlighting the long-term consistency of its business.

This quarter, Expeditors generated an operating profit margin of 10.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

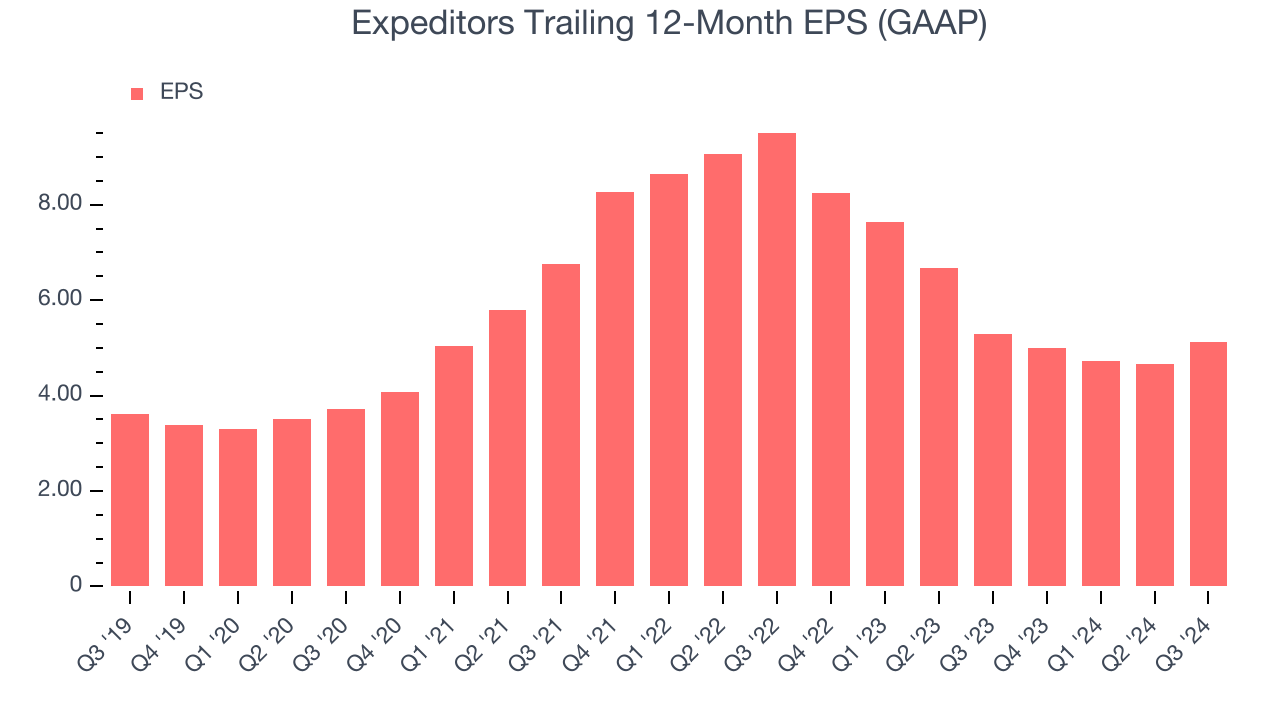

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Expeditors’s EPS grew at an unimpressive 7.2% compounded annual growth rate over the last five years. This performance was better than its 3.5% annualized revenue growth but doesn’t tell us much about its business quality because its operating margin didn’t expand.

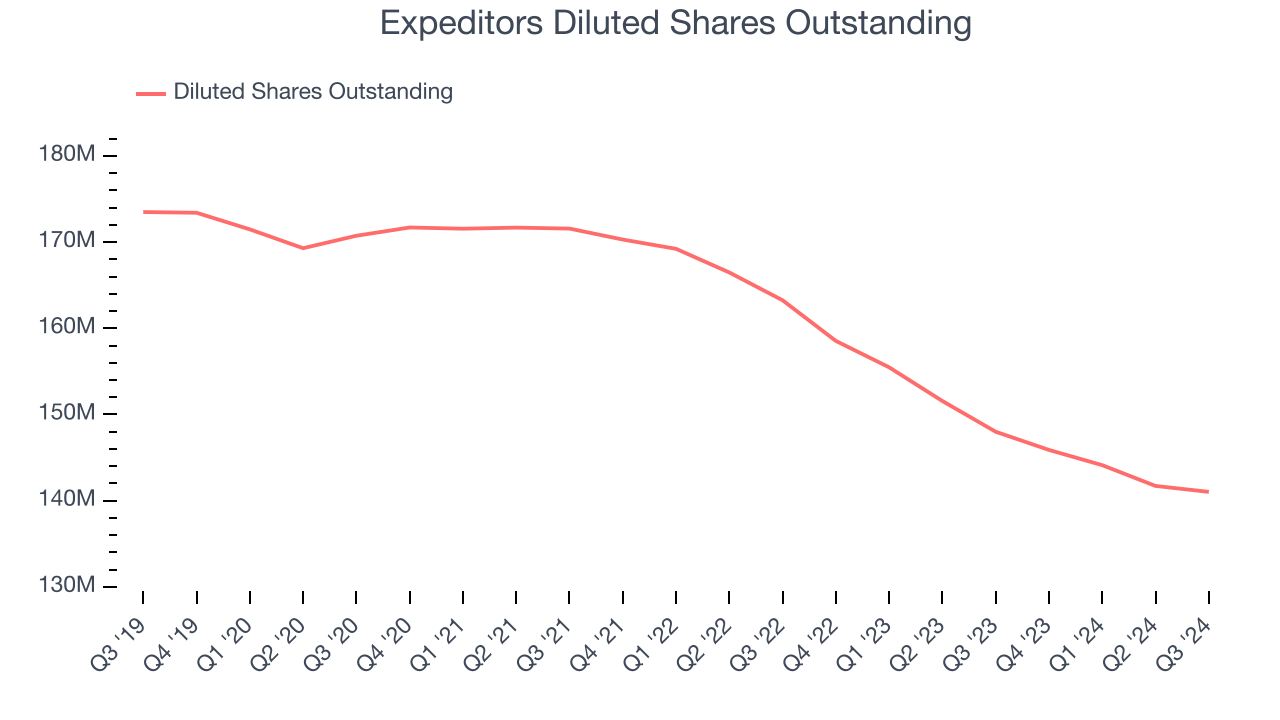

Diving into the nuances of Expeditors’s earnings can give us a better understanding of its performance. A five-year view shows that Expeditors has repurchased its stock, shrinking its share count by 18.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

For Expeditors, its two-year annual EPS declines of 26.6% show it’s continued to underperform. These results were bad no matter how you slice the data.In Q3, Expeditors reported EPS at $1.63, up from $1.16 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Expeditors’s full-year EPS of $5.13 to stay about the same.

Key Takeaways from Expeditors’s Q3 Results

We were impressed by how significantly Expeditors blew past analysts’ EBITDA and EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 3.1% to $124.11 immediately after reporting.

Indeed, Expeditors had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.