Financial News

Sit-Down Dining Stocks Q3 Recap: Benchmarking Bloomin' Brands (NASDAQ:BLMN)

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how sit-down dining stocks fared in Q3, starting with Bloomin' Brands (NASDAQ: BLMN).

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

The 12 sit-down dining stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 0.9%.

While some sit-down dining stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4% since the latest earnings results.

Bloomin' Brands (NASDAQ: BLMN)

Owner of the iconic Australian-themed Outback Steakhouse, Bloomin’ Brands (NASDAQ: BLMN) is a leading American restaurant company that owns and operates a portfolio of popular restaurant brands.

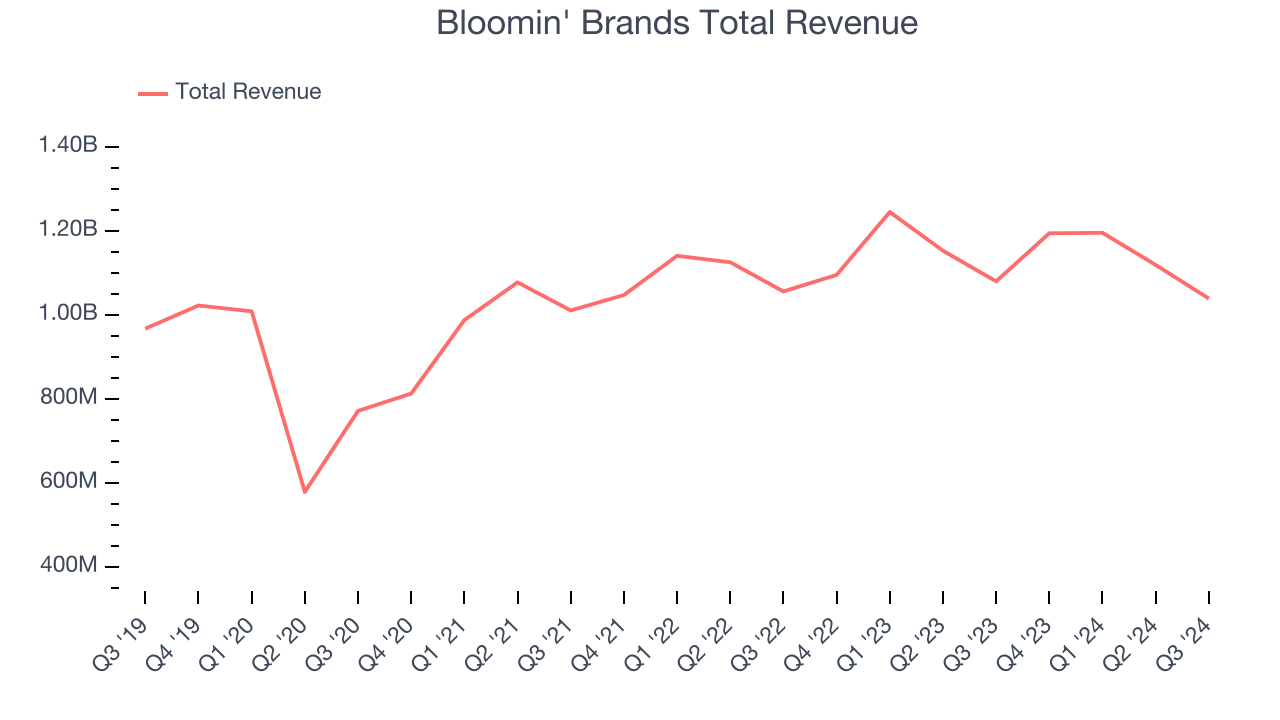

Bloomin' Brands reported revenues of $1.04 billion, down 3.8% year on year. This print fell short of analysts’ expectations by 0.8%. Overall, it was a softer quarter for the company with full-year EPS guidance missing analysts’ expectations.

Bloomin' Brands delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 25% since reporting and currently trades at $12.59.

Read our full report on Bloomin' Brands here, it’s free.

Best Q3: Brinker International (NYSE: EAT)

Founded by Norman Brinker in Dallas, Texas, Brinker International (NYSE: EAT) is a casual restaurant chain that operates under the Chili’s, Maggiano’s Little Italy, and It’s Just Wings banners.

Brinker International reported revenues of $1.14 billion, up 12.5% year on year, outperforming analysts’ expectations by 3.4%. The business had a stunning quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ same-store sales estimates.

Brinker International achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 28.3% since reporting. It currently trades at $124.74.

Is now the time to buy Brinker International? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Denny's (NASDAQ: DENN)

Open around the clock, Denny’s (NASDAQ: DENN) is a chain of diner restaurants serving breakfast and traditional American fare.

Denny's reported revenues of $111.8 million, down 2.1% year on year, falling short of analysts’ expectations by 3.2%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 5.4% since the results and currently trades at $6.27.

Read our full analysis of Denny’s results here.

The Cheesecake Factory (NASDAQ: CAKE)

Celebrated for its delicious (and free) brown bread, gigantic portions, and delectable desserts, Cheesecake Factory (NASDAQ: CAKE) is an iconic American restaurant chain that also owns and operates a portfolio of separate restaurant brands.

The Cheesecake Factory reported revenues of $865.5 million, up 4.2% year on year. This number met analysts’ expectations. It was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

The stock is up 9.5% since reporting and currently trades at $46.90.

Read our full, actionable report on The Cheesecake Factory here, it’s free.

BJ's (NASDAQ: BJRI)

Founded in 1978 in California, BJ’s Restaurants (NASDAQ: BJRI) is a chain of restaurants whose menu features classic American dishes, often with a twist.

BJ's reported revenues of $325.7 million, up 2.2% year on year. This result was in line with analysts’ expectations. More broadly, it was a softer quarter as it produced a significant miss of analysts’ EBITDA estimates.

The stock is down 7.9% since reporting and currently trades at $34.15.

Read our full, actionable report on BJ's here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.