Financial News

Renewable Energy Stocks Q3 Highlights: First Solar (NASDAQ:FSLR)

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at renewable energy stocks, starting with First Solar (NASDAQ: FSLR).

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 16 renewable energy stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 10.2% while next quarter’s revenue guidance was 8.4% below.

In light of this news, share prices of the companies have held steady as they are up 3.4% on average since the latest earnings results.

First Solar (NASDAQ: FSLR)

Headquartered in Arizona, First Solar (NASDAQ: FSLR) specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

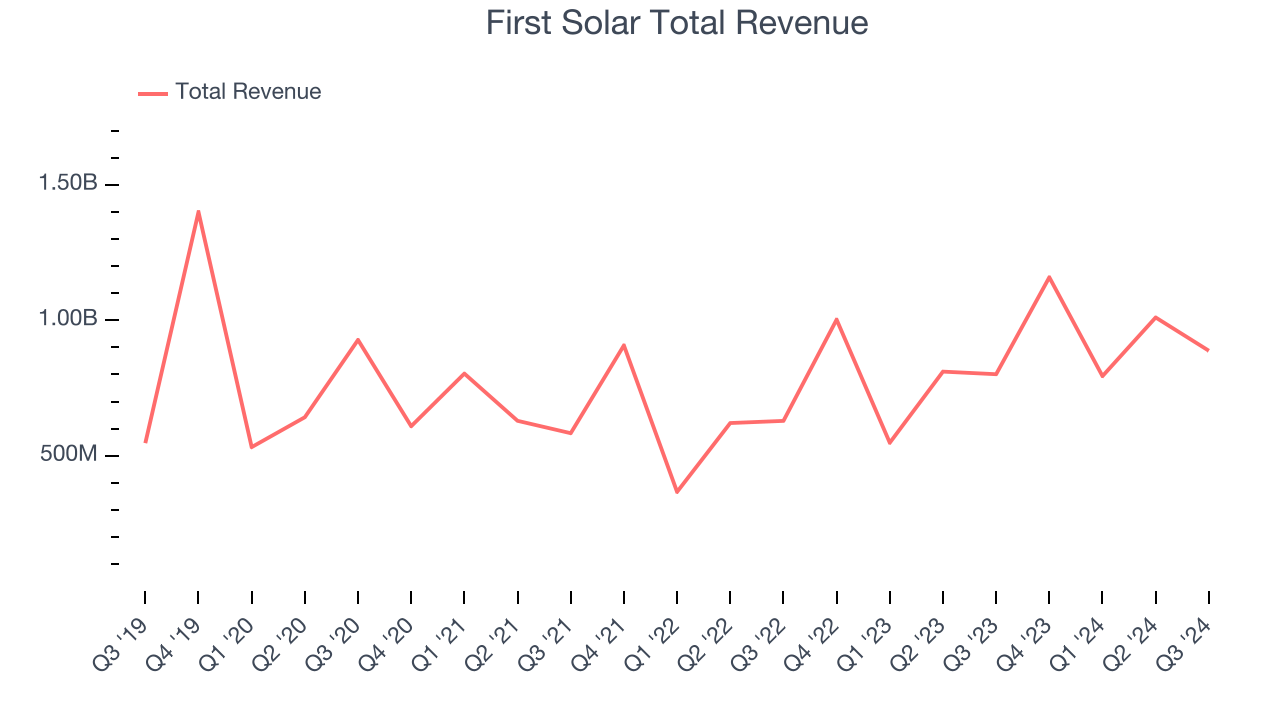

First Solar reported revenues of $887.7 million, up 10.8% year on year. This print fell short of analysts’ expectations by 17.6%. Overall, it was a disappointing quarter for the company with full-year revenue guidance missing analysts’ expectations.

“As we approach the end of 2024, we remain pleased with the progress made across our business, navigating against a backdrop of industry volatility and political uncertainty, with a continued focus on balancing growth, profitability, and liquidity,” said Mark Widmar, CEO of First Solar.

Unsurprisingly, the stock is down 7.4% since reporting and currently trades at $185.

Is now the time to buy First Solar? Access our full analysis of the earnings results here, it’s free.

Best Q3: American Superconductor (NASDAQ: AMSC)

Founded in 1987, American Superconductor (NASDAQ: AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

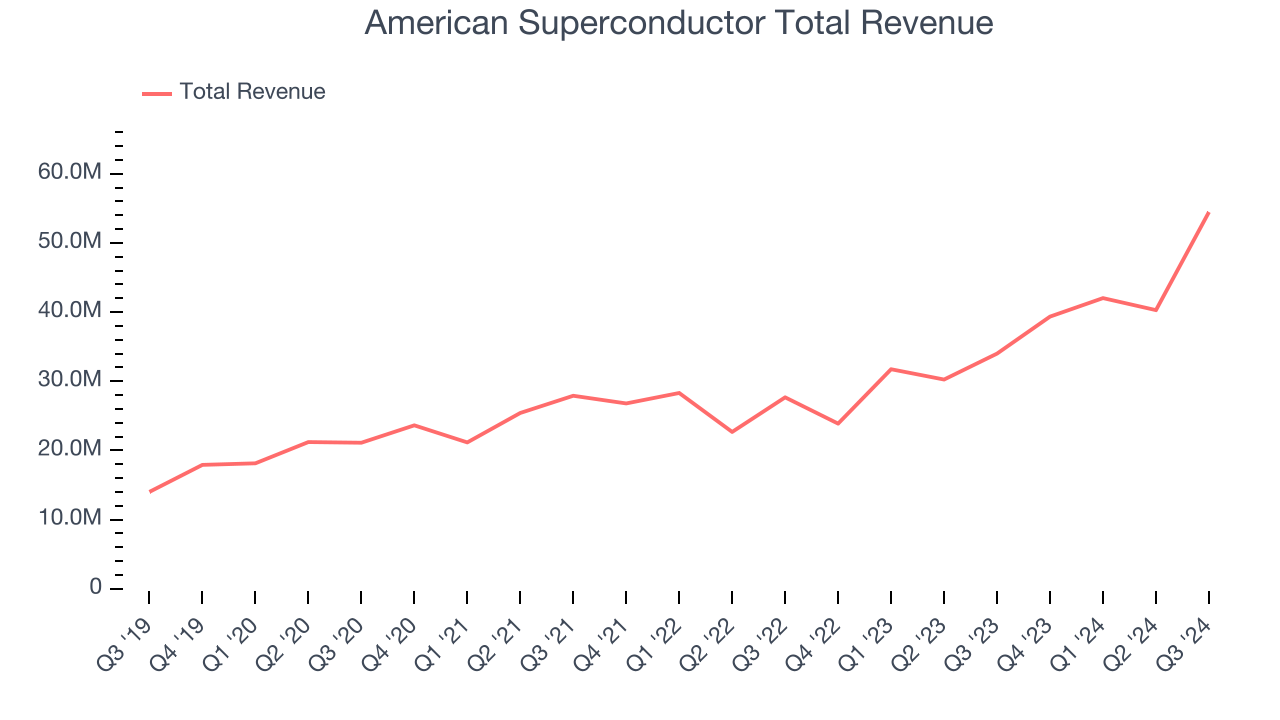

American Superconductor reported revenues of $54.47 million, up 60.2% year on year, outperforming analysts’ expectations by 6.1%. The business had an exceptional quarter with an impressive beat of analysts’ EPS and EBITDA estimates.

American Superconductor scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 35.9% since reporting. It currently trades at $31.94.

Is now the time to buy American Superconductor? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Blink Charging (NASDAQ: BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $25.19 million, down 41.9% year on year, falling short of analysts’ expectations by 28.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

Blink Charging delivered the weakest full-year guidance update in the group. As expected, the stock is down 21.9% since the results and currently trades at $1.57.

Read our full analysis of Blink Charging’s results here.

Nextracker (NASDAQ: NXT)

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dabhi solar farm project, Nextracker (NASDAQ: NXT) is a provider of solar tracker systems that help solar panels follow the sun.

Nextracker reported revenues of $635.6 million, up 10.9% year on year. This number surpassed analysts’ expectations by 3.6%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ backlog estimates and full-year EPS guidance exceeding analysts’ expectations.

The stock is up 14.3% since reporting and currently trades at $36.55.

Read our full, actionable report on Nextracker here, it’s free.

SolarEdge (NASDAQ: SEDG)

Established in 2006, SolarEdge (NASDAQ: SEDG) creates advanced systems to improve the efficiency of solar panels.

SolarEdge reported revenues of $260.9 million, down 64% year on year. This number missed analysts’ expectations by 3.7%. Overall, it was a disappointing quarter as it also produced revenue guidance for next quarter missing analysts’ expectations.

The stock is down 26.4% since reporting and currently trades at $10.80.

Read our full, actionable report on SolarEdge here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.