Financial News

Wingstop (WING) Q3 Earnings: What To Expect

Fast-food chain Wingstop (NASDAQ: WING) will be reporting earnings tomorrow before the bell. Here’s what you need to know.

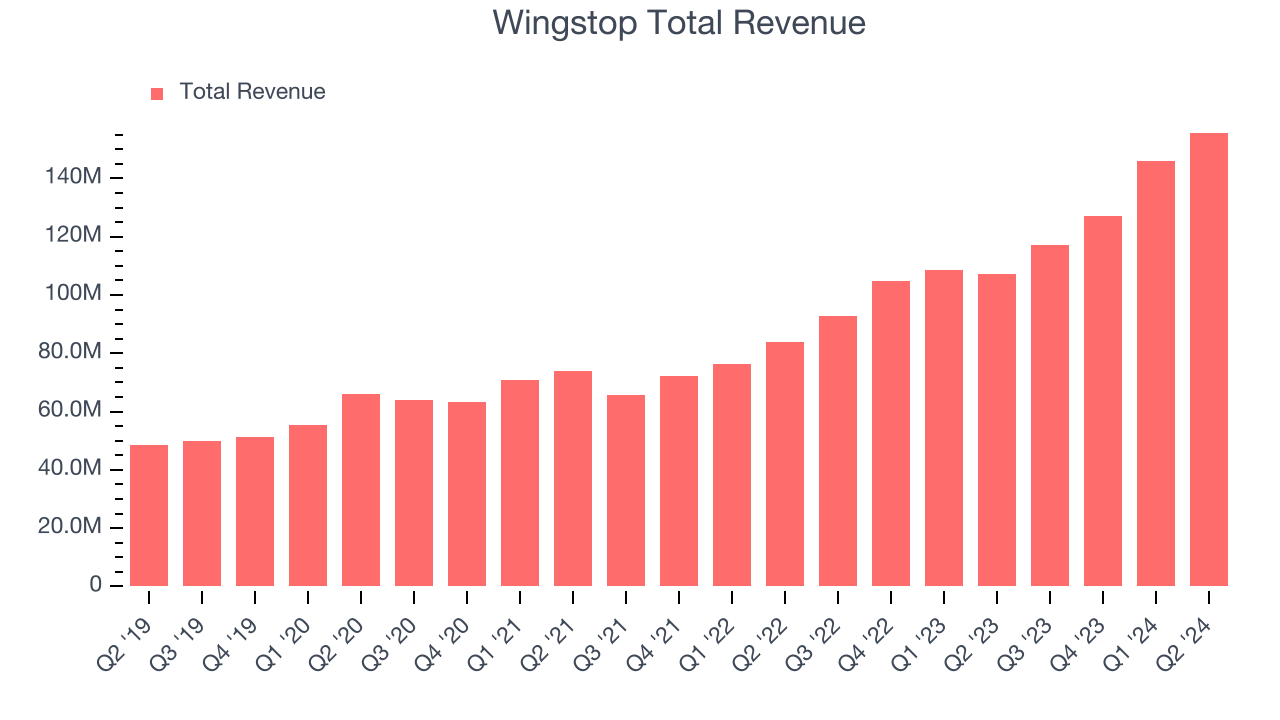

Wingstop beat analysts’ revenue expectations by 7.3% last quarter, reporting revenues of $155.7 million, up 45.3% year on year. It was a strong quarter for the company, with a decent beat of analysts’ earnings estimates.

Is Wingstop a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Wingstop’s revenue to grow 36.5% year on year to $159.9 million, improving from the 26.4% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.96 per share.

Heading into earnings, analysts covering the company have grown increasingly bullish with revenue estimates seeing 7 upward revisions over the last 30 days (we track 20 analysts). Wingstop has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 5.9% on average.

Looking at Wingstop’s peers in the restaurants segment, some have already reported their Q3 results, giving us a hint as to what we can expect. Domino's delivered year-on-year revenue growth of 5.1%, missing analysts’ expectations by 1.6%, and Texas Roadhouse reported revenues up 13.5%, in line with consensus estimates. Domino's traded up 4% following the results while Texas Roadhouse was also up 3.6%.

Read our full analysis of Domino’s results here and Texas Roadhouse’s results here.

There has been positive sentiment among investors in the restaurants segment, with share prices up 5.5% on average over the last month. Wingstop is down 12.2% during the same time and is heading into earnings with an average analyst price target of $418.01 (compared to the current share price of $365.37).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.