Financial News

Chipotle (NYSE:CMG) Misses Q3 Revenue Estimates, Stock Drops

Mexican fast-food chain Chipotle (NYSE:CMG) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 13% year on year to $2.79 billion. Its non-GAAP profit of $0.27 per share was 6.6% above analysts’ consensus estimates.

Is now the time to buy Chipotle? Find out by accessing our full research report, it’s free.

Chipotle (CMG) Q3 CY2024 Highlights:

- Revenue: $2.79 billion vs analyst estimates of $2.82 billion (in line)

- Adjusted EPS: $0.27 vs analyst estimates of $0.25 (6.6% beat)

- EBITDA: $643.5 million vs analyst estimates of $530.5 million (21.3% beat)

- The company guided for full-year same-store sales growth in the mid to high-single-digit range (in line)

- Gross Margin (GAAP): 39.3%, in line with the same quarter last year

- Operating Margin: 16.9%, in line with the same quarter last year

- EBITDA Margin: 23%, up from 19.2% in the same quarter last year

- Free Cash Flow Margin: 10.7%, down from 14.1% in the same quarter last year

- Same-Store Sales rose 6% year on year, in line with the same quarter last year

- Market Capitalization: $82.99 billion

"Our focus on exceptional people, food and throughput and the long-awaited return of Smoked Brisket drove another quarter of strong results led by transaction growth," said Scott Boatwright, Interim CEO, Chipotle.

Company Overview

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE:CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Chipotle is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have.

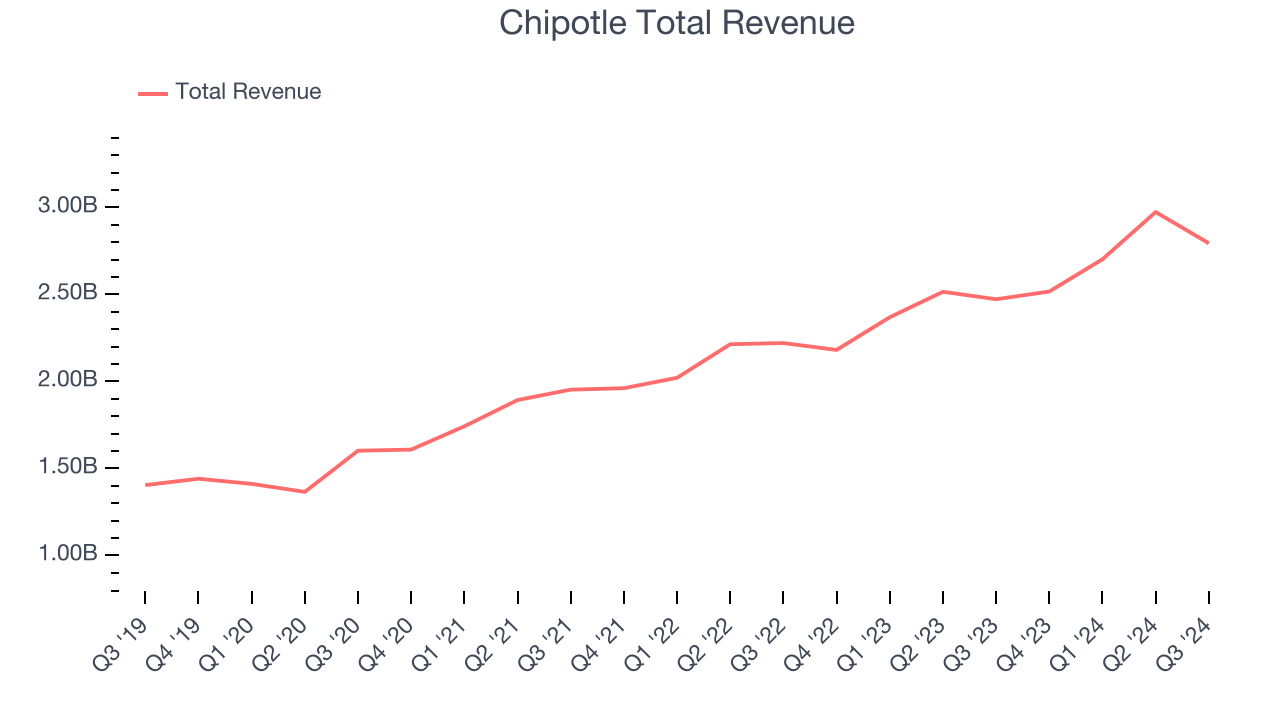

As you can see below, Chipotle grew its sales at an impressive 15.4% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Chipotle’s year-on-year revenue growth was 13%, and its $2.79 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months. Some tapering is natural given the magnitude of its revenue base, and we still think its growth trajectory is attractive.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

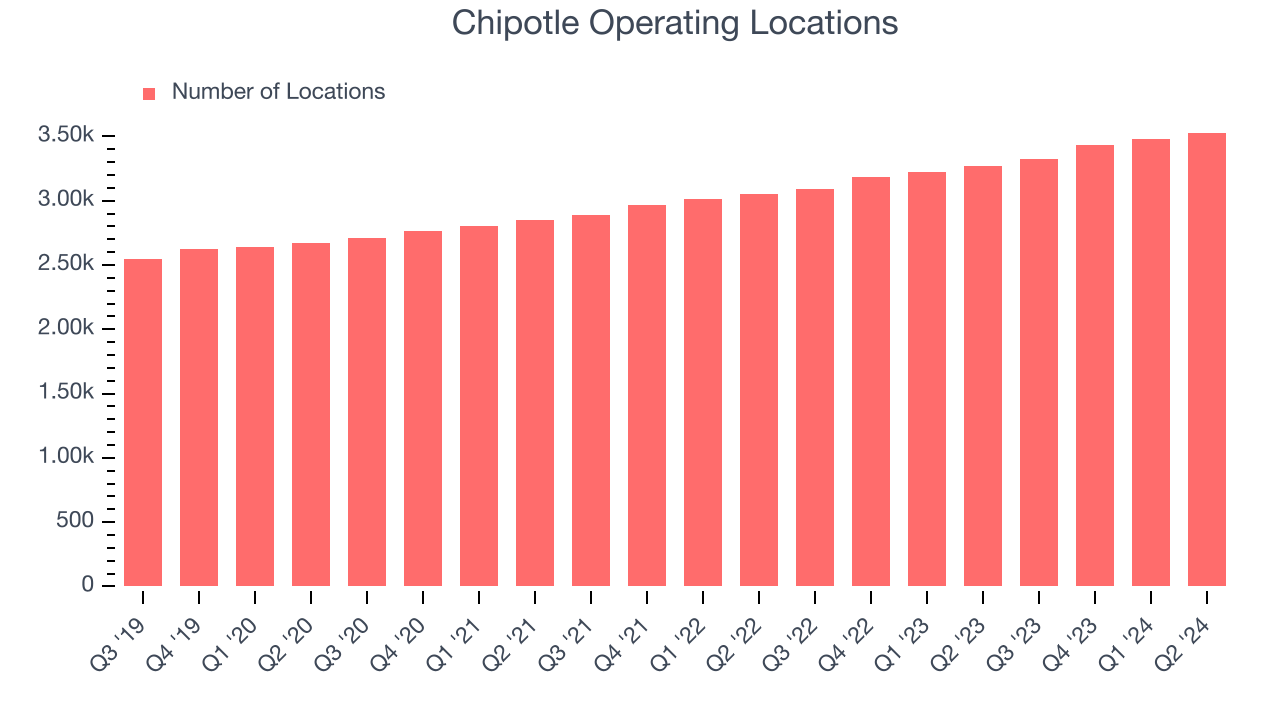

Chipotle opened new restaurants at a rapid clip over the last two years and averaged 7.5% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Note that Chipotle reports its restaurant count intermittently, so some data points are missing in the chart below.

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

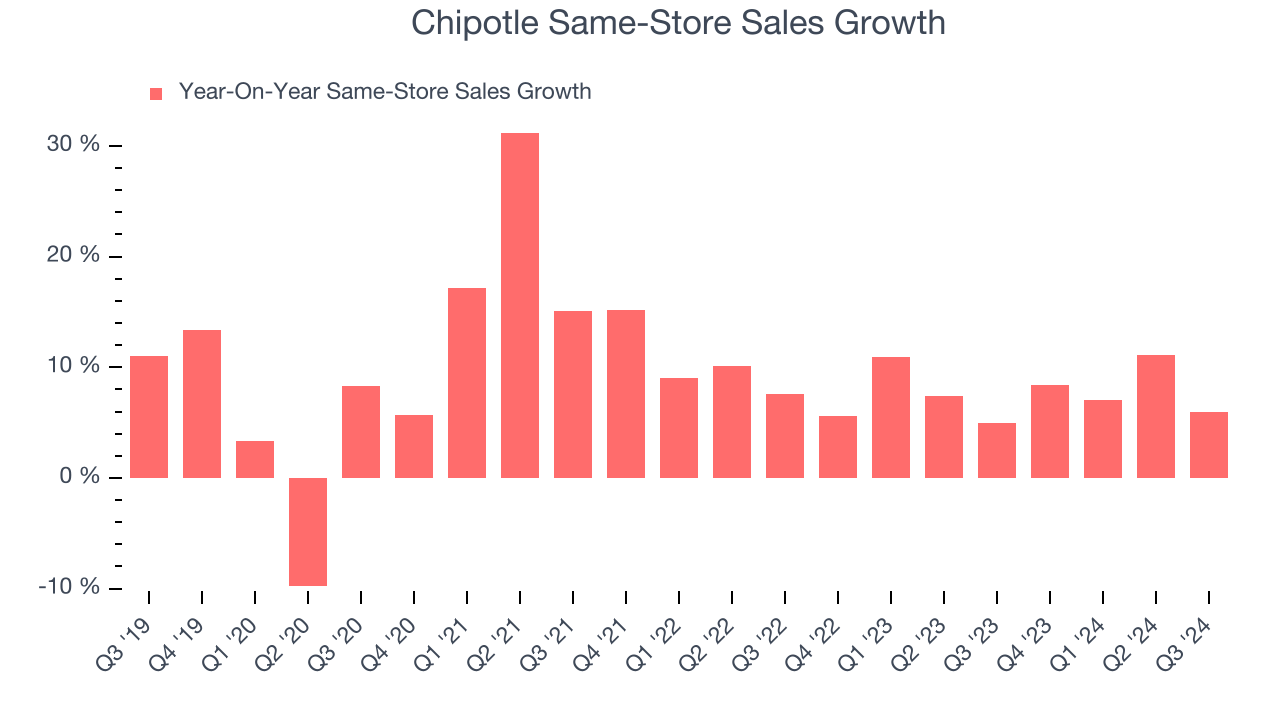

Chipotle has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 7.7%. This performance suggests its rollout of new restaurants is beneficial for shareholders. We like this backdrop as Chipotle has multiple ways to win: revenue growth can come from new restaurants or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Chipotle’s same-store sales rose 6% annually. This performance was more or less in line with the same quarter last year.

Key Takeaways from Chipotle’s Q3 Results

We were impressed by how significantly Chipotle blew past analysts’ EBITDA and EPS expectations this quarter. Looking at the full year, the company's guidance for same-store sales growth and new restaurant openings was in line with Wall Street's estimates. Overall, this quarter had some key positives, but the market was likely expecting a more optimistic outlook given the stock's premium valuation. Shares traded down 7.2% to $56.11 immediately following the results.

So should you invest in Chipotle right now?The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.