Financial News

Vertiv (NYSE:VRT) Delivers Impressive Q3, Provides Encouraging Full-Year Guidance

Data center products and services company Vertiv (NYSE: VRT) announced better-than-expected revenue in Q3 CY2024, with sales up 19% year on year to $2.07 billion. On the other hand, the company expects next quarter’s revenue to be around $2.14 billion, slightly below analysts’ estimates. Its non-GAAP profit of $0.76 per share was also 10.2% above analysts’ consensus estimates.

Is now the time to buy Vertiv? Find out by accessing our full research report, it’s free.

Vertiv (VRT) Q3 CY2024 Highlights:

- Revenue: $2.07 billion vs analyst estimates of $1.98 billion (4.8% beat)

- Adjusted EPS: $0.76 vs analyst estimates of $0.69 (10.2% beat)

- Revenue Guidance for Q4 CY2024 is $2.14 billion at the midpoint, below analyst estimates of $2.16 billion

- Management raised its full-year Adjusted EPS guidance to $2.68 at the midpoint, a 7.2% increase

- Gross Margin (GAAP): 36.5%, in line with the same quarter last year

- Free Cash Flow Margin: 16.3%, up from 12.7% in the same quarter last year

- Organic Revenue rose 19.2% year on year (17.2% in the same quarter last year)

- Market Capitalization: $42.19 billion

“Vertiv’s strong performance in the third quarter was driven by robust underlying demand for our critical digital infrastructure products and services, our continued and unrelenting focus on strong operational execution and Vertiv’s unique market position in enabling artificial intelligence and other critical applications for the data center,” said Giordano Albertazzi, Vertiv’s Chief Executive Officer.

Company Overview

Formerly part of Emerson Electric, Vertiv (NYSE: VRT) manufactures and services infrastructure technology products for data centers and communication networks.

Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

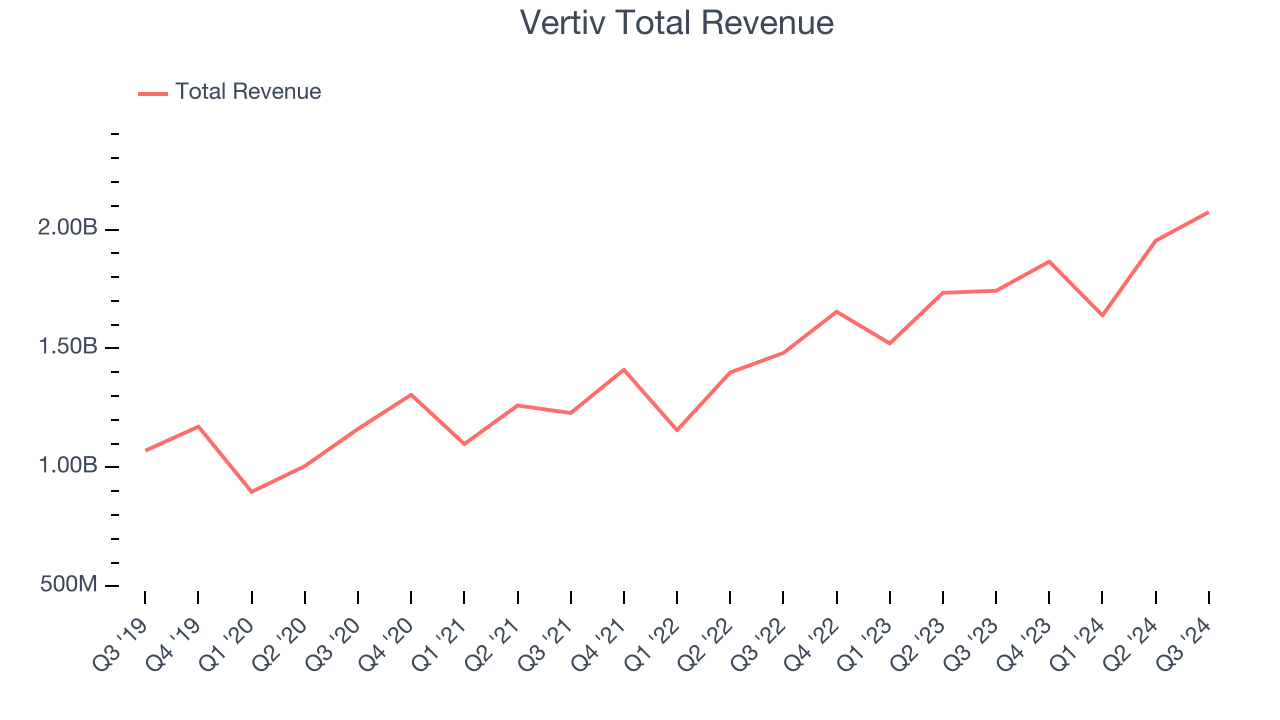

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Vertiv’s sales grew at an impressive 11.2% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Vertiv’s offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Vertiv’s annualized revenue growth of 17.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. Vertiv’s recent history shows it’s one of the better Electrical Systems businesses as many of its peers faced declining sales because of cyclical headwinds.

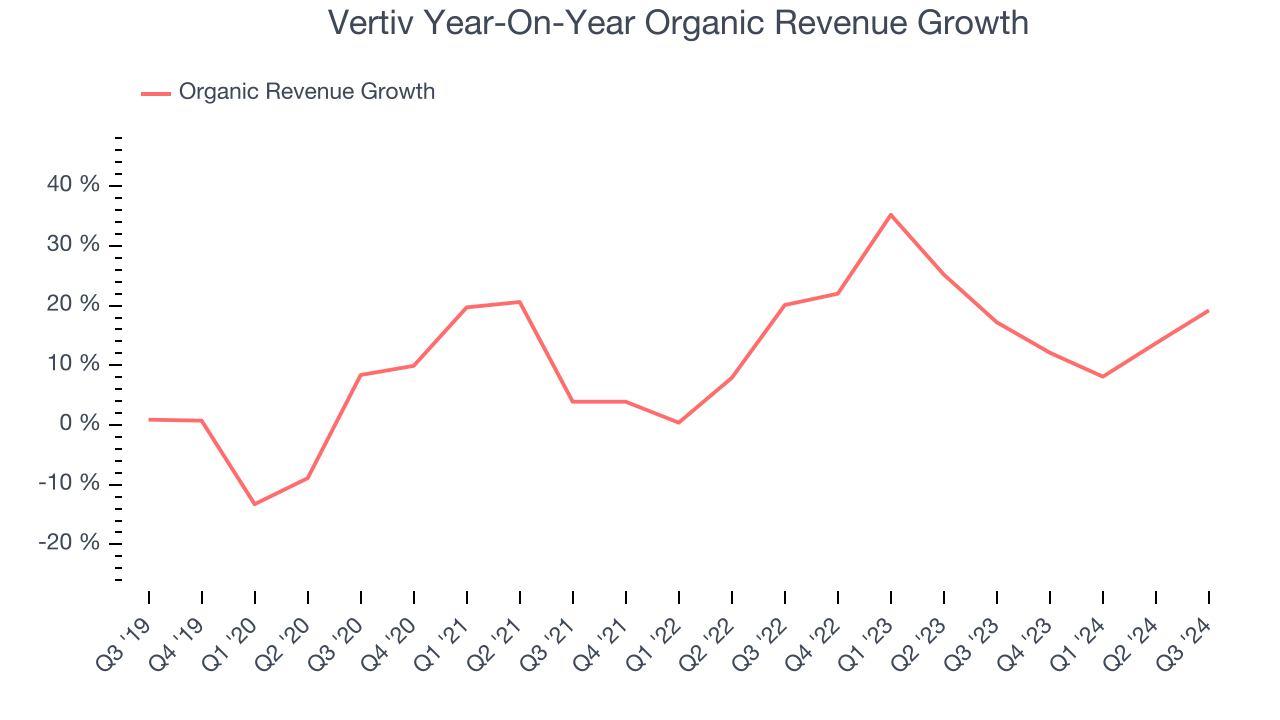

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations because they don’t accurately reflect its fundamentals. Over the last two years, Vertiv’s organic revenue averaged 19.1% year-on-year growth. Because this number is better than its normal revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline performance.

This quarter, Vertiv reported year-on-year revenue growth of 19%, and its $2.07 billion of revenue exceeded Wall Street’s estimates by 4.8%. Management is currently guiding for a 14.7% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13% over the next 12 months, a deceleration versus the last two years. This projection is still healthy and indicates the market is baking in success for its products and services.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

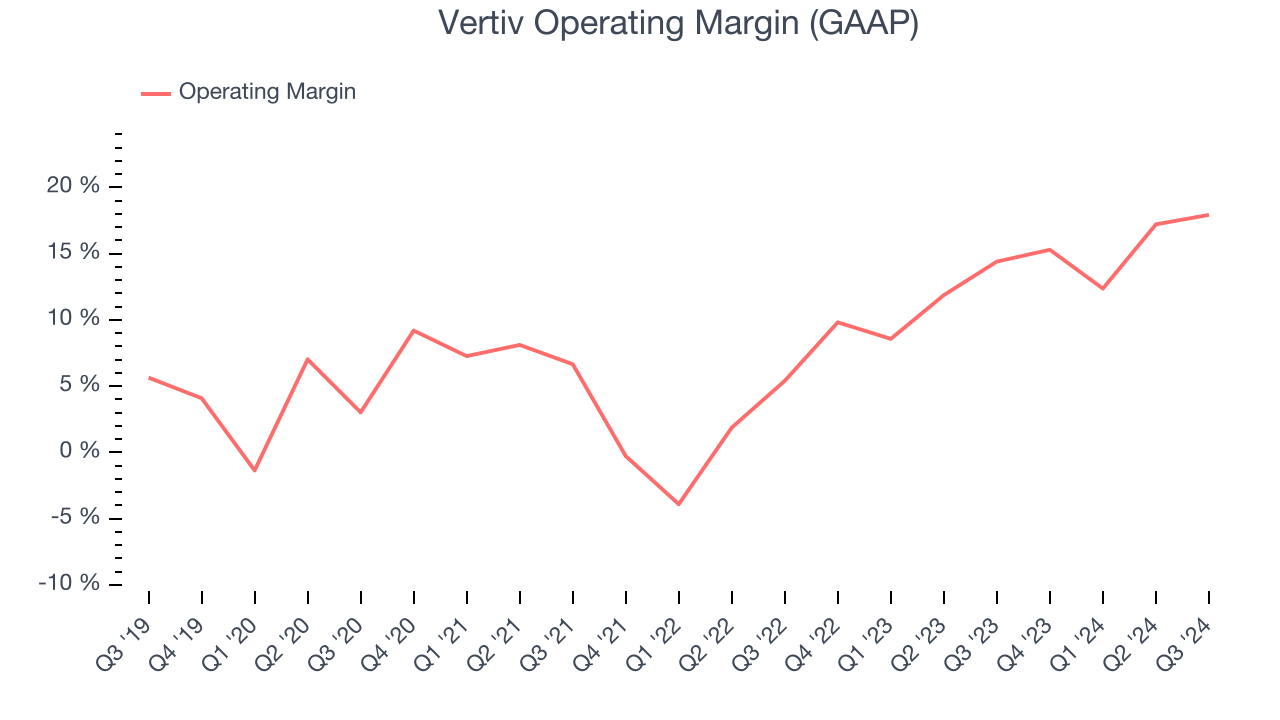

Looking at the trend in its profitability, Vertiv’s annual operating margin rose by 12.5 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Vertiv generated an operating profit margin of 17.9%, up 3.5 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

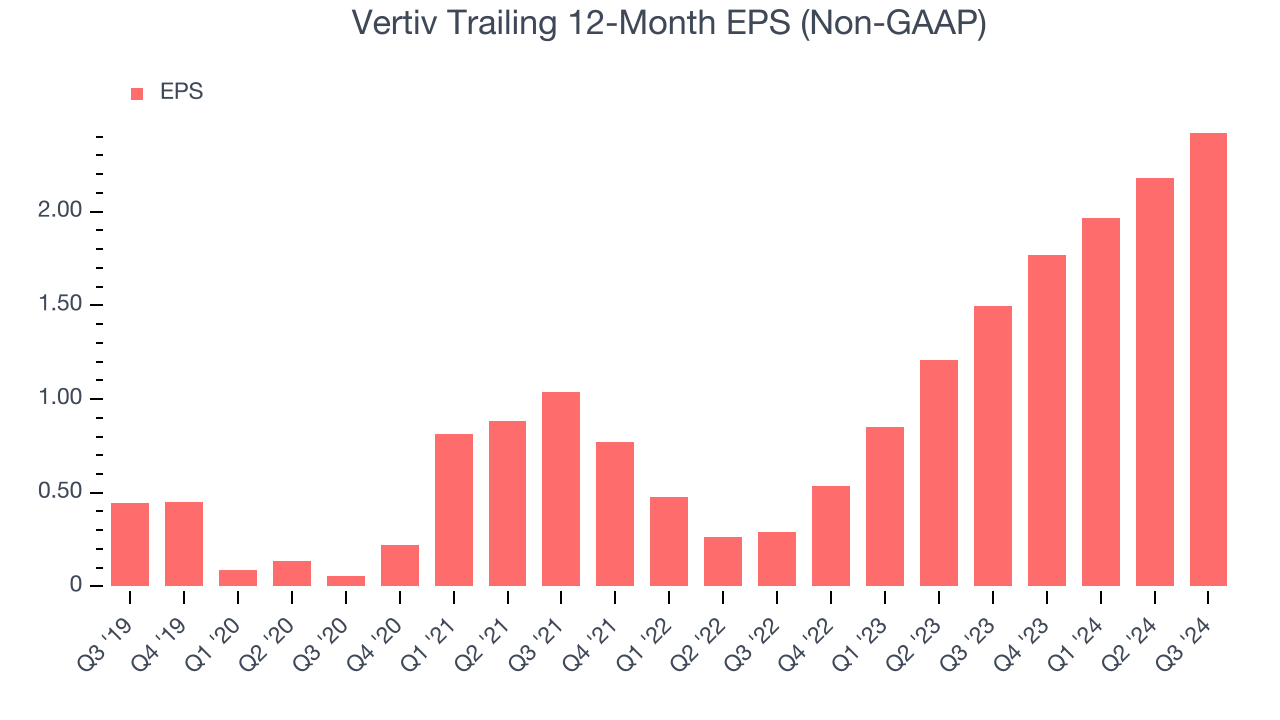

Analyzing long-term revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Vertiv’s EPS grew at an astounding 40.3% compounded annual growth rate over the last five years, higher than its 11.2% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of Vertiv’s earnings can give us a better understanding of its performance. As we mentioned earlier, Vertiv’s operating margin expanded by 12.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business. For Vertiv, its two-year annual EPS growth of 190% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Vertiv reported EPS at $0.76, up from $0.52 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Vertiv’s full-year EPS of $2.42 to grow by 28.7%.

Key Takeaways from Vertiv’s Q3 Results

We were impressed by how significantly Vertiv blew past analysts’ organic revenue expectations this quarter. We were also glad it raised its full-year revenue, operating profit, and EPS guidance, though the revenue outlook fell short of Wall Street's estimates (the others beat). Zooming out, we think this quarter featured some important positives, but expectations were likely even higher than Wall Street's published numbers given the stock was up 140%+ YTD before the results. Shares traded down 2.3% to $109.93 immediately after reporting.

So do we think Vertiv is an attractive buy at the current price?If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings.We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.