Financial News

Enphase (NASDAQ:ENPH) Reports Sales Below Analyst Estimates In Q3 Earnings, Stock Drops

Home energy technology company Enphase (NASDAQ: ENPH) missed Wall Street’s revenue expectations in Q3 CY2024, with sales falling 30.9% year on year to $380.9 million. Next quarter’s revenue guidance of $380 million underwhelmed, coming in 12.7% below analysts’ estimates. Its non-GAAP profit of $0.65 per share was also 16.8% below analysts’ consensus estimates.

Is now the time to buy Enphase? Find out by accessing our full research report, it’s free.

Enphase (ENPH) Q3 CY2024 Highlights:

- Revenue: $380.9 million vs analyst estimates of $393.9 million (3.3% miss)

- EPS (non-GAAP): $0.65 vs analyst expectations of $0.78 (16.8% miss)

- Revenue Guidance for Q4 CY2024 is $380 million at the midpoint, below analyst estimates of $435.2 million

- Gross Margin (GAAP): 46.8%, in line with the same quarter last year

- Free Cash Flow Margin: 42.4%, up from 22.1% in the same quarter last year

- Sales Volumes fell 55.7% year on year (-10.1% in the same quarter last year)

- Market Capitalization: $12.24 billion

Company Overview

The first company to successfully commercialize the solar micro-inverter, Enphase (NASDAQ: ENPH) manufactures software-driven home energy products.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

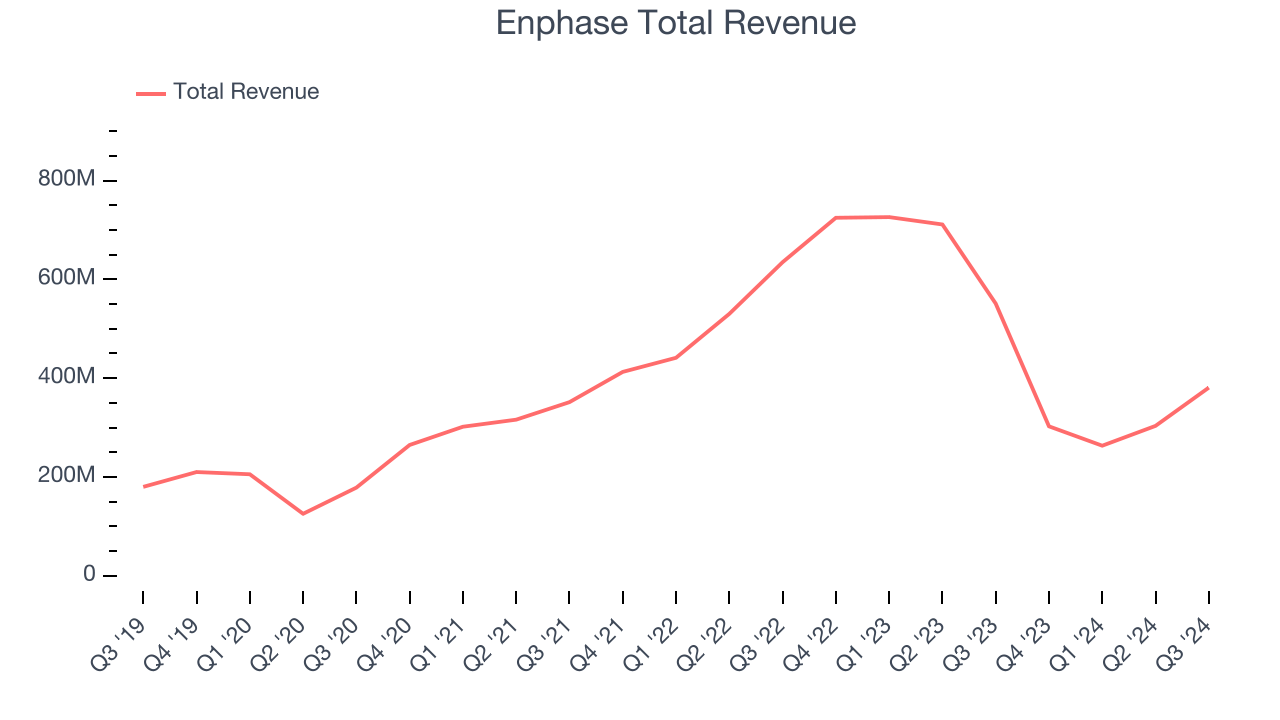

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Luckily, Enphase’s sales grew at an incredible 19.8% compounded annual growth rate over the last five years. This shows it expanded quickly, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Enphase’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 21.3% over the last two years. Enphase isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

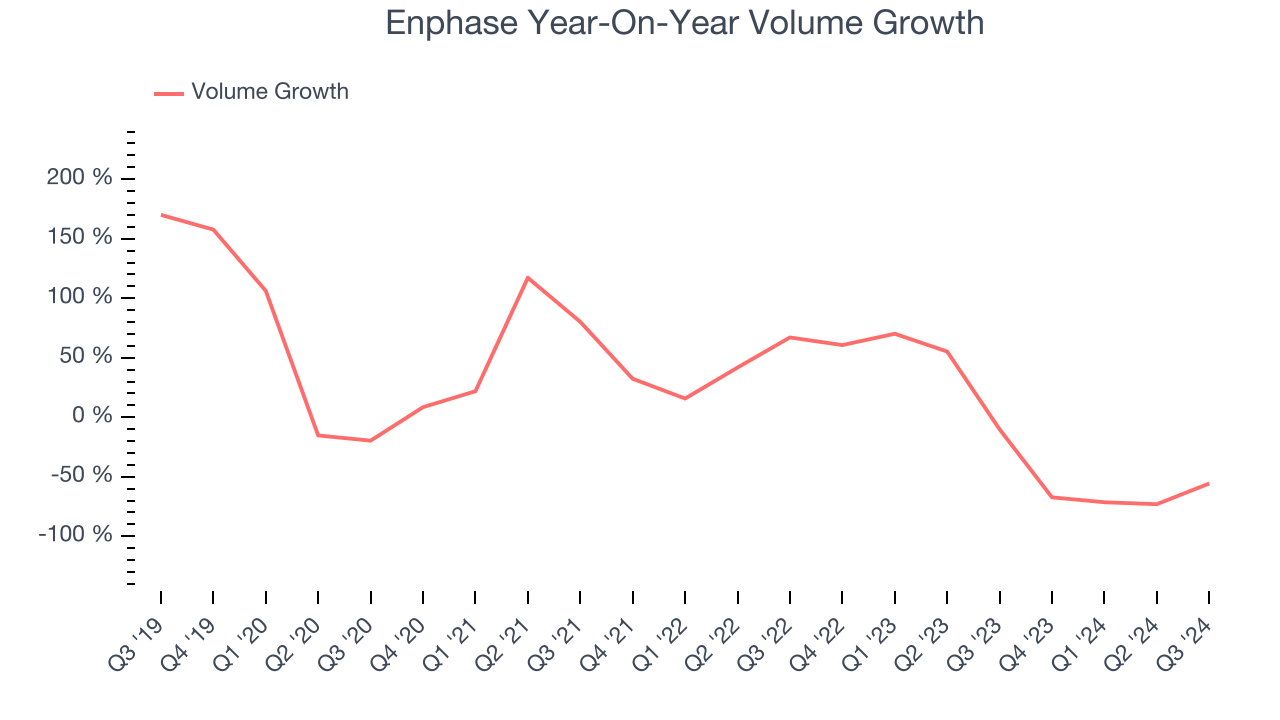

We can dig further into the company’s revenue dynamics by analyzing its sales volumes, which reached 1.73 million in the latest quarter. Over the last two years, Enphase’s sales volumes averaged 11.4% year-on-year declines. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Enphase missed Wall Street’s estimates and reported a rather uninspiring 30.9% year-on-year revenue decline, generating $380.9 million of revenue. Management is currently guiding for a 25.6% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 49.5% over the next 12 months, an acceleration versus the last two years. This projection is commendable and indicates the market believes its newer products and services will spur faster growth.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

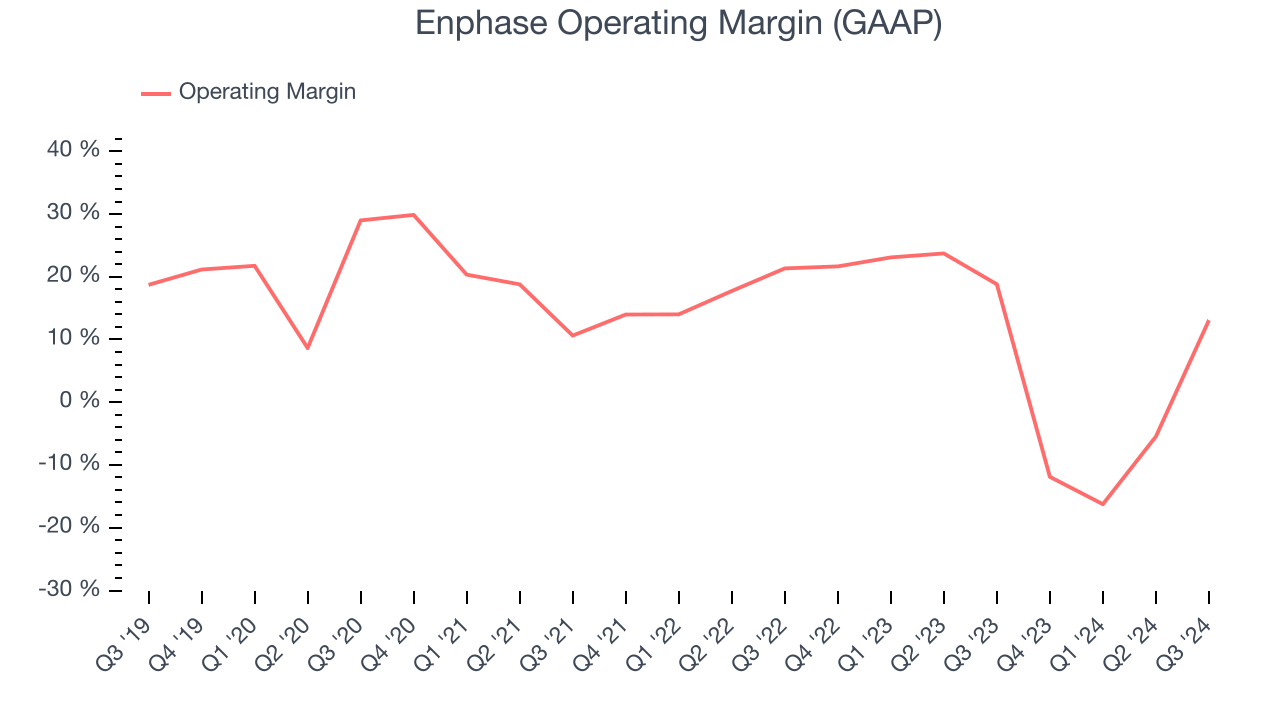

Enphase has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 16.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Enphase’s annual operating margin decreased by 24.7 percentage points over the last five years. Even though its margin is still high, shareholders will want to see Enphase become more profitable in the future.

This quarter, Enphase generated an operating profit margin of 13.1%, down 5.7 percentage points year on year. Since Enphase’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

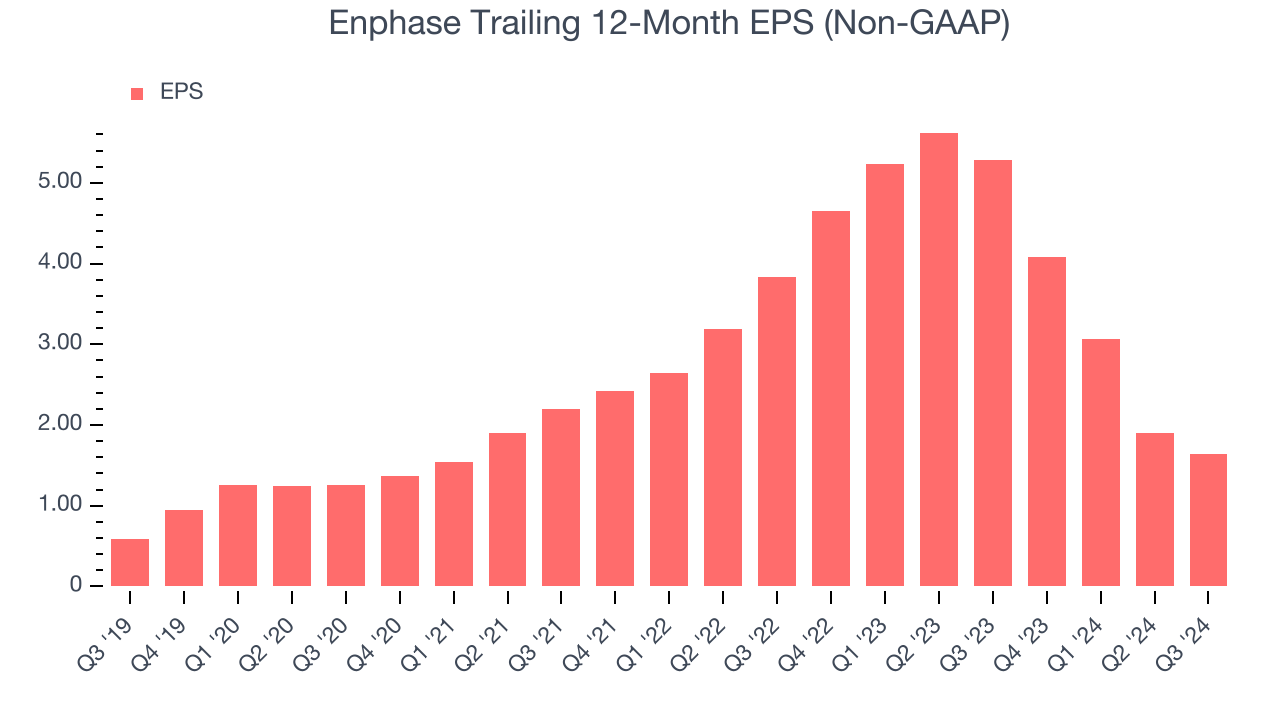

Enphase’s EPS grew at an astounding 22.7% compounded annual growth rate over the last five years, higher than its 19.8% annualized revenue growth. However, this alone doesn’t tell us much about its day-to-day operations because its operating margin didn’t expand.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business. Enphase’s two-year annual EPS declines of 34.6% were bad and lower than its two-year revenue performance.

In Q3, Enphase reported EPS at $0.65, down from $0.91 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Enphase’s full-year EPS of $1.64 to grow by 153%.

Key Takeaways from Enphase’s Q3 Results

We struggled to find many strong positives in these results. Its revenue and EPS fell short of Wall Street’s estimates along with next quarter's guidance. Overall, this quarter could have been better. The stock traded down 7.8% to $85.10 immediately following the results.

The latest quarter from Enphase’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price.The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy.We cover that in our actionable full research report which you can read here, it’s free.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.