Financial News

We are thinking about … Regional banks and why we diversify

SAN FRANCISCO - March 15, 2023 - PRLog -- We are thinking about … Regional banks and why we diversify.

Peter Coe Verbica, JD, CFP®, Author,

with Contributions by Patricia Williams, CFP®,

Calum Cunningham, AIF®, and Scott Smith, JD

www.siliconprivatewealth.com

At Silicon Private Wealth, we are a Bay Area-based Registered Investment Advisor (RIA) with a front row seat to the ebb and flow of business in "the Valley." All eyes are presently upon the spectacle of Silicon Valley Bank ("SVB"). We have fielded calls on a myriad of topics, including FDIC protection, how a hawkish Fed might tilt its emphasis, the esoterica of bank reserve classifications, receiver certificates, and more. Much attention has been given to SVB's uninsured deposits, and for good reason. Many institutional equity and debt holders in SVB were caught off-guard. A tip of the hat to Marina Temkin for her timely piece on the impact to borrowers served by SVB, many of which are startups where cash (whether via equity or debt infusion) is the quintessential lifeblood.

Reassurance and a Collective Sigh of Relief

According to journalist David Goldman, "US regulators say SVB customers will be made whole as second bank fails." Naturally, those in high tech and private equity with deposits far in excess of the FDIC protection minimums are breathing a collective sigh of relief with this recent reassurance. Skeptics moderate this enthusiasm with the follow-on question of "When?"

The Collapse of a Significant Regional Bank

Like many, we are studying the SVB collapse with great interest. Before the dark blue suits descended upon the institution, the former regional bank was a centerpiece to the Bay Area's success story; its collapse is big news for technology, private equity, depositors and investors. A friend blessed with a golden voice hosts a popular technology radio program and podcast; he has been asked to travel all the way to Dubai -- just to speak on SVB implosion. The debacle, in some sense, is that proverbial "shot heard around the world."

The Importance of Diversification

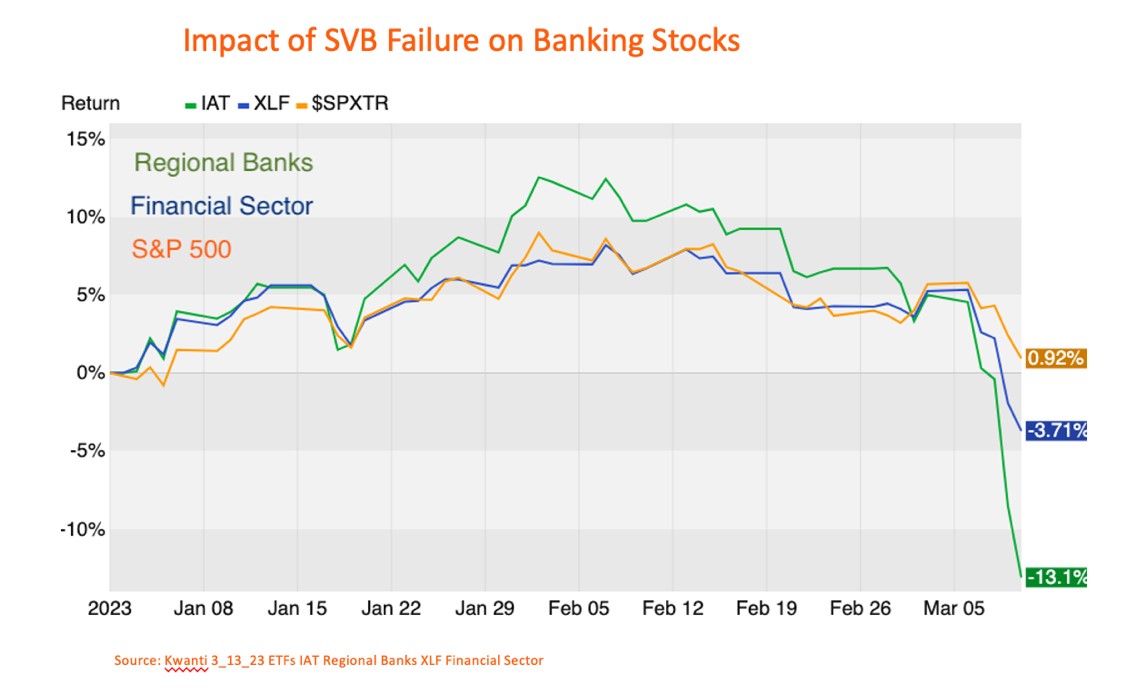

For us, the regional bank's failure reinforces our ongoing mantra that diversification makes good sense. By way of example if you have a particular affinity for regional banks, or want to wear the hat of a contrarian, consider diversified ETFs which have a stake hold in the sector, such as SPDR® S&P Regional Banking ETF (ticker symbol "KRE") or iShares U.S. Regional Banks ETF (ticker symbol "IAT"). ETFs which hold major money center banks as well as other financial services companies include iShares U.S. Financials ETF (ticker symbol "IYF") and Vanguard Financials Index Fund ETF Shares (ticker symbol "VFH"). Also noted is that the first regionals to be closed (SVB) and New York-based Signature Bank could be considered outliers – SVB with its unusual concentration of start-up deposits and Signature Bank's ill-fated decision to be "crypto-friendly."

What Led to SVB's Demise?

Rising Interest Rates: A Blessing and a Curse for Banks

With the rise in interest rates, investment pundits often wrote about how banks were poised to benefit with juicier markups on their lending rates. Unfortunately left out of the discussion was the impact to bond portfolios held as reserve collateral, especially intermediate or long-term paper, whether held in Treasuries or other fixed income investments. The longer the duration of these holdings, the greater the impact of rising interest rates to a bank's reserve holdings.

Lack of Sticky Deposits

Colin Plunkett, an equity analyst, wrote about SVB's "Economic Moat" back in February of 2019.[ii] He pointed to some concerning attributes regarding SVB's deposits. Most of the deposits were of the "non-interest bearing" variety, making them more susceptible to flight in the event rates rose. In addition, unlike a Wells Fargo or Bank of America, the majority of SVB's deposits are commercial rather than stickier retail deposits. Compounding the issue was the fact that many of SVB's deposits were highly concentrated; their deposits, though substantial, were from start-ups which "burn" through their cash. Moreover, when Peter Thiel reportedly expressed concern about SVB's fiscal health, venture capitalists and their portfolio companies began a massive withdrawal of their deposits.[iii]

The Fed's Potential Role to Calm the Markets

The Fed, in the past, has been a willing holder of less attractive bank securities, allowing banks under duress to reinforce their balance sheet; interestingly, historically the Fed benefitted from many of these trades. The Fed could also moderate the pace of its rate hikes; perhaps more consideration could be paid to the consequences of trying to get inflation under control. The Fed could also step in and force weaker banks to take actions that would improve liquidity and shore up balance sheets.

Diversification as the Main "Takeaway"

Our main takeaway is to urge our clients to revisit their portfolio allocation and examine any embedded risks, whether systematic or unsystematic, including interest rate risk, market risk, political risk, etc.

Consider Who Holds Your Cash

The FDIC protects bank customers if an FDIC insured depository institution fails. Deposits are insured up to $250,000 per depositor, per FDIC insured bank and per ownership category. SVB's demise prompts a review of where and how your cash deposits are held. We would be happy to provide ideas on how you manage your cash.

Reach out to us for a more in-depth conversation: www.siliconprivatewealth.com

Silicon Private Wealth (SPW) Is Unaffiliated with Silicon Valley Bank (SVB)

Our firm is NOT affiliated with Silicon Valley Bank (SVB). We (SPW) are a Registered Investment Advisor ("RIA"), so assets are not held by us; in fact, the lion's share of our customer assets is held by Schwab Institutional, and we feel good about that choice for many reasons. Again, the bottom line: SPW is an RIA, rather than a commercial bank.

General Disclosure

This note is a publication of SPW. Information presented is for educational purposes only is intended for a broad audience. It should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of SPW on the date of publication and are subject to change. Content should not be viewed as personalized investment advice or as an offer to buy or sell, or a solicitation of any offer to buy or sell the securities discussed. This information is believed to be materially correct, but no representation or warranty is given as to the accuracy the information provided. All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be suitable or profitable for an investor's portfolio. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. SPW has presented information in a fair and balanced manner. Silicon Private Wealth is registered as an investment adviser and only transacts business in states where it is properly registered or is excluded or exempted from registration requirements. Registration as an investment adviser does not constitute an endorsement of the firm by securities regulators nor does it indicate that the adviser has attained a particular level of skill or ability. SPW has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser's services, investments, or client experiences. Please refer to: (https://adviserinfo.sec.gov/firm/brochure/284145) for the adviser's ADV Part 2A for material risks disclosures. "Silicon Private Wealth" is a trademark of Silicon Private Wealth, LLC.

https://finance.yahoo.com/news/crypto-friendly-signature-bank-shut-222541514.html

[ii] Morningstar's research report on SIVB, 3/28/2019

[iii]https://www.bloomberg.com/news/articles/2023-03-09/founders-fund-advises-companies-to-withdraw-money-from-svb

Photos: (Click photo to enlarge)

Read Full Story - We are thinking about … Regional banks and why we diversify | More news from this source

Press release distribution by PRLog

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.