Financial News

First Bancorp of Indiana, Inc. Announces Financial Results September 2023

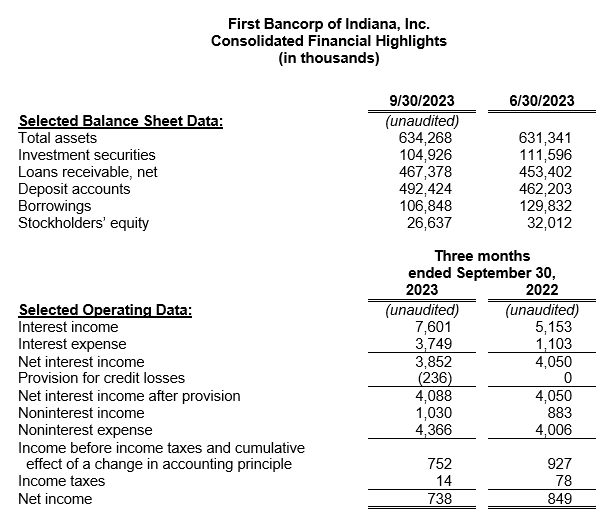

EVANSVILLE, Ind. - Nov. 3, 2023 - PRLog -- First Bancorp of Indiana, Inc. (OTCPK:FBPI), the holding company (the Company) for First Federal Savings Bank (the Bank), reported earnings of $738,000 ($0.44 per diluted common share) for the first fiscal quarter ended September 30, 2023, compared to $849,000 ($0.50 per diluted common share) for the same quarter a year ago. Earnings for the three-month period yield a return on average assets (ROA) of 0.47% and a return on average equity (ROE) of 9.80%. This compares to an annualized ROA of 0.63% and an annualized ROE of 10.23% last year.

Net interest income for the first quarter of the fiscal year was reduced by 4.9% from the previous year. Improved yields on earning assets, thanks to the higher interest rates on newly originated and variable rate loans and investments, were outpaced by higher funding costs as deposit rates continued their upward trajectory. The Company's Net Interest Margin (NIM), as a percentage of average interest-earning assets, was 2.63% for the quarter ended September 30, 2023. Noninterest income increased 16.6% for the same timeframe due to higher gains on loan sales and improved point of sale interchange fees. Total noninterest expense was 9.0% higher year over year – primarily increased personnel costs, occupancy expenses, and FDIC insurance premiums between the comparative periods. The Bank's efficiency ratio for the first quarter of Fiscal 2024 was 81.8%.

"Despite inflation, market uncertainties, and the challenging banking environment, we remain focused on meeting the needs of our customers," stated Michael H. Head, President and CEO.

In Fiscal 2022, the board of directors approved a leveraging strategy to increase earnings. The elevated deposit and liquidity levels at that time were utilized to increase investment securities holdings and meet loan demand. Proceeds from the Company's $12 million subordinated debt offering and wholesale deposits acquired by the Bank funded additional growth. The securities portfolio, primarily composed of investment-grade municipal bonds or obligations of US government agencies, totaled $104.9 million on September 30, 2023.

Despite the rising interest rate environment, net loans outstanding have increased $14.0 million, or 3.1%, for the first quarter of the fiscal year. The portfolio grew to $467.4 million of net loans on September 30, 2023. Commercial loan production, including $2.0 million participated with other banks, totaled $12.4 million for the quarter. Single-family mortgage loan production added $22.7 million during the same timeframe. A lack of housing supply in the local market has been partially offset by increased housing construction activity. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, totaled $4.3 million.

Effective July 1, 2023, the Bank adopted ASU 2016-13, Financial Instruments – Credit Losses (Topic 326), commonly referred to as the current expected credit loss (CECL) methodology, to determine the required Allowance for Credit Losses (ACL) on the Bank's loans, investments, and unfunded commitments. The adoption increased the allowance by $1.9 million and, on a tax-effected basis, reduced retained earnings by $1.4 million.

Despite an increase in nonperforming loans on September 30, 2023, no loans were charged off during the quarter. Moreover, a $286,000 recovery was received in late September on a previously charged off loan. As the allowance was deemed adequate, the funds were recorded as a reverse provision and offset the $50,000 that was added during the quarter.

The ratio of nonperforming loans 90 days or more delinquent to total loans was 1.35% on September 30, 2023, compared to 0.13% a year ago. Overall, the Allowance for Credit Losses, including reserves for investment securities and unfunded commitments, stood at $5.65 million at quarter end. The portion of the allowance attributed to the loan portfolio represented 1.17% of at-risk loans. Although management believes that the allowance is adequate, a slowing economy, removal of government stimulus, and persistent inflation may have an adverse effect on the credit quality of our loan portfolio. Management remains in close contact with our most vulnerable borrowers and will make additional provisions to the allowance, as necessary.

Deposit accounts, totaling $492.4 million on September 30, 2023, have increased 6.5% since the beginning of the fiscal year. Competition for funding, both in local markets and at the wholesale level, has driven deposit rates higher and pushed the Bank's cost of deposits to an annualized 2.37% for the quarter. Similarly, the Company's total cost of funds, including higher-costing FHLB advances and debt of the holding company, increased to an annualized 2.54% for the same timeframe.

As a part of the Bank's Liquidity Management Plan, contingency funding sources are maintained, and liquidity stress scenarios are reviewed. First Federal Savings Bank maintains lines of credit at multiple institutions and additional borrowing capacity at FHLB. The Bank also has access to, but has not utilized, the Federal Reserve's discount window and the Bank Term Funding Program.

Stockholders' equity totaled $26.6 million on September 30, 2023, which includes a $15.0 million fair value reduction to the available for sale securities portfolio given the rapid rise in market interest rates. Notably, this adjustment is excluded from regulatory capital calculations, and gains or losses are only realized if a security is sold. Based on the 1,675,923 outstanding common shares on September 30, 2023, the book value per share of FBPI stock was $15.89.

On September 30, 2023, First Federal Savings Bank's Community Bank Leverage Ratio (CBLR) was 8.15%. The Bank comfortably exceeds the applicable regulatory standards to be considered "well-capitalized".

This news release may contain forward-looking statements within the meaning of the federal securities laws. Statements in this release that are not strictly historical are forward-looking and are based upon current expectations that may differ materially from actual results. These forward-looking statements, identified by words such as "will," "expected," "believe," and "prospects," involve risks and uncertainties that could cause actual results to differ materially from those anticipated by the statements made herein. These risks and uncertainties involve general economic trends and changes in interest rates, increased competition, changes in consumer demand for financial services, the possibility of unforeseen events affecting the industry generally, the uncertainties associated with newly developed or acquired operations, market disruptions and the potential effects of the COVID-19 pandemic on the local and national economic environment, on our customers and on our operations as well as any changes to federal, state and local government laws, regulations and orders in connection with the pandemic. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Photos: (Click photo to enlarge)

Source: First Bancorp of Indiana Inc (OTCPK:FBPI)

Read Full Story - First Bancorp of Indiana, Inc. Announces Financial Results September 2023 | More news from this source

Press release distribution by PRLog

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.