Financial News

First Bancorp of Indiana, Inc. Announces Financial Results December 2021

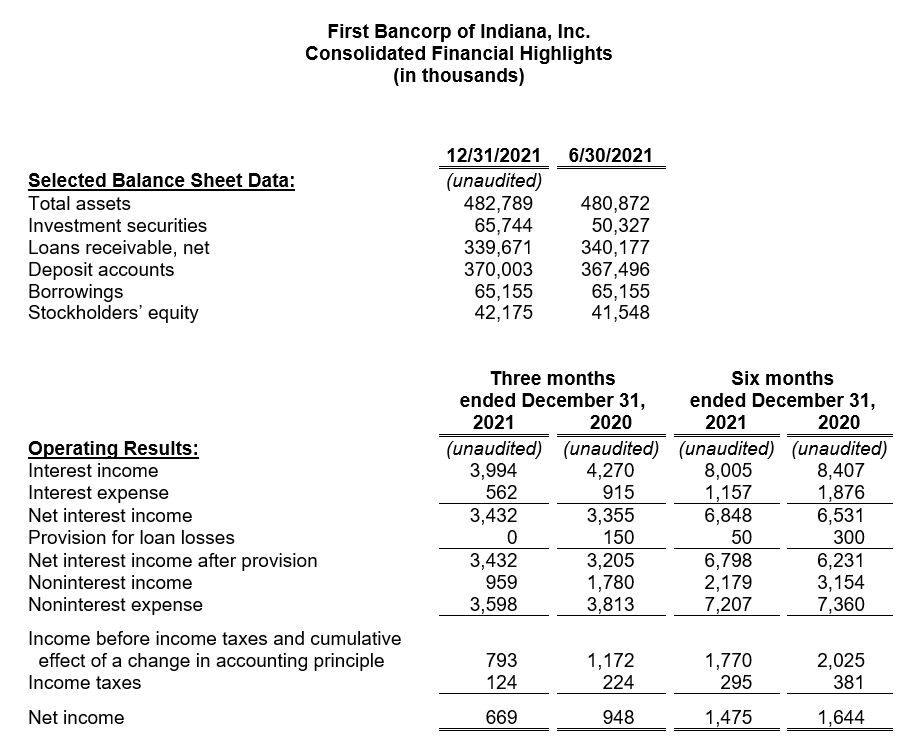

EVANSVILLE, Ind. - Feb. 4, 2022 - PRLog -- First Bancorp of Indiana, Inc. (OTCPK:FBPI), the holding company (the "Company") for First Federal Savings Bank (the "Bank"), reported earnings of $669,000 ($0.38 per diluted common share) for the second fiscal quarter ended December 31, 2021, compared to $948,000 ($0.55 per diluted common share) for the same quarter a year ago. Likewise, earnings for the first half of Fiscal 2022 totaled $1.48 million ($0.85 per diluted common share), compared to $1.64 million ($0.95 per diluted common share) last fiscal year-to-date. Earnings for the six-month period equates to an annualized return on average assets (ROA) of 0.62% and a return on average equity (ROE) of 7.07%. This compares to an annualized ROA of 0.69% and an annualized ROE of 8.34% for the corresponding timeframe last fiscal year.

Net interest income for the first half of the fiscal year was 4.9% higher than the previous six-month period as lower yields on earning assets were more than offset by reduced cost of funds. Noninterest income was reduced for the same timeframe as lower gains on loan sales were partially offset by increased service charges on deposit accounts and higher debit card interchange fees. Total noninterest expense was 2.1% lower year over year as savings in compensation, occupancy costs, and repossession expenses outpaced increases in advertising and data processing expenses between the comparative periods. The bank's efficiency ratio for the first six months of Fiscal 2022 increased to 77.6% from 72.2% last fiscal year.

When the COVID-19 pandemic hit, local businesses and non-profits turned to First Federal Savings Bank to secure their funds thru the SBA's Paycheck Protection Program ("PPP"). In the first two rounds of PPP, the bank helped more than 400 clients navigate the PPP application process to obtain $41.1 million of funding. In December 2020, Congress authorized a third round of funding, and another $20.8 million was originated for nearly 300 customers. As of December 31, 2021, $10.4 million of PPP loans remained outstanding. Due to the full guaranty of the SBA and the underwriting process the bank's employees have followed, no credit issues are expected with SBA PPP loans and, consequently, no allowance for loan losses has been established for these loans.

Excluding PPP loans, net loans increased $16.6 million, or 5.3%, during the first half of the fiscal year. The $339.7 million of net loans on December 31, 2021, included $315,000 of loans committed for sale to either Fannie Mae or the Federal Home Loan Bank.

Loan origination volume, though 39.1% lower than the totals posted last fiscal year, outpaced the production totals from two years ago by 16.9%. Despite the slowing refinance activity and a slight rise in interest rates, single-family mortgage loan production totaled $42.8 million for the six-month period. Consumer lending originations, which included auto loans, personal loans, and home equity loans and lines of credit, added $9.3 million. Commercial loan production, including $5.0 million participated with other banks, was $30.8 million for the period.

Management has recorded $50,000 of provisions for loan losses in the first half of the fiscal year, boosting the allowance for loan losses to $3.5 million. Although management believes that the allowance is adequate, the COVID-19 pandemic may yet have an adverse effect on the credit quality of our loan portfolio. Management remains in close contact with our most vulnerable borrowers and will make additional provisions to the allowance, as necessary.

Deposit accounts, which have increased to $370.0 million at December 31, 2021, were $2.5 million higher than six months earlier. At an annualized 0.31%, the cost of deposits for the six-month period was 40.0% below the same period last year. Local deposit rates declined over the year, and existing wholesale funds were replaced at significantly lower rates. Similarly, the Company's total cost of funds declined to an annualized 0.55% for the six months ended December 31, 2021, down from 0.88% for the like period a year ago, as $30.0 million of higher-costing FHLB advances matured over the past year.

Stockholders' equity increased to $42.2 million on December 31, 2021. Based on the 1,741,029 of outstanding common shares, the book value per share of FBPI stock was $24.22 as of December 31, 2021.

At 8.70%, First Federal's tier one capital ratio was well in excess of the five percent regulatory standard for "well-capitalized" financial institutions. The bank's other capital measurements also continue to comfortably exceed "well-capitalized" standards.

This news release may contain forward-looking statements within the meaning of the federal securities laws. Statements in this release that are not strictly historical are forward-looking and are based upon current expectations that may differ materially from actual results. These forward-looking statements, identified by words such as "will," "expected," "believe," and "prospects," involve risks and uncertainties that could cause actual results to differ materially from those anticipated by the statements made herein. These risks and uncertainties involve general economic trends and changes in interest rates, increased competition, changes in consumer demand for financial services, the possibility of unforeseen events affecting the industry generally, the uncertainties associated with newly developed or acquired operations, market disruptions and the potential effects of the COVID-19 pandemic on the local and national economic environment, on our customers and on our operations as well as any changes to federal, state and local government laws, regulations and orders in connection with the pandemic. The Company undertakes no obligation to release revisions to these forward-looking statements publicly to reflect events or circumstances after the date hereof or to reflect the occurrence of unforeseen events, except as required to be reported by applicable law.

Photos: (Click photo to enlarge)

Read Full Story - First Bancorp of Indiana, Inc. Announces Financial Results December 2021 | More news from this source

Press release distribution by PRLog

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.