Financial News

Bank Collapse and Upcoming Earnings Drive Gold Prices Higher

US bank stocks have taken a beating following the recent collapses and upcoming quarterly earnings will either make or break them. The bank crisis comes as S&P 500 companies head toward their second straight year-over-year decrease in quarterly earnings, marking the first profit recession for US corporations since COVID-19 impacted corporate performance in 2020. Concerns about banks have mimicked concerns about global finances following the collapse of the US housing market, which fueled the global financial crisis from 2007 to 2009. As US regulators confront harsh questions about what caused bank failures, the gold price is once again aiming for $2,000. The Fed chair has stated that we are reaching the conclusion of this cycle’s rate hikes, leading to a drop in US government yields and the dollar index, which benefits bullion. As new events happen every day and the chance of a financial crisis spreading to the rest of the economy grows, gold prices might keep going up, creating an opportunity for companies like Fury Gold Mines Limited (TSX:FURY) (NYSE-A:FURY), Newmont Corporation (TSX:NGT) (NYSE: NEM/quote">NYSE: NEM), Equinox Gold Corp. (TSX:EQX) (NYSE American:EQX), Agnico Eagle Mines Limited (NYSE: AEM/quote">NYSE: AEM) (TSX:AEM), and Kinross Gold Corporation (TSX:K) (NYSE: KGC/quote">NYSE: KGC).

FURY Gold Mines (TSX:FURY) (NYSE-A:FURY) is a well-financed high-grade gold exploration company ideally positioned in the James Bay Region of Quebec and the Kitikmeot Region of Nunavut. Fury owns 23.5% of Dolly Varden Silver’s 59.5 million common shares. The company seeks to expand its multi-million-ounce gold platform through meticulous project evaluation and exploration expertise, guided by a management team and board of directors with a track record of funding and progressing exploration assets.

On April 11, Fury announced its 2023 exploration plan for its Eau Claire project in James Bay. The company plans to drill between 15,000 and 20,000 meters (m) at the project this year to continue expansion of the high-grade Eau Claire resource, follow up on the 2022 success at the Percival Prospect 14 kilometers (km) to the east of Eau Claire, and advance early-stage exploration targets around the Cannard Deformation Zone to the drill-ready stage.

“Following a highly successful drill program in 2022, we are excited to be returning to the Eau Claire resource and Percival Prospect. Our goal is to continue to expand the Eau Claire resource, which we know is open in all directions, while also looking for new discoveries elsewhere on the Eau Claire land package which we believe are possible at the Percival Prospect and to the East at our new targets discovered along the Cannard Deformation Zone,” commented Tim Clark, CEO of Fury. “Additionally, we are thrilled that Fury will start the year with C$16.2 million in the treasury and about C$60 million in current value in shares in Dolly Varden Silver, which arguably makes Fury one of the best-financed juniors in the sector.”

Fury’s updated geological interpretation of the Eau Claire resource and its focus on the fold geometry at the Hinge Target this year has resulted in a 25% increase to the mineralized footprint. The mineralized system remains open in every direction and returned intercepts of 4m of 5.75 g/t gold, 1m of 21.4 g/t gold, 3.5m of 5.86 g/t gold and 1.5m of 22.77 g/t gold. The 2023 exploration plans at the Hinge Target will focus on continued expansion of the mineralization footprint to the west and updip.

Earlier this year, the company shared an update on targeting at its fully owned Lac Clarkie project in the Eeyou Istchee Territories in Quebec’s James Bay region. Through the conclusion of a B-horizon soil sampling program, Fury defined a total of eight gold prospects. Six of the targets are located in the Cannard Deformation Zone, which contains multiple gold occurrences along its 100 km mapped range, including Fury’s Eau Claire Deposit and the Percival Property.

Fury recently completed private placement for C$8.75 million in cash, significantly boosting the company’s treasury, which currently stands at C$16.2 million.

For more information about Fury Gold Mines Limited (TSX:FURY) (NYSE-A:FURY), click here.

Gold Miners Report Solid Financial Results

Banks may be facing financial uncertainty this year, but gold stocks are fairing quite well thanks to elevated prices.

Leading gold producer Newmont Corporation (TSX:NGT) (NYSE: NEM/quote">NYSE: NEM) reported 96.1 million attributable ounces of gold Mineral Reserves for 2022, up from 92.8 million ounces at the end of 2021. Other metals, including over 15 billion pounds of copper reserves and roughly 600 million ounces of silver deposits, offer great upside potential for Newmont. The grade of gold reserves increased by 2% to 1.09 grams per tonne (g/t), up from 1.06 g/t the previous year, owing primarily to higher grade reserves from Newmont‘s 40% equity ownership in Pueblo Viejo, as well as positive results from the Company’s underground managed operations, including Cerro Negro, Tanami, and Musselwhite, and increased equity ownership in Yanacocha.

On March 28, Equinox Gold Corp. (TSX:EQX) (NYSE-A:EQX) announced that a $140 million gold prepay arrangement has been finalized. A non-binding term sheet for an additional $50 million gold purchase and sale deal has also been signed by the Company. These agreements strengthen Equinox‘s financial flexibility and provide extra cash liquidity at competitive terms as the company continues to fund its 60% ownership in the Greenstone Gold Mine, which is on track to begin gold production in the first half of 2024. Equinox can increase total proceeds to $150 million if another gold prepay is executed on or before June 30, 2023.

Agnico Eagle Mines Limited (NYSE: AEM/quote">NYSE: AEM) (TSX:AEM) disclosed in February fourth-quarter and full-year 2022 financial and operating results, as well as future operating outlook. Agnico Eagle maintained solid operating performance in a challenging cost and manpower environment in the fourth quarter of 2022 and during 2022. The Company maintained good production and cost management, enhanced mineral reserves and mineral resources, moved expansion projects forward, and provided the best safety performance in the Company’s 66-year history. With the merger of Kirkland Lake Gold and the announced acquisition of Yamana Gold’s Canadian holdings, the year also witnessed significant strategic acquisitions targeted at strengthening Agnico Eagle‘s primary strategy of consolidating positions in premier mining jurisdictions (including the other half of the world-class Canadian Malartic mine).

Kinross Gold Corporation (TSX:K) (NYSE: KGC/quote">NYSE: KGC) announced in February its fourth-quarter and fiscal year 2022 results. Quarter after quarter, production increased, with the fourth quarter having the highest output and lowest costs of the year. The Company has added 2.7 million Au oz. of measured and indicated mineral resources to the Great Bear initial resource estimate, as well as 2.3 million ounces to its inferred mineral resource. Kinross returned $455 million in cash to shareholders in 2022, with about $155 million in dividends and $300 million in share buybacks as part of its increased share buyback programme. In 2023 and 2024, the company aims to continue its dividend and share buyback initiatives.

Fury Gold Mines Limited (TSX:FURY) (NYSE-A:FURY) recently appointed Brian Christie as an Independent Director by its Board of Directors.Christie was the Vice President of Investor Relations at Agnico Eagle for over 9 years and is currently employed as a Senior Adviser, Investment Relations by Agnico Eagle.

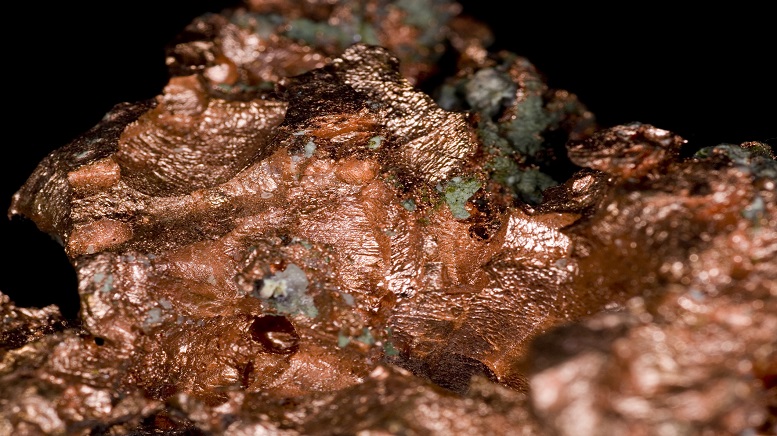

Featured Image MegaPixl @ Petrv

Disclosure:

This article is issued on behalf of Fury Gold Mines Limited (“Fury”). The article is a paid communication of Fury which is solely responsible for all factual matters about Fury contained in this article. David Rivard, P. Geo., Fury’s Exploration Manager is the qualified person who has reviewed the technical contents of this article in relation to all Quebec projects. Bryan Atkinson P.Geol., Fury’s SVP of Exploration is the qualified person who has reviewed the technical contents of this article in relation to Committee Bay. Market Jar Media Inc. has or expects to receive from Fury’s digital marketing agency (Native Ads Inc.) sixty-eight thousand and four hundred Canadian dollars in connection with the dissemination of this article. The owners and management of Native Ads and/or Market Jar do not currently own securities of Fury butmay acquire or dispose of securities in Fury from time to time without notice or restriction. Market Jar has not compensated the author of the article nor is Market Jar responsible for its contents. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of us and full legal disclaimer as set forth here. This article is not investment advice and persons interested in learning about Fury and the risks and challenges of its business should review Fury’s continuous disclosure record found at www.sedar.com.

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.