Financial News

Lithium Overdose: Can These 2 Lithium Stocks Recover in 2024?

The electric vehicle (EV) trend brought the spotlight on the demand for lithium used in EV batteries. The fear of a dwindling supply of lithium and growing demand for it caused lithium carbonate prices to surge as high as $81,360 per tonne in November 2022. However, lithium prices collapsed to nearly $10,000 per tonne in 2023. Nevertheless, lithium will remain in short supply as the EV market has a long runway for growth.

Lithium stocks have also seen their prices surge and collapse along with lithium prices. If you believe that EVs will become mainstream, then lithium stocks may find a respite in 2024. Here are two lithium stocks in the basic materials sector to watch as lithium prices rebound.

Piedmont Lithium

Piedmont Lithium Inc. (NASDAQ: PLL) is a development stage exploration company specializing in lithium discovery, excavation and production. Piedmont made news when it closed a deal to provide spodumene concentrate to Tesla Inc. (NASDAQ: TSLA) through 2025. China dominates the lithium industry, which has caused concerns in the United States. The United States considers it a national defense issue to domestically ensure U.S. battery supply chains. It signed an agreement with competitor Albemarle under the Defense Production Act to support Albemarle Co. (NYSE: ALB) opening of the Kings Mountain, North Carolina lithium mine to increase domestic production.

Carolina Lithium Project

Piedmont's greatest asset is its 100% ownership of the Carolina Lithium Project, which is comprised of 3,706 acres in North Carolina. The Carolina Tin-Spodumene Belt is located northwest of Charlotte, North Carolina. The project is located within the Carolina Tin-Spodumene Belt and the U.S. Battery Belt. It is being designed as a fully integrated mini, lithium hydroxide and spodumene concentrate manufacturing operation.

Vertical Integration: The First in the World.

Lithium hydroxide is the compound used in lithium-ion batteries found in EVs, energy storage systems, smartphones and portable electronic devices. Spodumene concentrate must undergo a series of processing steps to extract lithium hydroxide. Mining companies will mine to extract spodumene concentrate and then ship it to China to extract the lithium hydroxide. Piedmont plans to be the first vertically integrated company to both extract and process lithium hydroxide. It will be the first integrated site in the world. The company has been struggling with regulators to get its lithium project going since submitting the permit application nearly three years ago.

Permit Approved After Nearly 3 Years

On April 15, 2024, the North Carolina Department of Environmental Quality's Division of Energy, Mineral and Land Resources provided the long-await mining permit approval. Piedmont submitted the application nearly three years ago, on August 30, 2021. The permit enables Piedmont to move forward with the construction, operation and reclamation of the Carolina Lithium Project in Gaston County, North Carolina.

Piedmont Lithium CEO Keith Phillips commented, "We plan to develop Carolina Lithium as one of the lowest-cost, most sustainable lithium hydroxide operations in the world and as a critical part of the American electric vehicle supply chain. The project is expected to contribute billions of dollars of economic output and several hundred jobs to Gaston County and North Carolina's growing electrification economy." Piedmont has to obtain zoning variances, which could cost upwards of $1 billion, and financing for the project.

Daily Rectangle Pattern

The PLL daily candlestick chart illustrates a rectangle pattern. PLL surged over 30% initially on the Carolina Project permit approval on April 15, 2024, but fell back down from a $17.66 high back under the rectangle upper trendline at $15.58 as investors sold the news. PLL then proceeded to fall to the lower trendline at $11.61 just 4 days later. The daily relative strength index (RSI) has also turned back down, falling to the 40-band. Pullback support levels are at $10.31, $9.19, $7.84 and $7.00

Piedmont Lithium analyst recommendations and price targets can be found on MarketBeat.

Lithium Americas

Lithium Americas Co. (NYSE: LAC) is the American spin-off of the original Lithium Americas. The other spin-off is Lithium Americas Argentina Co. (NYSE: LAAC). Lithium Americas is a standalone operation in the United States. Its prime focus is the Thacker Pass project in Nevada, the largest known lithium source in the United States.

Thacker Pass

The Thacker Pass mining site has two phases. The first phase is expected to produce 40,000 tons of lithium carbonate extract (LCE) annually by 2028 at full capacity. This phase requires $2.9 billion of financing. Its second phase is expected to produce an additional 40,000 tones of production. The company announced it received a conditional commitment from the U.S. Department of Energy to finance $2.2 billion.

On January 1, 2023, General Motors Co. (NYSE: GM) announced a $650 million equity investment in two tranches for first dibs on the first 10 years of production at the spot rate. GM planned to use lithium in its Ultium battery cells. Thacker Pass is expected to commence in the second half of 2026. The construction for phase 1 is underway, with the DoE loan expected in the second half of the year.

Rug Pull Offering Pricing

Lithium Americas caused shares to drop nearly 30% on April 18, 2024, when it priced its $275 million equity offering at $5.00 per share for 55 million shares. Lithium America's stock was trading at $6.63 on the prior close before the announcement. The low-ball offering price soured investor sentiment, causing shares to fall under the offering price floor to $4.66. This last offering should technically fund phase 1 of the Thacker Pass project, but dilution and execution concerns are keeping the share depressed.

Daily Cup Pattern

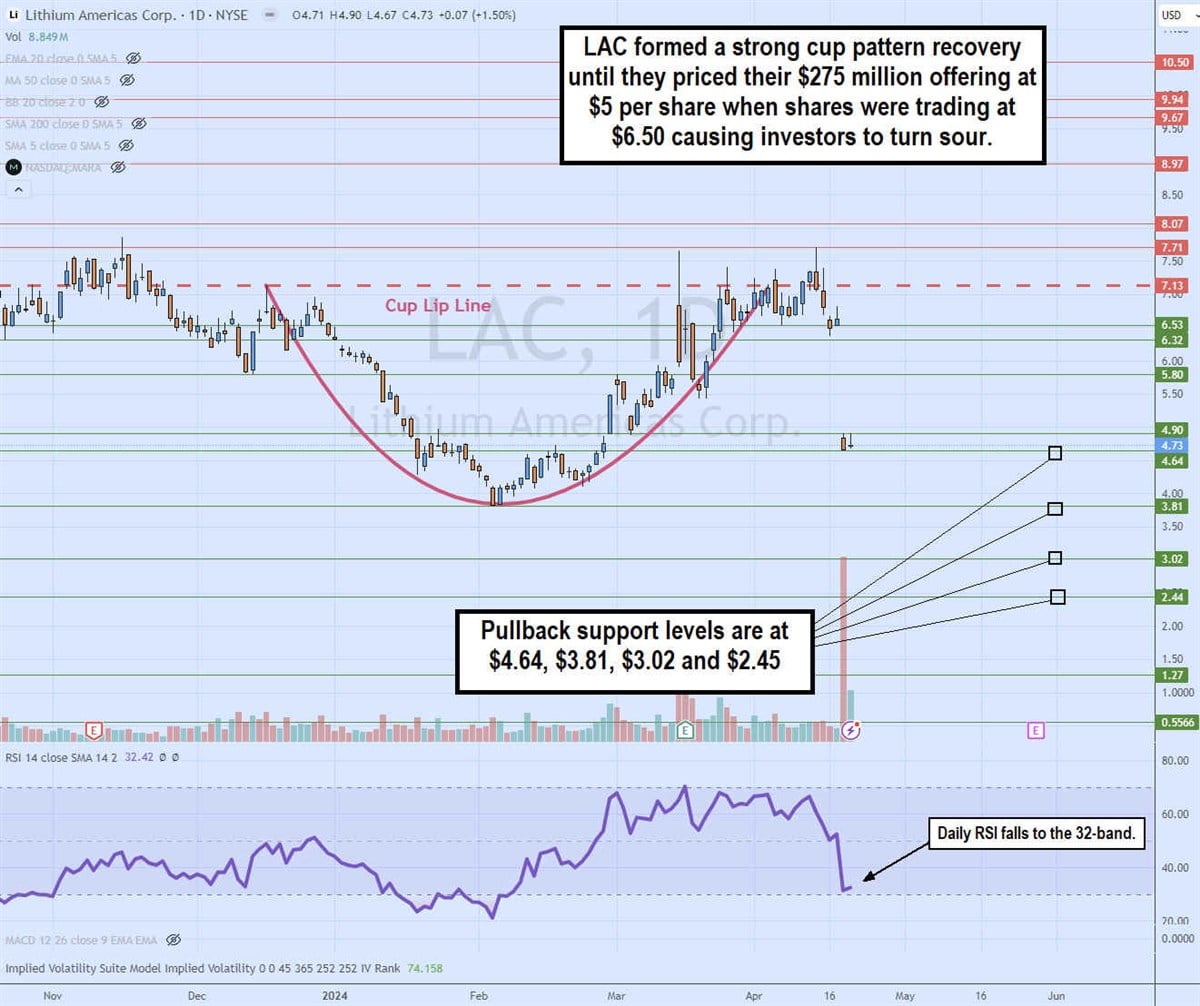

The daily candlestick chart on LAC had a cup pattern. The cup lip line formed at $7.13 on December 15, 2023. Shares fell to a low of $3.81, forming a rounding bottom that eventually set off a rally back to the cup lip line by April 2024. Shares maintained their elevation around $6.50 until the plunge on the $5 per share offering announcement. The shock triggered heavy volume selling in excess of 30 million shares traded. Whether the selloff can bottom and coil a handle will depend on $4.64 holding support. Pullback supports are at $4.64, $3.81, $3.02 and $2.45.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.