Financial News

Best Buy: AI Demand Is Recharging the Electronics Upgrade Cycle

Buy Best Co. Inc. (NYSE: BBY) is a leading big-box retailer of consumer electronics products and services. The company's physical stores average 36,800 square feet, which has actually been shrinking. Its year-over-year (YoY) sales have also been shrinking. Still, ironically, its profits have been improving for the past five years, driven by solid cost containment, membership, and service fees with a laser-focused concentration on higher-margin products and services. Artificial intelligence (AI) deployment and innovations are helping to drive the electronics upgrade cycle, which should bode for a robust second half of 2024.

Best Buy competes in the wholesale/retail sector, facing tough competition from retailers like Walmart Inc. (NYSE: WMT), Target Co. (NYSE: TGT), and online behemoth Amazon.com Inc. (NASDAQ: AMZN).

Best Buy’s Advantage Over Competitors

While Best Buy faces tough competition from massive brick-and-mortar retailers like Walmart and Target, it offers much more depth in consumer electronics product selection. Walmart and Target have electronics departments, but Best Buy is all electronics. Best Buy provides better technical support, especially with its Geek Squad installation and repair services. It's also made strides in matching or even beating prices.

While Amazon.com exceeds Best Buy's selection, you can't touch and feel the products like you can at a physical store, and you take the risk of damage from shipping. You also take a risk with third-party sellers, and returns and exchanges can be more tedious. The biggest advantage becomes evident during the last weeks of holiday shopping when you risk packages being lost, stolen, or late versus ordering online and picking them up at your local Best Buy store in time for Christmas.

Competition Has Been Chipping Away at Sales

However, it's not to say the competition hasn't impacted Best Buy. Their sales have been dropping YoY since the start of 2023. Competitors have been taking away some sales but are also suffering. While the pandemic was a boon for electronic sales as consumers loaded up and upgraded their electronics and home offices during the lockdowns, the post-pandemic normalization has been evident. The good news is the normalization and inventory glut are starting to ween as its comp sales only fell 2.3% in its recent fiscal Q2 2025, which was better than the previous forecast for a drop of 3%.

Best Buy Has Been Growing Efficiencies During Normalization

In the meantime, Best Buy has been demonstrating masterful execution and growing efficiencies by cutting costs, trimming layers of management with headcount reductions, and pivoting its focus on higher-margin products and services. This was evidenced in its fiscal second quarter of 2025 when its selling, general, and administrative (SG&A) expenses fell another 3.7% YoY. Best Buy has been growing its membership and services business, helping push margins by 20 bps YoY to 23.5%. What makes it even more impressive is the backdrop of weakened consumer demand. Things are improving, as the 2.3% YoY comp sales drop was better than last year's 6.1% YoY comp sales decline, and a rounding bottom is forming.

AI Is Driving the Electronics Upgrade Cycle

It's not a secret that AI has become mainstream, and it's starting to revive the upgrade cycle as normalization concludes. The computing and mobile phone category is starting to show growth again as new AI functionalities and features are deployed on devices. For example, Microsoft Co. (NASDAQ: MSFT) AI-power co-pilot is a feature sparking sales, indicating a stronger holiday shopping season coinciding with the upgrade cycle in store. AI-powered devices also have higher average selling prices (ASPs), which is a boon for the company.

However, other electronic categories, including TVs, video games, and appliances, are still sluggish. This could be attributed to competitors like Costco Wholesale Co. (NASDAQ: COST) and The Home Depot Inc. (NYSE: HD) taking some market share. This is the underlying concern prompting Best Buy to trim its fiscal full-year comp sales guidance.

Best Buy Raises EPS Estimates

The company reported fiscal Q2 2025 EPS of $1.34, up 10% YoY, beating consensus analyst expectations by 18 cents. Revenues fell 3.1% YoY to $9.29 billion but still crushed analyst expectations for $9.23 billion. Comp sales fell only 2.3% versus previous expectations for a drop of 3% YoY.

To the delight of investors (as evidenced by the price gap), Best Buy raised its fiscal full-year 2025 EPS guidance to $6.10 to $6.25, up from the previous forecast of $5.75 to $6.20 versus $6.07 consensus estimates. Revenues are expected between $41.3 billion to $41.9 billion versus $41.75 billion. Full-year comp sales are expected to be down 3% to 1.5% versus earlier guidance of being down 3% to flat. Fiscal Q3 2025 comp sales are expected to fall by 1%, and the non-GAAP operating income rate is expected to be around 3.7%.

Best Buy CEO Corey Barry commented, "We delivered strong results in our Domestic tablet and computing categories, which together posted comparable sales growth of 6% versus last year. With our market position, expert sales associates, and compelling merchandising, we capitalized on the demand driven by customers' desire to replace or upgrade their products combined with innovation."

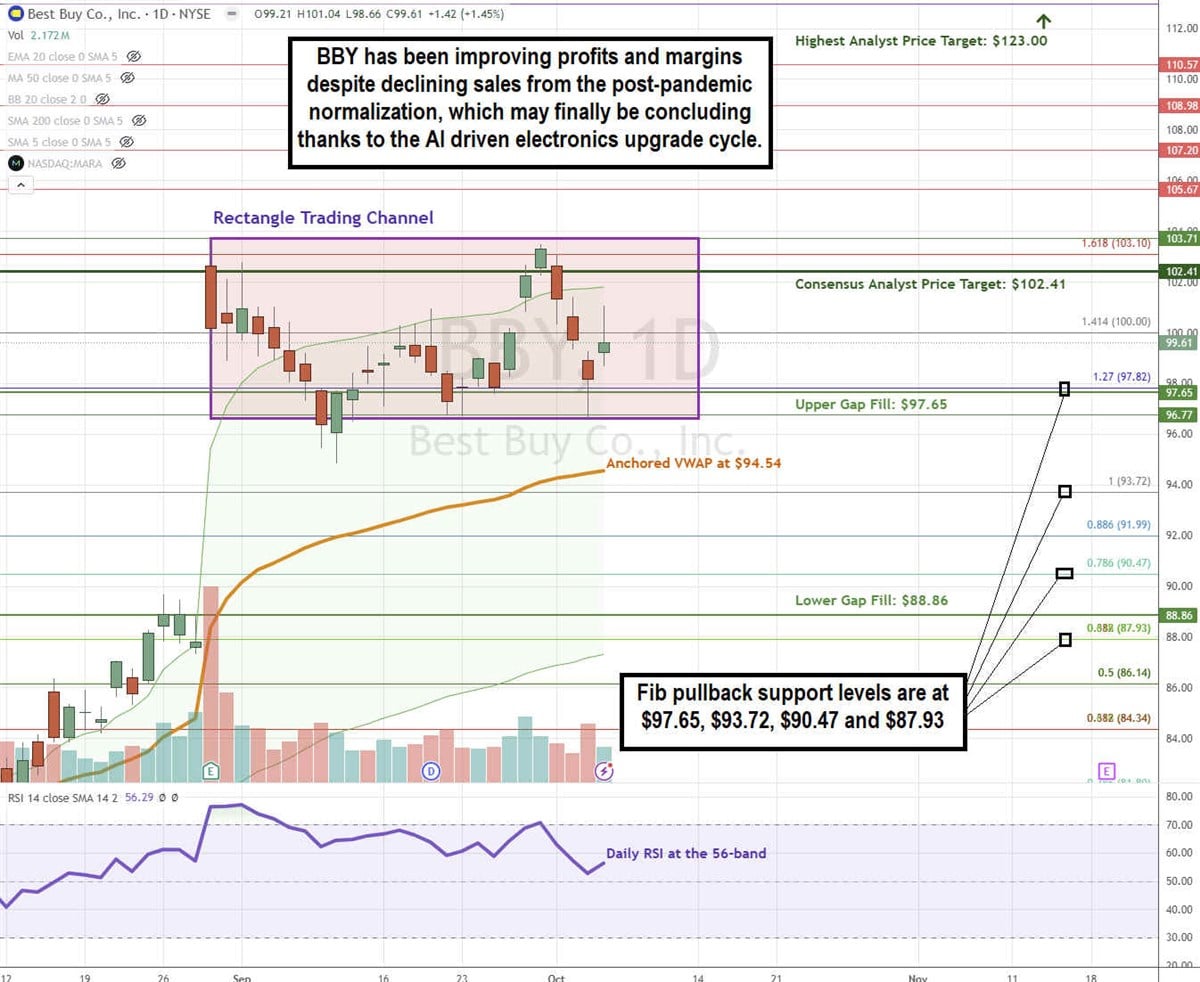

BBY Forms a Rectangle Trading Channel

A rectangle trading channel is comprised of a flat-top upper trendline resistance and a parallel flat-bottom lower trendline support.

BBY gapped on its earnings report to $97.65, forming the upper gap-fill level. The rectangle formed at the $103.71 flat-top upper trendline resistance and $96.77 flat-bottom lower trendline support level. The anchored VWAP support is at $94.54. The daily RSI is trying to coil up at the 56-band. Fibonacci (Fib) pullback support levels are at $97.65, $93.72, $90.47, and $87.93.

Best Buy’s average consensus price target is $102.41, and its highest analyst price target sits at $123.00. It has 10 Buy ratings, five Hold ratings, and one Sell rating from analysts. The stock trades at 15.88x forward earnings.

Actionable Options Strategies: Bullish investors can consider using cash-secured puts to buy BBY at the fib pullback support levels for entry and write covered calls to execute a wheel strategy for income in addition to the 3.77% annual dividend yield.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.