Financial News

7 Best Hotel REITs to Buy Now

Are you looking to invest in hotel real estate investment trusts (REITs) in 2023? Hotel REITs offer you the chance to diversify your portfolio with exciting and luxurious properties located in exotic locations around the world, from New York to Bali. By investing in a REIT, you can potentially increase your income and gain capital appreciation and the opportunity to invest in a more resilient asset class.

If you're considering investing in hotel REITs, you'll want to ensure you're investing in the best ones. This article will overview some of the top hotel REITs to consider in 2023. We'll look at their fundamentals, dividend yields and more and help you pick the best hotel REITs for you and your investing goals. So let's get started!

What is a Hotel REIT?

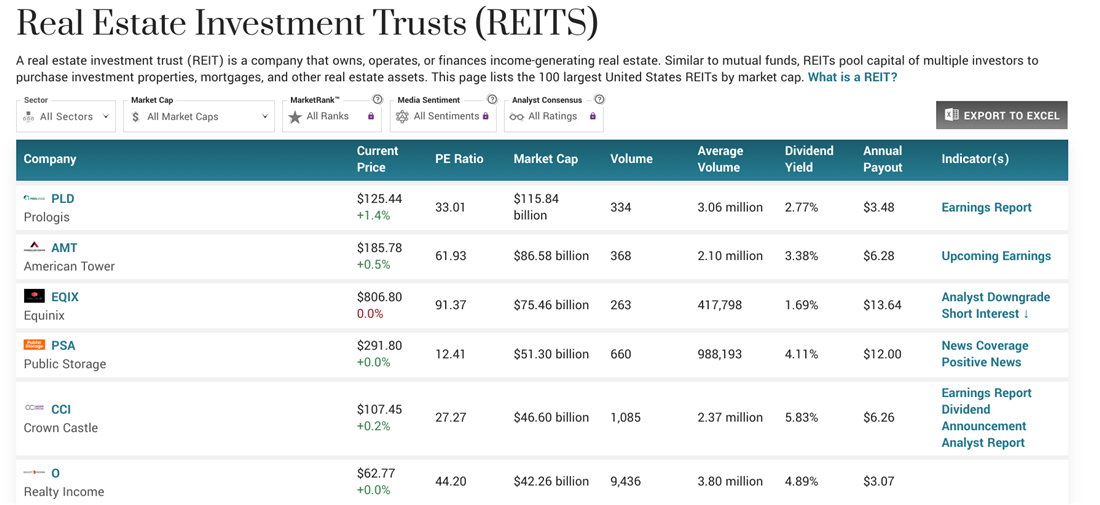

A REIT is a type of security (such as those on the MarketBeat REITs list, below) where you can purchase shares in a publicly-traded real estate company that owns and operates hotels.

Hotel REITs typically specialize in acquiring, operating, operating and managing full-service, luxury or extended-stay hotels. The companies on our hotel REITs list provide you with the potential to boost your income and gain capital appreciation through their vast portfolios of hotel properties.

REIT hotels offer stability through diversification and the ability to invest in properties worldwide, from Canada to Brazil and beyond. Hospitality REITs are a great way to invest in a more resilient asset class while gaining exposure to global markets.

Understanding Hotel REITs

This article will examine some of the top hotel REITs to consider in 2023.

First, our lodging REITS list will start with a brief overview of the three major types of hotel REITs. Lodging REITs invest in full-service hotels, such as Marriott REIT, Hilton and Hyatt; select-service REITs focus on mid-priced hotels like Hampton Inn and Comfort Inn, and extended-stay REITs specialize in extended stay properties, such as Residence Inn and Extended Stay America.

7 Hotel REITs to Consider in 2023

Now, let's look at some of the top largest hotel REITs you should consider investing in this year.

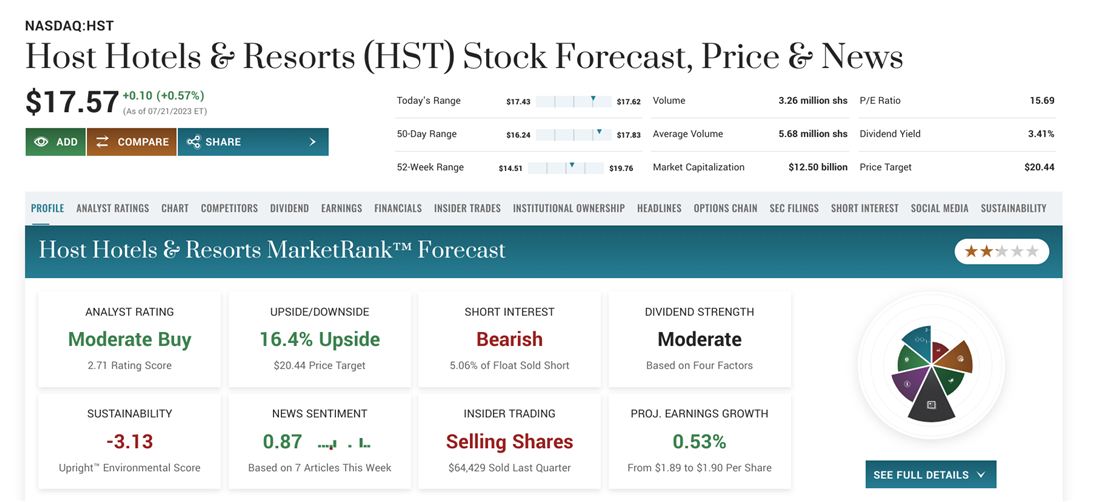

Host Hotels & Resorts

Host Hotels & Resorts (NYSE: HST) is one of the largest publicly traded lodging companies in the world. It owns almost 80 luxury properties from around the globe with locations that include the US, Canada and Brazil. The company also has strong fundamentals, including a Host dividend yield of 4.3% and revenue growth of 5% over the past year.

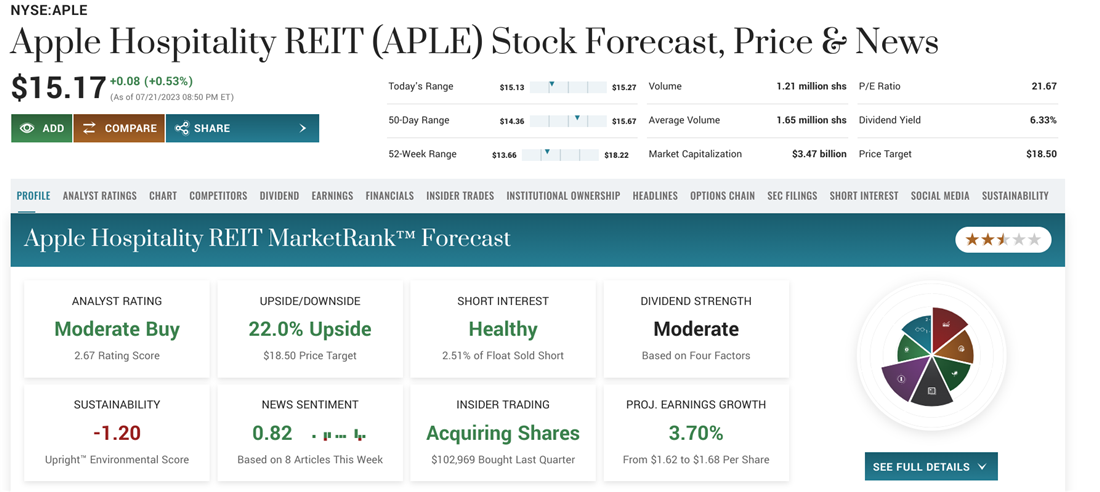

Apple Hospitality REIT

Apple Hospitality REIT (NYSE: APLE) is one of the largest owners and operators of high-end hotels in the U.S., with over 200 upscale properties ranging from resorts to extended stays across 37 states. The company currently offers a generous dividend yield of 6.3%, making it an appealing option if you're looking for income generation.

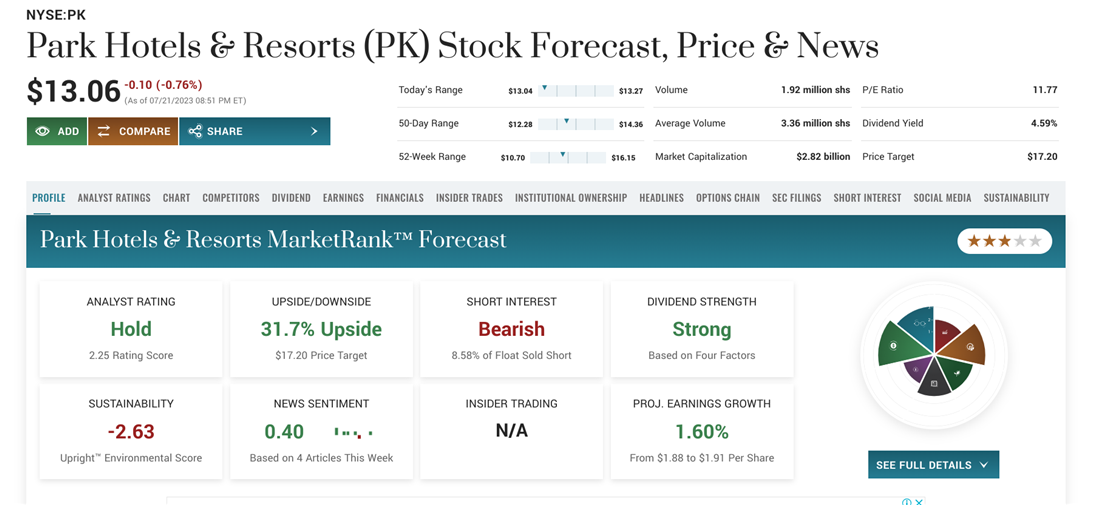

Park Hotels & Resorts

Park Hotels & Resorts (NYSE: PK) is another leading hospitality company with a portfolio consisting of over 60 premium hotels across North America. The company has seen solid growth over recent years, reporting revenue growth of 35.3% compared to last year's quarter and a dividend yield of 5.59%.

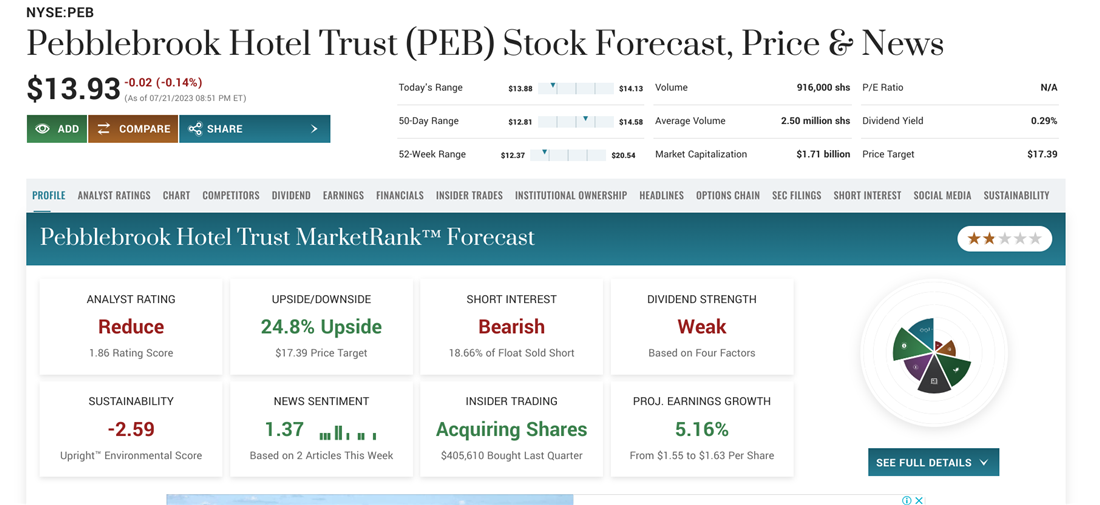

Pebblebrook Hotel Trust

Pebblebrook Hotel Trust (NYSE: PEB) is a luxury hotel REIT with a portfolio of nearly 50 properties in top urban and resort destinations across the United States. It also offers investors a Pebblebrook dividend yield of 4.2%.

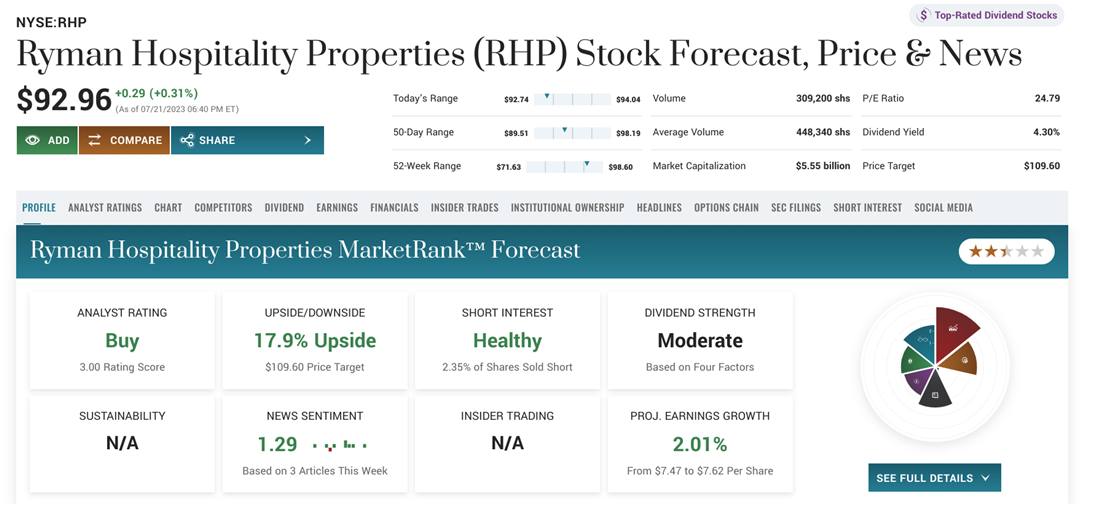

Ryman Hospitality Properties

Ryman Hospitality Properties (NYSE: RHP) owns and operates four of the most iconic entertainment destinations in the U.S. — Gaylord Hotels and the famous Ryman Auditorium in Nashville, home of the Grand Ole Opry — providing guests with an immersive experience in music and entertainment. The Ryman financial outlook is strong, with a dividend yield of 4% and revenue growth of 9% over the past year.

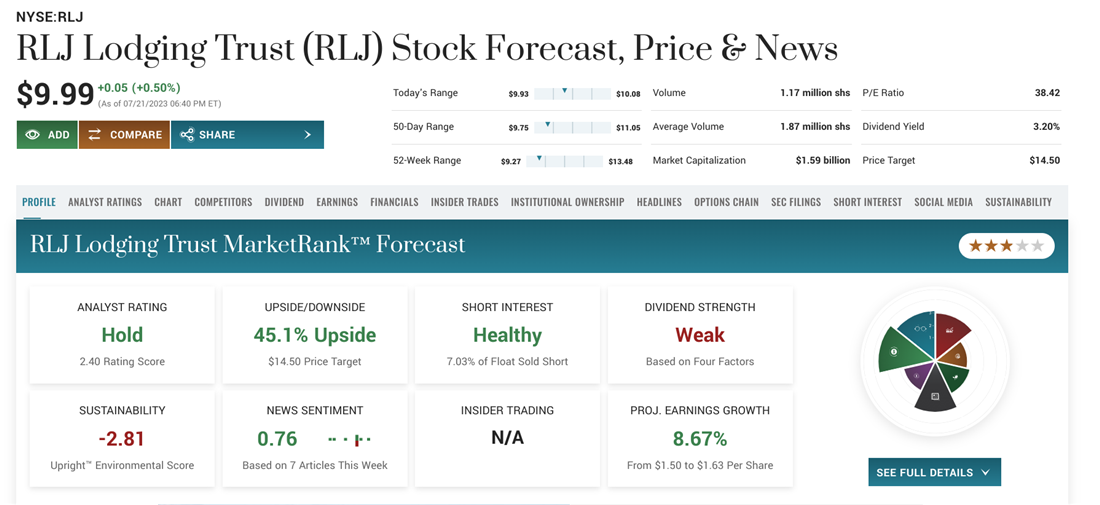

RLJ Lodging Trust

RLJ Lodging Trust (NYSE: RLJ) is a select-service hotel REIT with a portfolio of nearly 100 mid-priced properties across the U.S. The company's properties are primarily located in urban markets and have consistently delivered strong financial results, with an RLJ dividend yield of 6.2% and revenue growth of 12% over the past year.

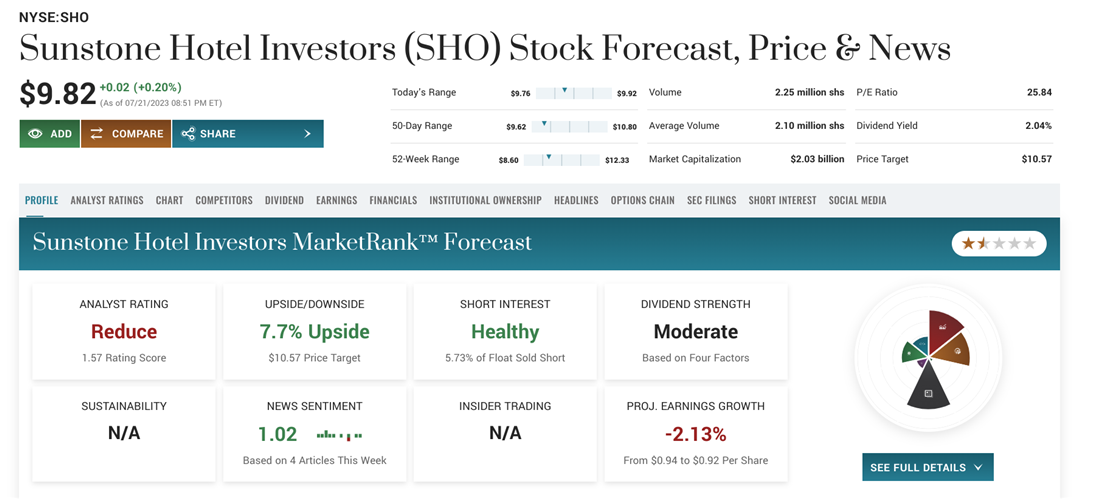

Sunstone Hotel Investors

Sunstone Hotel Investors (NYSE: SHO) is a luxury hotel REIT with 15 high-end properties in prime locations around the U.S. The company's iconic properties include Hilton, Marriott and Four Seasons. Sunstone Hotel Investors also offers investors a dividend yield of 2.04%, and the REIT earned $243.44 million during the quarter, compared to Sunstone analyst ratings expectations of $223.93 million.

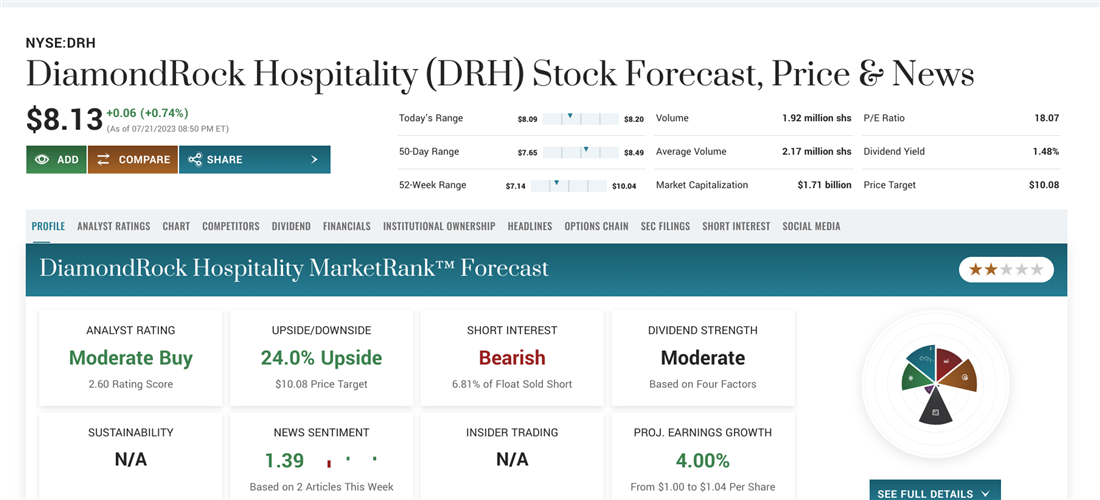

DiamondRock Hospitality Company

DiamondRock Hospitality Company (NYSE: DRH) is a lodging REIT that owns and operates 35 upscale hotels across the U.S. The company's properties include brands such as Marriott, Hilton and Westin. DiamondRock financials are strong, with a dividend yield of 1.48%.

How to Invest in Hotel REITs

Investing in hotel REIT stocks requires just a few basic steps.

Step 1: Research hotel REITs.

Thoroughly research your hotel ETF list before investing. Consider factors such as the company's dividend yield, revenue growth, occupancy rate and where its properties are located. Pay attention to analyst ratings and read through the REIT's 10-K reports to better understand the company's financials.

Step 2: Set investment goals.

Clearly define your investment goals to decide which hotel REIT stocks are right for you. Factors to consider include risk tolerance, expected return on investment and timeframe for realizing gains.

Step 3: Invest in hotel REITs.

Once you've identified a hotel REIT on our hospitality REITS list that meets your criteria, you can invest in it by purchasing shares directly from the company or through a broker. Some brokers offer commission-free REIT purchases, which can help you save money on transaction fees. Be aware of any changes in market conditions or potential risks before making a purchase decision.

Step 4: Monitor performance and reevaluate investment goals.

Regularly monitor the performance of your hotel REIT investments and adjust your strategies accordingly. Reevaluate your investment goals periodically to ensure that they're still in line with your original objectives.

Pros and Cons of Hotel REITs

Hotel REITs are a popular way to gain exposure to the hospitality industry without buying physical properties. However, there are pros and cons to investing in one of the REITs on our hospitality REIT list.

Pros

The following are some pros of investing in hotel REITS:

- Diversified portfolio: Hotel REITs allow you to gain exposure to hospitality businesses without having to purchase multiple physical properties.

- High-yield investing: Hotel REITs typically offer higher dividend yields than other real estate investments.

- Liquidity: Hotel REITs are usually publicly traded on major stock exchanges, making them easy to buy and sell.

- Tax benefits: You may be eligible for certain tax benefits when investing in hotel REITs, such as deductions on depreciation and amortization expenses.

- Professional management: Most hotel REITs employ experienced management teams to run hospitality operations.

Cons

Of course, there are also cons of choosing to invest in a hotel REIT:

- Market risk: The stock prices of hotel REITs can fluctuate due to market conditions or other external factors, which could lead to losses if you don't manage them properly.

- Leverage risk: Many hotel REITs use leverage, which means that if creditors call their debt they may not have enough cash on hand to pay back their loans, resulting in a default.

- Concentration risk: Many hotel REITs invest heavily in a limited number of markets or property types, which can expose them if those markets or sectors experience downturns.

- Rising interest rates: Rising interest rates can increase the cost of borrowing money and reduce available capital for investments, potentially resulting in lower returns for you.

Checking into Hotel REITs

Hotel REITs can be a lucrative investment and allow you to buy into the exciting world of travel and hospitality. They offer high dividend yields, access to professional management, and liquidity and diversification benefits. However, they also come with market risk, leverage risk, concentration risk and rising interest rates. Always research the specific risks associated with hotel REIT investments before making any decisions.

FAQs

Now that you better understand hotel REITs, you may still have lingering questions. Don't worry. We provide detailed answers and explanations to ensure your confidence before investing.

What is the largest hotel REIT in the U.S.?

Apple Hospitality owns and operates a vast portfolio of properties, including over 200 hotels with around 29,000 guest rooms spread across 37 states. Most hotels are branded by industry-leading names: 96 under the Marriott banner, 119 as Hilton locations, four Hyatt hotels and one independent hotel.

What is the most successful hotel real estate investment trust?

Host Hotels & Resorts, Inc. is the world's largest publicly-traded lodging REIT, with a geographically diverse portfolio of luxury and upscale hotels across the United States. They're one of the largest owners of luxury and upper-upscale hotels. The company was incorporated as a Maryland corporation in 1998 and operated as a self-managed and self-administered REIT while being traded on the NASDAQ under the symbol "HST." The company's management team has decades of experience in the hospitality industry.

How does a hotel REIT work?

A hotel REIT is an investment vehicle that holds and operates income-producing real estate assets, particularly hotels and resorts. When you purchase shares of a hotel REIT, you become part owners of the company and, in turn, receive a portion of the earnings generated. Hotel REITs are typically managed by experienced professionals with expertise in hotel operations, management and finance who use their expertise to manage the day-to-day operations of their properties and source new investments.

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.