Financial News

MarketBeat ‘Stock of the Week’: Central Garden & Pet

If Tractor Supply and Petsmart had a baby, it would be Central Garden & Pet Company (NASDAQ: CENT).

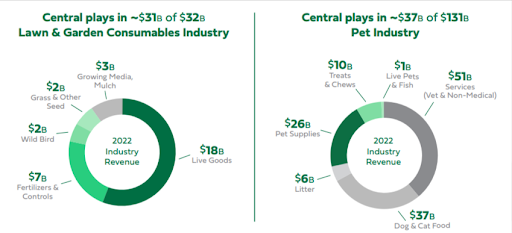

The California-based company is the country’s second-largest retailer of lawn and garden consumables. Excluding food and litter, it is also the second-largest seller of pet supplies. This makes it a unique way to invest in not one but two popular consumer spending areas.

On the garden side of the business, a ‘rural revitalization’ that took hold during the pandemic continues to be a favorable trend. More Americans are opting to live in suburban or rural areas instead of cities. Credit a work-from-home revolution that is allowing people to stray from congested urban settings to the great outdoors.

As a result, families are surrounded by bigger lawns and farmland. Demand for things like grass seed, vegetable seeds, fertilizers and fish to fill the scenic countryside pond are on the rise — especially among younger generations. Millennial homeowners now represent almost one-third of all U.S. gardeners.

The pet industry ‘tail’-winds are another lasting force accelerated by the pandemic. Pet adoption soared during lockdown restrictions as people worldwide sought the companionship of a furry friend. Adoption rates have slowed in 2023, but the ‘humanization of pets’ remains a growth driver for the industry. An estimated 95% of U.S. pet owners consider pets to be family. In turn, pets are being pampered with treats, comfortable bedding and veterinary care like never before.

Combining the garden and pet categories in which it competes, CENT has an unusual, two-pronged $68 billion market opportunity on its hands. And with its sales breakdown of roughly 60% pets and 40% garden, it's a balanced model that shareholders have long benefited from.

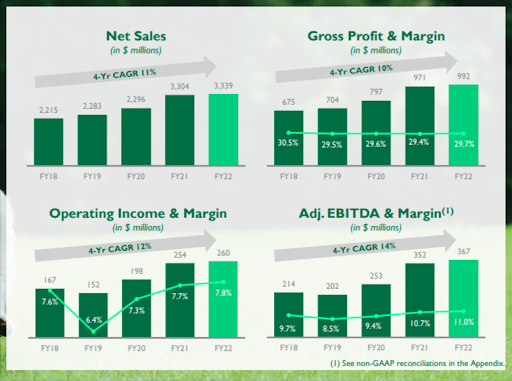

Over the last 10 years, CENT has delivered a 19.5% annualized return. The small-cap S&P 600 index to which it belongs is up 6.5% annually over the same period.

Make no mistake, it’s not all ‘paws’-itive for Central Garden & Pet. The retailer is exposed to the same economic pressures that its peers are. The impact of inflation and high interest rates on consumer spending have made double-digit revenue growth (including 23% growth in 2021) a thing of the past. With inventory levels and operating expenses also higher, profitability has trended lower since last year. But relative to competitors, CENT is performing quite well.

Last week, Chewy announced a worse-than-expected third-quarter loss. Tractor Supply reported 4% year-over-year sales growth that fell shy of Wall Street’s forecast — and its stock is suddenly seeing rising short interest.

Considering CENT participates in many of the same product categories and faces similar challenges, its recent financials — and stock performance — look pretty darn good.

Fundamental improvements

Last month, Central Garden and Pet announced that fiscal 2023 fourth quarter (period ended September 30th) sales grew 6% to $750 million — about $10 million ahead of consensus. Not surprisingly, the beat was led by 10% growth in the Pet segment, which confirms that Americans’ willingness to spend on their dogs and cats still has ‘legs.’ But what about profits?

After posting a $0.04 per share net loss in the prior year period, fiscal Q4 earnings per share (EPS) of $0.10 also exceeded analyst expectations. Interim CEO Beth Springer cited successful inventory management and progress with the company’s ‘Cost and Simplicity’ program. With Chewy whiffing on its bottom line performance, CENT’s return to profitability smells garden-fresh.

In addition to a stabilizing income statement, the balance sheet is getting healthier. Central exited the quarter with a $489 million cash position, nearly three-times larger than a year ago. Being able to convert inventory to cash is a big plus. A $1.2 billion debt balance is above where it was last year, but the company’s 45% debt-to-capital ratio is manageable.

And after generating record cash flow in fiscal Q4 — an achievement the market has yet to fully appreciate — CENT’s ability to activate its share repurchase program looks better. Central bought back $2.4 million of its stock during the quarter. Further buybacks in 2024 could provide downside support for the stock.

Housing rebound, M&A are potential catalysts

Up 20% year-to-date, what could also keep CENT climbing is falling interest rates. If upcoming economic data releases — most notably, inflation and employment figures — come in cooler than expected, the Federal Reserve could start lowering rates as early next year.

This would lead to lower mortgage rates and increased home-buying activity. For homeowners who are already locked in at 5%, 4% or less, remodeling loans may become more attractive. Wherever it comes from, a housing market recovery could be a significant boost to property care retailers like Central.

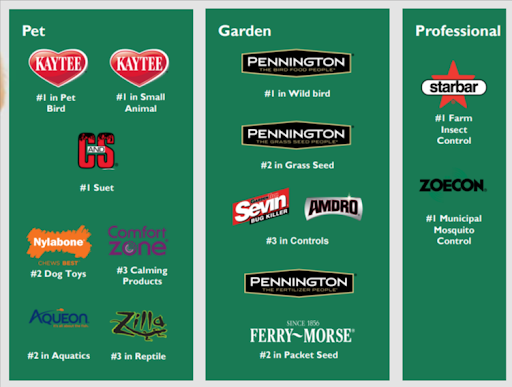

In the meantime, the company will likely continue to lean on a strategy that has served it well for decades — acquiring complimentary pet and lawn brands. Over the last 30 years, Central has completed a staggering 60 acquisitions. Several have become prominent brands. Nylabone chews are now the nation’s second-best-selling dog toy. Kaytee is the top brand for pet bird and small animal food. In the garden business, a recently re-branded Pennington is Central’s featured line.

Keeping with tradition, Central wrapped up its latest acquisition in early November. It purchased TDBSS, a maker of premium natural dog chews and treats based in Richmond, Virginia. The move will 1) strengthen Central’s position in dog snacks by providing worthy Nylabone sidekicks in Best Bully Sticks, Barkworthies and Paw Love, and 2) bolster its digital capabilities.

TDBSS has a strong online presence through both direct-to-consumer and third-party channels. Bulking up its e-commerce capabilities will be critical for Central because the pet supplies industry is rapidly shifting online. Despite Chewy’s recent struggles, online pet shopping is growing at a much faster clip than traditional retail.

In search of a top dog

Central’s next chapter of product innovation and acquisition will be led by a new top dog. In September 2023, the company appointed independent board member and former Clorox executive Beth Springer as interim CEO. She replaced former CEO Tim Cofer, who left to become the next CEO at Keurig Dr. Pepper. The search for a new CEO is still ongoing and probably won’t conclude until after the winter holidays.

In her first time presiding over quarterly results, Ms. Springer highlighted “evolving consumer behavior” in addition to inflation, inventory and weather as headwinds. Nevertheless, she was able to deliver an overall positive update that, curiously, was followed by a 10% selloff. Whether it was concerns around next year’s consumer spending environment or leadership uncertainty, the November 21st drop was largely unfounded — and has been greeted by steady buying activity since.

As part of the fiscal Q4 release, management provided fiscal 2024 adjusted EPS guidance of $2.50 “or better.” Considering Central topped or matched consensus earnings estimates in every quarter of fiscal 2023, the likelihood of it being better is high.

A more favorable entry point awaits

Sticking with the company’s $2.50 EPS forecast, CENT has a forward-looking price-to-earnings (P/E) ratio of around 18x. Over the last two years, the stock has traded at P/E multiples between 13x and 18x. This puts the current valuation at the high end of the recent range and suggests there’s a better entry point to be had.

How does the valuation compare to that of Tractor Supply? TSCO is trading around 21x next year’s earnings estimate. It's not an apples-to-apples comparison, but given their customer overlap, CENT can be viewed as a less expensive small-cap cousin.

CENT’s six-day winning streak came to an end on Friday when it finished in the red by 0.5%. It's a run that has put the stock nearly $10.00 above its $35.60 May 2023 low. A dip back below the $40.00 level would present a cheaper opportunity for swing traders or longer-term investors.

For a company that has been publicly traded since 1993, Central Garden and Pet has surprisingly thin analyst coverage. Only three sell-side research groups actively follow the stock — and only one of which has refreshed its opinion since last month’s earnings report.

On November 20th, Truist Financial reiterated its buy rating on CENT, giving it a $50.00 price target. It's a target that could soon be increased, though, with the stock just $5.00 away. The upside of 10% for a stock that has returned 20% historically seems low — even in a tough macro environment.

Bottom Line

Central Garden and Pet is outperforming despite the challenging consumer spending backdrop. The company’s exposure to two upward trending markets should lead to even stronger results as inflation and rate pressures moderate.

A solid track record of growth led by an effective M&A campaign has planted the seed for the next growth wave to be driven by ‘rural revitalization’ and ‘pet humanization.’ Embracing this underloved small cap could lead to some tail-wagging gains.

More News

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.