Financial News

2 stocks that under-promised and over-delivered on their earnings

Companies that underpromise and over-deliver are a joy for shareholders and analysts alike. Like underdogs, these mighty yet soft-spoken companies surprise with actions, not words. They inspire investors and pave the way towards transformation towards the higher tier in their respective sectors and industries. Most importantly, they attract interest from new investors and institutions seeking performance. These two companies are not new but have undergone turnarounds in their operations and stock prices. While prices are not cheap, they are worth watching on deep pullbacks for potential value positioning opportunities.

Rambus Inc. (NASDAQ: RMBS)

This former high flier was one of the original momentum stocks of the 2000 internet bubble, peaking at $127 in January 2020 before crashing with the technology bubble. Shares had fallen into obscurity, trading in the $5 to $20 range for the past decade until they erupted during the post-pandemic era, catapulting prices to levels not seen since 2020.

Rambus is a semiconductor company that's been around since 1990. The company invented RDRAM and continues to grow its IP with new chip design and architecture like Arm Holdings plc (NASDAQ: ARM) does. Rambus owns over 5,000 patents and licenses over half of them to semiconductor companies. It was known for its IP-based litigation when DDR-SRAM memory hit the marketplace. The company develops high-speed chip-to-chip and memory interfaces to enhance the performance, security and efficiency of servers, workstations, networking equipment, mobile devices and consumer electronics. Rambus is a huge benefactor of the artificial intelligence (AI) trend, as AI systems require massive data, security, high-speed processing and massive memory bandwidth.

Hemorrhaging continues

On October 30, 2023, Rambus reported Q3 2023 GAAP EPS of 93 cents per share versus consensus analyst estimates for 41 cents, beating by 52 cents and doubling the estimates. Revenues fell 6.1% YoY to $105.3 million, missing analyst estimates of $131.2 million. Rambus generated $56.1 million in cash and completed its $100 million accelerated stock buyback program. License billings were $57.9 million, product revenue was $52.2 million, and contract revenue was $24.2 million. Rambus completed the sale of its PHY IP business for $106.3 million to strengthen the focus on chips and digital IP. Rambus closed the quarter with $375.5 million in cash and cash equivalents.

Q4 2023 guidance and CEO insights

Licensing billings for Q4 2023 are expected between $56 million to $62 million, product revenues of $52 million to $58 million and other revenues of $17 million to $23 million.

CEO insights on AI

Rambus CEO Luc Seraphin commented, "As the industry builds out the infrastructure for the broadening adoption of AI, we look forward to continued innovation and growth in server CPUs as well as workload-optimized accelerators." He continued, "This trend also creates opportunities for our silicon IP business. The ongoing specialization of computing systems makes our high-performance CXL, PCIe, HBM and GVR IP controller increasingly critical."

Rambus analyst, ratings and price targets are at MarketBeat. Rambus peers and competitor stocks can be found with the MarketBeat stock screener. RMBS is trading up 89% YTD and has a 4.28% short interest.

Daily rectangle breakout

The daily candlestick chart on RMBS illustrates a rectangle breakout pattern. The rectangle trading range started forming on July 28, 2023, after peaking at $62.94, forming the upper trendline resistance. The lower trendline support formed at $48.82 on August 10, 2023. The daily market structure low (MSL) triggered the breakout through $55.34. Shares chopped within the range, retesting the lower trendline on Q3 2023 earnings. Since then, RMBS has continuously climbed for 12 sessions to break through the $62.94 upper trendline resistance, hitting $67.91 on November 15, 2023. A daily market structure high (MSH) sells triggers under $65.07. The daily relative strength index (RSI) has made a choppy rise off the oversold 30-band before earnings peak at the oversold 70-band at its swing high. Pullback supports are $55.34 daily MSL trigger, $52.11, $48.82 and $46.16.

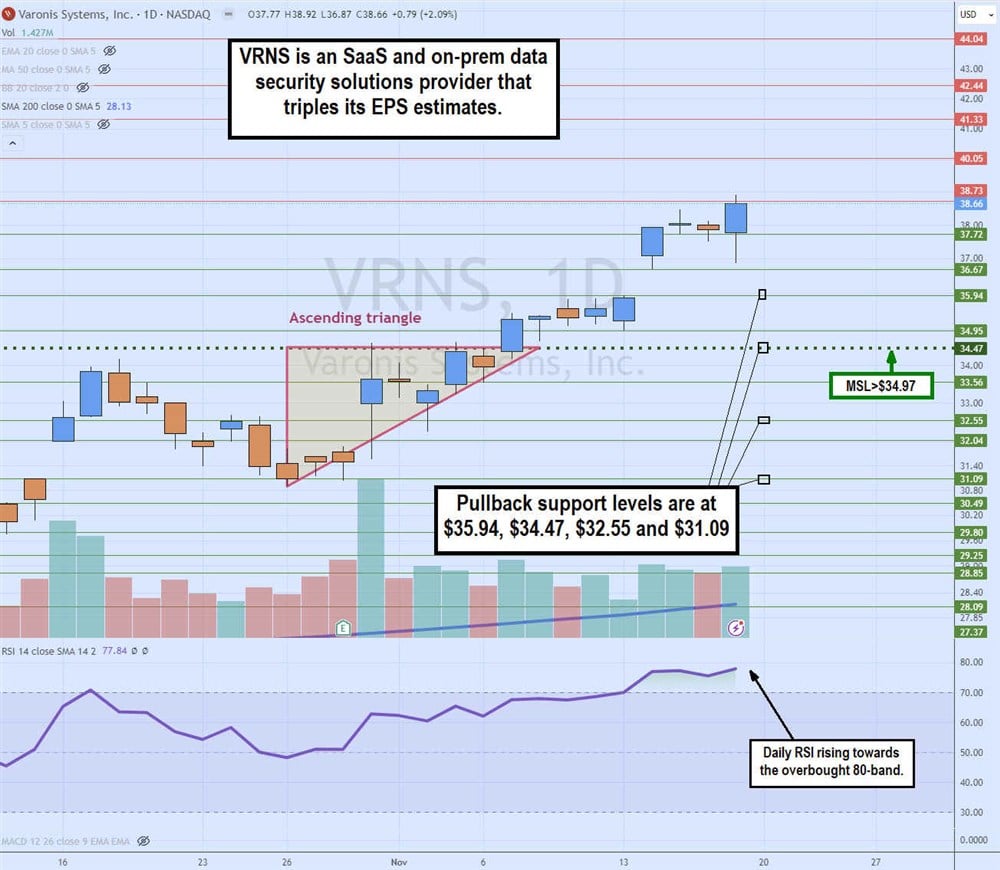

Varonis Systems Inc. (NASDAQ: VRNS)

Varonis Systems is a data security provider offering solutions through its software-as-a-service (SaaS) platform. The company has been transitioning to a SaaS subscription model from on-premise solutions. Varonis exists and operates under the belief that data is the prime target for "bad actors ."While the explosive growth of the cloud and remote work has vastly improved collaboration, it's also made securing data exponentially more difficult. Varonis enables companies to locate, access and secure sensitive data automatically.

Data is the prime target

It offers data management systems enabling customers to manage, organize and protect data through its data security platform. It provides a dozen security products, from data discovery, auditing, access governance, and automated remediation to insider risk, compliance management, and ransomware protection on one unified platform. The company's client list includes well-known brands like The Coca-Cola Co. (NYSE: KO), Toyota Motor Co. (NYSE: TM), NASA, Nasdaq Inc. (NASDAQ: NDAQ) and BlueCross BlueShield.

The SaaS transition is paying off.

On October 30, 2023, Varonis reported Q3 2023 EPS of 9 cents, tripling the analyst estimates for 3 cents. Revenues fell 0.8% YoY to $122.3 million versus $125.45 million consensus analyst estimates. Subscription revenues rose to $97.7 million in the quarter, up from $96.1 million. Annual recurring revenues (ARR) rose 16% YoY to $517.5 million. The SaaS mix of new business and upsell ARR in Q3 was 59%. Cash generated from operations was $49 million, up from $8.4 million in the year-ago period. The free cash flow generated was $46 million, up from $800 thousand in the year-ago period.

Raised Q4 EPS guidance

Varonis sees Q4 2023 EPS of 22 to 24 cents versus 18 cents consensus analyst estimates. Revenues are expected between $150 million to $154 million versus $151.96 million consensus analyst estimates.

CEO Insights

Varonis CEO Yaki Faitelson commented, "Our third quarter results reflect the continued healthy adoption of Varonis SaaS, and approximately 15% of total company ARR now comes from SaaS. The progress of our transition and our faster pace of innovation get us closer to achieving our $1 billion ARR target and delivering meaningful stakeholder value."

Varonis analyst ratings and price targets are at MarketBeat. VRNS is trading up 60.8% YTD and has a 5.53% short interest.

Daily ascending triangle breakout

The daily candlestick chart for VRNS illustrated an ascending triangle breakout. The flat-top resistance overlaps with the weekly market structure low (MSL) trigger at $34.47. The ascending trendline formed at $31.09 on October 26, 2023. VRNS made higher lows on pullbacks heading towards the flat-top trendline resistance as the daily RSI slowly accelerated. The breakout triggered the MSL breakout through $34.97 as the daily RSI surged through the 70-band and headed to the overbought 80-band level. Pullback supports are at $35.94, $34.47 daily MSL trigger, $32.55 and $31.09.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.