Financial News

Building the Future of Exchanges: Prospects and Opportunities for TEX

Currently, centralized exchanges (CEXs) and decentralized exchanges (DEXs) form the foundation of the entire cryptocurrency exchange landscape. According to Coingecko's Q1 2023 industry report, while DEXs still account for only about 15% of cryptocurrency trading volume, their market share is steadily growing.

In the long run, not just exchanges but the entire financial industry is gradually shifting towards decentralized finance, and this trend is becoming increasingly clear. Centralized exchanges rely entirely on operators who can only be restrained by ethics, and human ethics are unreliable. Even compliant exchanges like Coinbase face various issues. Therefore, all centralized financial institutions must undergo strong and rigorous regulation.

In contrast, decentralized finance, especially decentralized exchanges, does not require regulation because blockchain technology itself serves as a regulator, often even more effectively than traditional oversight. However, why do decentralized financial systems, especially decentralized exchanges, still occupy a small market share? What are the fundamental reasons behind this?

What Makes a High-Quality Exchange?

For a trading user, what do they need?

1.Trust: Custodial risks before, during, and after trading should be transparent and minimized as much as possible.

2.Convenience and User-Friendliness: Ordinary users prefer a trading experience similar to Web2 products, with low entry barriers, fast exchange speeds, and low transaction fees.

3.Best Prices: Users want the best possible prices or prices close enough that they don't worry about finding a better deal elsewhere.

4.Transparent Information: Users expect all trading data and activities to be fair and transparent, ensuring that others don't get better prices or lower fees.

5.Strong Liquidity and Wide Asset Coverage: Rich trading pairs with deep liquidity provide users with confidence in obtaining good prices.

Smart contracts are highly suitable for running exchanges: they commodify trust, making custody, fees, prices, and settlements equally transparent and allowing anyone to become a market maker.

While blockchain serves as excellent infrastructure for exchanges, the complete transition of trading volume to blockchain hasn't happened yet, and there are reasons for this: the user experience is terrible, high gas fees, and decentralized liquidity lead to low liquidity for traders.

However, this doesn't mean that decentralized exchanges are doomed to fail. There are good solutions that exist and will make DEXs more attractive: Web2-like trading experiences, aggregated and automated liquidity, and cheaper block space on Layer 2.

Building a Better On-Chain Trading Experience

Currently, a new type of exchange called the Transparent Exchange (TEX) is attempting to address the issues of poor user experience, high gas fees, and liquidity depth that plague DEXs.

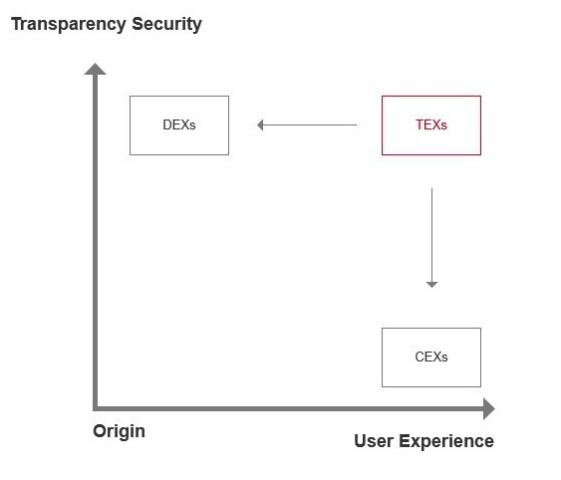

The essence of the Transparent Exchange (TEX) is a new type of exchange designed to bridge the gap between decentralized exchanges (DEXs) and centralized exchanges (CEXs), combining the strengths of both. TEX strives to provide users with the user experience of centralized exchanges while maintaining the transparency and security of decentralized exchanges. By addressing the pain points of DEXs, TEX aims to provide a user-friendly platform that attracts a broader audience.

Compared to decentralized exchanges (DEXs) on the blockchain, TEX offers an experience closer to CEXs and is more user-friendly.

Here are some core features of TEX:

1.Registration and Login: Users can easily register and log in using their phone number or email, making the process as simple as using a Web 2.0 application.

2.Trading Experience: TEX provides professional candlestick charts, a simple and user-friendly trading interface and process. After downloading the app, users can engage in trading activities anytime, anywhere.

3.Trading Depth: On TEX, it aggregates on-chain DEXs' liquidity, such as Uniswap and GMX.

4.Account Recovery: To facilitate secure account recovery, TEX innovatively utilizes smart contract accounts (ERC-4337), account abstraction, and social recovery techniques.

Through these innovations, Transparency Exchange (TEX) is committed to creating a trading platform that combines the advantages of decentralization with the high-quality experience of centralized exchanges.

Competing in the TEX

Certainly, the Transparent Exchange (TEX) still faces strong competition. The current main competitors are major centralized and decentralized exchanges (CEXs and DEXs), each playing a significant role in this competition, each with its own strengths and weaknesses, attracting users, and gaining market share.

In the case of centralized exchanges (CEXs), exchanges like Coinbase, Binance, and OKEX have ample liquidity, a Web2 trading user experience, rich product services, attracting users who are less familiar with decentralized processes or prefer traditional financial institutions.

On the other hand, decentralized projects like DYDX, GMX, Vela, and GNS provide higher transparency, security, and credibility through decentralized design and smart contract execution. They attract users who are already familiar with decentralized processes or prefer secure and transparent solutions.

Currently, both centralized and decentralized exchanges have their share of the market. For TEX to stand out from intense competition, the path to the future remains challenging. However, competition comes with opportunities. In the exchange sector, new rounds of reshuffling occur every few years, presenting challenges and new opportunities for TEX. With the passage of time and market development, new projects and innovative solutions will continually emerge, reshaping the competitive landscape.

The Future Prospects of TEX

In the future, how Transparency Exchange (TEX) can gain market share in this competitive landscape and achieve a Web2 user experience while ensuring safety and transparency is a question worth exploring.

To ensure the long-term healthy development of Transparency Exchange (TEX), the first step is to design a simpler and more convenient registration, login, and trading process to lower the entry barrier for users and enhance the user experience. The simple and repeatable operation of signing transactions without the need for private key signatures brings a smooth, Web2-like experience, attracting more participants to the TEX market.

Ensuring safety and transparency is equally crucial. For example, mechanisms such as on-chain transaction data visibility, asset self-custody, and ERC-4337 account recovery can effectively prevent malicious behavior and clandestine operations, providing users with trust and enhancing platform stability and reliability.

Additionally, having sufficient liquidity is key to achieving long-term healthy growth for TEX. By building its own decentralized contract exchange application (APP) based on infrastructure like GMX/GNS/Vela/Uniswap (including liquidity), TEX can directly access third-party liquidity, providing users with a seamless trading experience without worrying about liquidity issues.

Based on these insights, it is believed that the future competition for TEX will focus on two critical opportunities: Web2.0 experience and safety and transparency. By combining these two aspects, TEX can create a more convenient, secure, transparent, and liquid trading platform.

In conclusion, TEX, as an essential part of the exchange sector in the blockchain industry, competes with its unique solutions and features. As time passes and the market evolves, Transparency Exchange (TEX) will continuously adapt, bringing new competitive dynamics and opportunities.

Website: https://www.tsp.exchange/

Twitter: https://twitter.com/Tsp_exchange

Discord: https://discord.com/invite/yu7a6SDfwM

Medium: https://medium.com/@Tsp_Exchange

Tsp.exchange beta 1.0 test: https://www.tsp.exchange/Downlond_app.html

Test tutorial: https://tsp-exchange.gitbook.io/tsp.exchange/help-center/guide/testing-guide

Media Contact

Company Name: Tsp.exchange

Contact Person: Kara

Email: Send Email

Phone: +66 0807428497

Country: Singapore

Website: https://www.tsp.exchange/

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.