Financial News

Gold and Silver Exploration Co. Brigadier Gold (Stock Symbol: BGADF) is now a Reporting Company with OTC Markets

By:

EIN Presswire

April 21, 2021 at 11:29 AM EDT

Gold and Silver Exploration Co. Brigadier Gold (Stock Symbol: BGADF) is now a Reporting Company with OTC Markets

Brigadier Gold Limited (OTCMKTS:BGDAF)

I am thrilled to join THE BGADF TEAM alongside top tiered Geologist Michelle Robinson, whose passion and plan to execute an aggressive drill program on Brigadier's Picachos Project ”

MARKHAM, ONTARIO, CANADA, April 21, 2021 /EINPresswire.com/ -- Gold and Silver Exploration Co. Brigadier Gold (Stock Symbol: BGADF) is now a Reporting Company with OTC Markets— Mr. Robert Birmingham BGADF Director, President and CEO

BGADF sees Steady Progress at their Gold & Silver Mining Property in Mexico

Experienced New CEO Appointed and Company Finances Strengthened

Proven Precious Metals and Minerals Properties Under Development.

Diamond Drill Program Fully Funded with $4.2 Million Raised.

Phase 1 of Current Sample Drilling Project Nearing Completion.

Closing of $1,000,000 Non-Brokered Private Placement.

Debt Settlement Completed, Retiring $100,000 of Indebtedness.

Brigadier Gold Limited (OTC: BGADF) (TSXV: BRG) (FSE: B7LM), based in Vancouver, BC, was formed to leverage the next major bull market in the natural resource sector, particularly precious metals. The BGADF company mandate is to acquire undervalued and overlooked mining projects with demonstrable potential for advancement. Led by a management team with over 100 years of collective experience in mineral exploration and capital markets development, BGADF is focused on advanced exploration opportunities in politically stable jurisdictions with current operations in Mexico and Canada.

BGADF is currently focused on a first-ever diamond drill program on its 100% controlled Picachos project in mineral rich Mexico, targeting mineralized veins underneath and surrounding the historical high grade San Agustin gold mine located on the property. The BGADF diamond drill program is fully funded with $4.2 million raised since June of 2020.

The BGADF Picachos land package was methodically assembled by Michelle Robinson (MASc, PEng, geologist, 43-101 QP) over 10 years ago. Ms. Robinson has worked in Mexico for over 20 years with a number of major mining companies. She has authored over 20 technical reports and published several papers for the Society of Economic Geologists. Ms. Robinson and her team are executing on the company’s 5,000-metre diamond drill program -- the first ever on this project.

Brigadier Continues Phase-1 Exploration at Picachos High Grade Gold-Silver Property

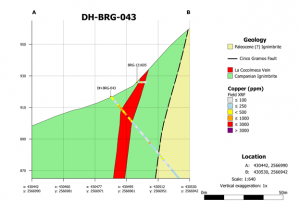

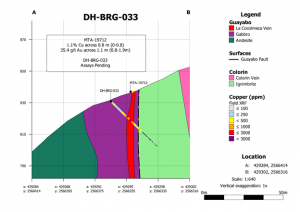

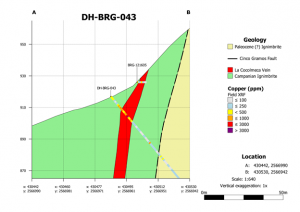

On April 1st BGADF announced it continues to drill its Picachos gold-silver project, Sinaloa, Mexico. To date 4538 metres of the planned 5000-meter phase-1 diamond drill program has been completed in 43 holes with assays for 15 holes pending. Currently, the drill is testing Punto Cinco, a recently discovered outcrop of the Cocolmeca Vein located about 1.2 kilometres northeast of San Antoñio.

The principal target of the BGADF phase-1 campaign was the ENE trending Colcomeca Vein system that trends for more than 7 kilometres along the diagonal of the Property. This structure was tested in the winter of 2020 near the San Agustín Mine portal, and under the historic San Antoñio Mine 2.6 kilometres northeast of San Agustín. In the spring of 2021, Brigadier tested under the historic Guayabo Mine, located 180 metres southwest of San Antoñio.

Mineralization at Guayabo is hosted near the faulted contact of andesitic volcanics of probable Jurassic age that are intruded by megacrystic gabbro of probable Early Cretaceous age with intermediate ignimbrites that are correlated to the Socavon member of the Late Cretaceous Tarahumara Volcanic arc.

Several stages of mineralization are apparent from inspection of the drill core: (i) pervasive silicification with disseminated sulfide that is oxidized to hematite, (ii) crustiform quartz veining with sulfides, and (iii) cockade breccias in the central part of the structure. These breccias consist of angular rock fragments that are altered to a soft black mica on fragment margins. These altered rock fragments are surrounded by mamillary quartz interbanded with sulfide that is oxidized to hematite and oxidized copper minerals such as chrysocolla.

At Punto Cinco, the Socavon member is faulted against rhyolitic volcanics and ignimbrite that probably correlate to the Paleocene-Eocene Productive Volcanics mapped at other locations in the western Sierra Madre such as the Tayoltita gold-silver mine in Durango. At Punto Cinco, rocks altered by pervasive silicification and deposition of disseminated sulfide were brecciated to aggregate breccia (a breccia formed of quartz fragments) prior to mineralization by crustiform quartz. Like Guayabo, the central part of the structure is marked by cockade breccia, angular rock fragments with crustiform mammillary bands. At Punto Cinco, these bands include delicate encrustations of zonal rose quartz interbanded with oxidized copper minerals and hematite.

Appointment of New Director, President and CEO

BGADF also announced, subject to approval by the TSX Venture Exchange, that Mr. Robert Birmingham has been appointed as a Director, President and Chief Executive Officer of the Company. Mr. Birmingham has over 15 years of public markets experience, with a focus on management, investor relations and capital raising. He is currently CEO and Director of New Destiny Mining Corp. (TSX.V: NED), and Director of BIGG Digital assets (CSE: BIGG). He has been on the board of multiple TSX.V and CSE listed companies. Mr. Birmingham holds of Bachelor of Business Administration from Capilano University.

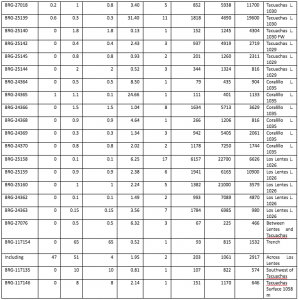

BGADF Discovers and Samples Several Historic Underground Mines at its Picachos High Grade Gold-Silver Property

On March 22nd BGADF announced the discovery, and systematic sampling of over two dozen historic underground workings at its Picachos gold-silver project, Sinaloa Mexico.

BGADF has rehabilitated, mapped and sampled 29 newly discovered historic mine workings in the central part of the Property near the intersection of the ENE trending Cocolmeca Vein system (CVS) and northwesterly trending El Placer system. The underground workings are concentrated in two areas named El Cobre and El Placer Norte. Having discovered, accessed and sampled these underground workings was an efficient and inexpensive way to improve BGADF knowledge of the mineralizing systems at Picachos.

• Closing of $1,000,000 Non-Brokered Private Placement

On March 16th BGADF announced that the non-brokered private placement previously announced on February 19, 2021 had been closed. BGADF issued 5,000,000 Units at a price of $0.20 per Unit for gross proceeds of $1,000,000. Each Unit was comprised of one (1) common share in the capital of BGADF (each a "Common Share") and one (1) non-transferrable Common Share purchase warrant (each a "Warrant"). Each Warrant entitles the holder to purchase one Common Share at a price of $0.30 per Common Share until March 16, 2022. All dollar amounts in this release are expressed in Canadian dollars, unless otherwise stated.

In connection with the Offering, BGADF paid a total of $42,840 in cash finder's fees and issued 214,200 finder's warrants to qualified non-related parties, in accordance with the policies of the TSX Venture Exchange. Each Finder's Warrant entitles the holder to purchase one Common Share for $0.30 until March 16, 2022. All securities issued under the Offering, including securities issuable on exercise thereof, are subject to a hold period expiring July 17, 2021.

Proceeds from the Offering will be used to fund exploration at the BGADF Picachos and Killalla Lake properties, corporate marketing campaigns, and general working capital purposes.

Completion of Debt Settlement

On February 11th BGADF announced that it has received approval from the TSX Venture Exchange to complete the debt settlement previously announced on January 27, 2021, with one arm's length creditor. The Debt Settlement resulted in an aggregate of $100,000.00 of indebtedness being retired in consideration for the issuance of 454,545 common shares at a price of $0.22 per share. The Debt Settlement did not result in the creation of a new insider or control person. The common shares issued under the Debt Settlement are subject to a four-month resale restriction expiring June 12, 2021.

For more information on Brigadier Gold Limited (BGADF) visit: https://www.brigadiergold.ca

DISCLAIMER: FrontPageStocks/CorporateAds.com (CA) is a third-party publisher and news dissemination service provider. FPS/CA is NOT affiliated in any manner with any company mentioned herein. FPS/CA is news dissemination solutions provider and are NOT a registered broker/dealer/analyst/adviser, holds no investment licenses and may NOT sell, offer to sell or offer to buy any security. FPS/CA’s market updates, news alerts and corporate profiles are NOT a solicitation or recommendation to buy, sell or hold securities. The material in this release is intended to be strictly informational and is NEVER to be construed or interpreted as research material. All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. All material included herein is republished content and details which were previously disseminated by the companies mentioned in this release or opinion of the writer. FPS/ CA is not liable for any investment decisions by its readers or subscribers. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. FPS/CA has been compensated $500 by the company for dissemination of this Article.

Disclaimer/Safe Harbor:

These news releases and postings may contain forward-looking statements within the meaning of the Securities Litigation Reform Act. The statements reflect the Company’s current views with respect to future events that involve risks and uncertainties. Among others, these risks include the expectation that any of the companies mentioned herein will achieve significant sales, the failure to meet schedule or performance requirements of the companies’ contracts, the companies’ liquidity position, the companies’ ability to obtain new contracts, the emergence of competitors with greater financial resources and the impact of competitive pricing. In the light of these uncertainties, the forward-looking events referred to in this release might not occur.

SOURCE: CorporateAds.com

Ranjeet Sundher

Brigadier Gold Limited

+1 604-377-0403

email us here

Visit us on social media:

Twitter

Brigadier Gold (TSXV: BRG | US: BGADF | Frankfurt: B7LM) On The Crest Of A Mexican Gold Renaissance

More News

View More

Tesla’s Robotaxi Goes Unsupervised: Is the Rally Justified? ↗

Today 18:12 EST

Via MarketBeat

UAL Stock Taking Flight After Earnings Confirm Strong Demand ↗

Today 17:26 EST

Via MarketBeat

Why Apple’s Sell-Off May Be Overdone Right Before Earnings ↗

Today 16:44 EST

Via MarketBeat

Tickers

AAPL

Via MarketBeat

Tickers

QCOM

Via MarketBeat

Tickers

HAL

Recent Quotes

View More

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.