Financial News

PensionBee Analysis Finds Left-Behind 401ks May Cost Americans $90,000 by Retirement

Job hopping early in your career can leave you vulnerable to predatory Safe Harbor IRAs, according to new research by online retirement provider PensionBee.

In today’s dynamic job market, frequent career moves are common, especially among younger professionals. However, this trend has led to a growing issue: abandoned 401(k) accounts. Recent estimates indicate that over 29 million forgotten 401(k) accounts exist in the U.S.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250603378769/en/

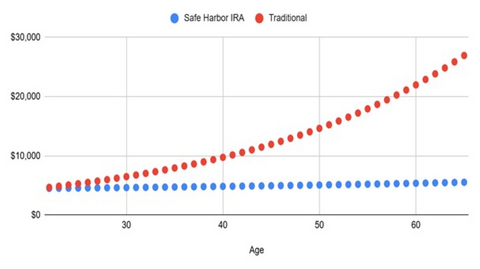

Figure 1: Projected Impact of Default Type on $4,500 Account. The values in this figure represent hypothetical scenarios of investment growth over a 45 year timeline. The calculations estimate the return differential between default options, assuming a 5% annual return with a 0.85% annual fee for “Traditional” and 2% annual return with a $75 annual fee for “Safe Harbor IRA.”

To make matters worse, when employees leave behind small 401(k) balances - under $7,000 - employers can transfer these funds into Safe Harbor IRAs without the employee's consent to help manage high volumes of inactive accounts.

PensionBee examined the impact of this common administrative practice, revealing the stark return differential between Safe Harbor IRAs and traditional retirement accounts. Americans who leave behind just a handful of accounts early in their careers can lose out on over $90,000 by the time they retire.

The Three-Fold Problem

Safe Harbors IRAs are designed to preserve rather than grow capital. Previous market analysis by PensionBee found that combined high fees and low returns of many mainstream providers work against this goal, and may even deplete forgotten retirement accounts to $0.

The problem is threefold:

First, mandated ultra-conservative investments. Regulations require Safe Harbor IRAs to use low-risk investments, usually offering far below standard retirement portfolio returns, often below the rate of inflation. Many Safe Harbor IRA providers use bank deposits with very low interest rates, sometimes as low as 0.5%.

Second, many providers charge excessive fees that devour returns. Unlike 401(k) plans, which have an average fee of approximately 0.85%, Safe Harbor IRAs charge seemingly small monthly fees ($1-$5) that quickly accumulate. One provider charges $5.67 monthly plus 0.5% annually—on a $3,500 account, that's $85.54 yearly (2.4%) before additional withdrawal fees of $75 per transaction. These fees often exceed any earnings and actively deplete principal.

Third, interest skimming. Certain providers have been known to pay less than 1% interest while prevailing rates exceed 4%, taking substantial portions of investment returns as a “bank servicing fee.”

The Generational Toll

Younger workers face a perfect storm. Not only do Gen Zers change jobs often, but they are also opening retirement accounts earlier than ever before. The average Gen Zer starts saving for retirement at age 22, compared with Millennials, who began at 27, Gen X, whose average age was 31, and Boomers, who didn’t start until the age of 37.

The combination of changing jobs more frequently and opening retirement accounts earlier than their predecessors creates a dangerous vulnerability. Gen Z is more likely to accumulate multiple small 401(k) accounts that are prime targets for automatic transfers to Safe Harbor IRAs, which were never meant to be long-term investing vehicles. Our system quietly undermines their early start through these forced transfers to low-yield investments.

The lack of transparency compounds the problem. This isn't merely a different default option; it's a fundamentally different investment approach with dramatically reduced growth potential.

The Compounding Problem

PensionBee’s latest research compared growth trajectories of Safe Harbor IRAs (~2% returns) and 401(k) investments (~5% returns), to model the difference in returns between employees whose small balances are forced into low-yielding accounts and those who are not.

The findings suggest that automatic rollovers into Safe Harbor IRAs with low-yielding accounts harm former employees and can lead to an exponential difference in returns across several accounts.

For illustrative purposes, the analysis looks at a typical worker who:

- Job hops between the ages of 20 and 30, leaving behind a 401(k) every two years (five total)

- Has a starting salary of $50,000 that grows 10% with each new job

- Retirement balances are calculated as 3% of that salary annually, with 50% employer match vested

PensionBee's analysis shows that a typical 20-year-old worker who leaves behind a $4,500 retirement account will see it grow to just $5,507 by retirement age if left in a typical Safe Harbor IRA. Had that same amount been rolled over to a traditional 401(k) earning 5%, it would grow to $25,856, a difference of over $20,000 from a single account.

The impact compounds dramatically with multiple job changes. Someone who switches jobs every two years in their 20s and rolls over their accounts each time saves over $90,000 more by retirement than someone who leaves them in Safe Harbor IRAs. This difference exceeds the median American retirement savings of $87,000.

How to Protect Your Retirement Savings

- Check Account Size: Know your balance when leaving a job, as accounts under $7,000 may be automatically transferred to Safe Harbor IRAs. If your account is under $1,000, it may be cashed out automatically, triggering taxes and penalties.

- Know Your Options: You generally have four choices for your retirement account when switching jobs: keep it with your former employer, transfer it to an IRA, move it to your new employer's plan, or cash out, potentially triggering penalties and taxes.

- Update Contact Information: Ensure all retirement account providers have your current contact information to prevent account transfers without your knowledge.

- Take Timely Action: Make decisions about your retirement funds within 30 days of leaving a job to prevent automatic transfers.

Bottom Line

The silent drain of retirement savings through inadequate Safe Harbor IRAs remains largely invisible to millions of Americans who switch jobs regularly. Most job-hoppers assume their retirement accounts are safe, even if unaccounted for. Instead, forgotten accounts may be eroded by excessive fees and low returns, potentially costing thousands in retirement savings.

"Safe Harbor IRAs represent a critical blind spot in America's retirement system," notes Romi Savova, CEO of PensionBee. "The lack of transparency in these accounts is particularly troubling, as most assume that the money they put towards their retirement will remain theirs. The difference between investment defaults matters enormously."

Savova emphasizes that "these seemingly small default decisions have profound long-term consequences for savers. Greater transparency around default investment strategies would empower consumers to make informed choices about their financial future."

About PensionBee

PensionBee is a leading online retirement provider, helping people easily consolidate, manage, and grow their retirement savings. The company manages approximately $8 billion in assets and serves over 275,000 customers globally, with a focus on simplicity, transparency, and accessibility.

Notes

The information provided in this announcement, including any projections for investment returns and future performance, is for informational and educational purposes only and should not be considered investment advice. Past performance is not indicative of future results. All investments carry risk, including the potential loss of principal. PensionBee is not liable for any losses or damages arising from the use of this information. Projections and forecasts are based on assumptions and current market conditions, which are subject to change.

PensionBee Inc. is registered with the Securities and Exchange Commission as an investment adviser. We do not provide in-person advice. PensionBee Inc (Delaware Registration Number SR20241105406 ) is located on 85 Broad Street, New York, New York, 10004. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20250603378769/en/

This isn't merely a different default option; it's a fundamentally different investment approach with dramatically reduced growth potential.

Contacts

Adela McVicar

adela.mcvicar@pensionbee.com

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms Of Service.