Financial News

Ionic Digital Reports Preliminary Fiscal Year 2024 Earnings

Preliminary FY 2024 Financial Results Reflect Foundation-Setting Progress in Inaugural Year of Operation

FYE 2024 Preliminary Financial Results Highlights

- Bitcoin Mining Revenue of $138.4 million

- Operating Income of $42.3 million

- Adjusted EBITDA of $84.6 million

- Cash and Bitcoin of $271.8 million

- Bitcoin Held in Treasury 2,398.8 BTC

Ionic Digital Inc., (“Ionic” or the “Company”), a digital infrastructure and cryptocurrency mining company, today issued preliminary earnings for its inaugural year of operations from the first day of operation following the Company’s acquisition of the mining assets of Celsius Mining LLC (“Celsius Mining” or the “Predecessor Entity”) on January 31, 2024, through December 31, 2024 (the “eleven months ended December 31, 2024”). The Company expects to report Operating income of $42.3 million, driven by $138.4 million of bitcoin (“BTC”) mining revenue and an increase to the fair value of BTC totaling $77.3 million. These preliminary results are subject to the completion of the independent audit by its external auditors and, as such, are subject to material adjustment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250626954899/en/

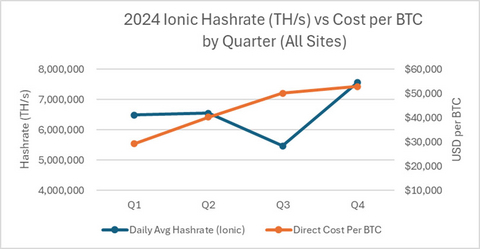

Figure 1 - Note: Direct Cost Per BTC is calculated by dividing total direct costs of revenue by the number of BTC mined during the eleven months ended December 31, 2024. This figure excludes miner depreciation and is reported net of curtailment credits, providing a clear measure of cash production efficiency and cost discipline.

“Ionic Digital’s inaugural year of operations and 2024 financial performance reflects a critical foundation-building phase that laid the groundwork for future growth, marked by solid revenue generation and execution of the Company’s strategic transition from hosted sites to a self-mining operation through investment in our operating sites, particularly Cedarvale,” said Interim CEO, Anthony McKiernan. “Expenses in FY 2024 were partially driven by front-loaded fixed-asset development and post-bankruptcy related vendor and advisory costs, which we are working toward significantly reducing going forward, and bodes well for future profitability.”

“As we look ahead, with our core bitcoin holdings of 2,398.8 BTC at year end and 2,520.2 BTC as of May 31, 2025, robust liquidity, and zero debt position, Ionic is well-positioned to pursue future growth opportunities both within and outside of the BTC mining sector to maximize shareholder value. We are also advancing with shareholder liquidity initiatives and expect to complete required filings to achieve liquidity solutions for shareholders in short order.”

Summary of Key 2024 Preliminary Financial Results*:

Operations for the eleven months ended 12/31/24* |

($ millions) |

Mining Revenue |

$138.4 |

Cost of Revenue |

($90.6) |

Depreciation Expense |

($42.4) |

Administrative Expenses |

($39.7) |

Gain on Fair Value of BTC |

$77.3 |

Operating Income |

$42.3 |

*These results are preliminary and subject to material adjustment pending completion of the audit by Ionic’s external auditor. |

During the eleven months ended December 31, 2024, the Company mined 2,075.5 BTC, net of mining pool fees, as the concentration of deployed miners transitioned from 36,000 miners at hosted sites and 27,581 miners at Company-owned sites to 20,949 miners at hosted sites and 88,986 at Company-owned sites by fiscal year end. Upon Ionic’s acquisition of mining assets from Celsius Mining, the Company’s mining facilities at both Company-owned and hosted sites had 229 megawatts (“MW”) of total energy capacity, of which 38% was attributable to Ionic-owned sites. As of December 31, 2024, the Company had expanded its total energy capacity to 357 MW, of which 265 MW, or 74%, was attributable to Ionic-owned sites.

With the closing price of BTC on December 31, 2024, at $93,354.22, the Company’s total appreciation of BTC in treasury amounted to $77.3 million for the eleven months ended December 31, 2024. During 2024, the Company employed a hold strategy for its BTC, selling only when necessary to fund cash operating expenses.

Cost of Revenue consists primarily of energy costs and hosting contract fees. Energy cost for the eleven months ended December 31, 2024, totaled $29.1 million, with the average cost per kWh for Ionic-owned sites amounting to 3.93 cents per kWh before curtailment credits and 3.53 cents per kWh after curtailment credits earned during the period. The Company actively manages its mining operations and uses a curtailment strategy to employ a disciplined approach to BTC mining focused on profitability on a real-time basis. The Company assumed three material hosting contracts from Celsius Mining, two of which were partially or fully terminated in October and November 2024. Hosting fees paid in accordance with the three contracts totaled $51.2 million for the eleven months ended December 31, 2024. Ionic expects hosting fees to decline substantially going forward, with one ongoing hosting contract continuing to support operations.

Administrative expenses of $39.7 million in part reflected significant costs related to transitioning management of the mining assets acquired from Celsius Mining as of January 31, 2024, with consulting and finance related expenses of $10.1 million and legal expenses of $5.3 million.

For the eleven months ended December 31, 2024, the Company’s Adjusted EBITDA, a non-GAAP measure that eliminates non-recurring other income and expenses, depreciation, taxes, tax-related impacts, interest income and expense, is equal to operating income less depreciation, or $84.6 million. This metric eliminates the impact of any goodwill impairment that may be recorded, as well as the realized gain on litigation settlement of $6.8 million, which represents a one-time benefit to Ionic as a result of the resolution of disputes over a hosting contract terminated by the Predecessor Entity.

Key Performance Indicators

Key Mining and Operating Metrics |

|

Total Fleet |

As of and for the eleven months ended 12/31/24 |

Capacity (MW)¹ |

357.0 |

Efficiency (J/THs)² |

30.5 |

Daily Average Hash Rate (EH/s)³ |

6.5 |

BTC Mined⁴ |

1,988.6 |

Average BTC/Day |

6.2 |

Bitcoin Sold⁵ |

150.0 |

BTC Holdings⁶ |

2,398.8 |

¹ Total current capacity available at hosted and directly owned sites. |

² Represents the capabilities of 106,373 active miners as of 12/31/2024 |

³ The reported hash rate is derived from internal performance data. Hash rate values reflect miner downtime and voluntary curtailment. |

⁴ BTC mined after hosting fees of 87.0 BTC |

⁵ Total BTC sold for an average of $67,341 per coin |

⁶ BTC Holdings includes 5.4 BTC earned but in transit as of year-end. The BTC Holdings acquired from the Predecessor Entity totaled 560.2 BTC |

For the eleven months ended December 31, 2024, Ionic achieved a daily average hash rate of 6.52 EH/s, despite curtailment and downtime that impacted performance in the second half of the year and mined 1,988.6 BTC net of hosting fees – an average of 6.2 BTC per day. To support operations, the Company sold 150.0 BTC during the eleven months ended December 31, 2024, at an average realized price of $67,341.

As noted in Figure 1 and Figure 2, Ionic’s cost to mine a bitcoin reflects the operational realities of each quarter, including fluctuations in curtailment, network difficulty, and site-level availability. While Company-wide direct cost per BTC rose in the third and fourth quarters due to lower production and elevated power costs, Ionic’s owned sites demonstrated stronger cost control and efficiency, particularly in the fourth quarter as the Company increased output. The Company remains focused on controlling its owned direct cost per BTC through continued optimization of infrastructure and strategic capital investment.

Select 2024 Preliminary Balance Sheet Results*

Key Balance Sheet Assets as of 12/31/2024 |

($ millions) |

Cash and equivalents |

$48.4 |

Digital Assets (BTC held) |

$223.4 |

Property, Plant and Equipment |

$286.8 |

Key Balance Sheet Liabilities as of 12/31/2024 |

($ millions) |

Accounts and Taxes Payable |

$3.6 |

Accrued Expenses |

$9.0 |

Debt/Financing Obligations |

$0.0 |

Deferred Tax Liabilities |

$13.4 |

Other Liabilities |

$5.0 |

*These results are preliminary and subject to material adjustment pending completion of the audit by Ionic’s external auditors. |

Cash and Digital Assets

As of December 31, 2024, the Company held $48.4 million of cash and cash equivalents to cover anticipated expenses and provide a comfortable cushion of liquidity in the event of a BTC market disruption. In addition, the Company’s BTC held in treasury totaled 2,398.8 as of December 31, 2024.

Fixed Assets

Property and equipment are stated at cost, less depreciation accumulated using the straight-line method over the estimated useful lives of the assets. Property and equipment of $286.8 million consisted primarily of mining equipment and the buildings and improvements located at Ionic-operated facilities (Cedarvale and Midland, TX sites). Capital expenditures incurred by the Company during the eleven months ended December 31, 2024, (after Ionic’s acquisition of the mining assets from Celsius Mining on January 31, 2024) totaled $73.9 million and were primarily related to construction requirements at its Cedarvale site.

Balance Sheet Liabilities

Liabilities totaling $31.1 million as of December 31, 2024, consisted of short-term ordinary course of business payables, a deferred tax liability, and liabilities assumed from the Predecessor Entity that are currently in arbitration. The Company holds no short- or long-term debt instruments.

Financial Audit Outstanding Items

The audit for the year ended December 31, 2024, which includes an audit of (a) the Predecessor Entity for the one-month period-ended January 31, 2024, and (b) Ionic for the eleven months ended December 31, 2024, is not yet complete. The primary remaining GAAP analysis relates to the potential impairment of the goodwill arising from the acquisition of the mining assets from the Predecessor Entity. The Company anticipates that the result of that impairment analysis will not impact the preliminary Revenue or Adjusted EBITDA results reported herein, nor will it impact the operations or management’s strategic plan. Any recorded goodwill impairment will impact GAAP Net Income and Income Tax Expense on the statement of operations, as well as the goodwill recorded to the balance sheet. It is important to management that the reported financial statements reflect full transparency and proper values prior to utilizing them for future regulatory filings, and the Company will publish the full audited financial statements and notes to the financial statements upon completion.

About Ionic Digital

Ionic Digital is a prominent Bitcoin miner and emerging innovator in energy monetization. With facilities across the United States and more than 110,000 active miners, Ionic expects to drive the next generation of energy efficient, low cost computing through sustainable Bitcoin mining. For more information, visit ionicdigital.com and follow us on X at @IonicDigital.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250626954899/en/

Contacts

Media

Pr@ionicdigital.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.