Financial News

PULSE® Study Finds Debit’s Importance to Consumers Continues to Increase

Card-Not-Present Transactions Account for 45% of Debit Spend; 38% of Debit Cards are Loaded into Mobile Wallets

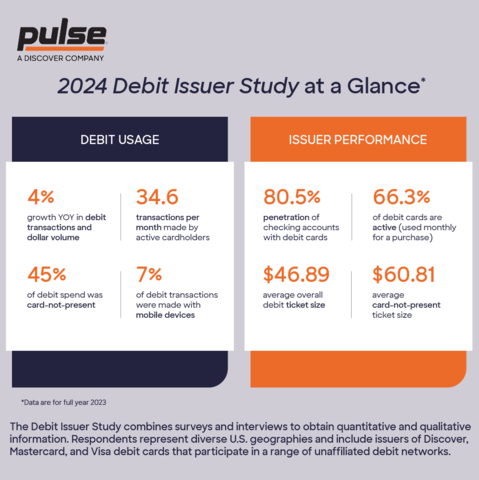

More U.S. consumers are using debit for more transactions and are spending more in the process. The 2024 PULSE Debit Issuer Study, commissioned by Discover® Financial Services’ PULSE debit network and conducted by Banking & Payments Group, finds the total number of debit cards, transactions, and annual spend per active card all increased in 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240808048611/en/

The 2024 PULSE Debit Issuer Study found more U.S. consumers are using debit for more transactions and are spending more in the process. (Graphic: Business Wire)

“The ease and convenience of debit has made it a cornerstone of the retail banking customer experience,” said Steve Sievert, executive vice president of Marketing and Brand Management with PULSE. “With active cardholders now using debit for more than 400 transactions per year, a debit card serves as a daily reminder of the value of the relationship between a consumer and their financial institution.”

Debit Used Daily

The 2024 Debit Issuer Study found the number of debit transactions is growing faster than spend. Active cardholders completed 34.6 transactions per month in 2023, including 30.7 point-of-sale (POS) transactions, 2 account-to-account transfers, and 1.9 ATM transactions. POS use grew at an average annual rate of 4.4% between 2018 and 2023. The average debit ticket size was $46.89 in 2023, an increase of 3.4% per year, on average, over the period. Annual spend per active card was $17,274, up an average 8.1% per year between 2018 and 2023.

Issuers reported a debit penetration rate (percentage of accounts with an associated debit card) of 80.5%, improving by an average 0.6% per year between 2018 and 2023. Debit card active rates (the percentage of debit cards used regularly) declined slightly (-0.2% per year) over the period to 66.3% in 2023.

Card-not-Present (CNP) Gained Share

U.S. consumers continue to adopt new ways to use debit, including without a physical card. Issuers reported that CNP transactions accounted for 36% of debit transactions and 45% of debit spend in 2023, an increase of 5.2% year-over-year (YOY). The average CNP ticket size increased 2.8% YOY to $60.81.

Mobile and Digital Trends

Mobile devices originated 7% of all debit transactions and 15% of in-store contactless payments in 2023. While all surveyed issuers support provisioning debit cards into digital wallets such as Apple Pay and Google Pay, 38% of debit cards are actually loaded into digital wallets. Apple Pay remains the most popular digital wallet.

Issuers reported an average of three digital wallet transactions per active card per month in 2023, with an average value of $27.69. This is approximately 40% lower than the overall average debit ticket, reflecting a mix of small-ticket in-person payments and small in-app purchases.

Digital issuance, through which an institution pushes debit card credentials directly to the digital wallet prior to physical card issuance, is the number one new capability issuers plan to introduce. Half of issuers reported plans to add digital instant-issuance capabilities. Benefits of digital issuance include superior convenience, no lag to use, and significant cost savings for the institution.

Debit Faces Shifting Dynamics

In addition to benefiting from debit’s continued growth and evolution, issuers are responding to three macro trends impacting debit:

- A pending reduction in Regulation II’s interchange cap for covered issuers (those with $10 billion or more in assets).

- Increased competition from both traditional institutions and digital challengers.

- The potential impacts of real-time payments growth.

As issuers respond to these developments, they revealed three key priorities for the remainder of 2024 and into 2025:

- Continue to optimize penetration, active, and usage rates.

- Strengthen their fight against fraud.

- Invest in new digital capabilities, such as instant digital issuance and cardholder visibility into recurring payments.

For more information, visit the PULSE Debit Issuer Study resource center.

About the Study

The 2024 Debit Issuer Study is the 19th installment in the study series, commissioned by PULSE and conducted by Banking & Payments Group, an independent management consulting firm that specializes in the retail payments market. The study provides an objective fact base on debit issuer performance and financial institutions’ outlook for the debit business. Study respondents included large banks, credit unions and community banks. The sample is representative of the U.S. debit market in terms of institution type, geography and debit network participation.

About PULSE

PULSE is a leader in debit payments, global cash access, and account transfers, and we deliver exceptional value, choice, and convenience to clients across the payments ecosystem. We enable reliable and secure digital money movement for a wide variety of debit card programs through our PULSE Network, the Discover® Debit program, an advanced fraud-detection platform, and partner-support services. Our commitment to continuous improvement, innovation, and prioritizing the unique business needs of our clients empowers payment solutions that meet the evolving demands of consumers. PULSE is a Discover (NYSE: DFS) company and part of the Discover Global Network. For more information, visit PulseNetwork.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240808048611/en/

Contacts

Anne Uwabor, 832-214-0234

PULSE

anneuwabor@pulsenetwork.com

Dan Keeney, 800-596-8708

DPK Public Relations

dan@dpkpr.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.