Financial News

Generation Mining Provides Update on 2024 Summer Exploration Program

Generation Mining Limited (TSX:GENM, OTCQB: GENMF) ("Gen Mining" or the "Company") is pleased to provide an update on its multi-phased summer exploration program targeting copper dominant and higher-grade palladium group metals (PGM) prospects on its Marathon Property in northwestern Ontario (see news release dated March 7th, 2024). The Company is also pleased to announce initial results from the ALS Goldspot Artificial Intelligence (“AI”) process.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240726949339/en/

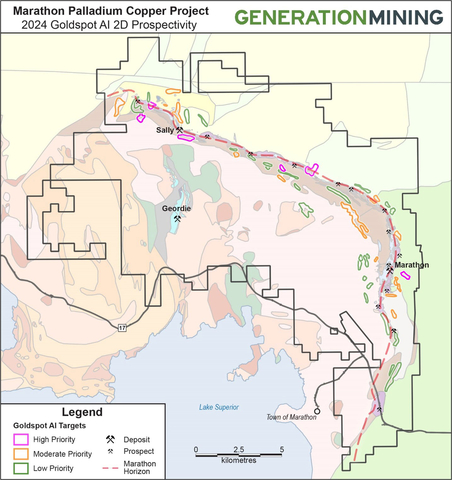

Figure 1: Map showing the 46 priority exploration targets identified by Goldspot during the 2024 2D Prospectivity analysis. Red dashed line shows the approximate location of the main Marathon Horizon along the outer limb of the Coldwell Complex (Graphic: Business Wire)

Jamie Levy, President and CEO commented, “We are very excited to get the first phase of the Goldspot AI process completed on the Marathon Property. The historic site data is now in one place and with the AI-tools being used to assess the exploration and structural data, we have identified 6 new high priority targets that have not previously been drilled and have seen only minimal ground exploration. The AI analysis and recent drilling results should lead to some very interesting future exploration potential.”

Goldspot 2D Prospectivity Analysis

Between March and June 2024, the company engaged ALS Goldspot to review and analyse over 60 years of historic surface exploration data using their AI driven integrated targeting technique. Targets were identified by comparing overlapping geophysical and geochemical signatures to those of known mineralization on the property. The exercise resulted in a total of 46 untested exploration targets, including 6 high priority and 14 moderate priority locations. The higher priority targets were selected based on a range of criteria, such as their similarities to other known deposits and prospects, upside size potential and relatively low density of surface prospecting data which represent some of the best areas for new discoveries on the property. These results will be used to guide several surface stripping and mapping programs being initiated in the coming months. A map of the identified exploration targets can be found in Figure 1.

Diamond Drilling

The diamond drilling portion of the 2024 exploration program has also been completed on the Marathon Property, including the Sally Deposit, Four Dams Prospect and Biiwobik Prospect.

Sally Deposit

Drilling at Sally consisted of a single drillhole targeting a large Magnetotelluric (MT) anomaly down dip from the Sally Deposit.

Drilling was completed to 954 m and encountered a wide interval of mineralization approximately 275m outside the currently defined deposit, highlighting the exceptional expansion potential at Sally. Highlights from this zone include 48 metres at 1.52 g/t PdEq (0.74 g/t Pd, 0.18% Cu, 0.46 g/t Pt, 0.13 g/t Au and 0.94 g/t Ag) including 6.0 metres at 3.42 g/t PdEq (1.91 g/t Pd, 0.03% Cu, 0.46 g/t Pt, 0.39 g/t Au and 0.23 g/t Ag). Results from this hole (SL-24-079) can be found in Table 1 below.

Table 1: 2024 Sally Drilling Location and Orientation

HoleID |

Total Depth |

CollarAzi |

Colar Dip |

Easting UTM NAD83 |

Northing UTM NAD83 |

Elevation |

SL-24-079 |

954 |

348 |

-61 |

537677 |

5412219 |

531 |

Table 2: 2024 Sally Drilling Results

HoleID |

From |

To |

Length1 |

Cu (%) |

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq (%)2 |

PdEq (g/t)3 |

SL-24-079 |

730 |

754 |

24 |

0.29 |

0.02 |

0.02 |

0.02 |

0.88 |

0.35 |

0.50 |

and |

764 |

768 |

4 |

0.08 |

0.81 |

0.92 |

0.02 |

0.30 |

1.11 |

1.63 |

and |

798 |

846 |

48 |

0.18 |

0.74 |

0.46 |

0.13 |

0.94 |

1.04 |

1.52 |

including |

806 |

812 |

6 |

0.03 |

1.91 |

1.35 |

0.39 |

0.23 |

2.34 |

3.42 |

1. All lengths are in metres. Interval lengths of interceptions are assumed to be approximate to true width.

2. The Copper Equivalent (“CuEq”) calculation expressed in % is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one percent of copper in such one tonne sample. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of $1,500, $1,100, $1,800, $26 were used, respectively, for Pd, Pt, Au, Ag and a $3.20/lb value was assigned for Cu.

3. The Palladium Equivalent (“PdEq”) calculation expressed in g/t is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one gram of palladium. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of $1,500, $1,100, $1,800, $26 were used, respectively, for Pd, Pt, Au, Ag and a $3.20/lb value was assigned for Cu.

Four Dams Prospect

Drilling at Four Dams was designed to test the down dip and eastern extension of the Four Dams Prospect, including a large untested Magnetotelluric target 400 metres east of the main Four Dams occurrence.

Drilling on the main Four Dams ultramafic pipe yielded mixed results. FD-24-046 encountered 74 metres of mineralized ultramafic rock grading 0.22% CuEq including 24 metres grading 0.30% CuEq as well as 2.0 metres of basal massive sulphides grading 0.65% CuEq. This mineralized sequence supports the exploration model targeting areas conducive to pooling of potentially high-grade massive sulphides at depth. FD-24-045 drilled approximately 85 metres to the east and FD-24-047 drilled approximately 100 metres to the west did not encounter similar ultramafic rocks and additional drilling will be required to adequately define the true extents of the ultramafic pipe both down dip and along strike. Follow up BHEM surveys will be conducted later in the summer to help define future targets.

Two drillholes completed on the eastern MT anomaly confirmed the MT response is related to mineralization. FD-24-044 targeted the upper portion of the anomaly and yielded 0.23% Cu over 22.0 metres, including 0.47% CuEq over 4.5 metres. FD-24-048 targeted the centre of the anomaly and yielded 0.45% CuEq over 18.0 metres including 0.86% CuEq over 2.0 metres. This under-explored zone represents a significant step out from the currently defined Four Dams prospect and warrants additional drilling to determine its true extent. Results from the Four Dams drilling campaign can be found in Table 4 below.

Table 3: 2024 Four Dams Drilling Location and Orientation

HoleID |

Total Depth |

CollarAzi |

Colar Dip |

Easting UTM NAD83 |

Northing UTM NAD83 |

Elevation |

FD-24-044 |

463 |

30 |

-65 |

548094 |

5408970 |

378 |

FD-24-045 |

510 |

31 |

-56 |

547797 |

5409165 |

376 |

FD-24-046 |

477 |

13 |

-52 |

547797 |

5409165 |

376 |

FD-24-047 |

483 |

27 |

-57 |

547659 |

5409204 |

375 |

FD-24-048 |

537 |

13 |

-73 |

548185 |

5408947 |

381 |

Table 4: 2024 Four Dams Drilling Results

HoleID |

From |

To |

Length1 |

Cu (%) |

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq (%)2 |

FD-24-044 |

406 |

428 |

22 |

0.20 |

0.01 |

0.01 |

0.02 |

0.38 |

0.23 |

including |

422 |

426.5 |

4.5 |

0.42 |

0.01 |

0.02 |

0.03 |

0.39 |

0.47 |

FD-24-045 |

318 |

326 |

8 |

0.11 |

0.06 |

0.20 |

0.42 |

0.30 |

0.60 |

including |

320 |

322 |

2 |

0.25 |

0.14 |

0.43 |

0.91 |

0.80 |

1.32 |

FD-24-046 |

374 |

448 |

74 |

0.20 |

0.00 |

0.01 |

0.01 |

0.52 |

0.22 |

including |

392 |

416 |

24 |

0.29 |

0.00 |

0.01 |

0.00 |

0.81 |

0.30 |

and |

438 |

440 |

2 |

0.59 |

0.02 |

0.03 |

0.03 |

0.85 |

0.65 |

FD-24-047 |

356 |

368 |

12 |

0.12 |

0.10 |

0.06 |

0.07 |

0.58 |

0.28 |

FD-24-048 |

308 |

326 |

18 |

0.25 |

0.16 |

0.04 |

0.07 |

1.31 |

0.45 |

including |

324 |

326 |

2 |

0.55 |

0.17 |

0.02 |

0.18 |

2.70 |

0.86 |

1. All lengths are in metres. Interval lengths of interceptions are assumed to be approximate to true width.

2. The Copper Equivalent (“CuEq”) calculation expressed in % is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one percent of copper in such one tonne sample. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of $1,500, $1,100, $1,800, $26 were used, respectively, for Pd, Pt, Au, Ag and a $3.20/lb value was assigned for Cu.

Biiwobik Prospect

A borehole electromagnetic survey was completed in two holes drilled over the winter at the Biiwobik Prospect.

The survey yielded three strong off hole conductors, two of which were targeted during Phase 2 of the 2024 Biiwobik drill program (see news release dated April 23, 2024, for phase 1 results). MB-24-060 targeted a narrow conductor which extended approximately 100 metres N-NE of mineralization in MB-24-059. Drilling was carried out on the very northern extent of this conductor but did not encounter any significant mineralization. MB-24-061 targeted an off-hole conductor located near the base of the gabbro unit in MB-24-055. The hole encountered multiple mineralized intervals such as 0.58% CuEq over 50.0 metres including 1.50% CuEq over 10.0 metres. The EM target was explained by a 6.0 metre zone of semi-massive sulphides which graded 1.02% CuEq within a broader 12.0 metre zone grading 0.63% CuEq.

Table 5: 2024 Biiwobik Drilling Location and Orientation

HoleID |

Total Depth |

CollarAzi |

Colar Dip |

Easting UTM NAD83 |

Northing UTM NAD83 |

Elevation |

MB-24-054 |

474 |

86 |

-70 |

549914 |

5406823 |

376 |

MB-24-055 |

459 |

90 |

-72 |

549934 |

5406765 |

370 |

MB-24-056 |

468 |

99 |

-70 |

549967 |

5406846 |

380 |

MB-24-057 |

459 |

93 |

-71 |

550013 |

5406611 |

369 |

MB-24-058 |

447 |

82 |

-68 |

549928 |

5406937 |

370 |

MB-24-059 |

426 |

82 |

-71 |

549940 |

5407002 |

356 |

MB-24-060 |

273 |

135 |

-71 |

550019 |

5407146 |

307 |

MB-24-061 |

441 |

88 |

-79 |

549979 |

5406708 |

368 |

Table 6: 2024 Biiwobik Drilling Results, including MB-24-054 to MB-24-059 (see news release dated April 23, 2024)

HoleID |

From |

To |

Length1 |

Cu (%) |

Pd (g/t) |

Pt (g/t) |

Au (g/t) |

Ag (g/t) |

CuEq (%)2 |

PdEq (g/t)3 |

MB-24-054 |

240 |

256 |

16 |

0.08 |

0.33 |

0.08 |

0.04 |

0.39 |

0.38 |

0.56 |

and |

262 |

296 |

34 |

0.11 |

1.02 |

0.17 |

0.08 |

0.29 |

0.96 |

1.41 |

including |

262 |

282 |

20 |

0.13 |

1.37 |

0.23 |

0.1 |

0.33 |

1.27 |

1.85 |

and |

374 |

385 |

11 |

0.39 |

0.5 |

0.09 |

0.04 |

2.25 |

0.84 |

1.22 |

and |

436 |

450 |

14 |

0.33 |

0.77 |

0.21 |

0.05 |

1.36 |

1.02 |

1.49 |

Including |

440 |

450 |

10 |

0.38 |

0.93 |

0.26 |

0.05 |

1.53 |

1.21 |

1.76 |

MB-24-055 |

172 |

198 |

26 |

0.07 |

0.16 |

0.08 |

0.04 |

0.4 |

0.26 |

0.38 |

and |

242 |

272 |

30 |

0.11 |

0.31 |

0.08 |

0.05 |

0.6 |

0.41 |

0.6 |

including |

242 |

262 |

20 |

0.04 |

0.42 |

0.1 |

0.05 |

0.26 |

0.42 |

0.62 |

and |

262 |

272 |

10 |

0.25 |

0.09 |

0.03 |

0.04 |

1.28 |

0.37 |

0.55 |

and |

378 |

384 |

6 |

0.15 |

0.26 |

0.1 |

0.06 |

0.6 |

0.43 |

0.64 |

and |

402 |

430 |

28 |

0.11 |

0.34 |

0.1 |

0.03 |

0.46 |

0.42 |

0.62 |

MB-24-056 |

168 |

174 |

6 |

0.12 |

0.5 |

0.14 |

0.08 |

0.5 |

0.6 |

0.88 |

and |

194 |

212 |

18 |

0.07 |

0.33 |

0.07 |

0.03 |

0.4 |

0.36 |

0.53 |

and |

422 |

428 |

6 |

0.19 |

0.39 |

0.12 |

0.05 |

1.87 |

0.58 |

0.85 |

MB-24-057 |

164 |

188 |

24 |

0.03 |

0.32 |

0.09 |

0.03 |

0.11 |

0.32 |

0.47 |

and |

362 |

378 |

16 |

0.3 |

0.68 |

0.15 |

0.07 |

1.97 |

0.92 |

1.35 |

MB-24-058 |

194 |

208 |

14 |

0.11 |

0.62 |

0.2 |

0.07 |

0.67 |

0.7 |

1.02 |

including |

198 |

208 |

10 |

0.13 |

0.77 |

0.23 |

0.08 |

0.76 |

0.85 |

1.24 |

and |

348 |

378 |

30 |

0.41 |

1.02 |

0.24 |

0.1 |

1.88 |

1.33 |

1.95 |

including |

364 |

372 |

8 |

0.85 |

2.48 |

0.57 |

0.22 |

4 |

3.06 |

4.47 |

and |

394 |

404 |

10 |

0.25 |

0.46 |

0.07 |

0.07 |

0.94 |

0.67 |

0.98 |

MB-24-059 |

216 |

250 |

34 |

0.05 |

0.4 |

0.14 |

0.08 |

0.19 |

0.46 |

0.68 |

including |

230 |

236 |

6 |

0.11 |

1.35 |

0.41 |

0.19 |

0.3 |

1.4 |

2.04 |

and |

324 |

346 |

22 |

0.19 |

0.9 |

0.19 |

0.08 |

0.89 |

0.98 |

1.43 |

including |

324 |

329 |

5 |

0.56 |

1.12 |

0.21 |

0.15 |

2.92 |

1.59 |

2.32 |

MB-24-060 |

240 |

256 |

16 |

0.08 |

0.33 |

0.08 |

0.04 |

0.39 |

0.38 |

0.56 |

MB-24-061 |

182 |

232 |

50 |

0.10 |

0.52 |

0.13 |

0.06 |

0.32 |

0.58 |

0.84 |

including |

214 |

224 |

10 |

0.23 |

1.50 |

0.26 |

0.13 |

0.80 |

1.50 |

2.20 |

and |

408 |

420 |

12 |

0.21 |

0.44 |

0.14 |

0.05 |

1.18 |

0.63 |

0.92 |

including |

408 |

414 |

6 |

0.35 |

0.69 |

0.22 |

0.08 |

1.90 |

1.02 |

1.49 |

1. All lengths are in metres. Interval lengths of interceptions are assumed to be approximate to true width.

2. The Copper Equivalent (“CuEq”) calculation expressed in % is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one percent of copper in such one tonne sample. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of $1,500, $1,100, $1,800, $26 were used, respectively, for Pd, Pt, Au, Ag and a $3.20/lb value was assigned for Cu.

3. The Palladium Equivalent (“PdEq”) calculation expressed in g/t is calculated as the sum of the theoretical in situ value of the constituent metals (Au + Pt + Pd + Cu + Ag) in one tonne sampled divided by the value of one gram of palladium. The calculation makes no provision for expected metal recoveries or smelter payables. USD per ounce commodity prices of $1,500, $1,100, $1,800, $26 were used, respectively, for Pd, Pt, Au, Ag and a $3.20/lb value was assigned for Cu.

Continuation of the 2024 Exploration Program

Field crews are currently on site carrying out surface stripping, field mapping and soil sampling programs over priority exploration targets, including multiple high priority Goldspot targets presented above. The company looks forward to presenting results from these programs as the progress advances over the summer field season.

Quality Assurance/Quality Control

Quality assurance and quality control protocols for the 2024 drilling assay program were unchanged from previous years and involve a rotating inclusion of one duplicate, blank, low-grade standard and high-grade standard every 15 samples. All controls are checked to be within a working limit of 2 standard deviations. Sample intervals are selected in 1m or 2m lengths dependent on the nature of the mineralized zone. The core samples are split on site using a diamond saw where half of the core is sent for analysis and the other half is securely stored on site for future reference. All samples are shipped to the ALS Global laboratory in Thunder Bay, Ontario for processing. Pulp sample material was then sent to the Vancouver ALS facility for analysis. ALS Minerals is independent of Generation Mining and operates with a quality management system and complies with the requirements of ISO9001:2008. The quality management system of ALS is audited both internally and by external parties. The samples were prepared and sent for multi-element analyses. Palladium, platinum and gold were analysed using method PGM-ICP23 using a nominal sample weight of 30g. Copper and silver were analysed using method ME-ICP41 (4 acid digest). Copper and silver grades above 1% and 100 g/t respectively, triggered an overlimit analysis by method OG46-OL.

Data verification programs have included a review of QA/QC data, re-sampling and sample analysis programs, and database verification. Validation checks were performed on data, and comprise checks on surveys, collar coordinates and assay data.

About Generation Mining Limited

Gen Mining’s focus is the development of the Marathon Project, a large undeveloped palladium-copper deposit in Northwestern Ontario, Canada. On May 31, 2024, the Company filed an Amended Feasibility Study Update for the Marathon Project with an effective date of December 31, 2022 (the “Feasibility Study”).

The Feasibility Study estimated a Net Present Value (using a 6% discount rate) of C$1.16 billion, an Internal Rate of Return of 25.8%, and a 2.3-year payback. The mine is expected to produce an average of 166,000 ounces of payable palladium and 41 million pounds of payable copper per year over a 13-year mine life (“LOM”). Over the LOM, the Marathon Project is anticipated to produce 2,122,000 ounces of palladium, 517 million lbs of copper, 485,000 ounces of platinum, 158,000 ounces of gold and 3,156,000 ounces of silver in payable metals. For more information, please review the Feasibility Study, filed under the Company’s profile at www.sedarplus.com or on the Company’s website at https://genmining.com/projects/feasibility-study/.

The Marathon Property covers a land package of approximately 22,000 hectares, or 220 square kilometres. Gen Mining owns a 100% interest in the Marathon Project.

Qualified Person

The scientific and technical content of this news release was reviewed, verified, and approved by Mauro Bassotti , P.Geo , Vice President Geology of the Company, and Drew Anwyll, P.Eng, Chief Operating Officer both Qualified Persons as defined by Canadian Securities Administrators’ National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Forward-Looking Information

This news release contains certain forward-looking information and forward-looking statements, as defined in applicable securities laws (collectively referred to herein as "forward-looking statements"). Forward-looking statements reflect current expectations or beliefs regarding future events or the Company’s future performance. All statements other than statements of historical fact are forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "continues", "forecasts", "projects”, “predicts”, “intends”, “anticipates”, “targets” or “believes”, or variations of, or the negatives of, such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, including statements relating to the ability of the current or future exploration programs to extend feeder zones, target higher grade mineralization, extend mine life, expand or alter potential mine pit designs; the possibility of future drilling adding to an inferred mineral resource or increasing potential metal grades in reserves or resources; and the anticipated life of mine; mineral production estimates, payback period, and financial returns from the Marathon Project.

Although the Company believes that the expectations expressed in such statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the statements. There are certain factors that could cause actual results to differ materially from those in the forward-looking information. These include the timing for a construction decision; the progress of development at the Marathon Project, including progress of project expenditures and contracting processes, the Company’s plans and expectations with respect to liquidity management, continued availability of capital and financing, the future price of palladium and other commodities, permitting timelines, exchange rates and currency fluctuations, increases in costs, requirements for additional capital, and the Company’s decisions with respect to capital allocation, and the impact of COVID-19, inflation, global supply chain disruptions, global conflicts, including the wars in Ukraine and Israel, the project schedule for the Marathon Project, key inputs, staffing and contractors, commodity price volatility, continued availability of capital and financing, uncertainties involved in interpreting geological data, environmental compliance and changes in environmental legislation and regulation, the Company’s relationships with First Nations communities, results from planned exploration and drilling activities, local access conditions for drilling, and general economic, market or business conditions, as well as those risk factors set out in the Company’s annual information form for the year ended December 31, 2023, and in the continuous disclosure documents filed by the Company on SEDAR+ at www.sedarplus.ca. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements in this news release speak only as of the date of this news release or as of the date or dates specified in such statements.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. Forward-looking statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions relating to: the availability of financing for the Company’s operations; operating and capital costs; results of operations; the mine development and production schedule and related costs; the supply and demand for, and the level and volatility of commodity prices; timing of the receipt of regulatory and governmental approvals for development projects and other operations; the accuracy of Mineral Reserve and Mineral Resource Estimates, production estimates and capital and operating cost estimates; and general business and economic conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking information. For more information on the Company, investors are encouraged to review the Company’s public filings on SEDAR+ at www.sedarplus.ca. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240726949339/en/

Contacts

For further information please contact:

Jamie Levy

President and Chief Executive Officer

(416) 640-2934 (O)

(416) 567-2440 (M)

jlevy@genmining.com

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.