Financial News

Amid High Interest Rates and Inflation, American Homeowners Would Rather Renovate Than Buy a New Home

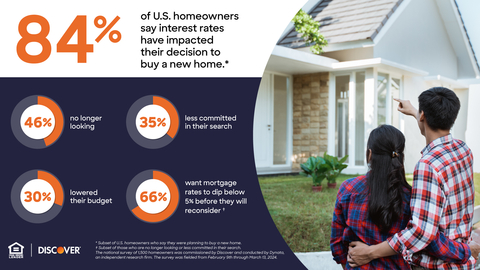

84% of U.S. homeowners who were planning to buy a new home say interest rates have impacted their decision

Discover Home Loans recently conducted a survey to determine Americans’ intentions for their homes, and whether they are choosing to renovate their current property or buy a new house that better fits their needs and personal style.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240506832767/en/

84% of U.S. homeowners say interest rates have impacted their decision to buy a new home. (Graphic: Business Wire)

The survey found high interest rates are having a profound impact on American homeowners. 84% who were planning to buy a new home say interest rates have affected their decision. Of those impacted, 46% indicated they are no longer looking, 35% are less committed in their search and 30% have lowered their budget. For most in this group, rates would need to fall significantly with 66% of respondents planning to wait for 30-year mortgage rates to dip below 5% before they would seriously consider purchasing a home.

“When the Fed does gain confidence that inflation is under control, rate decreases are likely to be modest and gradual,” says Rob Cook, vice president of marketing at Discover Home Loans. “In the meantime, the housing market may remain sluggish. Consumers should reset their expectations and budgets accordingly.”

Interest rates are also modifying homeowners’ preferred financing options. Only 9% of homeowners plan to use a cash-out refinance for their home improvement project, down significantly from 24% in 2023. “Homeowners are understandably avoiding lending options that would impact the rate they currently have on their primary mortgage,” says Cook. “In this rate environment, home equity loans are an attractive option as they allow homeowners to leverage the available equity they have in their homes without modifying their existing mortgage.”

Inflation also has a significant impact on homeowners’ finances, with 49% of respondents reducing discretionary spending and 33% choosing to delay home renovation projects. For those who pursue home renovations, many are feeling inflation’s impact with 47% of respondents indicating their project is costing more than they expected and 30% stating they have reduced the size of their project.

U.S. Homeowners Are Renovating to Add Personal Style and Functionality

More than half (55%) of American homeowners would rather renovate their current home vs. move to a new home (24%) or keep their home “as is” (21%). In fact, 57% of survey respondents either have a home improvement project underway or are planning a project within the next year. For those planning a home improvement project, 87% want to make cosmetic changes to reflect their personal style; 84% want to use home improvements as an investment opportunity; and 73% want to upgrade home features in need of repair.

Gen Z vs. Baby Boomers: Thoughts on Home Renovations and Personal Finances

Younger generations are generally more optimistic about their financial future this year with 48% of Gen Z and Millennial homeowners expecting their finances to improve over the next year — compared to only 31% of Gen X and Baby Boomers. Reasons for renovating a home also differ between generations. Gen Z and Millennial respondents are more likely to take on renovation projects that personalize their homes, while Gen X and Baby Boomers are taking on home renovations to feel a sense of accomplishment.

Spending and saving habits also differ between generations. Gen Z, Millennials and Gen X are more likely to expect their home improvement project to go over their anticipated budgets, while Baby Boomers are most likely to expect to stay consistent with their budget. Baby Boomers are less likely to budget for extra costs, while Gen Z is more likely to save between 11-15% when compared to other generations.

“As younger generations are building equity and looking to renovate, they appear to be willing to spend more to create a home that better reflects their personal aesthetic,” says Cook. “Meanwhile, older generations are willing to spend on improvements to keep up with the maintenance of their homes, but not embellish or completely overhaul.”

Discover has resources that can help determine if home renovation goals are financially attainable. For example, consumers can receive an estimated interest rate and monthly payment breakdown on home renovation financing options by visiting the Discover Monthly Payment Calculator.

About the Survey

The national survey of 1,500 homeowners was commissioned by Discover and conducted by Dynata (formerly Research Now/SSI), an independent survey research firm. The survey was fielded from February 9th through March 13th, 2024.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover® card, America's cash rewards pioneer, and offers private student loans, personal loans, home loans, checking and savings accounts and certificates of deposit through its banking business. It operates the Discover Global Network® comprised of Discover Network, with millions of merchants and cash access locations; PULSE®, one of the nation's leading ATM/debit networks; and Diners Club International®, a global payments network with acceptance around the world. For more information, visit www.discover.com/company.

Equal Housing Lender

Discover makes loans without regard to race, color, religion, national origin, sex, handicap, or familial status.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240506832767/en/

Contacts

Media Contact:

Matt Miller

Discover

mattmiller@discover.com

224-405-0653

@Discover_News

More News

View More

Recent Quotes

View MoreQuotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.